September 12th, 2025 | 07:10 CEST

Cryptos & tokens in rally mode - Caution with Strategy, Finexity, Coinbase and Palantir

Stock market dynamics evolve in certain cycles. With the advent of high-performance computers, trading has become faster, and new asset classes like cryptocurrencies are leading to a shift in liquidity to other segments. The global crypto market is expected to experience exponential growth through 2030, potentially reaching over EUR 10 trillion, driven by increasing acceptance of tokens, DeFi, NFTs, and institutional investments. The market opportunities for tokenized securities are enormous, with experts projecting an annual growth rate of over 60%. Strategy and Coinbase are very well-positioned on the NASDAQ as prominent representatives of the crypto sector. Palantir is proving to be an innovation leader at the interface of AI, Blockchain, and data management. In Germany, the financial services provider Finexity AG recently went public. Opportunities are plentiful – but selection is far from easy.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

MICROSTRATEG.A NEW DL-001 | US5949724083 , FINEXITY AG | DE000A40ET88 , Coinbase | US19260Q1076 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Strategy and Coinbase – The NASDAQ leaders in the crypto business

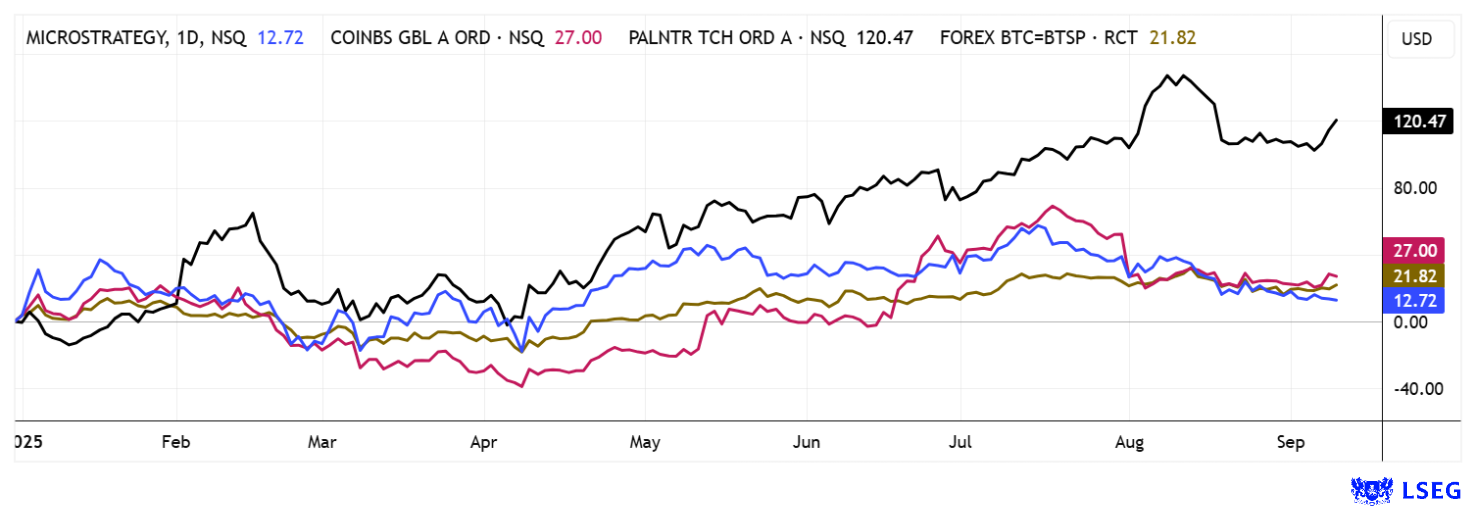

Shares in MicroStrategy (new name: Strategy) and Coinbase have benefited greatly from the crypto boom over the last 12 months, rising by 138% and 88%, respectively. Under former CEO Michael Saylor, Strategy has established itself as a pioneer of an entrepreneurial Bitcoin strategy and currently owns over 420,000 Bitcoins (BTC), which has a strong influence on the Company's value. The stock is considered a proxy for Bitcoin, as it allows investors to participate in the performance of the cryptocurrency indirectly. Coinbase is expanding its offering with innovative crypto financial products and remains a central trading venue for institutional and private investors.

