March 25th, 2025 | 15:40 CET

Buy recommendation for dynaCERT: GBC sees upside potential of over 300% to EUR 0.48!

Enter the green revolution: Cleantech stock with hydrogen potential! dynaCERT Inc. (ISIN: CA26780A1084 | TSX: DYA) is the focus of analyst Matthias Greiffenberger – and for good reason: The Canadian cleantech company is developing technologies to reduce emissions from combustion engines and could become a key player in the clean technology market in light of global decarbonization targets. In its latest analysis dated March 25, 2025, the renowned GBC AG issued a "Buy" recommendation – with a fair value of EUR 0.48 per share. This represents an upside of over 300% compared to the current share price! Read the report to find out more!

time to read: 2 minutes

|

Author:

Mario Hose

ISIN:

DYNACERT INC. | CA26780A1084

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

HydraGEN™ & HydraLytica™: Innovation meets market potential

The core of dynaCERT's strategy is its proprietary HydraGEN™ technology, which uses a patented electrolysis process to produce hydrogen and oxygen gases to make combustion in diesel engines more efficient. The result: lower CO₂ emissions, reduced fuel consumption, and thus a clear economic advantage for fleet operators, logistics companies, and companies in the mining, construction, or energy sectors.

The product is complemented by HydraLytica™, an intelligent telematics platform that analyzes data-based savings and is expected to enable monetization through CO₂ certificates in the future.

A past with challenges – A future with potential

Like many technology companies, dynaCERT has faced challenges in the past: Declining revenues, sluggish customer adoption, and regulatory delays led to operating losses. Revenues in 2023 were only CAD 0.45 million, down from CAD 1.15 million the previous year. However, in 2024, a clear trend reversal is evident, and revenues of CAD 2.40 million are expected.

According to the GBC study, dynaCERT is now on the path to an operational turnaround. The order situation is improving, the first major customers are implementing the technology, and financing has been stabilized through recent capital measures of CAD 6 million. The analysts expect strong revenue growth to CAD 21 million by 2026 – accompanied by an EBIT turnaround and forecast net income of CAD 5.77 million.

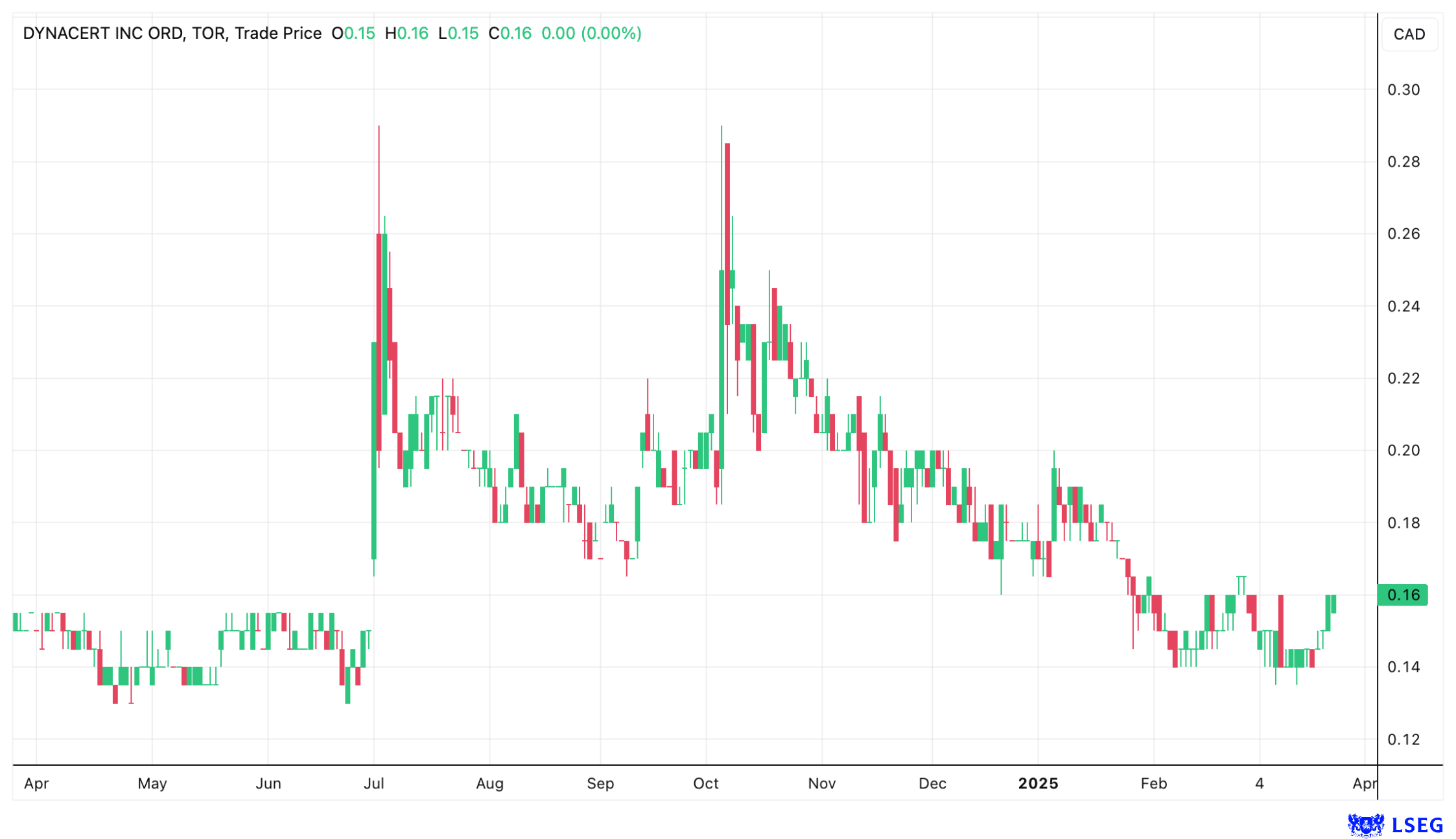

Valuation with catch-up potential: Is CAD 0.15 just the beginning?

GBC values the stock at CAD 0.75 or EUR 0.48 per share using the DCF model. This is contrasted by a current market price of around CAD 0.15 – a clear signal of significant catch-up potential.

Particularly in times when climate protection, CO₂ reduction, and regulatory pressure on companies are increasing, dynaCERT could benefit massively from its positioning in the Cleantech and hydrogen sectors. In addition, in the medium term, there is the prospect of inclusion in international funding and credit programs, as well as entry into the CO₂ certificate trading market.

Conclusion: Turnaround candidate with ESG potential and strong price potential

With its fresh capital base, innovative technology, and clear ESG drivers, dynaCERT (ISIN: CA26780A1084 | TSX: DYA) positions itself as an exciting small cap with a strong growth-oriented future. The GBC Buy recommendation with a target price of EUR 0.48 / CAD 0.75 highlights confidence in the Company and the realistic potential for a revaluation of the share.

Download the complete GBC research report: here

Get informed now – before the market does.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.