May 18th, 2023 | 09:55 CEST

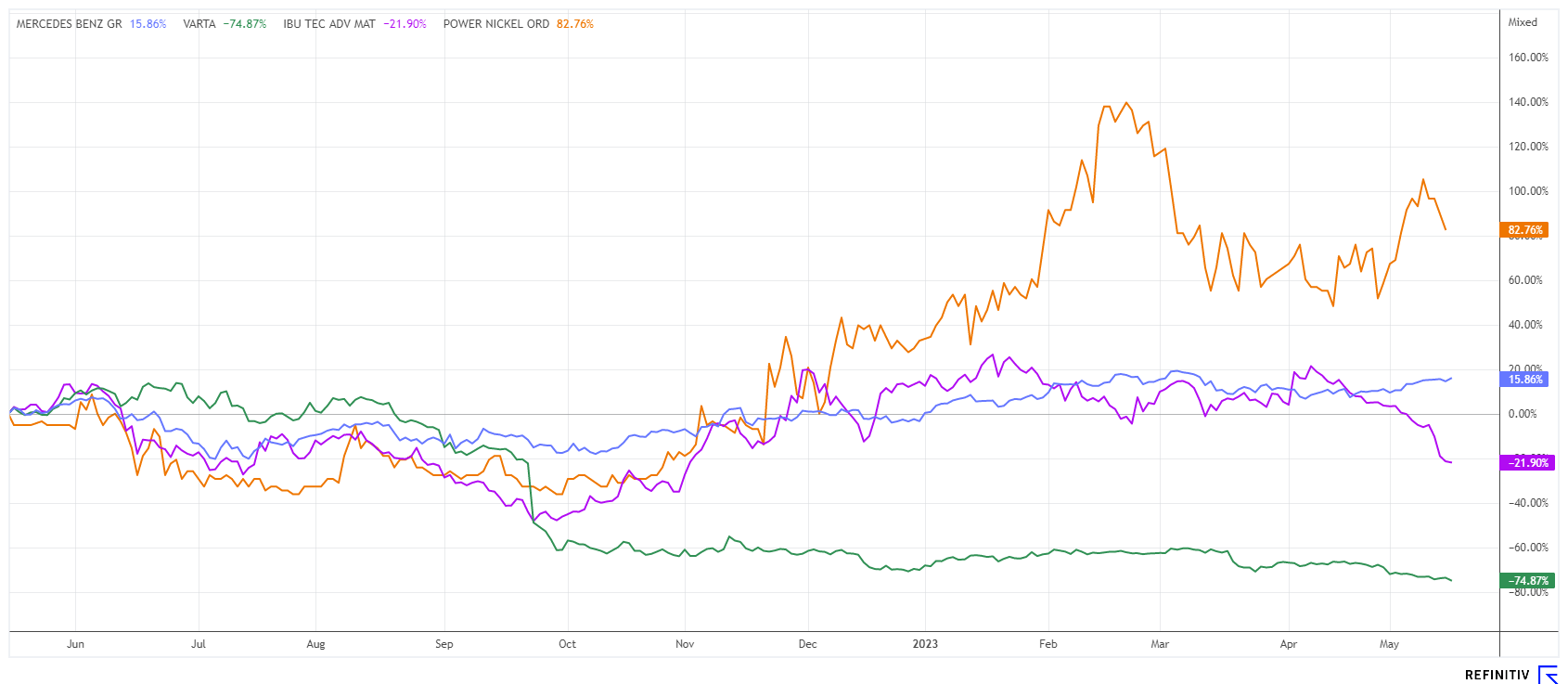

Attention in the battery sector: Varta in sellout, Mercedes, Power Nickel and IBU-tec with good prospects!

What a debacle for Varta! While many manufacturers worldwide are looking for clean battery solutions, things continue to go downhill for the company in Ellwangen. The linchpin of mobile electrification is the development of a super battery. The conventional battery market is dominated by the Chinese group CATL with a 38% share, followed by BYD. But there are also many smaller technology companies in Germany, such as Altech Advanced Materials and IBU-Tec, that are getting involved in the battery market. We go in search of sector highlights.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , MERCEDES-BENZ GROUP AG | DE0007100000 , Power Nickel Inc. | CA7393011092 , IBU-TEC ADV.MATER. INH.ON | DE000A0XYHT5

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Mercedes-Benz Group - A hail of upgrades from analysts

After the Daimler annual general meeting, it becomes clear to many observers that the German automotive industry is not done yet. Solid figures for 2022 and a stable outlook are like water on the shareholders' mills. With a 2023 estimated P/E ratio of 5.3 and a dividend yield of 6.8% - analytically, there is no catch here.

