July 14th, 2025 | 07:25 CEST

DAX correction! Biotech in takeover mode! BioNTech, CureVac, Pfizer, Vidac Pharma, and Kraft Heinz in focus

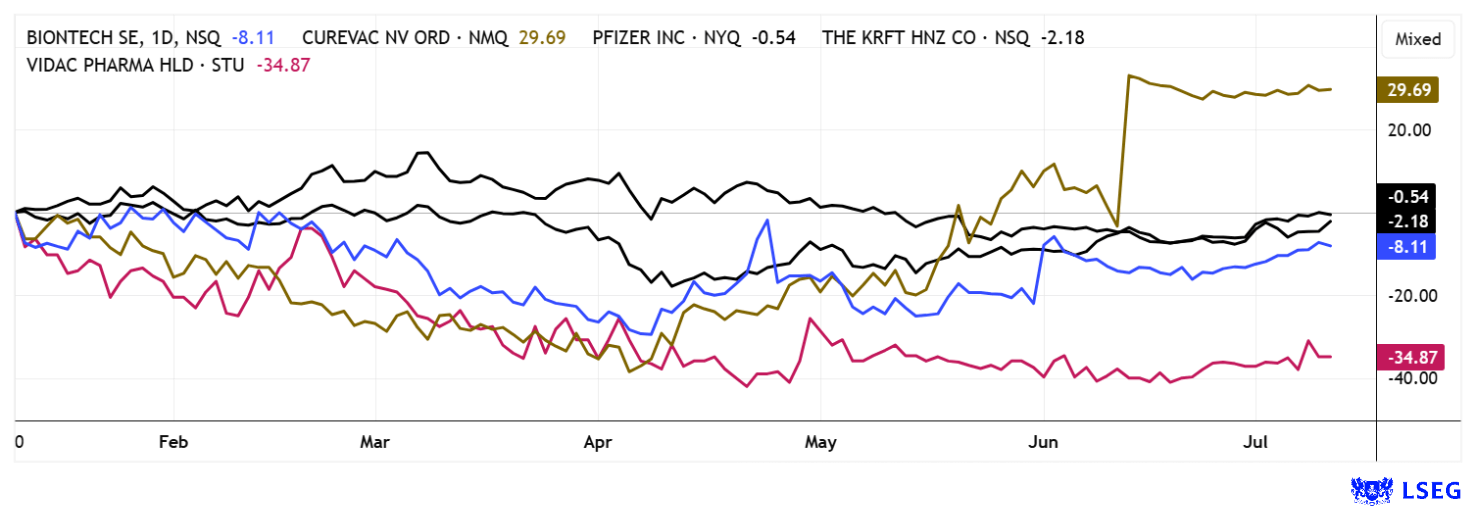

The stock markets are in top form: both the DAX and the NASDAQ 100 have flexed their muscles in recent days. Prices are being driven primarily by the continued strength of technology stocks and growing hopes for stable global economic growth, despite Donald Trump's tariff madness. At the same time, a growing takeover fever in the biotechnology sector is providing additional momentum. In the field of cancer research in particular, companies such as BioNTech, Moderna, and other specialized mRNA players such as CureVac are increasingly becoming the focus of strategic investors. The fight against cancer is increasingly becoming one of the key drivers for new partnerships and market consolidation. Speculation about possible mergers and billion-dollar acquisitions is currently on the rise again. This opens up an exciting environment for investors, offering opportunities for above-average returns. We identify the trigger points.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , CUREVAC N.V. O.N. | NL0015436031 , PFIZER INC. DL-_05 | US7170811035 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , KRAFT HEINZ CO.DL -_01 | US5007541064

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech and Pfizer – A comparison of takeover strategies

In an increasingly competitive market, BioNTech is positioning itself as a driving force in the next generation of cancer medicine through targeted acquisitions. With the planned acquisition of its archrival CureVac for around USD 1.25 billion, the Company is sending a strong strategic signal. The merger brings together two mRNA pioneers and opens up new potential for innovative therapeutic approaches. CureVac shareholders will benefit from an attractive premium, while BioNTech will significantly expand its oncology portfolio. At the same time, the acquisition of Chinese biotech company Biotheus strengthens the Company's global presence and adds a highly innovative bispecific antibody candidate to its own development network. These steps show that BioNTech is consistently investing in the future of precision medicine. At the same time, a billion-dollar cooperation agreement was signed with Bristol Myers Squibb, which will raise the international profile of BioNTech's clinical pipeline.

