March 10th, 2023 | 10:15 CET

Defeat cancer! Defence Therapeutics, BioNTech, Morphosys, Bayer - These biotechs are close

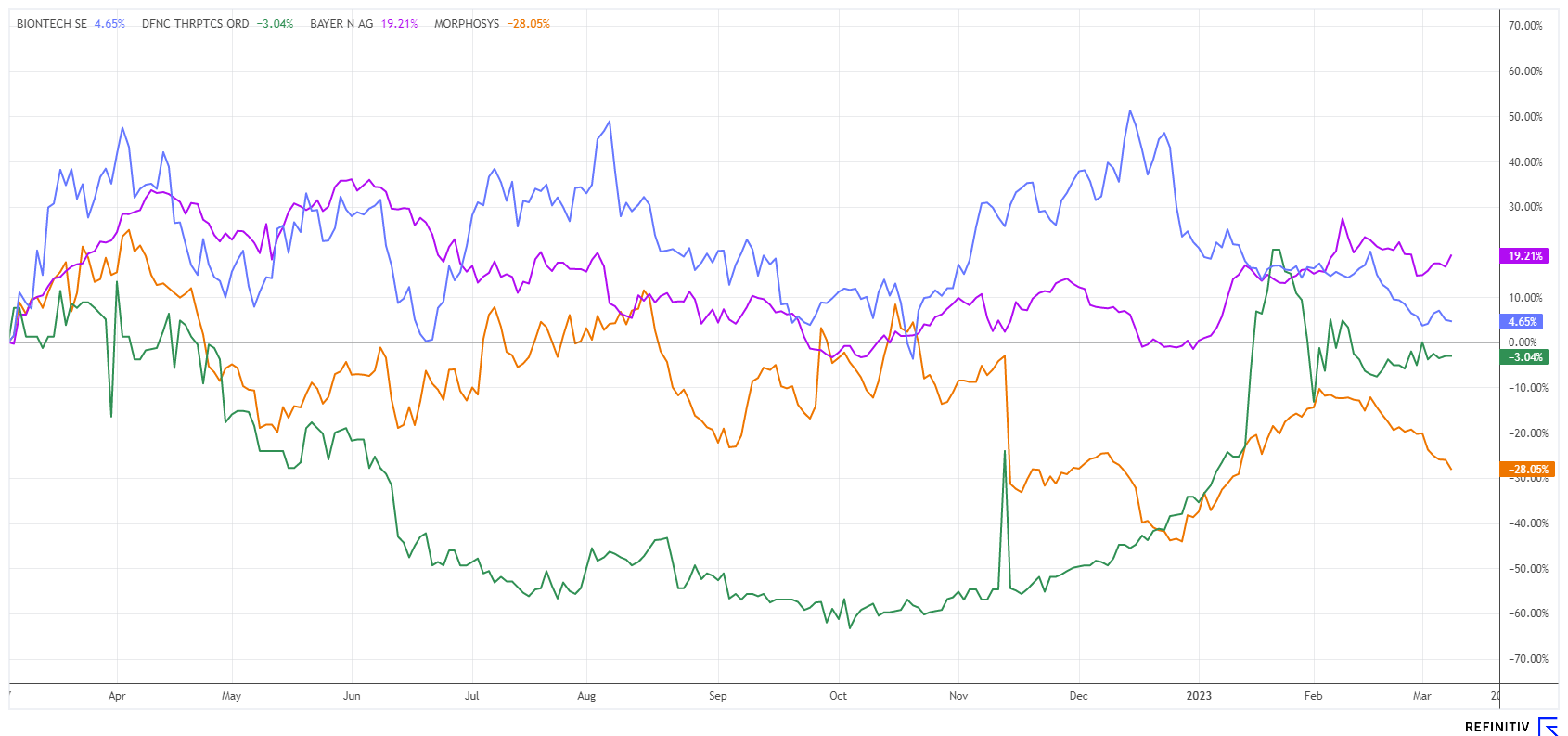

The listed biotechnology sector has entered a strong correction phase since the COVID-19 pandemic mode ended. In the process, sector leader BioNTech suffered a loss of over 70% from its high. Compounding the problem for companies is the significant increase in interest rates for long-term financing. The segment relies on revolving investor capital, but the corresponding risk parameters have been adjusted upward, making some refinancings extremely expensive. Costs are rising, which is leading to renewed price markdowns. However, some companies are convincing through their innovative strength and have recently outperformed the market. We take a closer look at the blockbuster stocks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEFENCE THERAPEUTICS INC | CA24463V1013 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , MORPHOSYS AG O.N. | DE0006632003 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer and BioNTech - Already closely tracking cancer

The Bayer share is currently a very popular DAX stock. On the one hand, the Leverkusen-based company has built up a large pipeline in its health sector, and on the other hand, a split-up fantasy has been traded for several weeks. The latest publications sound promising: the prostate cancer drug Nubeqa is one of the great hopefuls in the Leverkusen company's pharmaceutical product portfolio, as the previous top sellers Xarelto and Eylea are threatened with sales losses in the coming years as the products gradually lose their patent protection.