The investment banks Goldman Sachs, JP Morgan and Deutsche Bank have also noticed this and have raised their ratings for the Mercedes-Benz Group considerably. Goldman rates the stock "Buy" with a target price of EUR 98, and their US colleagues JP Morgan give it "Overweight" with a target price of EUR 90. Deutsche Bank is bullish and issues a "Buy" with a price expectation of EUR 115.

Among the 24 analysts on the Refinitiv Eikon platform, there is no sell recommendation for the Stuttgart-based technology firm. The average 12-month price target of EUR 90.54 still offers 33% price potential from the current level. From a chart perspective, however, the EUR 73 mark must first be reached. Below EUR 65, it is worth adding to your portfolio!

Power Nickel - The discovery of new mineralization zones

With a current nickel price of USD 21,375, the commodity has returned to normal levels after extreme movement at the turn of the year. Nevertheless, the demand already exceeds the existing supply, so the nickel price could quickly change into an upward trend. According to a study by the Nickel Institute in 2021, the share of nickel in modern batteries will increase from about 39% to 58% in 2025.

In this environment, there is good news from the Canadian raw material explorer Power Nickel. The Company reports the discovery of a new high-grade Cu-PGE mineralized zone about 5 km northeast of the primary NISK deposit. The target area has never been drilled before and has been identified as "Wildcat". It is characterized by a prominent magnetic anomaly. Drilling has discovered veins with strong enrichments of platinum and palladium, with significant gold and silver also present. The Wildcat area represents an entirely new exploration target and is of great significance as high-grade platinum and palladium are geologically associated with copper. CEO Terry Lynch comments, "It is not uncommon for nickel deposits to contain numerous high-grade PGMs, but this drill hole is special. Naturally, we will follow up this intercept in our next phase of drilling."

With its NISK project, Power Nickel is well in the running to supply high-grade nickel for future battery producers. Power Nickel shares have already had a good run in the first quarter, doubling quickly on the good news. Take advantage of the current setback to reposition.

Varta - Now it is the turn of the short sellers

Reports of new short positions in the Varta share are piling up daily, and the price is steadily sinking to new lows for the year. Of course, the share price is visually cheap, but after last week's Q1 figures, it should first be analyzed carefully whether an entry is worthwhile. After all, the share price has fallen by a factor of ten since its high of around EUR 180 in 2021. This is rarely seen with reputable shares, but whether the term "fallen angel" still fits is questionable.

The first quarter delivered an 11% decline in sales, a negative operating margin and a net loss of EUR 37.8 million. Now there is also a dilutive capital increase. The analysts at M.M.Warburg are already throwing in the towel and are voting "Sell" with a target price of EUR 16. We are no longer far away from that. The new CEO Markus Hackstein comfortingly sees a higher order intake from the middle of the year and believes the turnaround course will succeed. Put Varta on the watch list because, after another sell-off, there are opportunities again.

IBU-tec - Subsidiary founded for battery development

A lot is happening at IBU-tec, the battery materials specialist from Weimar. The current CEO, Ulrich Weitz, will not join the supervisory board in 2023, but his daughter, Isabelle Weitz, will take his place. An indication that Mr Weitz's purely supervisory board activity seems too early in his curriculum vitae. At the same time, it is announced that the trained mechanical engineer, who founded IBU-tec and led it to the stock exchange, will now act as managing director of the 100% subsidiary IBUvolt Battery Materials GmbH. Overall, this decision should have a positive effect on the IBU Group. At around EUR 23, the share is highly attractive and offers excellent growth potential in the e-mobility environment.

The battery market comes up with news on a daily basis. It has become one of the key investment areas for climate change. Mercedes-Benz is investing billions and is valued favourably. Varta and IBU-tec offer turnaround opportunities, and Power Nickel is setting out to be the next nickel supplier.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.