November 26th, 2024 | 07:00 CET

Crypto & Bitcoin, the USD 100,000 madness – Will power shortages loom? Coinbase, Myriad Uranium, C3.ai and Palantir

The crypto madness continues! This week, Bitcoin enthusiasts are glued to their trading screens. Will the cryptocurrency break through the USD 100,000 barrier? Experts in the coin segment even consider price targets between USD 250,000 and 1 million conceivable. Anything is possible, as they say today. Meanwhile, market analysts are also noting the looming risks of power shortages. The extensive mining operations and the increasing use of artificial intelligence are consuming unprecedented amounts of electricity, demands not anticipated five years ago. Several countries have, therefore, decided to expand their nuclear power capacities, including France, Poland, Finland, the US and China. Conversely, Germany plans to stick to renewable energy sources - let's hope the sun starts shining at night soon. We explore these booming segments and seek opportunities for returns.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

Coinbase | US19260Q1076 , MYRIAD URANIUM CORP | CA62857Y1097 , C3.AI INC | US12468P1049 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] Most of all we were on a mission to MAKE CRYPTOCURRENCY ACCESSIBLE [...]" Justin Hartzman, CEO, CoinSmart Financial Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

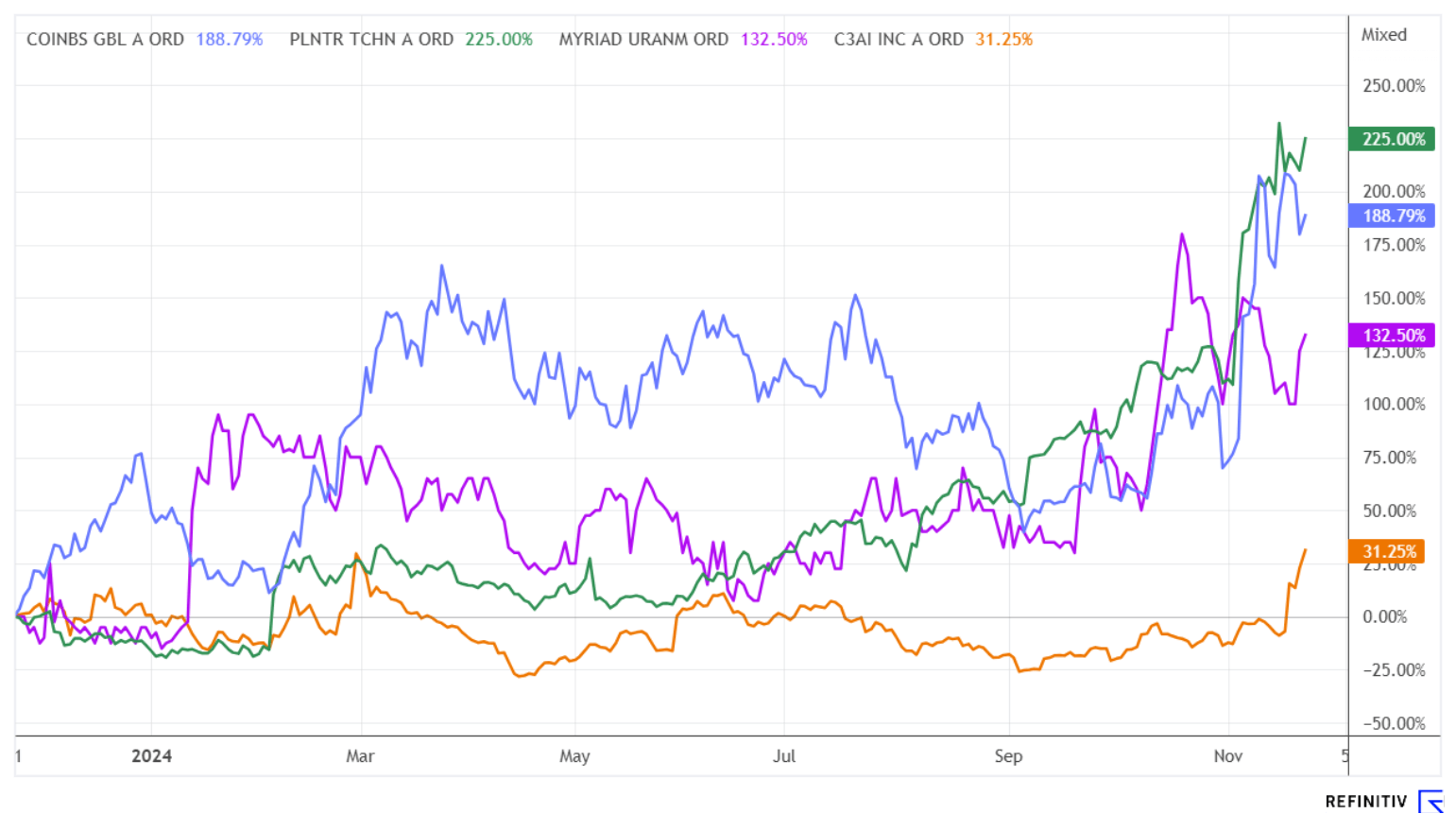

Coinbase – Tenfold growth in 24 months

One of the winners of the crypto bull market is the trading platform Coinbase. Investor expectations here are based on the rising revenues and trading profits, which have more than tripled over the last year. The price of Coinbase shares celebrated this fact with a tenfold increase since the end of 2022 when Bitcoin reached its correction low at around USD 16,000. At the time, Coinbase shares were trading at around USD 34. In the last trading week, the price reached a new 4-year high of USD 341.50. It is now not far from its all-time high from 2021.

