October 19th, 2023 | 07:20 CEST

Defense Metals, Rheinmetall, FREYR Battery - Who offers the greatest growth potential?

Demand for rare earths is rising relentlessly, especially in sectors such as electromobility, renewable energies and agribusiness. Defense Metals, a Canadian explorer company, plays a key role in these industries. Through their Wicheeda rare earths project, they have the potential to become a leading producer of raw materials, which is particularly valuable given geopolitical tensions and the need for secure raw material suppliers. Rheinmetall wins an important electromobility order worth millions. Their specially designed heat pump for electric tractors is revolutionizing temperature control in modern commercial vehicles. FREYR Battery has successfully produced Norway's first lithium iron phosphate battery cell. They are also strengthening regional supply chains to establish a permanent presence in North America in the long term. Discover where the greatest growth potential lies now.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

DEFENSE METALS CORP. | CA2446331035 , RHEINMETALL AG | DE0007030009 , Freyr Battery | LU2360697374

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Hidden Champion Defense Metals Continues to Grow in the Rare Earth Sector

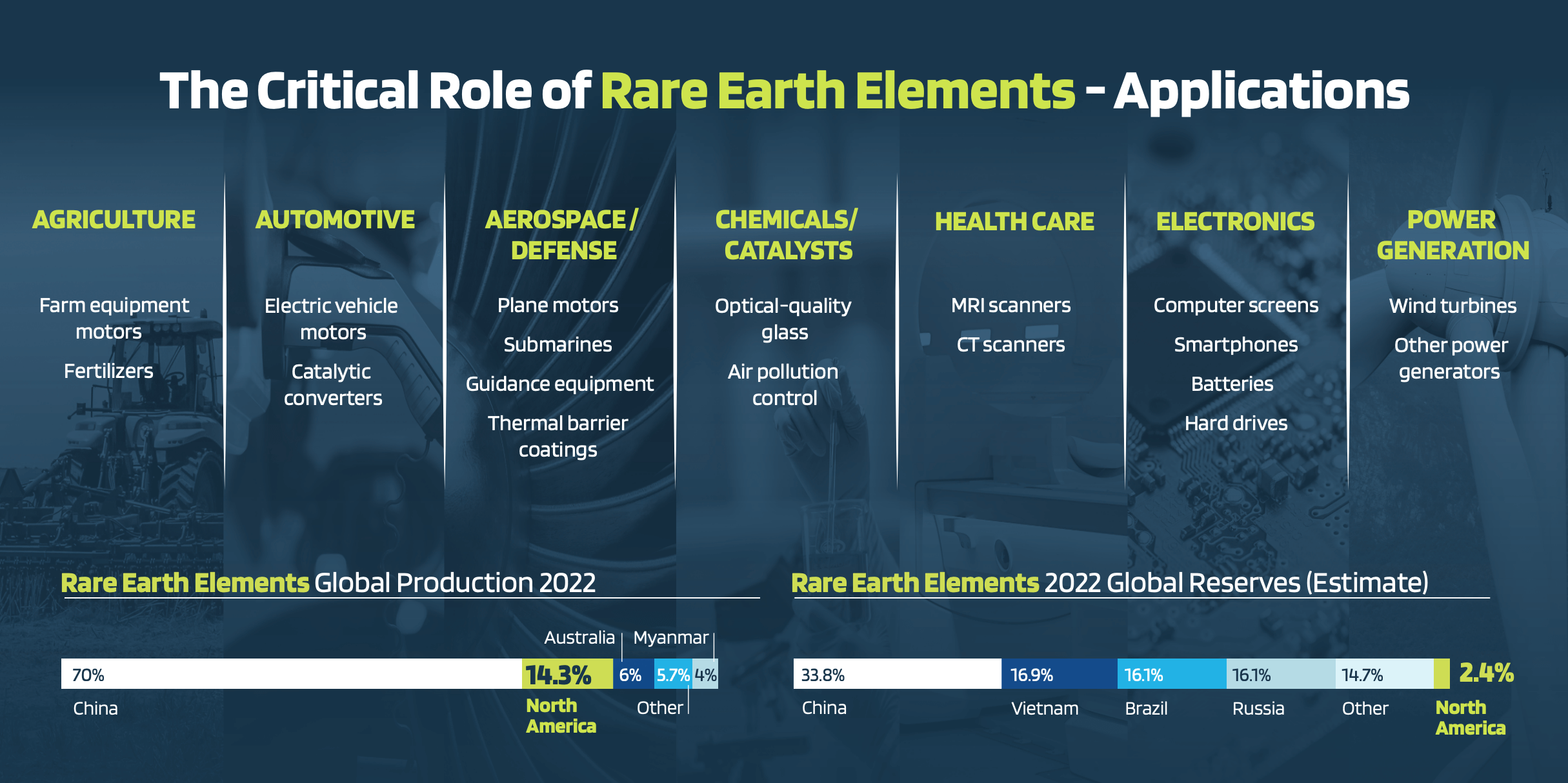

Rare earths are the fuel for the energy transition. As the global shift from fossil fuels to renewable energy continues, manufacturers of electromobility, wind and solar energy, and agriculture, need precisely these rare earths to be well equipped for future production.

