October 23rd, 2025 | 07:15 CEST

Defense and metals in correction! Enter now with a 100% chance at Almonty, thyssenkrupp, TKMS, Hensoldt, and Mutares

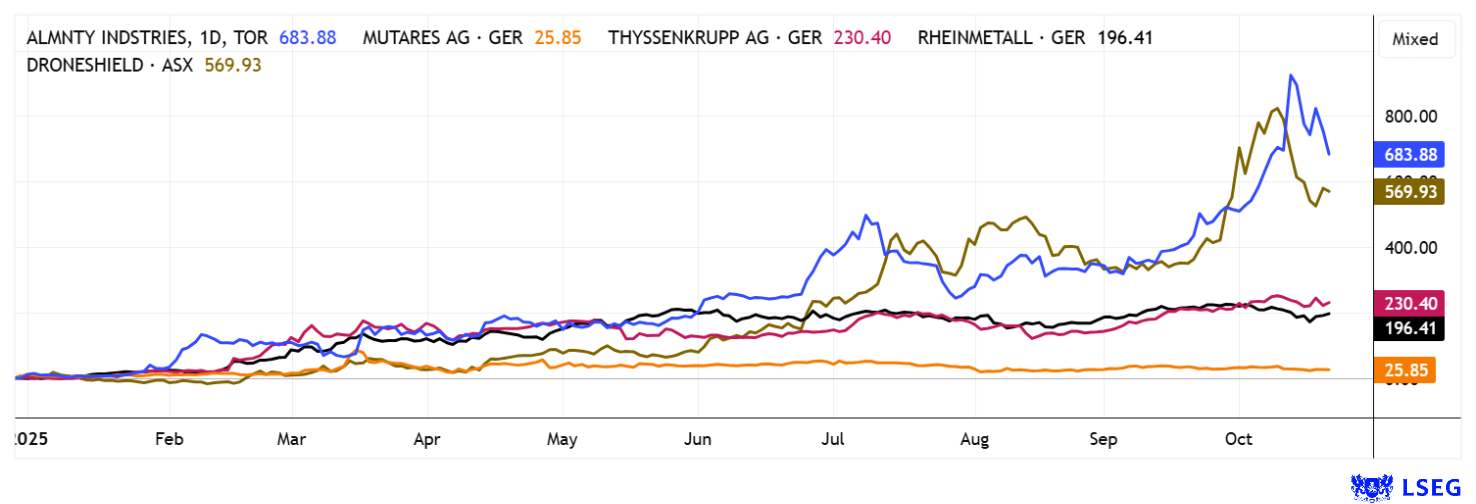

That happened fast. After a temporary surge in defense and metal stocks, investors are taking profits. This is understandable, as some stocks, such as Almonty Industries, had risen by over 1,000% in just 10 months. Now it is time to let the market settle and, with renewed confidence, return to the most sought-after sectors of 2025. Of course, it is recommended to diversify across many regions and sectors, such as AI, high-tech, or precious metals, to keep portfolio volatility low. Here are a few examples that have gained relevance in recent days.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , THYSSENKRUPP AG O.N. | DE0007500001 , TKMS AG & CO KGAA | DE000TKMS001 , HENSOLDT AG INH O.N. | DE000HAG0005 , MUTARES KGAA NA O.N. | DE000A2NB650

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp – TKMS placement successful

It is done! thyssenkrupp's marine subsidiary debuted on the stock market at the beginning of the week with substantial gains. Germany's largest naval shipbuilder gained more than 60% in value at the start, making the stock market launch of Thyssenkrupp Marine Systems (TKMS) a resounding success. After reaching a daily high of over EUR 100, prices returned to normal levels by Wednesday, settling at around EUR 75. This still represents a solid 25% gain, giving the Company a market capitalization of EUR 4.8 billion. This was not a traditional IPO, but rather a spin-off from the Essen-based industrial group thyssenkrupp, which floated 49% of its marine subsidiary on the stock exchange as part of its corporate restructuring. The majority stake of 51% remains with a new holding company of thyssenkrupp. The underlying shipyard is fully booked until the early 2040s.

