December 9th, 2024 | 07:15 CET

DAX 20,400 – Year-end rally underway! 100% opportunities are still lurking at Shell, BP, Saturn Oil + Gas, Nel ASA, and Plug Power

All EU countries have ramped up their alternative energy production in recent years. In particular, countries like Germany achieved a 65% share of electricity from renewable sources in the first half of 2024, with wind and solar as the main drivers of growth. However, the conflict in Ukraine since 2022 has now jeopardized the achievement of the 2050 targets more than ever because the lack of affordable fossil gas is threatening the transformation of the economy. The rising gas prices of recent weeks have awakened bad memories of 2022 among European energy traders and politicians alike. When the continent was in a rush to end its dependence on Russian gas, prices had already risen by 400%. The energy sector offers great opportunities – timing is of the essence!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BP PLC DZ/1 DL-_25 | DE0008618737 , Shell PLC | GB00BP6MXD84 , Saturn Oil + Gas Inc. | CA80412L8832 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TotalEnergies and Shell – Fossil and renewable energies on the move

Despite all the EU's efforts to reduce the fossil fuel share of its energy supply, progress is far from as rapid as hoped. The two energy giants, Shell and Total, are aligning their growth strategies with the EU's guidelines. TotalEnergies has put liquefied natural gas (LNG) at the forefront of its energy transition strategy. LNG is a key contributor to the Company's overall oil and gas portfolio, with a focus on low-cost, low-emission projects such as the expansion of the Qatar North Field, Mozambique LNG and US LNG projects. The 2023 annual report indicates that LNG and other gas-related activities account for approximately 10-15% of TotalEnergies' revenues. The Company also forecasts steady growth in gas-related cash flow, which is expected to grow by EUR 3 billion between 2023 and 2028.

Its much larger competitor, Shell, is a leading player in the global gas market, particularly in LNG. With a share of almost 45% of the total energy mix in 2023, gas accounts for a significant part of Shell's business. The Company plans to maintain its leadership position by investing in integrated gas supply chains, including LNG production and regasification facilities worldwide. Shell is also opening up new markets for LNG as a clean energy source, particularly in Asia and Europe. By 2027, the Dutch-British group expects a further increase in revenues from the gas business. At the same time, Shell is launching projects for the transition to clean energy, with the share of fossil energy set to decline steadily. According to Shell management, the increasing use of gas in the global energy transition is consistent with "NetZero" targets, as gas, a relatively clean transitional commodity, strikes a balance between economic growth and emissions reduction. With dividend yields for 2025 ranging from 4.5% to 6% and P/E ratios below 8, both stocks are currently extremely undervalued.

Saturn Oil & Gas – All sails set for 2025

The Canadian company Saturn Oil & Gas has grown rapidly in the last two years. The Company has grown from a daily production rate of around 10,000 BOE (barrels of light crude oil equivalent) to almost 40,000 BOE, propelling it to the ranks of mid-tier producer. In mid-2024, a CAD 535 million deal was a catalyst to refinance its outstanding debt, along with the addition of significant oil reserves in Saskatchewan. The Company generated record adjusted EBITDA of CAD 135.8 million in Q3-2024, reaching the CAD 430 million mark for the trailing four quarters. After integrating the new assets, the Company has 2,160 identified drilling locations.

Saturn was able to significantly reduce the cost of its debt by replacing the previous instrument with new Senior Notes having a five-year term, and an interest rate approximately 40% lower, with greater flexibility around the hedging and capital spending programs. This can support the generation of stronger cash flows going forward that can be used for new development and debt reduction. Saturn continues to plan for the long term, with 50-60% of oil and liquids production hedged on a rolling 12-month basis, as well as financial derivatives in place that lock in the CAD/USD exchange rate on its principal and interest payments for the US dollar denominated Senior Notes.

At a price of CAD 2.20, the 202 million outstanding shares are valued at around CAD 444 million, and net debt was CAD 779 million at the end of Q3 2024. In contrast, the net asset value per share of Saturn’s proved developed producing and total proved oil and gas reserves are estimated at CAD 7.40 and CAD 10.69, respectively. Saturn is currently trading at 1.9x forecast 2025e enterprise value (EV)/Debt Adjusted Cash Flows (EV/DACF), while the peer average is around 2.4. Consequently, the analyst at Eight Capital rates the stock a "Buy" with a price target of CAD 7.35, while Ventum has a target of CAD 6.50. The average of seven analysts is reported at CAD 5.40 on the Refinitiv Eikon platform, around 150% above the current price. This makes Saturn Oil & Gas one of the most undervalued North American oil and gas companies.

