March 11th, 2025 | 07:45 CET

Artificial Intelligence – Fabulous profits with Xiaomi, Credissential, D-Wave, and Palantir

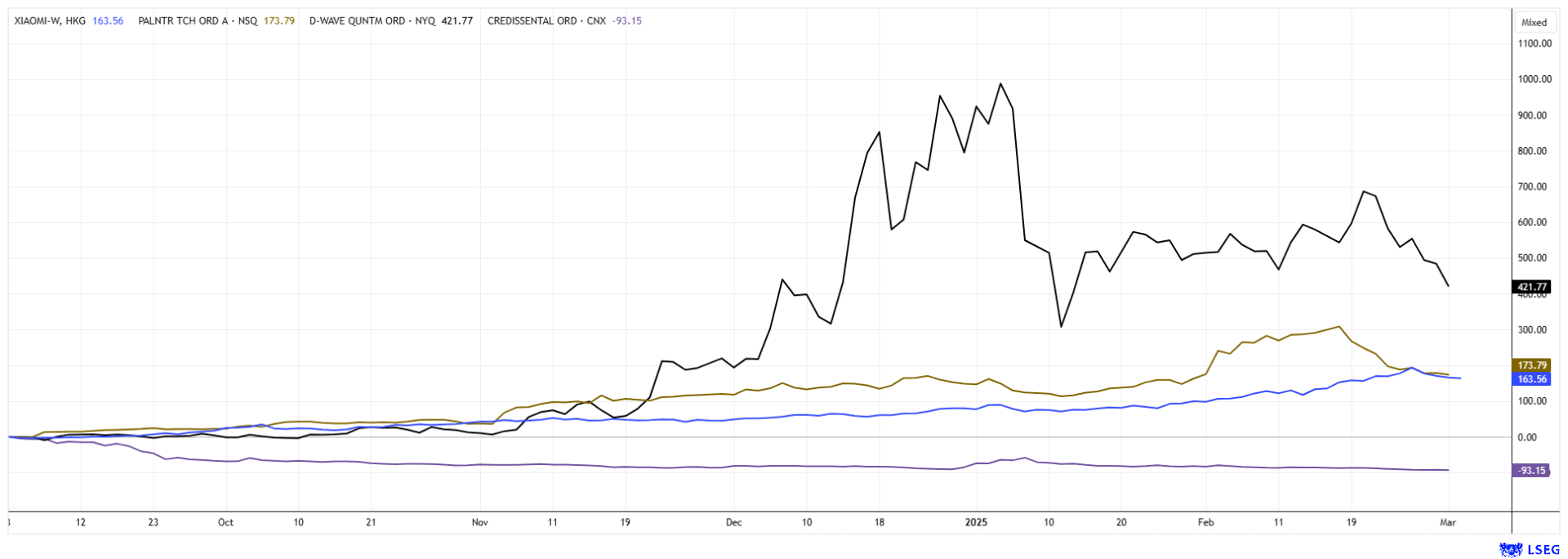

It is incredible how politics can sometimes drive markets. US President Donald Trump had broken away from Ukraine aid due to a dispute with Volodymyr Zelenskyy, and the alarm bells were immediately ringing in Europe. Defense stocks went through the roof, and EU governments scrambled to come up with new special packages to rearm NATO countries, totaling up to EUR 800 billion. The flustered chaos must have amused Vladimir Putin. However, a correction is also currently taking place in the long-hyped AI stocks. Some of the losses here are quite painful. The stock market seems to have discarded its "one-way street decree". Accumulated profits should be secured as quickly as possible. We delve deeper into the context.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

XIAOMI CORP. CL.B | KYG9830T1067 , CREDISSENTIAL INC | CA22535J1066 , D-WAVE QUANTUM INC | US26740W1099 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Xiaomi – The Chinese all-rounder

The shares of the Chinese Xiaomi Corp., which are listed in Hong Kong and on NASDAQ, have been in strong demand for several weeks and reached an all-time high of the equivalent of EUR 7.15 at the end of February. Xiaomi is based in Beijing and primarily focuses on IT hardware, networks, and smartphones. However, the technology company has also been working on the development of e-vehicles for several years. Already successfully launched in China, the Company wants to sell competitive electric vehicles in overseas markets from 2027, said the president of the smartphone giant, Lu Weibing. He revealed the secret in an interview with Chinese media on the sidelines of the MWC 2025 trade fair in Barcelona. In addition to the new Xiaomi 15 Ultra smartphone, the SU7 Ultra electric sedan was also presented. In the last three years, the smartphone expert has been met with a great deal of skepticism in the automotive sector, but now a veritable model has been presented. With rising sales figures, CEO Lu Weibling firmly counters the accusation that Xiaomi is entering the e-mobility market too late as a general store.