Pfizer, on the other hand, has remained cautious about acquisitions in the last six months. Following the USD 43 billion acquisition of Seagen, completed in 2023, the US pharmaceutical giant is currently focusing more on integration than expansion. While Pfizer is focusing on consolidation, BioNTech is pursuing a clear expansion strategy. The different focus is also reflected in the performance of the stocks. While BioNTech has already gained 23% in a 12-month comparison, Pfizer is lagging significantly with a loss of 17%. However, we find both attractive from a long-term perspective, BioNTech because of the momentum it has shown and, not least, Pfizer because of its 2025 P/E ratio of 8.5 and 6.6% dividend yield.

Vidac Pharma – New executive brings new momentum

With an impressive 12-month performance of +65%, Vidac Pharma is significantly outperforming both BioNTech and Pfizer. This success is attributable to the clear strategic focus of the Israeli biopharmaceutical company under the leadership of Dr. Max Herzberg. Vidac has a long and research-intensive history and is considered a pioneer in oncological drug development. The focus of its research is on the Warburg effect, a metabolic phenomenon in which cancer cells convert large amounts of glucose into energy. Vidac has developed a novel therapeutic platform that aims to specifically block this overactive glycolysis while restoring natural cell death (apoptosis) in tumor cells. This innovative approach could not only significantly reduce the side effects of traditional chemotherapy, but also make the tumor environment more receptive to immunotherapies and enhance their effectiveness.

As part of its dynamic growth strategy, Vidac Pharma has reached another milestone with the appointment of Dr. Eyal Breitbart (PhD) as its new Chief Technology Officer (CTO). Breitbart brings over 20 years of leadership experience in research, development, and operational management, including key positions at VBL Therapeutics. His extensive expertise spans all phases of drug development, from preclinical discovery to Phase 3 trials, as well as complex manufacturing processes in the biopharmaceutical industry. With his expertise, Vidac is driving forward further technological scaling and focusing on operational excellence.

"Dr. Breitbart combines technical depth with practical implementation in drug development, including late-stage work and manufacturing. He is also a strong team player, which fits well with Vidac's culture," said CEO Dr. Max Herzberg.

At the same time, Vidac Pharma is actively preparing for a stock market listing on a leading German trading platform, with the formal approval process with BaFin set to begin shortly. This is a strategic step to significantly expand access to international capital markets and secure the next stage of growth. With a strengthened team, strategic capital market access and a highly innovative pipeline, Vidac Pharma is excellently positioned to take the next step towards clinical and commercial breakthrough. The Vidac share price is attracting revenue again – the next rocket stage could soon be ignited.

Kraft Heinz – The long-awaited split is finally happening

A quick side note on Kraft Heinz. US food giant Kraft Heinz was formed in 2015 through the merger of Kraft Foods Group and H.J. Heinz Company, initiated by investment firms Berkshire Hathaway and 3G Capital. This USD 63 billion mega-merger combined two traditional companies to form one of the largest food companies in the world, with over 200 well-known brands. After years of below-average performance, stagnating sales, significant share losses of approximately 60% since 2017, and a write-down of USD 15 billion in 2019, Kraft Heinz is now considering a significant split. The Company intends to spin off its grocery segment into a separate entity this year, which analysts estimate could be worth up to USD 20 billion. The remaining company will focus on faster-growing categories such as sauces and condiments, including iconic brands such as Heinz Ketchup and Grey Poupon. They promise significantly higher margins. A great opportunity for value investors.

**Interest in biotech stocks is currently experiencing a noticeable comeback. Several company results and strategic outlooks are due in the coming weeks, which is likely to significantly increase volatility in the sector. Following the takeover of CureVac, BioNTech and Pfizer are now back in the spotlight for investors. Small-cap Vidac Pharma remains particularly exciting: its upcoming listing on a major German stock exchange could attract institutional investors and provide additional momentum.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.