Globally, China is among the largest suppliers of these valuable raw materials, with a 70% share, followed by North America (14.3%) and Australia (6%). In the wake of geopolitical tensions and the expansion of the BRICS countries, investors should look closely at which commodity producers they are betting on to hedge their portfolios.

A hidden champion in this area is Defense Metals, a Canadian explorer based in British Columbia. Defense Metals is a member of the Discovery Group, a global alliance of owner-operated mining and exploration companies that provide high-quality deal flow within the alliance. Defense Metals currently has a market cap of CAD 51.2 million and 256 million shares outstanding. The Company offers its investors tremendous growth potential. Many junior explorer companies are struggling with the difficulties of current market conditions. Not so for Defense Metals, as they are already established in the business - and this is where the investment opportunity presents itself as an entry point.

As President and Director Lisa Moreno reported last week at the 8th International Investment Forum, with one look at the world's trouble spots, it is clear how much the demand for rare earths is growing, even in the defense industry. This is the real inspiration behind the name "Defense Metals."

Through the Wicheeda rare earths project, the Company has the well-founded potential to become one of the world's most significant producers.

The mining acreage covers 6,759 hectares and is strategically located just 80 km from Prince George, with easily accessible roads. It has strong infrastructure, including power lines, a gas pipeline and a nearby railroad line. The residents of the city of Prince George in British Columbia also provide a skilled workforce. Furthermore, the Port of Prince Rupert, 500 km away and accessible by rail and road, provides access to global markets.** Thus, the Wicheeda project is ideally positioned for promising production in the rare earths industry.

The ongoing pre-feasibility study is expected to be completed by Q2-2024 and highlights the technical strength of the project. Recent exploration results indicate that the Wicheeda feedstock can be crushed, ground and used to produce a rare earth flotation product that achieves similar or better recoveries and grades than the world's leading producers. Defense Metals could soon have a major impact on the global rare earths market.

Revolutionary Rheinmetall heat pump gives e-tractors a boost

Until now, heat pumps have mainly been used for heating homes, and the German government's new heating law has made them more of a horror for medium-sized property owners. However, the range of applications for heat pumps is much broader than one might think. Because modern electric vehicles are increasingly complex in terms of temperature control, more and more components and connections have to be installed for the cooling system. This is especially true for commercial vehicles, such as tractors and other agricultural machinery in the agricultural industry.

Now Rheinmetall, the Düsseldorf-based defence and technology company, has won a new order worth tens of millions of euros. The order in the electromobility sector is for an innovative heat pump developed specifically for electric tractors.

The global market for electric tractors was estimated at USD 118 million in 2021 and is expected to rise to USD 132 million in 2022. It is expected to reach about USD 250 million by 2030, with a CAGR of 13% from 2022 to 2030.

The contract Rheinmetall has now signed covers a term of 7 years. The heat pump module that Rheinmetall is developing will also be used in construction machinery and boats. The first pumps for field tests are to be delivered from 2024. Thus, this order brings together all the areas for which Defense Metals will provide rare earths in the future.

Rheinmetall recorded a significant increase in orders in the first half of 2023. Group sales have grown by 7% to EUR 2.9 billion to date. The stock currently stands at EUR 267.50.

FREYR Battery produces its first lithium iron phosphate battery cell in Norway

FREYR Battery has successfully assembled and charged the first lithium iron phosphate (LiFePO4 or LFP) battery cell in semi-automated production at its Customer Qualification Plant (CQP) in Mo i Rana, Norway.

In order to produce locally as independently as possible in the future, FREYR Battery is focusing on seamless logistics. The Company's strategy is to establish regional supply chains while expanding its international supplier network. All this while maintaining maximum cost efficiency.

In the long-term, FREYR plans to localize its raw materials supply chains in both the US and Europe. During the transitional phase, raw material supplies from Asia are still in place, while new options are expected to develop within the networks of the US and Europe in the future. An ideal partner for this could be Defense Metals. The expected increase in global battery production, lithium price volatility, and security of supply are crucial considerations for customers, producers and suppliers in the value chain.

Lithium and graphite are the key raw materials for large-scale battery production, and FREYR-produced LFP cells do not contain nickel or cobalt. Today, the global supply chain for battery raw materials relies heavily on Asia, but this will change in the future as producers focus on decarbonization and localizing their sourcing.

The ongoing decarbonization of key industries such as electromobility, agriculture and energy supply underscores the growth potential at companies such as Defense Metals, Rheinmetall and FREYR Battery. Defense Metals stands out as a "hidden champion" in the rare earths industry and has the potential to emerge as a leading producer, which is important given rising demand and geopolitical tensions. Rheinmetall is setting new standards in electromobility with its innovative heat pump, which it is developing specifically for electric tractors and will later use in boats. Meanwhile, FREYR Battery is setting new standards in battery production in Norway, manufacturing the first battery locally in Mo i Rana. Investors can seize the opportunity to invest in high-growth companies that play a crucial role in the global economy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.