August 12th, 2024 | 07:45 CEST

After the crash, buy defense, big data, and high-tech now! Rheinmetall, BYD, VW, Globex Mining, and Palantir in focus

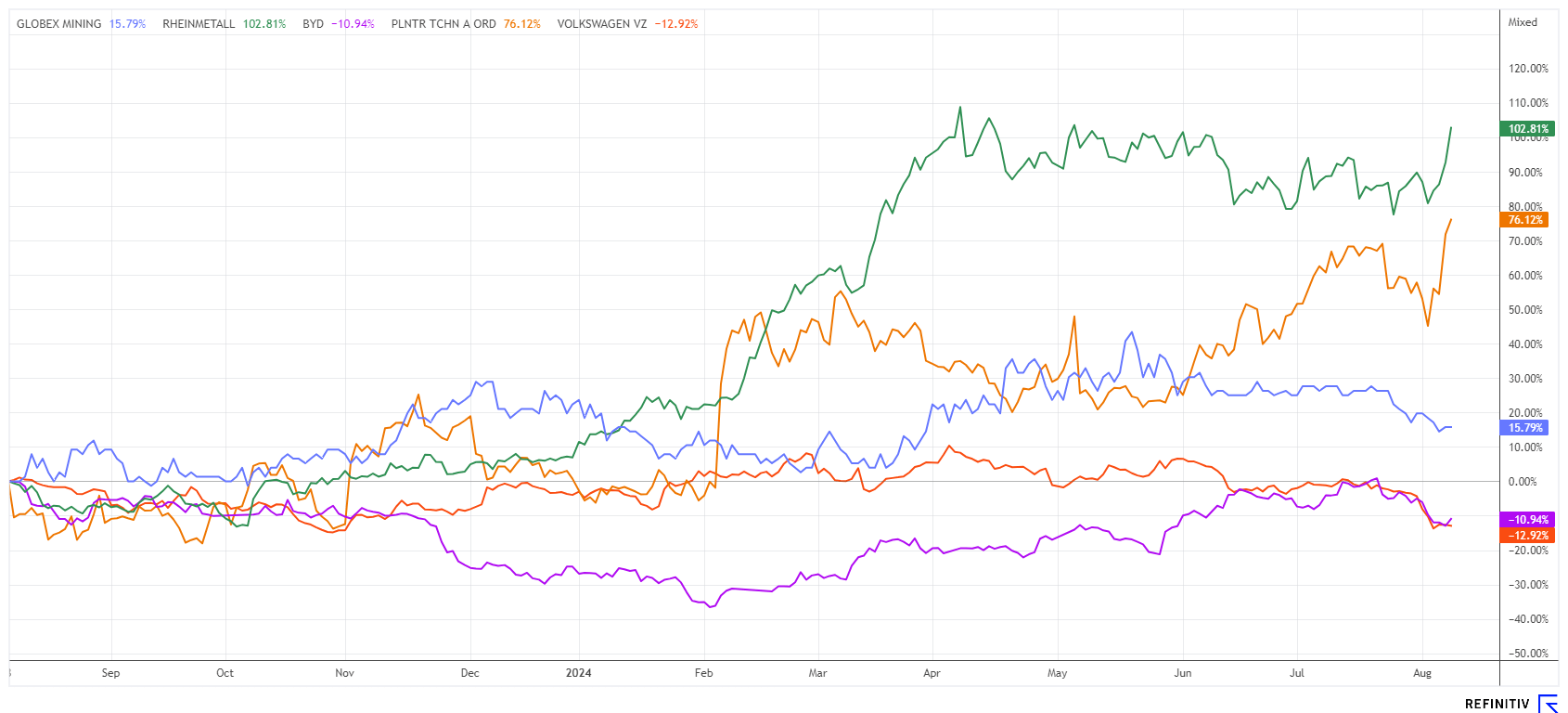

The DAX had gained a good 13% by the summer, while the tech-heavy NASDAQ 100 index saw an even more significant increase of 24%. However, much of this progress has melted away in recent weeks. Due to ongoing geopolitical uncertainties, especially in the Middle East, the stock markets experienced a summer setback. This is not uncommon for this time of year. There are often index corrections, which then transition seamlessly into the year-end rally from late fall. The FED could be the driving force this year. Renowned investment banks expect the September meeting to mark the start of a longer cycle of interest rate cuts by a total of 5 measures. This would likely mark the starting signal for the next super bull markets. Before then, we will separate the wheat from the chaff to ensure your portfolio is correctly positioned.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , BYD CO. LTD H YC 1 | CNE100000296 , GLOBEX MINING ENTPRS INC. | CA3799005093 , PALANTIR TECHNOLOGIES INC | US69608A1088 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and Volkswagen - Electromobility is stuttering

The two automotive giants, BYD and Volkswagen, are not yet on investors' buy lists. The Chinese manufacturer was long backed by investor Warren Buffett, but now he too is gradually exiting the Company. Growth rates do not appear to be sky-high, and the international trade climate with China is worse than it has been for a long time. The US has imposed a punitive tariff of 100% on e-imports from the Far East, and the EU is also toying with special tariffs of between 17% and 34%. However, this creates problems for European manufacturers, as well over 20% of global production occurs in China and reaches EU distributors by ship. These imports would also be subject to punitive tariffs.