The automotive division was not established until 2021, but just three years later, the SU7 sedan was introduced with a starting price of approximately USD 29,680. By 2025, the successor version, the Ultra, has already been launched, making waves. The SU7 Ultra is an ultra-performance electric sedan based on the regular SU7 but with three engines that deliver a maximum output of 1,548 hp. On February 27, Xiaomi launched the SU7 Ultra in China at a starting price of approximately USD 72,900. Demand is huge. Xiaomi is growing by almost 20% per year in terms of revenue, and analysts on the LSEG platform calculate a P/E ratio for 2025 of 18.9. The share price has already quadrupled in the last 12 months. Newcomers are waiting for a correction down to EUR 5, where an important technical support line lies.

Palantir and D-Wave – The first corrections are severe

That happened quickly. In the past few weeks, Palantir and D-Wave were still trading at prices of USD 125 and USD 10, respectively. These prices seem to be history for the time being. Palantir's figures were slightly above expectations, but analysts had estimated significantly higher growth. As a company that has now achieved a security-relevant status in the field of intelligence and reconnaissance, it can grow very strongly in the current environment if governments expand their budgets accordingly. Palantir Technologies should, therefore, be followed closely on the watchlist despite P/E ratios of over 150. First purchases in the correction zone of USD 60 to 70 make sense. At D-Wave, it was not only analysts who wondered what was fueling the euphoria. Although the Company is one of the first movers in the quantum field, the highly investive topic itself will take years to recoup the development costs of the past. Here, the large tech companies will likely play to their financing advantages. Anyone hoping for real sales and profits from D-Wave should return to the topic between 2028 and 2030. In the meantime, the price could easily halve again after a 55% crash. The stock is interesting in terms of a possible takeover by a tech giant.

Credissential Inc. – Innovations in AI and quantum computing

The Canadian newcomer Credissential (ticker symbol: WHIP) is also active in the field of AI and quantum computing. The stock has been listed on the CSE since March 2024 and can be traded in Germany. As part of the Company's ongoing commitment to future-proofing its technology, it has successfully integrated a quantum encryption layer into its proprietary Antenna software, ensuring high security for its users. Primarily, this is about cybersecurity risks arising from quantum computing. With encryption, Credissential ensures that Antenna's infrastructure remains resistant to new decryption methods. At its current stage of development, Antenna is a secure payment and file transfer platform. It benefits from post-quantum cryptography as a forward-looking protective measure. The Company uses artificial intelligence, blockchain technology, and innovative software platforms such as Credissential, Dealerflow, and Antenna. CEO Colin Frost believes that the rise of quantum computing represents both an opportunity and a challenge for global financial security.

AI, quantum, and blockchain technologies form the backbone of Credissential's solutions, providing data processing, automation, and security. Credissential uses AI to develop financial technology to transform financial services sustainably in the long term. In mid-February, the next phase of the growth strategy was presented. The initiative focuses on building a robust financial technology ecosystem, including current core solutions such as Dealerflow and Antenna, which are designed to improve financial literacy, solve key financial challenges, and create scalable revenue opportunities across various industries.

By combining advanced analytics, proprietary encryption, and human-centered design, Credissential is not only adapting to the future of finance but creating it. The range of solutions extends from identity protection to wealth optimization for individuals and businesses. The Canadian tech company is digitizing the US used car market with its AI-powered platform Dealerflow. The web-based technology digitally connects around 60,000 independent car dealers and offers a complete service package, including insurance, delivery, and financing from a single source. Credissential's approach is to balance organic growth through continuous product innovation with strategic acquisitions of financial technologies to further expand its technology offerings. Currently, the opportunity for newcomers to get in on the action is around CAD 0.04 to 0.05 in the WHIP share because the correction in the AI sector that has been ongoing for weeks did not leave Credissential unscathed.

The correction came faster than expected. After initial surges in defense stocks, the downward swing in tech stocks is now picking up speed. The recommended stops will take effect in the next few days. Keep Credissential in close focus, as it offers a very interesting option for mid-term gains.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.