March 1st, 2023 | 14:10 CET

Aixtron, Altech Advanced Materials, Sixt - Prospects remain rosy

Despite the continued uncertain environment of the Ukraine war, inflation and rising interest rates, many companies are surprising positively in their full-year 2022 figures. In addition, forecasts are extremely positive despite pessimism regarding the struggling global economy. In terms of innovations, too, the trend is steeply upward. In this context, one German company in particular could rise to become a leading player in battery technology.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

AIXTRON SE NA O.N. | DE000A0WMPJ6 , ALTECH ADV.MAT. NA O.N. | DE000A2LQUJ6 , SIXT SE VZO O.N. | DE0007231334

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

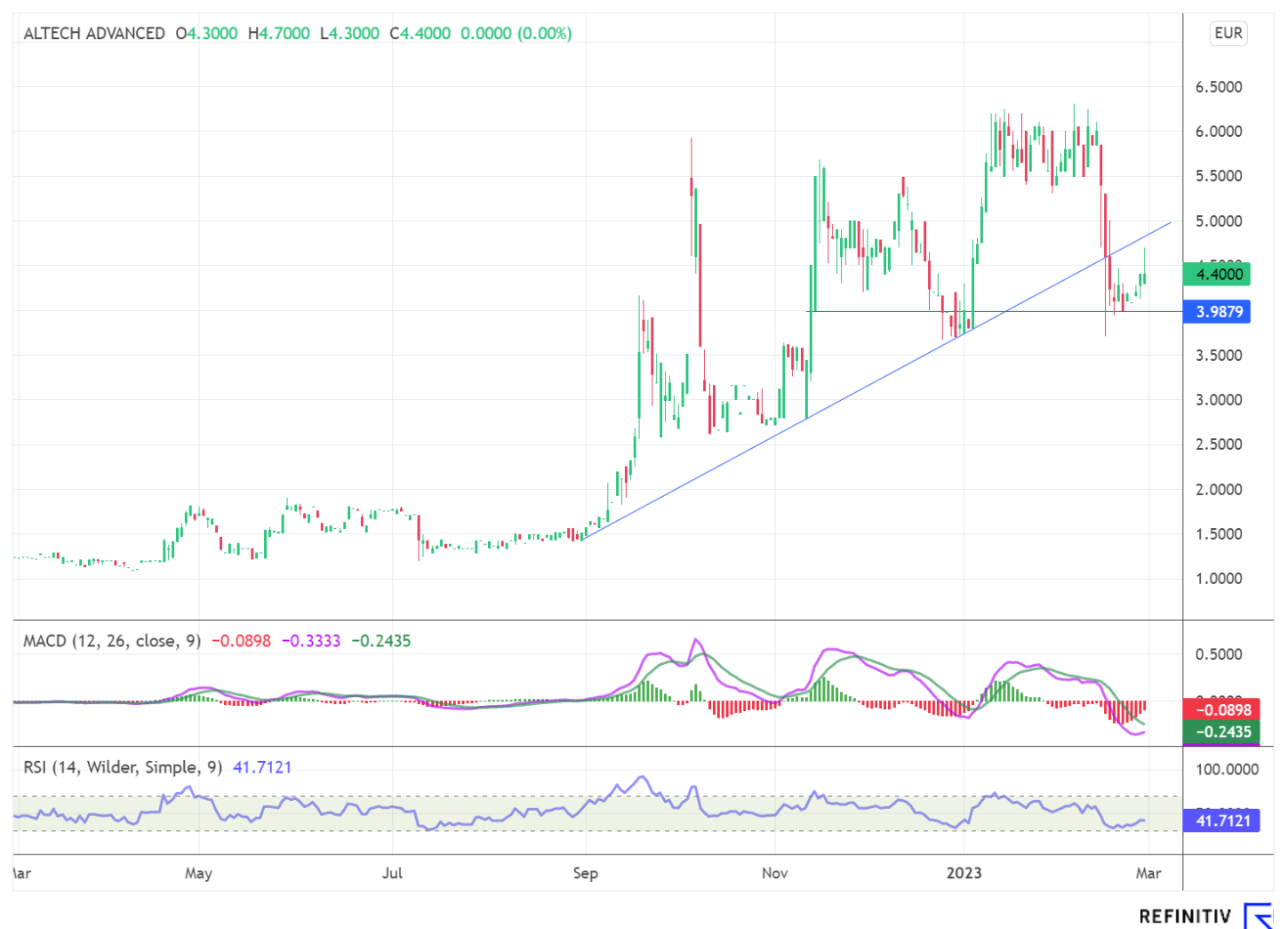

Altech Advanced Materials - End of the subscription period

To bring the two disruptive technologies, "Silumina Anodes" and "SAS CERENERGY Batteries", to the mass market, one thing is needed in addition to the existing know-how: money. The Heidelberg-based company intends to raise this money by issuing a zero-coupon convertible bond with a detached warrant. Accordingly, Altech will issue a zero-coupon, non-interest-bearing convertible bond with a total nominal value of up to EUR 3.531 million, each with a nominal value of EUR 1.00. For each convertible bond, each subscriber will also receive, free of charge, a warrant with no nominal value, which is separate from the convertible bond and entitles the holder to subscribe for one share in the Company at the issue price or subscription price of EUR 1.00 per share, or, at the discretion of the Company's Management Board, to a cash settlement.

The issuance of the bonds, together with the capital measures already carried out by the Company last year, serves the purpose of securing the Company's financing requirements, in particular, the financing share for the pilot plant for the anode coating material "Silumina Anodes" in the joint venture Altech Industries Germany GmbH, as well as for the sodium-alumina-solid-state battery project 'CERENERGY' joint venture Altech Batteries GmbH in Spreetal. The subscription period expired on February 28, 2022, so more should certainly be known soon about the Company's further plans.

Both technologies have blockbuster potential. The Silumina Anodes coating technology could become the new standard in battery technology for electromobility. Here, batteries are coated with a special nano-coating of high-purity aluminum oxide and an enrichment of silicon, which is intended to prevent the deposition of lithium particles on the electrodes and significantly minimize capacity loss. The CERENERGY solid-state sodium-alumina battery, in turn, has the potential to become the grid battery storage system of the future. The advantages over lithium-ion batteries are clear. CERENERGY batteries are non-flammable and therefore fire- and explosion-proof, have a lifetime of more than 15 years and function in extremely cold and hot climates. The battery technology does not require critical raw materials such as lithium, cobalt, graphite or copper and uses common salt and only small amounts of nickel.

