October 7th, 2025 | 07:40 CEST

Gold explosion to just under USD 4,000! Now is the time to invest in Barrick Mining, Newmont, Kobo Resources and Allied Gold

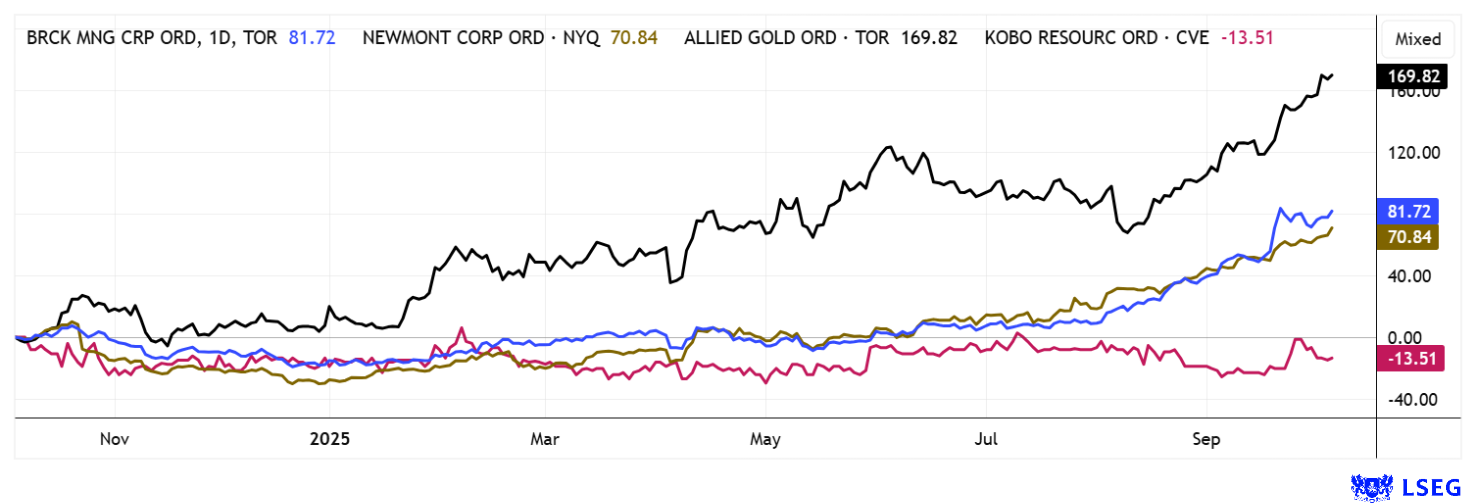

The price of gold is currently benefiting primarily from the prospect of falling US interest rates, a weaker dollar, high geopolitical uncertainty, and massive purchases by central banks. In 2024 alone, around 1,045 tons flowed into their reserves, one of the most substantial increases in recent years. Almost logically, major US investment houses have raised their forecasts: Goldman Sachs expects around USD 3,700 per ounce by the end of 2025, JPMorgan sees an average of around USD 3,675 in the fourth quarter, and UBS even foresees up to USD 3,800. In particularly optimistic scenarios, industry insiders are already discussing levels beyond USD 4,000. Yesterday, the price was just below that at USD 3,950. It will be interesting to see how heavyweights Barrick and Newmont perform in this environment. In West Africa, Allied Gold and Kobo Resources are making positive headlines. The precious metals rally is clearly gaining momentum. Here are a few suggestions.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , NEWMONT CORP. DL 1_60 | US6516391066 , KOBO RESOURCES INC | CA49990B1040 , ALLIED GOLD CORPORATION | CA01921D1050

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Allied Gold – Focus on the consolidation of the African continent

Under CEO Peter Marrone, Allied Gold is pursuing a clearly defined strategy to consolidate the African gold sector. The former Yamana executive aims to take a leading role in merging small and mid-tier African gold producers to create a continental champion with annual production capacities of up to two million ounces. Marrone views Africa as particularly attractive for mergers and acquisitions, as many junior and mid-tier companies produce between only 100,000 and 200,000 ounces each. The goal is to attract investment and liquidity and to achieve operational advantages through critical scale and synergies.