Despite all the crypto euphoria, investors should pay attention to the fundamentals. With estimated 2024 sales of USD 5.5 billion and net profit per share of USD 5.40, the current P/E ratio is 56, and the price-to-sales ratio, including debt, is a full 14.8. Such valuations are similar to those seen during the crypto bull market of 2019. It is, therefore, no wonder that the Company's founders and executives are vigorously exercising options and selling shares. In recent weeks, CEO Armstrong has dumped shares with a market value of over USD 300 million. This caused the price to correct from USD 330 to USD 290 for the time being. The shares recovered slightly at the start of the week. Caution: when Bitcoin turns, it could quickly go in the other direction!

Myriad Uranium – Heading into the new year with full coffers

The share of nuclear power in global energy supply is expected to increase significantly in the coming decades, particularly due to the expansion of new reactor technologies such as small modular reactors (SMRs). According to the International Atomic Energy Agency (IAEA), global capacity could more than double from around 390 GW at present to up to 950 GW by 2050. The main reasons for this increase are the global climate protection agenda and the need for energy security, particularly due to geopolitical tensions and rising energy prices. This development is being driven by new projects in Asia, Europe and especially North America.

According to experts, the uranium market will show a deficit of about 40% by 2030, so there is a need to develop new mines. With the coup in Niger, the Canadian uranium explorer Myriad Uranium left Africa. A wise decision because now the strategic metals expert concentrates on the most promising uranium deposits in the US. With a sensational 75% deal, Myriad gained access to an already extensively explored area called Copper Mountain. Exploration is currently picking up pace, with further results from equivalent uranium grades (eU3O8) to be announced in November. Spectral gamma ray measurements continue to confirm high-grade uranium mineralization in the Canning deposit area, as well as the results of historical work by Union Pacific. Chemical analysis of core and reverse circulation samples collected from the drilling is currently in progress. Drilling continues to return highly encouraging eU3O8 results, with multiple intercepts averaging greater than 1,000 ppm eU3O8 and with a top intercept of up to 3,870 ppm eU3O8 identified.

Myriad's shares are currently enjoying investor favor. The price has already climbed over 130% in 2024; we had recommended the stock early on. Last week, the Company raised an additional CAD 2.5 million in growth capital through a capital increase at CAD 0.40. This sets the course for 2025. Strengthen your holdings because the uranium rally is likely to continue vehemently in 2025!

C3.ai and Palantir Technologies – Artificial intelligence still in rally mode

Anyone investing in artificial intelligence repeatedly comes across the stocks C3.ai and Palantir Technologies. Both companies are growing at 30 and over 200%, respectively, and demand for their stocks remains strong. Since last week, C3.ai has been attracting attention again. C3 and Microsoft announced that they have expanded their strategic partnership to accelerate the adoption of AI in businesses on the Microsoft Azure cloud computing platform. The partnership dates back to 2018. Under the new agreement, Microsoft is the preferred cloud provider for C3's AI offerings, and C3 is integrating Microsoft Azure application software. A strong argument for further growth.

There is also a lot going on at Palantir Technologies. Revenues and profits are rising, but so is the valuation. The Company is now trading at a 2025 P/E ratio of 130, with analysts' average price targets of around USD 38 already exceeded by more than 70%. No wonder that CEO Alex Karp is also cashing in. On Friday, it was reported that he sold nearly 40 million shares in the past three months for USD 1.9 billion. In the last week alone, he sold securities worth around USD 73.1 million, according to a recently published SEC report. Another burden could arise from Karp's current trading strategy, which allows the sale of a further 9 million shares until May 2025. Jefferies responds with the first downgrade and a new price target of USD 29. On the Refinitiv Eikon platform, only 3 out of 19 analysts now issue a "Buy" recommendation. Caution at the platform edge, because the passing train is traveling at hyper speed.

The great popularity of cryptocurrencies and the use of artificial intelligence places great demands on the global energy infrastructure, as the main demand for electricity comes from urban areas. Whether all of this can be sustained with renewable sources is now being questioned even by scientists. Uranium will become scarce due to the necessary expansion of nuclear energy. Investors continue to benefit from these trends, and a risk-conscious diversification across several sectors is recommended.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.