December 11th, 2024 | 07:15 CET

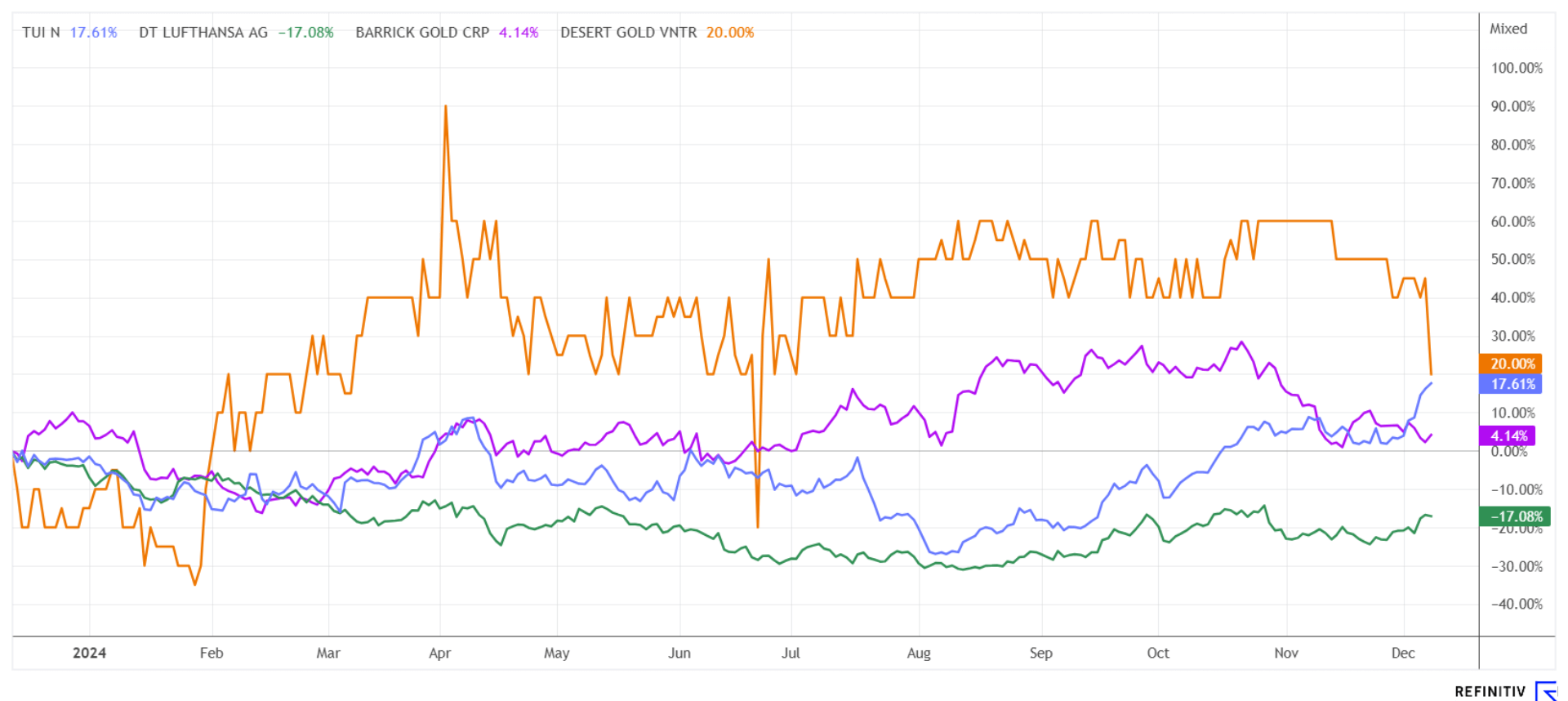

DAX 25,000 and gold at 3,500 next year? Position now with Lufthansa, TUI, Desert Gold, and Barrick Gold

After an extensive stock rally in 2024, many investors are wondering what the New Year 2025 will bring in terms of investments. Hopes are resting, on the one hand, on the upcoming conservative government changes in the US and Germany. There is great confidence in a new supply-side industrial policy flanked by further interest rate reduction measures. Deregulation of bureaucracy and tax relief could usher in a new era of corporate profitability, especially in Germany. This might eventually lead to the return of foreign investments and job creation, replacing the red-green visions of a carbon-neutral 28-hour workweek with full pay. We provide some insights on where and how profits might flow again.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

LUFTHANSA AG VNA O.N. | DE0008232125 , TUI AG NA O.N. | DE000TUAG505 , DESERT GOLD VENTURES | CA25039N4084 , BARRICK GOLD CORP. | CA0679011084

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Gold – The gold and copper giant at a historic low

With the gold price beyond the USD 2,650 mark, surprised investors are rubbing their eyes in disbelief when they look at the share price of the world's second-largest gold producer. At EUR 16.20, the stock has risen just 5.5% in the last 12 months, while the gold price has managed a respectable 33%. Barrick has been a reliable supplier of steady cash flows and distributions to its shareholders for years. This is because the gold and copper producer owns six so-called Tier One gold mines with an annual production of more than 500,000 ounces and a mine life of more than 10 years. At an investor event in November, CEO Mark Bristow gave an extremely positive summary of the past few years. Since 2019, the Company has generated USD 23 billion in operating cash flow and invested USD 15 billion in the Company's future.