And what the economic strategists in the political strongholds continue to ignore: Since the abolition of environmental bonuses, like subsidies for electric vehicles, new vehicle sales have fallen by over 70%. If consumers start favouring combustion engines again, import duties will no longer matter. In July 2024, only 30,762 pure electric vehicles were newly registered in Germany, which corresponds to a decline of 36.8% compared to the same month last year. The share of all-electric vehicles in total new registrations was just under 13%. These figures confirm a trend that has been apparent for months: Sales of electric vehicles in Germany are stagnating, and the new registration figures themselves are also significantly lower than in the previous year.

Constantin Gall from the consultancy EY commented on the new figures for Manager Magazin: "Electric vehicles are currently slow sellers." The reason: consumers are very unsettled by the political wrangling in Berlin and Brussels. They are holding off on buying a new vehicle for now, according to the motto: "The old one will do for another two years!" Under these conditions, the shares of BYD and VW are still not cheap enough despite heavy discounts. Keep these stocks on your watchlist, as VW is now at the bottom of the DAX list with an annual loss of around 20%. The calculated P/E ratio for 2024 has now reached 3.3, and the payout calculated on the share price is just under 9%. Operationally, however, the figures could be even worse .

Globex Mining - Things are moving forward

In the international context of metal shortages and the search for secure sources of supply, Globex Mining's properties are coming into focus. This year, the share price of the Canadian explorer and asset manager has already risen by more than 30% to CAD 1.15, with a small consolidation to CAD 0.88 in recent weeks. CEO Jack Stoch is currently overseeing 252 projects and has shares that can be liquidated at any time and cash of a good CAD 25 million. The special feature: the Company has no debt and almost all of its properties are located in mining-friendly areas of Eastern Canada.

The partner Scandium Canada Ltd. is now reporting progress in the immediate vicinity of a Globex project. Scandium reports that it has now completed two different types of drilling programs at Crater Lake, located 200 km northeast of Schefferville. The drilling campaign has provided data for an ongoing pre-feasibility study and has also shown mineralization in all drill holes addressed. Advancement of the project is in both parties' interests as the Scandium orebody and other rare earth elements are located in the northwestern part of a circular magnetic structure, the northern half of which is owned by Scandium Canada and the southern half by Globex.

The Globex share is anything but expensive. With 56.294 million shares, the market value of all properties is currently only around EUR 33 million. After the current wave of consolidation, prices above CAD 1.10 should, therefore, be on the cards again.

Rheinmetall and Palantir Technologies - Beneficiaries of global uncertainty

In addition to some "fallen angels", there are also stocks that have emerged stronger from the recent correction. In the case of Rheinmetall, it was the dazzling operating figures for the second quarter. As a result of the war in Ukraine, the armaments group's order books are fuller than ever at EUR 48.6 billion. The main drivers are not tanks but 155-mm artillery ammunition, which is in demand worldwide. Sales increased by a third to around EUR 3.8 billion in the first half of the year, while the operating result almost doubled to EUR 404 million. Berenberg analyst George McWhirter described the latest figures as encouraging. JPMorgan analyst David Perry also sees the current correction as a good buying opportunity. We remain invested and have raised our stop from EUR 485 to EUR 515.

High-tech stock Palantir Technologies is also continuing its upward trend, which is hardly surprising given that a cooperation with Microsoft is now in the offing. The aim of the collaboration is to sell specialized cloud, AI, and analysis capabilities to the US defense and intelligence services. Palantir, known for its data analytics software and close government collaborations, is well-positioned to serve multinational and security-related organizations by strategically integrating its highly sensitive products, such as Gotham, Foundry, and Apollo, into Microsoft's cloud environments. As part of the negotiated partnership, Palantir plans to be one of the first users of Azure's OpenAI service in Microsoft's "Secret" and "Top Secret" cloud environments. Palantir promptly raised its revenue forecast for 2024 to up to USD 2.75 billion. For CEO Alex Karp, this deal represents a breakthrough for all core sectors of the Denver, Colorado-based company. However, the stock is anything but cheap analytically, with a 2024 P/E of 85 and a P/S ratio of 25. The war premium is also noticeable in this valuation. In chart terms, the share price is still free to move upwards above USD 29.50.

A significant overheating of technology stocks since the beginning of the year has led to an initial wave of consolidation. While blockbusters such as Nvidia have lost over 30% in just two months, Palantir Technologies and Rheinmetall are benefiting from the increased geopolitical uncertainty. Globex Mining, Volkswagen, and BYD are getting ready for the next upswing and are still consolidating slightly. In the long term, new buying opportunities are opening up here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.