March 5th, 2025 | 07:25 CET

BYD, XXIX Metal Corp, Volkswagen – Copper crowns the electric boom

Electric mobility is gaining momentum worldwide, and copper is becoming an indispensable fuel for this energy transition. Without the metal, there would be a lack of batteries, electric motors, and the necessary infrastructure like charging stations. In the automotive sector, Chinese electric vehicle pioneer BYD is setting the course for its global expansion with a multi-billion dollar share issuance. The Company aims to produce 6 million vehicles in 2025. This boom will benefit the demand for raw materials such as copper. Here, the Company XXIX Metal shines. The Canadian copper explorer holds nearly 5 billion pounds of copper and could become a key player in this boom. Its name says it all: "XXIX" for the Roman numeral 29, which represents the atomic number of copper in the periodic table. Volkswagen can breathe a sigh of relief thanks to relaxed EU CO₂ regulations, but the Company is burdened by the planned US tariffs and technical setbacks. We provide the details.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , XXIX Metal Corp. | CA9013201012 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

BYD raises billions for global EV expansion

The Chinese electric vehicle maker BYD has raised HKD 43.5 billion (approx. EUR 5.32 billion) in Hong Kong with a share issue – the biggest issue sale in almost four years. Analysts see the financing as an acceleration for BYD's global ambitions. The Company sold 129.8 million shares at HKD 335.20 (around EUR 41) each. According to BYD, demand was enormous, and the offering was oversubscribed several times.

Strategic investors such as the Al-Futtaim family office from the United Arab Emirates as well as long-term and sovereign wealth funds have participated. BYD plans to expand its cooperation with Al-Futtaim in the field of innovative energy vehicles. The funds will be used to finance research and development, foreign expansion, working capital, and general corporate purposes. Since January, the share price of the Chinese high-flyer has already risen by 30%.

To avoid tariffs, BYD is setting up production facilities worldwide. Among other things, a third factory in Europe is in the planning stage, and a huge research and development center is being built in Shenzhen, China. In February, the Company sold over 318,000 electric and hybrid vehicles, representing an increase of 161% over the previous year. The Company also recorded further growth with 67,025 exports. BYD's target is to produce up to 6 million vehicles in 2025.

XXIX Metal is growing to become one of Eastern Canada's largest copper owners

The Canadian company XXIX Metal Corp. is growing into one of the largest copper owners in Eastern Canada, with the promising Opemiska and Thierry projects. At the Metals Investor Forum in Vancouver in mid-January, CEO and Chairman Stephen Stewart explained his strategy for further advancing the Company. "We have almost 5 billion pounds of copper in the ground," Stewart emphasizes. The new drilling will advance the Company further.