The solid financial policy is paying off: net debt fell by USD 3.7 billion, while shareholders shared in the success with distributions of more than USD 5.4 billion. Bristow emphasizes that the investments made will secure production for at least ten years. A mega project is being pursued in Pakistan, where Barrick is developing Reko Diq, one of the world's largest copper-gold projects. A long-term investment in Barrick Gold currently makes sense, as the 2025 P/E ratio is just below 10, and the analyst consensus on the Refinitiv Eikon platform is for a target price of USD 33.75 for the next 12 months, around 80% higher than the most recent trading price.

Desert Gold – The sails are set for 2025

The Canadian explorer Desert Gold Ventures has been focusing on the Senegal-Mali Shear Zone (SMSZ) for several years. More than 1 million ounces of gold have already been identified here near surface. CEO Jared Scharf and his team of geologists are confident that they will soon be able to bring potential strategic partners on board. The calculation could work out, as Barrick Gold plays a significant role in Mali's mining industry, particularly through its Loulo-Gounkoto gold complex, which is one of the country's largest gold production sites. The mines account for 5 to 10% of Mali's gross domestic product annually and significantly contribute to the country's economy. Since it started operations, Barrick has invested over USD 10 billion in Mali, more than USD 1 billion in the last year alone, which, in addition to jobs, also means a high level of prosperity for the local population.

Barrick is seeking to establish long-term partnerships with the government and pursuing an active exploration strategy to secure future deposits. Desert Gold is, therefore, also preparing for a merger scenario and has a pre-feasibility study in the works. In addition, heap leach production is expected to start soon and deliver initial cash flows. This process allows for near-surface gold mining at a cost of less than USD 700 per ounce. Investors from both Arabia and China are showing interest in West African raw material deposits and are exploring possible takeover targets. CEO Scharf is confident of being able to secure a deal in 2025. The strategies of Barrick or neighboring mine operators such as B2Gold, Endeavour, or Allied Gold should facilitate such a plan. Desert Gold will soon present a resource update for its SMSZ property, and the share price should then be able to take off quickly. Currently, the Desert Gold share (DAU) is patiently waiting on the runway at around CAD 0.07 or EUR 0.048.

TUI and Lufthansa – This could be a perfect turnaround

The largest European tourism group, TUI, has apparently managed the turnaround. As if pulled by a hatstring, the price rose without major setbacks from EUR 6.20 in October to EUR 8.60 yesterday. Europe's largest tour operator is reporting strong demand for summer vacations in the coming year. A total of 400,000 additional vacation offers have been created at short notice to meet the high demand, particularly for popular destinations such as Turkey, Greece, Spain, Egypt, and Dubai. The FTI bankruptcy plays a major role in this because their quotas are now in demand with competitors, and the "early booking discount" seems to be in high demand again, with travel prices on average 14% higher. The strong travel business during the cold season is also providing a tailwind. In the last week, the EUR 8 mark was reached, and analysts on the Refinitiv Eikon platform expect an average 12-month price target of EUR 9.85. The share is soaring, and the challenging years from 2019 to 2022 have been completely swept away!

The shares of Europe's largest airline, Lufthansa AG, have yet to gain momentum. The international group, which includes Lufthansa, Swiss, Austrian Airlines, and Brussels Airlines, generated revenues of around EUR 35.4 billion in 2023 and transported around 123 million passengers. While its fiercest competitor, Ryanair, carried more passengers, it did so at significantly lower revenue. Due to various issues at airports and a few strikes, the mood in Frankfurt could be better. Recently, even restructuring consultants were shown the door. However, the operational realignment is in full swing. In addition to strengthening the hubs in Frankfurt and Munich, the Company is also heavily investing in Portugal. Like TUI, Lufthansa's subsidiary Eurowings is also expanding its summer flight schedule for 2025. From a technical perspective, the value would now only have to overcome the EUR 6.80 mark, and then the way would be clear at least to EUR 7.70. At least the LHA share is currently trading at a P/E ratio of 5.2 for 2025. The dividend is expected to increase from EUR 0.24 to EUR 0.30 next year. The stock should take off soon! Collecting below EUR 6.80 should pay off in the long term!

High-tech stocks in the DAX-40 index and on the NASDAQ have performed exceptionally well in 2024. However, there is still catch-up potential for German second-tier stocks such as TUI and Lufthansa, as well as for commodity stocks, which have undergone significant corrections in recent months. Regardless of the gold price, the share of Desert Gold should also be revalued in 2025, alongside the standard value Barrick, because a pre-feasibility study is expected in the first quarter, and the groundbreaking ceremony for heap leaching could also take place. Good diversification significantly reduces portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.