November 19th, 2024 | 07:10 CET

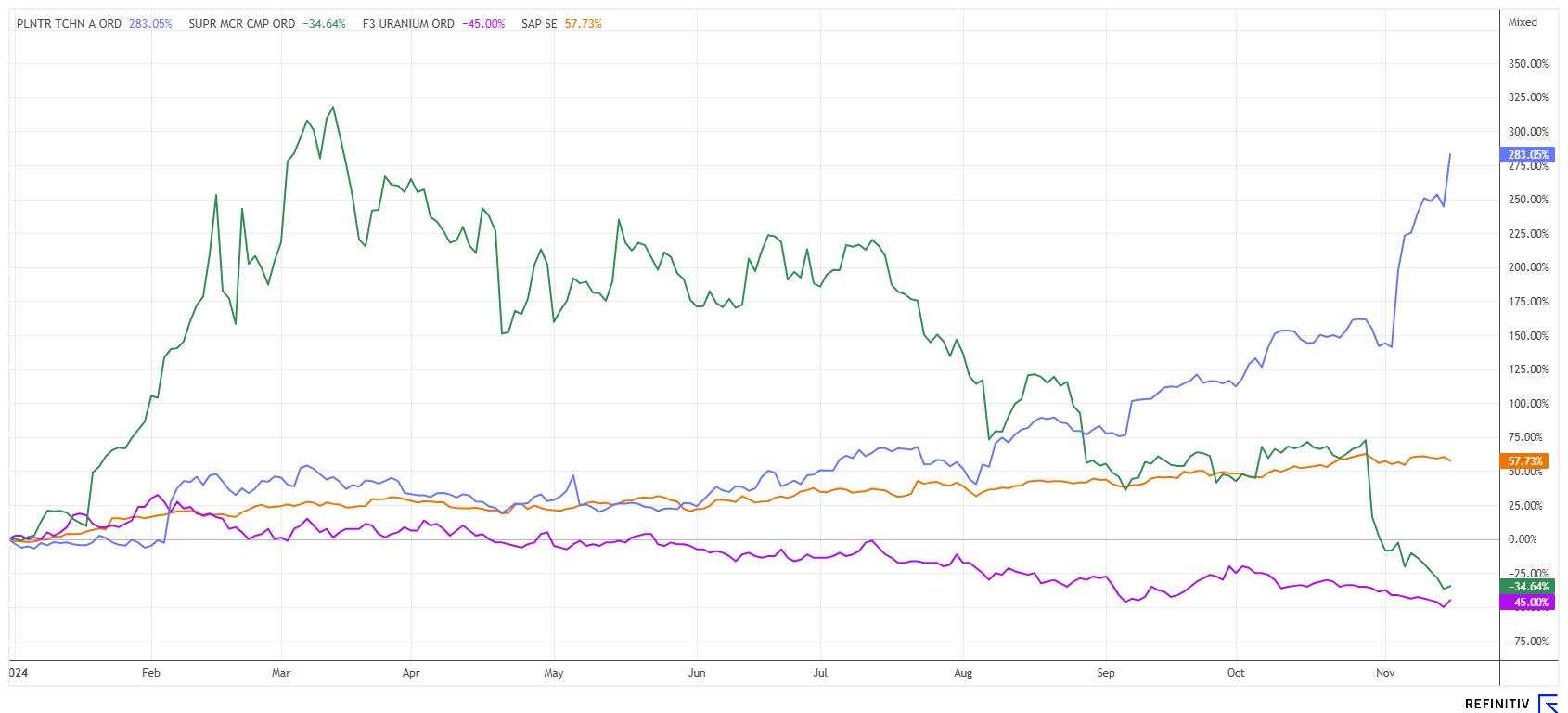

Energy-guzzling artificial intelligence – Uranium in focus! Higher prices possible for Palantir, F3 Uranium, SAP and SMCI!

The energy demand is skyrocketing! Currently, high-tech companies from Silicon Valley are investing in power generators and uranium companies. This is because they will all need many times more electricity in the coming years than they do today in order to roll out their AI-driven business models. Artificial intelligence consumes, on average, 10 to 15 times more energy than conventional search engine queries. As a result, industry leaders are no longer willing to leave future energy supplies solely in the hands of governments, as the risk of supply disruptions appears too great. For several months, nuclear companies in the US have been developing so-called small modular reactors, while the EU wants to continue with renewable energies. Investors should weigh these options carefully, as these trends present significant opportunities for growth.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , F3 URANIUM CORP | CA30336Y1079 , SAP SE O.N. | DE0007164600 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

F3 Uranium – With fresh capital into the new year

Uranium supply could experience a significant global shortfall from 2030 onwards, as demand for nuclear energy is rising sharply while uranium production falters. Experts estimate that by 2040, there could be a cumulative shortage of about 680,000 tons of uranium. This deficit is due, in particular, to limited production capacity and the slow reactivation process of decommissioned mines, which can take up to 15 years. Demand, which is already high, is expected to increase by a further 30% by 2030 and almost double by 2040. Driving prices higher are the energy plans of the US under Trump, as well as China, India, and select European countries distancing themselves from Brussels' energy policies. This dynamic puts pressure on the market, as the current production is heavily dependent on a few countries such as Kazakhstan, Canada, Namibia and Australia, which together control over 70% of global uranium production.

