May 22nd, 2025 | 07:20 CEST

Caution! Takeover imminent at Evotec or BioNxt, tension remains high at Bayer and Valneva

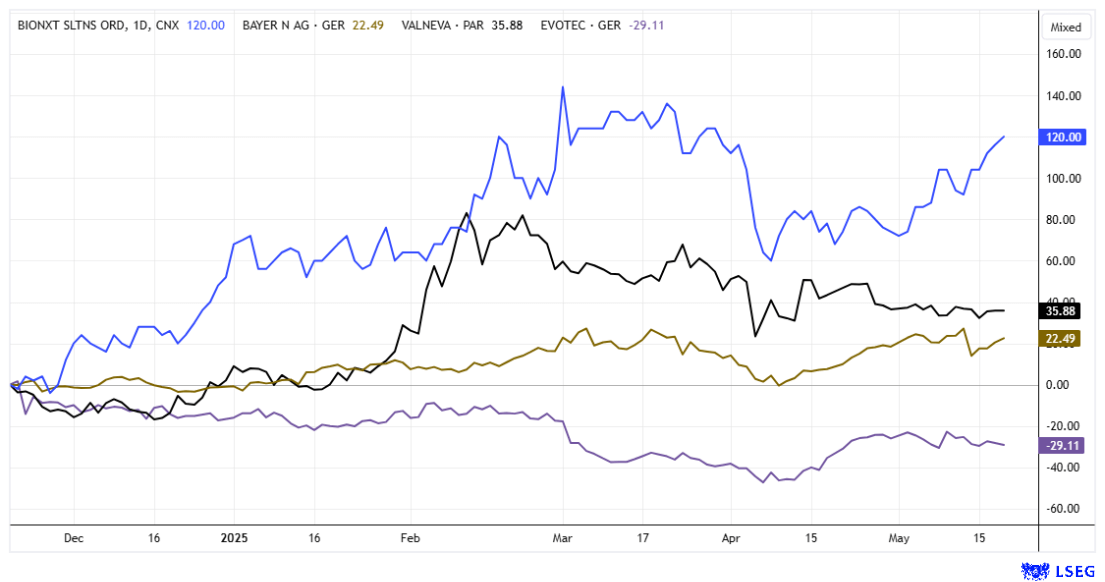

In advanced stock market cycles, many investors wonder where returns can still be made. Defense and high tech have raced ahead, and a sector rotation remains, particularly in favor of biotech. Despite substantial gains in major indices such as the DAX 40, up nearly 20%, the Nasdaq Biotech Index (NBI) is still down nearly 7%. The excitement is mounting, as some stocks are heading north and delivering better-than-expected figures. From an analytical perspective, Evotec and BioNxt are so undervalued that a takeover can no longer be ruled out. Bayer has issued a strong statement to the US courts, and Valneva is set to outperform its previous year's Q1 figures significantly. Time for an update: Where are the buying opportunities?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

Bionxt Solutions Inc. | CA0909741062 , BAYER AG NA O.N. | DE000BAY0017 , VALNEVA SE EO -_15 | FR0004056851 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer – Now highly interesting from a technical perspective

Hamburg-based drug discovery company Evotec saw a slight slowdown in revenue to around EUR 200 million in the first quarter. This was primarily due to lower revenues in the drug discovery and preclinical development business segment. As expected, EBITDA fell by approximately 60% to EUR 3.1 million. Expenses for the launch of the US subsidiary Just - Evotec Biologics had an impact on the results. The net loss increased by 50% from EUR 21 million to EUR 32 million. Surprisingly, the share price had already gained momentum after the April sell-off from EUR 5.30 to EUR 7.50, but fell back to around EUR 7 following the announcement. This is no disaster, as the market is looking to the future. Analysts on the LSEG platform expect an average 12-month performance of EUR 10.30, which offers around 50% potential. Technically, the renewed test of support has provided positive confirmation of the trend. The EUR 6.40 mark is a suitable stop line.

