January 28th, 2025 | 07:20 CET

DeepSeek hits right in the eye! Selective correction on the way! Watch out for Nel, Siemens Energy, First Hydrogen, and SMCI

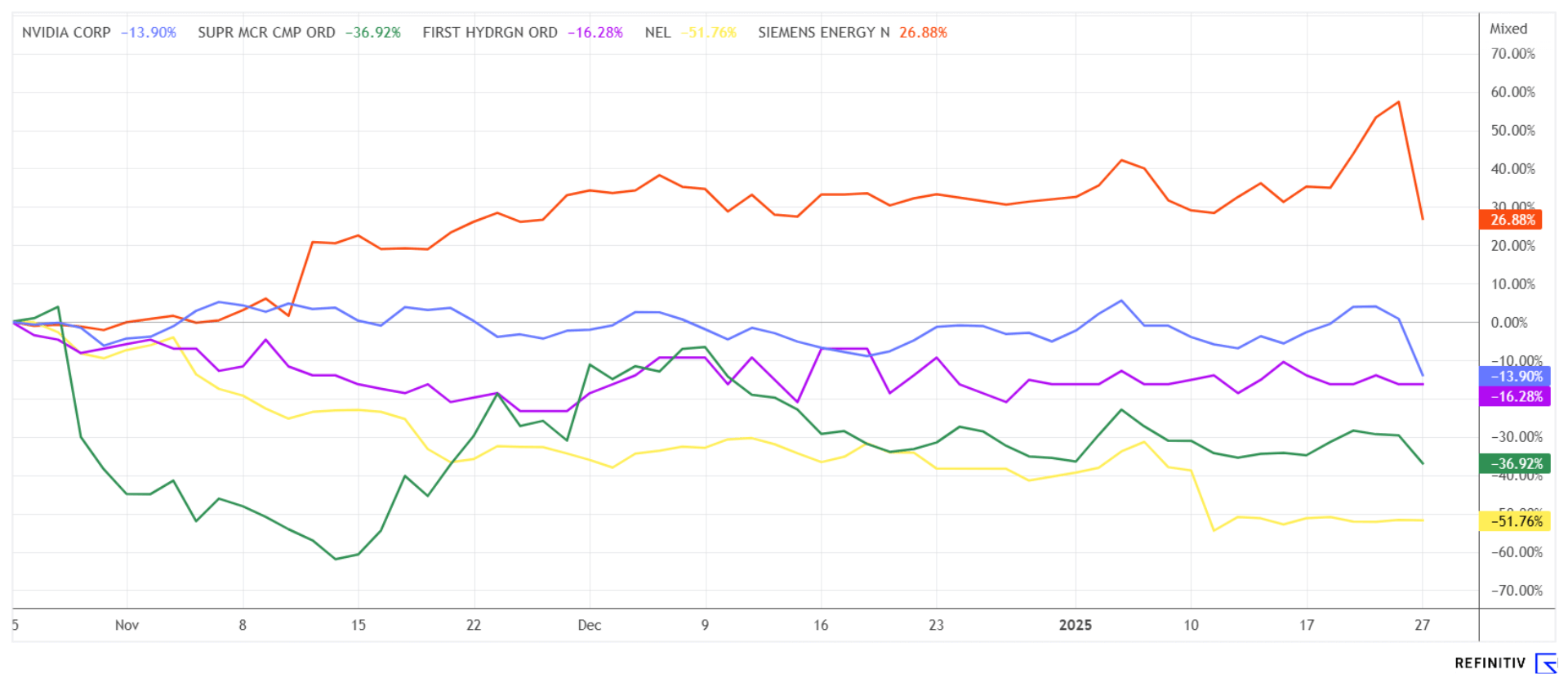

The Chinese language model DeepSeek is stirring up the AI market. The entire tech sector is reacting nervously and showing significant price losses. Artificial intelligence (AI) is proving indispensable in many areas. Large language models like ChatGPT are already helping to solve complex tasks, and their further development promises enormous advances for the economy and society. The new Chinese language model is seen as a serious challenge to US dominance in AI and threatens the dominance of the hyped US companies. The AI assistant introduced on January 10th recently overtook rival ChatGPT as the top-rated free software application in Apple's App Store in the US. A shot across the bow for Nvidia and associated companies. Some green energy stocks are also coming into focus. Is it time to jump on board now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , First Hydrogen Corp. | CA32057N1042 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Siemens Energy – A swap of favorites

Hydrogen currently has too few supporters in the political arena for the topic to be ready for discussion in Europe anytime soon. Central Europe lacks favorable energy sources to efficiently advance the conversion of water into green hydrogen. One of the pioneers in the electrolyser business is Nel ASA of Norway. While the Company has been struggling with a lack of major orders for some time now, the pressure to cut costs has now been added. The consequence: the production of alkaline electrolysers will be discontinued for the time being, and around one-fifth of the full-time positions are to be cut as of end-September 2024. Nel ASA shares fell to as low as NOK 2.10 or EUR 0.18 in a real sell-off. They have not yet recovered from this; at least the price is not falling any further. Speculative investors keep Nel on their watchlist and watch closely.