The Canadian company F3 Uranium (FUU) is at the forefront of the abundant uranium deposits in the Athabasca Basin. Currently, the focus is on the newly discovered high-grade JR zone on the PLN property in the west. This area in the state of Saskatchewan is on track to become the next major uranium zone and is home to large deposits such as Triple R, Arrow and Shea Creek. In recent weeks, F3 has raised additional funds for its upcoming exploration activities. As part of the capital increase, the Company sold 7.5 million federal flow-through units (FFT) at a price of 37.5 cents and 12.5 million Saskatchewan flow-through units of the Company at a price of 41.5 cents for a total of 20 million new shares at a blended price of 40 cents. In total, CAD 8 million (gross) was raised at a price that is around 80% above the current stock market price. This should please existing shareholders and create optimal conditions for the next steps. The research houses Red Cloud and SCP expect FUU shares to reach CAD 0.60 and CAD 0.75, respectively, in one year. F3 Uranium is, therefore, a promising addition to a future-oriented growth portfolio.

Palantir Technologies – Is the party over now?

Palantir Technologies recently surprised with a real share price boost. Based on Q3 figures that significantly exceeded analysts' expectations, the planned move to NASDAQ and further orders from the US government under Trump are helping to reach new highs. Since the beginning of the year, the Company's share price has increased by an astonishing 300%. Particularly noteworthy in operational terms is the increase in revenue in the commercial segment, which rose by almost 27% over the course of the year. The strong demand for Palantir's data analysis solutions in the domestic market remains striking. Given the robust business performance, Palantir has raised its revenue forecast for the current year to a range of USD 2.805 to 2.809 billion. But beware at the platform edge: CEO Alex Karp is currently selling many shares. Will the top pick list of ARK Investments prove to offer sound guidance? The fund has overcome difficult times, and Palantir is on cloud nine.

Super Micro Computer – The disaster unfolds

The crowd favorite Super Micro Computer (SMCI), a close partner of Nvidia, is currently moving in the opposite direction. First, the quarterly figures were not reported to the SEC, and then the auditor resigned. The Company was audited by none other than Ernst & Young, which brings back memories of Wirecard for investors. EY had expressed concerns about SMCI's financial reporting, which had been given added explosiveness by the allegations of Hindenburg Research. Hindenburg had accused the Company of accounting manipulation, which Super Micro vehemently rejected. The management board emphasised that an internal investigation has revealed no evidence of misconduct. From a high of EUR 122.90, it fell to EUR 17.25 last week. Yesterday, it rebounded to just under EUR 20. If the earnings per share estimate for 2025 of USD 2.95 proves correct, this AI stock could be acquired at a P/E ratio of 6.3. However, there is an immense risk that issues will come to light during the current transition to a new auditor.

SAP – From high to high

SAP shares are currently unstoppable. Following impressive Q3 figures, the ERP and cloud specialist is rushing from high to high. Analysts have raised their estimates for 2025 from EU R5.98 to 6.33 per share on average, which yields a P/E ratio of 34. Looking further ahead to 2029, the valuation could decrease to a P/E ratio of 23. The stock is a top performer in the DAX and has already gained over 50% this year. Last week, SAP was represented at the "CIIE" trade fair with the theme "Commercial AI in multiple scenarios" and presented the successes of AI applications in five key business areas. These include intelligent financial and decision analysis, human resource management, supply chain and procurement, sales and customer service, and sustainable development management. The stock's valuation could continue to move in line with Nvidia's performance. The only issue is that the NASDAQ's AI miracle has recently turned and has not reached any new highs. Cautious investors are, therefore, adjusting their stop from EUR 192.50 to 208.50.

The stock market is currently in a state of Trump euphoria. How long the good mood will last is questionable. The fact remains that the energy question could become decisive in the next few years. Therefore, adding uranium stocks such as F3 Uranium is sensible. Among the high-tech stocks, caution is advised with Palantir and SMCI, SAP is currently unstoppable. Move the stops close together.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.