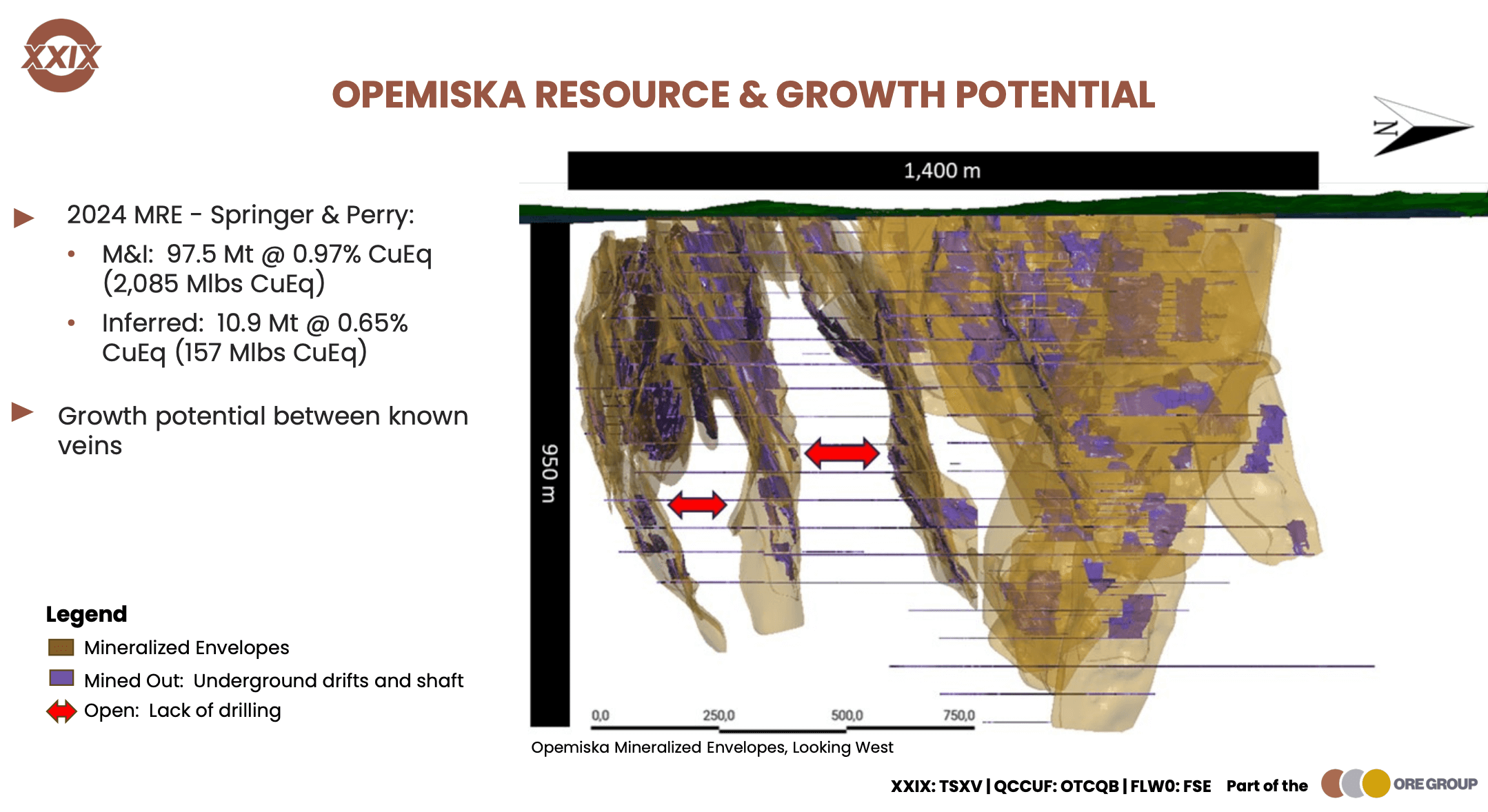

- The flagship Opemiska in Quebec is considered Canada's highest-grade open-pit copper deposit with 97.5 million tons at 0.97% CuEq (2.085 billion pounds, Measured & Indicated). In late February, the XXIX Metal team initiated a 20-hole drill program at the Saddle Zone to expand the high-grade resource. This follows a successful hole that returned 5.94% CuEq over 11 meters. The objective here is to convert waste to ore, add a mineable zone, and increase tonnage.

- Thierry in Ontario, the largest copper resource in the province, offers 8.8 million tons at 1.66% Cu (underground) and 53.6 million tons at 0.38% Cu (open pit). Both projects benefit from excellent infrastructure. With a market capitalization of CAD 17.44 million, CAD 6.8 million in cash and 174.4 million shares, XXIX plans to conduct pre-feasibility studies within two years.

The parent company of XXIX, Ore Group, has raised over CAD 200 million for this purpose, which provides additional stability in dynamic markets. "We are using the data from previous producers and building on it," says Stewart. XXIX offers investors an exciting investment in the copper boom, supported by ongoing exploration and solid management. Stewart has more than 15 years of experience in the industry.

Volkswagen breathes a sigh of relief: EU relaxes CO₂ targets, but US tariffs loom

Due to pressure from the automotive industry, the European Commission is relaxing the previous CO₂ emission targets. This means a deep breath and a slight upturn for the Volkswagen Group and its shares. Major manufacturers like VW now have three years (2025-2027) to meet the requirements for passenger vehicles and vans instead of the previous one year. "The targets remain, but the industry is getting more leeway," says Commission President von der Leyen. Implementation depends on increasing sales of electric vehicles – an area in which European manufacturers are lagging far behind Chinese brands such as BYD and US competitors such as Tesla.

The VW Group is facing new burdens: After the US has already imposed 25% tariffs on imports from Mexico and Canada, US President Trump is planning further levies on EU products. He literally said: "cars and all other things". Due to EU regulations, Volkswagen is also under pressure to adapt its supply chains. So far, the construction in Brussels seems to be doing more harm than good to European industry.

In addition, the Wolfsburg-based company had to recall over 60,000 electric vehicles (Audi Q4 e-tron, ID.4) in the US. In the land of automatic vehicles, a software error in the gear display poses a risk of rolling if the parking brake is not activated. Volkswagen remains attractive for investors, albeit with risks from trade policy and technical hurdles.

BYD impresses with a HKD 43.5 billion (approx. EUR 5.32 billion) share sale. With the ambitious goal of producing 6 million vehicles by the end of 2025, supported by flourishing research and development and worldwide production facilities, BYD is set to become an EV highflyer. For investors, the stock appears attractive due to growth and strategic partnerships such as in the UAE, but tariffs and competition could remain challenges - a promising player with high potential in the copper-driven EV boom. XXIX Metal Corp. scores exactly here with 5 billion pounds of copper and ongoing drilling, such as the Saddle Zone program (5.94% CuEq). With a market capitalization of CAD 17.44 million and CAD 6.8 million in liquidity, the explorer offers high potential in the copper market. The parent company, Ore Group, ensures stability, and now the pre-feasibility studies and their results are important. This is an opportunity for early-stage investors, as copper will become indispensable for e-mobility. Volkswagen gains time for its electric offensive from the EU's relaxed CO₂ targets (2025-2027), but US tariffs and a recall of 60,000 e-vehicles in the US dampen the mood. For investors, VW remains a heavyweight with potential, but technical problems and tariffs are dampening the euphoria here as well. BYD is driving demand for EVs, XXIX provides the resource base, and Volkswagen is fighting for its place in the market. Opportunities are emerging for investors, and the copper market connects them all.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.