November 27th, 2024 | 07:10 CET

Artificial intelligence and crypto with a 200% opportunity! SMCI, Power Nickel, Infineon and ARM Holdings on the buy list

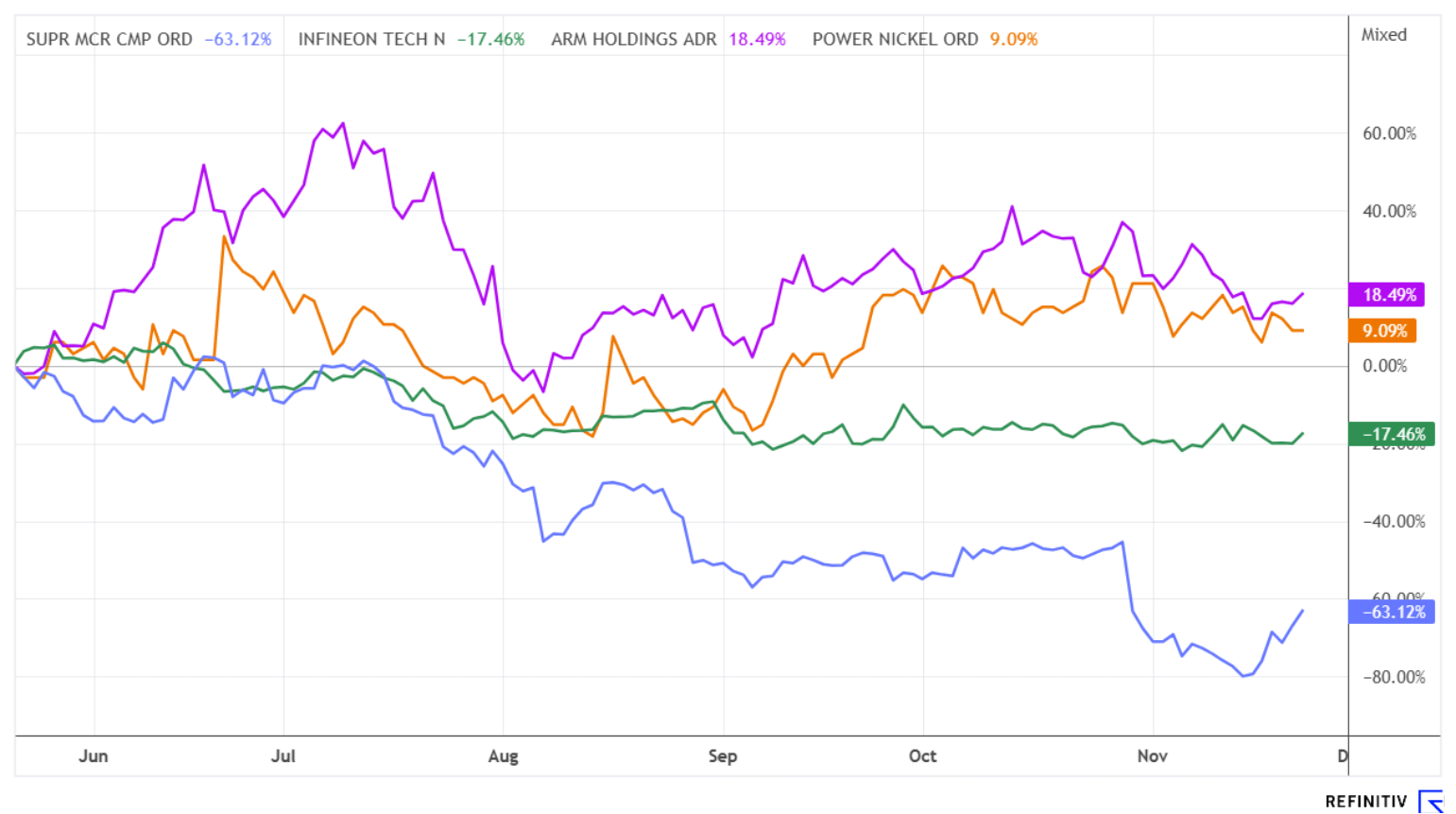

The crypto and AI boom is now quite advanced. Yesterday, Bitcoin hit a wall at just under USD 100,000, and Nvidia was also unable to reach new highs despite good Q3 figures. This suggests that a technical consolidation is underway, which could extend well into early 2025. However, some stocks have already fallen more sharply and are reappearing on investors' buy lists. 2025, the first year of the re-elected Donald Trump's term in office, is likely to bring a great deal of unrest, as the US will have to reposition itself in international trade. Announcements of introducing punitive tariffs are currently dominating the news, which are largely counterproductive. We highlight the opportunities for risk-conscious investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , Power Nickel Inc. | CA7393011092 , INFINEON TECH.AG NA O.N. | DE0006231004 , ARM HOLDINGS PLC ADR | US0420682058

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Super Micro Computer – Stabilization after the sell-off

Many inconsistencies have caused the high-tech stock Super Micro Computer (SMCI) to plummet since reaching highs of over USD 120. However, last week, SMCI shares caused a stir on the US markets with a full 70% increase in just 6 trading days. Of course, the value had fallen quite a bit to around USD 20, especially since the Company had not been able to report any conclusive figures to the supervisory authorities. Additionally, the auditor Ernst & Young announced the termination of its mandate.