According to its own information, TKMS is the global market leader for non-nuclear submarines, focusing on the construction of conventional submarines, frigates, and corvettes. The shipbuilder employs around 8,300 people, including around 3,700 at its headquarters in Kiel. Other locations include Wismar, where TKMS builds submarines as it does in Kiel and plans to have 1,500 jobs in the future, and Itajaí in Brazil. In December, the Bundestag's budget committee approved the construction of four additional Class 212CD submarines for the German Navy. TKMS emerged from the traditional Kiel shipyard HDW (Howaldtswerke-Deutsche Werft AG), whose origins date back to 1838. Since 2005, the shipyard has been part of thyssenkrupp, which now has approximately EUR 2 billion in free funds on its balance sheet - a blessing for the highly indebted industrial giant. In September, Rheinmetall also entered the naval business with the acquisition of the military division of the Bremen-based Lürssen Group. It will be interesting to see how TKMS's journey unfolds. Investors would be wise to watch the share price for a few weeks first, as there is always selling pressure!

Almonty Industries – Still on the rise despite 10% fluctuation on the day

Historic trading volume for the critical metals flagship, Almonty Industries. The fact that the price does not always continue to rise vertically is, to some extent, a reality of the stock market - a lesson for investors used to a bull market. In this respect, the drop from the current annual high of EUR 9.15 to around EUR 6.55 is painful, but with a price increase of over 1,000% since the end of 2024, it is certainly manageable.

Operationally, there is not much new at the moment, but the fact remains that provisional processing at the Sangdong mine will be transitioned into regular production by 2026, allowing Almonty to expand its already successful tungsten production in Portugal many times over. Western industry managers are likely to be lining up, as every company wants to reduce, if not eliminate, its dependence on currently dominant China. It will likely take five companies like Almonty to reallocate this massive demand in the market. It is therefore entirely possible that Almonty itself is seeking partners to put the global supply of this critical metal on a sustainable footing as quickly as possible. Contract prices for tungsten have risen sharply in recent months, although this is likely due to the general hysteria surrounding critical metals. Almonty also holds a major wildcard with its huge molybdenum deposit in South Korea, which it plans to bring to market in the coming years. Speculators expect industry consolidation in the coming months, including potential mergers and acquisitions. CEO Lewis Black is certainly keeping a tight rein on things here!

GBC analyst Matthias Greiffenberger provides the latest analytical insights on Almonty in an interview with Lyndsay Malchuk. https://www.youtube.com/watch?v=BySd1SrveLo

mutares and Hensoldt – The rally could already be well underway here

A quick note on Hensoldt and mutares. Both stocks have seen significant gains on the stock market in recent months amid the defense sector euphoria. However, given a 2026 price-to-sales ratio of 3.8, there are likely to be serious doubts as to whether the EUR 100 price this week represents a sustainable level. Experts on the LSEG platform estimate only a 15% increase in revenues for 2026. Anyone getting in here should also bear in mind that profits are still a long way from keeping pace with the high order momentum, as the necessary scaling can only be achieved over time, and profit margins will therefore only increase over time. Until the end of 2027, Hensoldt's P/E ratio will remain above 35. That is very ambitious.

Caution is also advised with mutares. Although the Company was able to generate double-digit extraordinary income in the current year with its Steyr coup, its success still depends on exit plans and portfolio transactions, as these are crucial to its business model. However, the market value of many investments in the automotive sector is difficult to assess. If these had to be realized, the expected proceeds could fall significantly short of internal valuations. The strengthening of the defense segment is certainly a positive factor. After several attempts to break through the EUR 30 mark, the share price has repeatedly fallen back. Technically, this calls for caution, at the very least.

The current consolidation is likely to create a new entry point for many stocks. After all, the markets have staged a rarely seen rally in recent weeks. What is currently missing is a release of steam, and the recent volatility could trigger a much-needed consolidation. Almonty Industries and several defense stocks remain highly attractive in the long term, while mutares could serve as a speculative addition to a diversified portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.