Marrone emphasizes that approval processes in most African countries are often more efficient and collaborative than in North America, for example, where the mining industry often encounters numerous regulatory and interest groups. Through the targeted acquisition of promising assets, such as the recent expansion of the Sadiola project in Mali and the Kurmuk development project in Ethiopia, Allied Gold aims to grow both organically and inorganically, thereby becoming a consolidator in industry. The Company currently has operating mines in Mali, Côte d'Ivoire, and Ethiopia and plans to increase production to around 800,000 ounces by 2029 with its own projects alone. At the same time, it is actively exploring acquisition opportunities to advance its consolidation strategy and become a major African gold giant with significant market influence in the medium term. With growth of over 150% in 2025, Allied Gold is one of the best-performing second-tier gold stocks and remains attractive due to its still manageable market capitalization of EUR 1.8 billion.

Kobo Resources – Promising prospects in West Africa

West Africa is one of the most dynamic growth regions in Africa and offers extensive raw material deposits, including significant gold deposits. Côte d'Ivoire stands out as one of the economic powerhouses of West Africa, with a gross domestic product of around USD 94.5 billion forecast for 2025 and growth rates of around 6% annually. The country is characterized by a stable investment climate, a diversified economic structure, primarily agriculture, services, and mining, and a trade surplus. The export structure is strongly influenced by cocoa and oil, but the gold sector is also becoming increasingly important.

Canadian exploration company Kobo Resources was founded in 2015 with a clear mission: to unlock the largely untapped potential of one of the world's most promising gold belts in Côte d'Ivoire. This region already hosts several gold deposits containing millions of ounces. Big names such as Allied Gold, Barrick, Perseus, and Endeavour are immediate neighbors with extensive gold deposits of over 10 million ounces each. Kobo focuses on advancing high-quality exploration projects in line with its own development strategy. The Company's philosophy centers not only on discovering new gold resources, but also on developing them responsibly and strengthening local communities. Kobo pursues a holistic approach, combining financial value creation with social progress.

The Company's most significant projects are located in the central-western region of Côte d'Ivoire, notably the flagship Kossou project, located just 9.5 km away from a major operating mine. Historically, more than 24,000 meters have already been drilled here, and geochemical analyses have revealed significant gold anomalies, indicating great economic potential. In addition to Kossou, Kobo is pursuing further exploration initiatives on adjacent properties that could offer additional growth opportunities. The active partnership with Luso Global Mining (Mota-Engil Group) forms a strong local team. An initial mineral resource estimate (MRE) is anticipated as early as 2026. With approximately 104 million shares outstanding, the market capitalization of approximately CAD 38 million is still in its infancy. Investors looking to invest in a high-growth exploration company with a clear strategic vision will find Kobo Resources to be a forward-looking partner. Highly interesting!

Barrick and Newmont – The titans are reaping the rewards

Barrick Mining and Newmont shares have already risen sharply in the last 12 months, with price gains of 58 to 64%, fueled by the rally in the gold market. If the price of gold continues to rise, this trend could accelerate even further. However, both companies are under pressure to develop new properties in order to meet investors' high expectations. Barrick is focusing on projects such as Reko-Diq in Pakistan and is seeking to make progress in Mali, but must manage risks such as political instability and local resistance. In Côte d'Ivoire, Barrick sold the Tongon mine to a local partner mid-year, highlighting its strategic portfolio adjustments. Strong mid-year cash flows create opportunities for accelerated exploration programs and strategic expansion. Barrick currently offers an attractive valuation with a 2026 P/E ratio of 12.4 and, according to analysts, upside potential of around 25%.

Newmont, on the other hand, scores with massive liquidity, an equity ratio of over 50%, and broad international diversification, which enables stable production increases and robust cash flow. Pre-tax earnings of just under USD 10 billion are expected for 2025, while the 2026 P/E ratio is slightly higher at 15.4. Both stocks could now enter the harvest phase, giving investors hope for rising earnings forecasts. In addition, stable dividends of 2.5% p.a. ensure an attractive current yield.

Gold reached approximately USD 3,950 at the beginning of the week, surpassing the 2025 price targets set by many investment banks. Investors are wondering where the journey might lead. So far, both the strong upward momentum and sustained market interest suggest that there will be no slowdown. Beyond the major gold producers, smaller precious metal explorers such as Kobo Resources are increasingly coming into the spotlight.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.