But now the cooling specialist and server manufacturer has presented a plan to avoid delisting from NASDAQ. BDO was engaged as auditor, which encouraged investors again. With huge sales, short sellers were probably forced to cover again. It remains to be seen how things will progress because brave newcomers in the USD 20 range are already sitting on high profits again. However, the short-term risks for SMCI remain. BDO will closely examine the Company's financial data, which could lead to further delays in submission. The annual report for the fiscal year ended June 30 and the quarterly report as of September 30 are still outstanding. However, the operating performance remains to be seen as the competitive climate has become more challenging. In addition, advanced valuations suggest that a sector correction is likely soon.

Power Nickel – Polymetal with incredible exploration success

The scarcity of strategic metals and the political changes in the US, Canada's most important trading partner, are playing right into the hands of the Canadian polymetallic explorer Power-Nickel. The properties are located in the province of Quebec, which benefits from a stable political environment and favorable economic conditions, making it a preferred location for resource extraction. Given the globally increasing demand for critical metals, this region remains the focus of larger investors. It is no wonder that the Power Nickel share price has already tripled since March 2024, and demand for the liquid stock remains strong. Now, the Company is reporting on new drilling results from the Lion Zone. The results to date have geologists excited, with 3.82% copper over 19.6 m recently discovered.

"The summer of 2024 will be remembered as an epic summer in terms of further discovery at the Lion Zone. The western extension continued to deliver some fantastic results. After 32 m at almost 7% copper equivalent (CuEq) and almost 40 m at 4.19% CuEq, hole 72 continues our track record. The further we advance west, the more we learn about the mineralized zone and how it behaves," says CEO Terry Lynch.

Next week, on December 4 at 3:00 pm CET at the 13th International Investment Forum, Terry Lynch will provide a detailed insight into the dream property Lion and explain further operational steps. Click here for free registration.

The Power Nickel share is currently one of the most stable exploration stocks in Canada. While tax optimization at the end of the year is depressing prices in the entire sector, the polymetallic company was once again able to inspire investors. The rally should, therefore, continue soon, as Donald Trump's proclaimed renewal of US infrastructure will have a knock-on effect on the commodity markets. Power Nickel is well positioned for the dynamic environment, with analysts giving an average target price of CAD 1.31 – a 75% premium to the current price.

Infineon and ARM Holdings – Taking a short breather

The high-tech industry is one of the most important customers for copper or battery metals. Companies such as Infineon and ARM Holdings depend on unhindered access to critical metals for their chip production. As crowd favorites, they dominate the shortlists of fund managers worldwide. After a pronounced rally until mid-2024, these stocks are now consolidating, and fundamentals are coming back into focus. Infineon recently suffered a drop in earnings due to ongoing margin pressure. At the end of the 2023/24 financial year in September, the Munich-based company reported earnings per share of EUR 0.98, down from EUR 2.38 in the previous year. The restructuring is ongoing, causing analysts to raise their consensus expectations for 2024/25 and 2025/26 again to EUR 1.55 and EUR 2.12, respectively. The stock is currently trading at around EUR 30 with a P/E ratio of 20 for 2025. Most recently, 20 experts again issued a "Buy" recommendation with an average 12-month price target of EUR 37.60. That is not a bad set-up for the coming year.

The British chip designer ARM Holdings plc currently has 38 analysts covering the stock. On average, this provides an expected value of USD 153 for the NASDAQ-listed title. For a long time, the sought-after tech title benefited from the AI rally driven by industry favorite Nvidia, reaching peak prices of USD 188 in July. A solid tripling compared to the IPO price of USD 51 in 2023. At the moment, there is a bit of calm. Chart-wise, the current consolidation could run to USD 120; fundamentally, P/E ratios of 84 to 68 for 2024/25 are being called for the stock, provided that the dynamic earnings growth of plus 25% per year can continue into the future. If the NASDAQ rally also takes a break, significant devaluations will likely occur here. Caution at the platform edge!

Chip and high-tech stocks have been in high demand in recent months. However, the underlying NASDAQ rally is showing clear signs of fatigue. For commodity stocks, catch-up effects of the recently observed supply difficulties for strategic metals could lead to a positive end-of-year performance on the stock market. Power Nickel appears particularly promising in this context.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.