January 13th, 2025 | 07:10 CET

Greentech stocks make a flying start in 2025 – Tax package on the way? Nel ASA, dynaCERT, Plug Power, and Nordex in focus

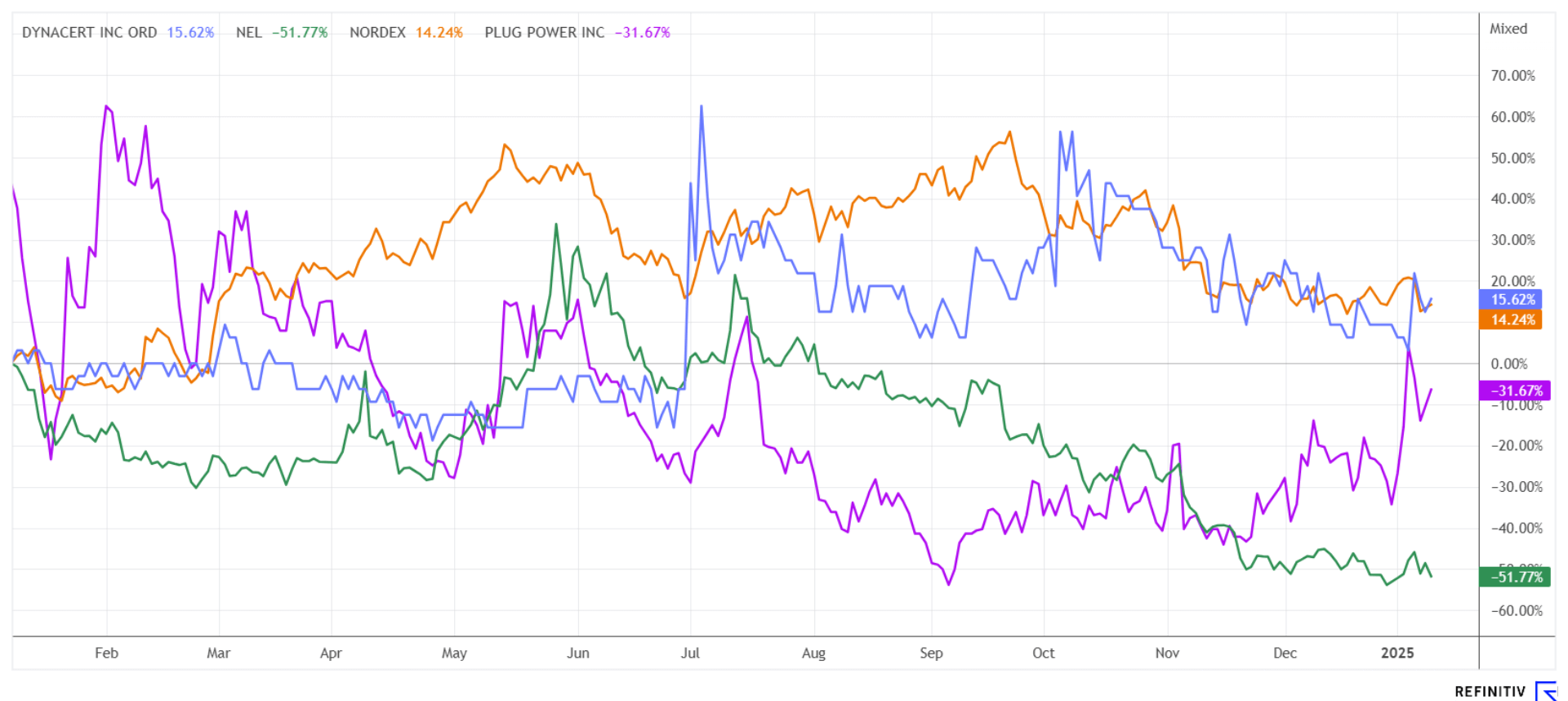

The stock market kicked off the year with significant volatility. However, while the DAX 40 index is setting new records daily, the NASDAQ is consolidating at a very high level. Some profit-taking is weighing on the recently favoured "Magnificent 7" stocks, while long-neglected stocks in the greentech sector are starting to make a comeback. Canadian hydrogen specialist dynaCERT has now cleared all regulatory hurdles and strengthened its emissions trading team with the appointment of a new board member. In Germany alone, the environmental certificate market represents an annual volume of EUR 18.5 billion. We analyze which greentech stocks are now in a position to unlock their potential.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , DYNACERT INC. | CA26780A1084 , PLUG POWER INC. DL-_01 | US72919P2020 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power – Off to a good start in the New Year

After three years of overall losses of up to 90%, the hydrogen stocks Nel ASA and Plug Power have completed their first attempts at bottoming out. Although Nel ASA reached a new 6-year low of EUR 0.229 on January 2, it had risen to EUR 0.248 by the end of last week. In the US, there are considerations to introduce tax incentives for the production of clean hydrogen. Whether this will ultimately come to pass remains to be seen after Donald Trump takes office. However, the mere hope of new government support is already making speculators sit up and take notice.