Despite ongoing skepticism from established banks and brokers, the crypto market has recently proven to be one of the fastest-growing asset classes globally, with strong momentum from institutional investors. ETFs and futures products on BTC and other standard coins are now available, regulation is progressing, and technological innovations are exploding. Key players like Strategy and Coinbase are well-positioned to help shape this evolution and offer attractive, albeit high-risk, opportunities. Those who do not want direct exposure to crypto assets can participate in the overall performance of the sector with these stocks. However, it is clear that the underlying companies and their business models vary in terms of success. Analysts on the LSEG platform believe Strategy and Coinbase have an average 12-month price target of USD 570 and USD 372, respectively. Even though there is room for growth, the price development will still be strongly aligned with Bitcoin as a benchmark.

Finexity AG – Private Markets go Blockchain

Back to Germany. On the fringes of the NASDAQ high-tech boom, it is also worth keeping an eye on the local scoreboard for promising stocks. Finexity AG, based in Hamburg, is a leading provider of digital private market investments and one of the few innovators in the European market for tokenized securities. The Company has been listed in the m:access segment for small and medium-sized companies on the Munich Stock Exchange since September 2025 and currently has a market capitalization of around EUR 55 million. The platform offers institutional and private investors access to asset classes such as real estate, private equity, private debt, infrastructure, renewable energy, and collectibles. More than 250 tokenized securities from over 50 issuers are already tradable, and the network comprises more than 84,000 registered investors. Originally launched as an investment broker for private clients, Finexity has been increasingly working as a white label partner for banks, savings banks, credit unions, and asset managers since 2022. In order to ensure regulatory compliance, Finexity acquired a majority stake in the liability umbrella provider Effecta GmbH in August. Tobias Hirsch, Founder and Managing Director of Effecta, will continue to lead Effecta and also take on a central role in the strategic development of Finexity AG.

The Company's own trading platform is considered a key growth driver and already enables the rapid trading of digital assets, which was previously reserved primarily for institutional investors. Finexity plans to push ahead with its transformation into a multilateral trading facility. This would transform the OTC model into a fully regulated infrastructure with real-time processing. Growth is based on three strategic pillars: targeted acquisitions, technological scaling, and international expansion. With CROWDLI in Switzerland and Effecta in Germany, two acquisitions have already been successfully integrated, opening up additional markets and around 70,000 investors. At the same time, the Company is exploring secondary listings to expand its reach and liquidity further. In fiscal year 2024, Finexity generated pro forma revenue of more than EUR 6.7 million and has raised over EUR 25 million in growth capital since its inception. The shareholder structure is considered stable, as around 50% of the shares are held by management and anchor shareholders. CEO Paul Hülsmann himself holds a significant stake of 16% and has repeatedly referred to the Company's long-term orientation. Investors and management are also subject to lock-up periods of between 24 and 30 months, which is a good sign.

The market environment for digital assets is evolving rapidly, while major players like Deutsche Börse and Coinbase are still proceeding with caution. In contrast, Finexity is capitalizing on its agility, regulatory expertise, and established partnerships. The Company is emerging as a dynamic and promising player in Germany's crypto and alternative assets space - with real momentum!

Palantir – Seemingly limitless growth

In terms of innovative strength and visionary approaches, it is worth taking a look at US data specialist Palantir Technologies. Founded by Peter Thiel, the Company made it onto the NASDAQ at the end of 2020 after a bumpy run. Headquartered in Denver, Palantir is considered a partner to governments and the military, and is said to have provided essential intelligence services in the Ukraine war. With its two data software systems, Gotham and Foundry, Palantir provides services in the areas of data tracking, cybercrime, and defense. Recently, it has also made a name for itself as an innovation leader at the interface of AI, Blockchain, and data management.

In the past fiscal year 2024, Palantir generated revenue of just under USD 2.87 billion and posted an after-tax profit of USD 462 million for the first time. In 2025, the Company is expected to increase its revenue by 50% to approximately USD 4.2 billion, with profits expected to triple. Based on these estimates, Palantir has a P/S ratio of 88 and a P/E ratio of approximately 250 for 2025. Analysts on the LSEG platform expect revenue to grow by 20 to 25% per year over the next few years. However, only 6 out of 26 experts still recommend buying the stock, with an average price target of USD 165. That is exactly where the stock ended up this week. Will the stock keep flying? A philosophical question.

In addition to Bitcoin and Ethereum, speculators have earned thousands of percent in recent years with so-called altcoins - smaller imitators of the major currencies. Today, investor interest has narrowed to around 10 leading cryptocurrencies and so-called tokenization. While companies like Strategy and Coinbase have long been considered blue chips in the sector, the newly listed financial services provider Finexity impresses with a specialized service portfolio. Palantir plays in a league of its own, as its valuation likely defies rational explanation for the average investor.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.