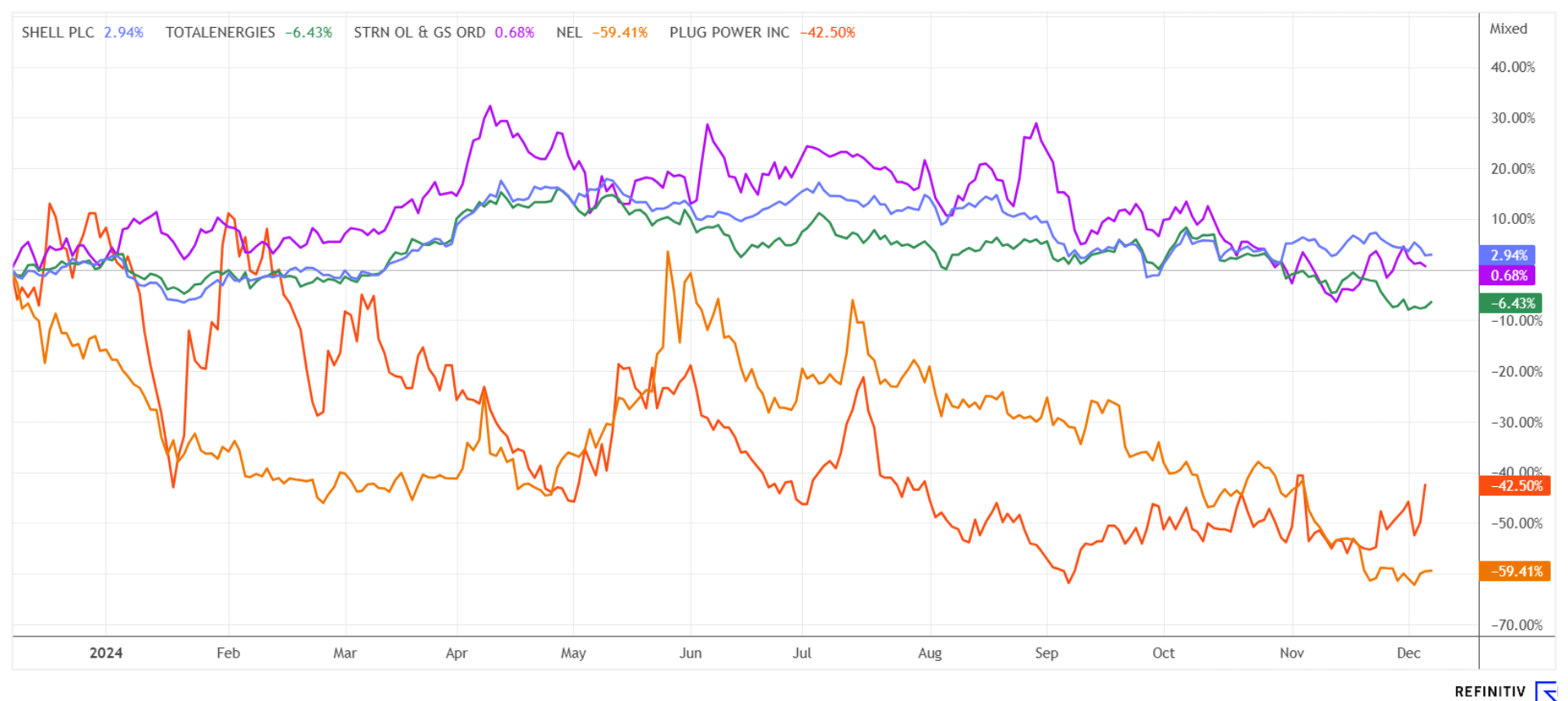

Nel ASA and Plug Power – The disaster is not over yet

In the context of the "NetZero" discussion, hydrogen as an energy source is also attracting a great deal of attention. One of the pioneers in the electrolyser business is Nel ASA from Norway. The share price is currently hitting new lows as there is a lack of public contracts across the board, and the issue is not being addressed by the private sector due to excessively high generation costs. Now, the hydrogen company, through its subsidiary Nel Hydrogen Electrolyser AS, has signed a contract with Samsung C&T for the delivery of 10 MW alkaline electrolyser technology. The demonstration plant in Korea will be used to test a model for so-called "pink hydrogen" projects, in which surplus energy from nuclear power is used to produce hydrogen. This innovative approach could set a precedent if successful. The contract value is a low EUR 5 million, but with annual revenue of around EUR 25 million, it is certainly relevant. Nel ASA recently hit a five-year low of NOK 2.75 but has held up well so far. On Friday, it rose above the NOK 3 mark again after a difficult few weeks of sell-offs. Keep the stock on your watchlist: if the NOK 3.30 mark is broken, a technical rebound could occur quickly.

The 10 times larger competitor from the US is Plug Power. Here, too, there have been historic losses of up to 95% since 2021. However, investors should remain vigilant, as the price has already rebounded 3 times at the USD 1.85 mark and stood at a recovered USD 2.36 on Friday. On the Refinitiv Eikon platform, 7 of 29 analysts still issue a "Buy" rating, with price targets varying between USD 1.50 and 5.00, delivering a weighted average of around USD 2.65. However, a further capital increase may be necessary in early 2025, as liquid funds fell to around EUR 94 million as of September 30. Keep watch!

The stock market appears to reflect a conciliatory year in 2024. Despite ongoing political wrangling, the EU has yet to be able to agree with the rest of the world on a reliable decarbonization path. As a result, oil and gas stocks remain in demand internationally. Saturn Oil & Gas is expected to continue to surprise in 2025 on the strength of its own merits. When hydrogen will be rediscovered as an investment, however, is anyone's guess.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.