At Bayer, good figures were finally reported again at the beginning of last week, and the share price jumped to a high of EUR 26.90 within two hours. However, when it became known that there were already new lawsuits against Monsanto regarding glyphosate, the mood immediately changed, and the share price plummeted back to around EUR 22. Operating results had previously reported that the cost-cutting program in middle management was slowly taking effect and that additional jobs would be cut in Leverkusen in the current year. With revenues of EUR 13.7 billion, EBITDA before special items fell by 7% to EUR 4.1 billion. Nevertheless, debt was reduced from EUR 37.5 billion to EUR 34.3 billion. There are now 5 positive analyst ratings out of a total of 28 current assessments. The average target price is now EUR 27.20. The double dip below EUR 20 on the chart is also encouraging, and the technical recovery should go significantly higher. If the US Supreme Court does not rule in Bayer's favor in the glyphosate case, the German group's management is threatening to spin off its US subsidiary Monsanto and declare it bankrupt. Legal reviews are already underway. Exciting times ahead!

BioNxt Solutions – On the way to becoming a producer

The Canadian expert in innovative delivery systems for active ingredients secured CAD 2.5 million in fresh financing in April. Since September 2024, BioNxt's share price has already tripled from around EUR 0.13 to EUR 0.39, with investors' positive sentiment based on recent progress. BioNxt has now leased research facilities in Munich through its German subsidiary to start developing market-ready products. In recent months, the focus has been primarily on transdermal and orally dissolvable preparations. The leading development program in the portfolio is the sublingual cladribine product for the treatment of multiple sclerosis (MS). The developers at BioNxt expect that their in-house cladribine product will offer a significant advantage over the available tablet form for patients suffering from dysphagia (difficulty swallowing). The current patent series covers the sublingual administration of drugs to treat autoimmune and neurodegenerative diseases.

Bionxt has relocated its research, development, and commercialization activities to Gen-Plus GmbH & Co. KG in Munich. The move provides BioNxt with expanded R&D and collaboration opportunities and benefits from accelerated innovation potential in an important European biotech hub. GMP-compliant processes are now possible, and the resulting potential for drug delivery systems, therapeutics for neurodegenerative diseases, and next-generation biomedical technologies could put the Company on the path to becoming a manufacturer in the coming quarters. In the coming weeks, BioNxt and Gen-Plus will focus on developing and marketing their lead product, BNT23001, a sublingual thin-film formulation of cladribine for treating multiple sclerosis (MS). The necessary preparatory activities for the planned human bioequivalence study include placebo studies, product and technology transfer, upscaling of production, and analytical validation of the pharmaceutical active ingredient. Work is already underway.

This is excellent news for investors in the newly resurgent BNXT share, as the long dry spell in development since 2021 could now lead to a significant acceleration. The technical resistance around EUR 0.40 might break sooner than expected. In 2021, the share price was already above EUR 2 – around five times higher. Due to the low valuation of just under EUR 38 million, a major player could also be lurking in the wings. Keep adding to your position!

Valneva – Q1 figures and administration halt

French-Austrian vaccine manufacturer Valneva posted fairly good figures for the first quarter. Revenues reached EUR 49.2 million after EUR 32.8 million in the previous year, but the bottom line is still a net loss of EUR 9.2 million. The previous year, the Company reported a profit of EUR 58.9 million thanks to extraordinary income from voucher rights in the US. However, the operating burn rate – i.e. capital expenditure – developed positively, dropping from a high EUR 28.4 million to just EUR 8.1 million. As of March 31, 2025, the Company had EUR 153 million in cash, plus an additional USD 14.2 million from a capital measure. Management's goal remains to reduce capital requirements and achieve revenue of approximately EUR 190 million. There are currently a few uncertainties regarding the live chikungunya vaccine. Both the EMA and the US CDC currently recommend suspending its use, as there appear to be some serious side effects. The share price has lost around 33% since its high of EUR 4.30 in 2024 and currently stands at EUR 2.90. First Berlin nevertheless confirmed its "Buy" recommendation with a target price of EUR 8.10 despite the uncertainties.

The biotech sector remains volatile and highly earnings-driven. Industry players are desperate for success in order to positively influence share prices. Despite recent corrections, the technical picture looks better for Bayer and Evotec, while Valneva needs the unresolved questions regarding side effects to be resolved positively. Otherwise, it may face trouble. BioNxt shares are performing exceptionally well, up more than 100% since the beginning of December. The rally could very well continue!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.