Aixtron - Rosy prospects

The shares of the semiconductor equipment manufacturer exited the trading session with a substantial gain of more than 12% to EUR 29.10. In addition to the sobering figures from last year, the reason was the extremely positive outlook for 2023, where Aixtron SE is targeting double-digit revenue growth. Order intake is expected to increase to between EUR 600 million and EUR 680 million, while revenues are expected to grow to between EUR 580 million and EUR 640 million. The gross margin is expected to be around 45%, while the EBIT margin is expected to hover between 25% and 27%.

The year 2022 was burdened by delivery delays. In addition, the lack of export licenses disrupted growth at the end of the year. According to CEO Felix Grawert, however, these are now available. The analyst firm AlsterResearch raised its estimates for the Company and increased its price target to EUR 31. The verdict is "buy." According to the analysts, Aixtron reported fourth-quarter results, with order intake, order backlog and forecasts exceeding expectations.

Sixt - Stronger than ever

Sixt shares were also among the day's winners following the publication of positive figures and an optimistic outlook. The international mobility services provider put record figures on the table, with North America, Europe and the home market of Germany contributing to the positive results. Here, Sixt benefited from the ongoing positive market environment in terms of demand for rentals as well as in terms of prices.

Group revenue increased by 34.3% to EUR 3.07 billion, while consolidated profit before tax grew by 24.4% to EUR 550.2 million despite high investments. Based on the strong results, a dividend of EUR 4.11 per ordinary share and EUR 4.13 per preferred share is planned, as well as a special dividend of EUR 2.00 per ordinary share and preferred share.

The car rental company expects a very positive financial year in the current fiscal year. A "substantial" increase in Group sales is expected, as well as EBT in the range of between EUR 430 million to EUR 550 million.

Aixtron and Sixt were among the day's market winners due to their positive outlook. At Altech, news on further planning regarding the construction of the pilot plant is expected shortly after the end of the subscription period for the convertible bond.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.