In yesterday's sell-off, the long upswing in Siemens Energy shares suffered its first noticeable setback. Previously, the stock had shone as the best performer in the DAX 40 index in 2024. However, investors were left red-faced yesterday with a minus of 19%. What happened? Siemens Energy was bought in recent weeks because investors suspected some links to the global AI boom. However, the DeepSeek announcement from China has dispelled these growth hopes and led to heavy profit-taking. Analytically, Siemens Energy is still conspicuously expensive for the year 2025 with a P/E ratio of 77, only in the next one does this ratio fall to 24.5, should earnings per share actually rise from EUR 0.74 to EUR 2.29. As a reminder, at the beginning of 2024, government guarantees had to be issued to get the troubled company back on track. The restructuring of the Spanish wind energy subsidiary Gamesa cost over EUR 4 billion at the time. Technically, the stock can still fall quite a bit before it finds solid ground again.

First Hydrogen – Small Reactors in Focus

Hydrogen from nuclear energy could become popular in the next few years. Many countries are stepping up their nuclear energy commitment under the NetZero environmental flag. Canadian innovator First Hydrogen is also picking up on this trend and, with its "Hydrogen-as-a-Service" model, aims to supply customers in the Montreal-Québec City region with clean, green hydrogen as a fuel for the first time in the next few years. The Company aims to create a fully integrated value chain that combines vehicle deployment, refueling, maintenance, and energy supply. With this combination of innovative technology and sustainable infrastructure, First Hydrogen plans to play a key role in shaping Canada's hydrogen economy for years to come.

The Company is exploring the potential of producing green hydrogen using electricity from small modular nuclear reactors (SMRs). Several high-tech companies, such as Microsoft and Nvidia, are thinking aloud about the use of SMRs, which provide a scalable and low-carbon alternative to conventional energy sources. These compact and flexible reactors not only promise cost-effective and safe energy production but also new opportunities for decarbonizing energy-intensive industries. Experts expect steep growth figures in the SMR sector. According to an estimate by IDTechEx, the global market for small reactors will grow to around USD 72 billion by 2033, and just 10 years later, it could be around USD 295 billion. First Hydrogen will ride this trend technologically, because it has been in the hydrogen business for several years.

First Hydrogen plans to present its technologies in Germany in the future. This is a good idea because there is a lack of creative energy solutions in this country, and the EU still needs to make significant efforts to meet its climate goals. First Hydrogen's shares have recently been trading more briskly again in the CAD 0.35 to CAD 0.40 range. With a market capitalization of only CAD 26 million, the FHYD stock could become a top pick for 2025.

Super Micro Computer – Hand in Hand with Nvidia

With a temporary discount of over 17%, the most hyped stock, Nvidia, leads the list of losers at the beginning of the week. This means that in one afternoon, three times the market capitalization of a Siemens share goes down the drain. We have repeatedly pointed out the overvaluation of high-tech stocks in recent weeks. The jug goes to the well so often until it breaks. Now, investors are watching the support lines at Nvidia like a hawk, they are between USD 97 and USD 112. Those who want to enter in the long term are waiting for the first turning signals. Currently, Nvidia is a falling knife!

Super Micro Computer (SMCI), a partner for cooling systems and mainframes, also went into reverse yesterday, falling 14% from USD 33.50 to USD 28.80. Hasty voices put the sell-off into perspective. "The doomsday scenario currently being propagated in the Twitter universe seems exaggerated," write the experts led by Stacy Rasgon of analyst firm Bernstein Research. Is that really the case? Interested investors who have not yet been involved should take a good look at developments over the next few days. Nvidia and SMCI are still far from favorably valued.

January has been quite decent so far, with the DAX 40 index still managing to gain over 1,500 points. However, there is much to suggest that the mood at the beginning of the year could now fade due to Donald Trump's inauguration. The high-tech sector is undergoing sharp corrections, and green energy is continuing to try to find a floor. First Hydrogen is involved in the area of SMRs, or small reactors. Here, the signs have been pointing to a storm for several weeks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.