Bayer has now received the green light from the European Medicines Agency (EMA) for the cancer drug in combination with chemotherapy for the treatment of metastatic hormone-sensitive prostate cancer (mHSPC). According to the Company's headquarters, this cancer is most common in men in almost all northern and western European countries. Nubeqa can therefore be put to use. Revenue of EUR 158 million has already been generated in Q4 2022 and is expected to reach EUR 466 million for the full year. Over the product cycle, total revenues of up to EUR 3 billion should be possible. Bernstein Research, UBS and Barclays see more than 50% potential for the share with positive ratings and price targets between EUR 80 and 99. The stock is also fundamentally worth a look, as the 2023 P/E ratio is a low 7.8, and there is a dividend of around 3.8% - the split speculation is the icing on the cake.

Meanwhile, the BioNTech share continues to weaken. The mental end of the Corona pandemic has put further pressure on the shares of the Mainz-based innovator, even though management frequently points to the lush pipeline and the cash balance of around EUR 20 billion. Sales of the vaccine "Comirnaty" are collapsing as more and more countries want to withdraw from their purchase agreements. Most recently, Bulgaria came forward with its intention to cancel because there are probably no more willing vaccinators in the Balkan state. Poland, the Czech Republic and Lithuania also support an EU-wide withdrawal from the mandatory purchase. The BioNTech share has started 2023 quietly after peaking in 2022 at around USD 460 and is currently still 15% behind at EUR 122. Most analysts at Refinitiv Eikon give positive votes and expect an average price target of USD 212.61. With a price potential of around 90%, this seems a bit high to us at the moment.

Defence Therapeutics - Billion-dollar blockbuster in the pipeline

The good news continues for Canadian biotech company Defence Therapeutics (DTC), as the pipeline is reaching several Phase I clinical trials. CEO Sebastien Plouffe recently provided his investors with an update on the successes already achieved and the milestones planned for 2023.

Over the past three years, Defence has been very active in developing its ACCUM-based platform pipeline. The Defence team's strategy is to demonstrate the versatility of this technology. It will be used in several verticals in the future, including the development of a cell-based cancer vaccine targeting solid tumors. ACCUTox, a small molecule variant derived from the ACCUM backbone, will be used as an injectable anti-cancer agent for solid tumors. In its intranasal formulation, it will be used to treat lung cancer in a non-invasive approach. Further, DTC aims to advance the development of a protein-based cervical cancer vaccine and the breast cancer-specific antibody-drug conjugate (ADC) program. This will be followed by a comprehensive Good Laboratory Practices (GLP) study and investigation of the enhancing effect of ACCUM in the mRNA vaccine platform.

With its many projects, Defence Therapeutics shows a high hit rate in the industry. It should produce some hits from the various research approaches under the successful ACCUM platform in clinical trials. The 41.51 million shares are currently traded at about CAD 3.82; a few weeks ago, a price of CAD 4.85 was even reached. If a study is successful, the value stands at a multiple of today's valuation. Please also read our latest update on www.researchanalyst.com.

Morphosys - Recently in a downward spiral again

The announcements of job cuts put the brakes on the recent strong rise in Morphosys and sent the stock into a consolidation. In the current year, however, the shares listed in the SDAX continue to show a plus of 18%, but further profit-taking and the increase in the short ratio put pressure on the share price.

Although the data from the preclinical programs are promising so far, Morphosys needs to invest significant resources to bring this research through to clinical development. As a result, Morphosys will reduce its workforce at its headquarters in Planegg by approximately 17%. This measure, along with other steps taken last year, will serve to focus resources on the mid to late-stage oncology pipeline. The biotechnology company cited the challenging market environment for the industry as the reason for the decision.

"Continuing to advance the late-stage oncology pipeline is a top priority for Morphosys. It includes three Phase III studies and, most importantly, our MANIFEST-2 study of pelabresib in the first-line treatment of myelofibrosis. Pelabresib has great potential to improve the standard of care in myelofibrosis. We look forward to presenting the first data from this pivotal study in early 2024," commented CEO Dr Kress. JPMorgan analyst James Gordon took a slightly positive view of the job cuts but maintained his "Underweight" rating and a price target of only EUR 11. The 12 analyst houses on Refinitiv Eikon are overall very heterogeneous in their valuation and expect a median target price of EUR 24.88 in the next 12 months. There is a lot of expectation here about the positive outcome within the oncology pipeline. A detailed study on Morphosys can be found at www.researchanalyst.com.

The biotech sector is struggling in 2023. However, the oncology sector remains the focus of investors. While BioNTech and Morphosys consolidate, Bayer and Defence Therapeutics rehearse the breakout to the upside. Diversification reduces the risk!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.