In recent years, the highly volatile hydrogen stocks have seen price jumps of 100% in just a few weeks. However, there is a headwind on the analyst front. Most recently, the experts at Goldman Sachs changed their Nel rating from "Buy" to "Neutral" in mid-December. The investment bank lowered the price target from NOK 6.00 to NOK 3.00, citing regulatory uncertainties in the EU and the US. Demand for green hydrogen from the private sector remains negligible, and government support is needed. From an analytical point of view, Nel ASA, with a market capitalization of only EUR 400 million, has a 2024 price-to-sales ratio (P/S) of around 2.8.

US competitor Plug Power has performed well since the beginning of the year, with prices of up to EUR 3.30, a performance of plus 57%, before profit-taking pushed the price back down to EUR 2.85. For the current year, a sales increase of around 30% to USD 918 million is expected. This means the New Yorkers are also valued with a low P/S ratio of 3. Nevertheless, most experts are expecting a downturn and share prices of around USD 3.00 over the next 12 months. So it will be interesting to see if there is a big surprise in store.

dynaCERT – The time is ripe for a revaluation

The Canadian hydrogen expert dynaCERT is considered a technology supplier for the transport industry in all segments. With its in-house hydrogen add-on units under the name HydraGEN™, diesel combustion processes can be optimized to such an extent that, depending on the type of use, between 5 and 15% fuel can be saved. The regulatory hurdles for certification by the international institute VERRA have been cleared, and the rollout of the latest retrofit devices is now on the agenda. The HydraGEN™ technology is a recognized process and part of the range of applications of the VERRA organization, meaning users of the technology can generate CO2 certificates through its use. In 2023, the leading platform, "EU ETS," already generated EUR 43.6 billion in revenue, funds mainly used to combat climate change and support the transition to clean energy. At the end of December 2024, the price of a certificate stood at around EUR 72 per ton of CO₂ - and rising.

With a manageable investment of around CAD 6,000 per machine for the dynaCERT application, valuable fuel can be saved. This makes it easier for customers such as fleet operators, logistics companies, mines and transport companies to comply with their existing ESG principles. For them, large-scale carbon reductions are an important future topic in their corporate mission and, at the same time, a gateway to sustainable clientele. With the appointment of Seth Baruch, an expert in the field of carbon credits, to the Advisory Board, dynaCERT is demonstrating its global expansion strategy. His consulting firm, Carbonomics, will support the implementation of the VERRA projects and equip the product line with all the necessities. This year, the HydraGEN™ technology is once again on board a DAF truck from Normany Race Solutions (NRS) in the Dakar 2025 Truck Race, where it will be in live-action for approximately 8,000 km.

dynaCERT also earns money from certificate generation with every unit sold, so sales will likely skyrocket in 2025. Well-known investor Eric Sprott has already invested CAD 14 million at around CAD 0.50 per share. Due to the long certification process, sales pushed the share price below CAD 0.20 by the end of the year. The current market capitalization of CAD 72 million currently only reflects the pure development costs, so the upcoming market expansion should lead to a multiple increase in valuation. The stock market should react to this scenario soon.

Nordex – Will the year start with another 50% surge?

Last year, Greentech stocks were able to start the new year with a tailwind in some cases. Between February and May, Nordex, for example, jumped by over 50% as the outlook improved. It was only in the course of the year that the outlook gradually deteriorated, and the stock lost almost all of its gains. Following solid results in the first half of 2024, the Company has slightly raised its full-year forecast and now expects an EBITDA margin of between 3% and 4%. In the first nine months, Nordex recorded a 14% increase in revenue to EUR 5.1 billion. Analysts estimate that the Company will generate revenues of EUR 7.3 billion and an EBITDA of EUR 284 million (margin of 3.9%) for the full year. The Hamburg-based company is expected to report on the full year on February 27. The order situation at the beginning of the year also sounds promising. 80 wind turbines with a capacity of 540 MW were ordered from the company UKA, while DenkerWulf and WPD ordered a further 198 MW. Spain, Greece, and PPC Renewables ordered a combined 439 MW. Analyst sentiment is positive, with 13 out of 14 experts on the Refinitiv Eikon platform issuing a "Buy" rating with a median price target of EUR 17.15. At the current price of EUR 11.30, this represents a premium of 52%. We believe initial positions up to EUR 11.50 make sense in the medium term.

The stock markets got off to a good start in the new year. In particular, greentech stocks were able to stage an impressive recovery. For Nel ASA and Plug Power, 2025 will likely be a year of destiny because long-term investors are still sitting on losses of between 75 and 90%. dynaCERT has now overcome all regulatory hurdles and could become the top pick in the current year. Diversification across countries and sectors significantly reduces risks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.