April 25th, 2023 | 07:20 CEST

100 gigawatts by 2030 - Hydrogen to the rescue! What happens to Plug Power, dynaCERT, Nel ASA and ThyssenKrupp?

According to various surveys, the installed capacity for hydrogen is currently just 1.75 gigawatts. Nuclear power is history, but still, Germany wants to become climate neutral by 2045 at the latest. How is this to be achieved? The EU has set some guidelines and wants to install 100 gigawatts of green hydrogen by 2030. That would require more than 60 times as many electrolyzers as today for Ursula von der Leyen's plan to work. The cost of research, development and production, including infrastructure, is about EUR 2.5 trillion, which EU citizens are expected to pay for a lower-emission future. What should investors pay particular attention to on the stock market now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - Hitting rock bottom?

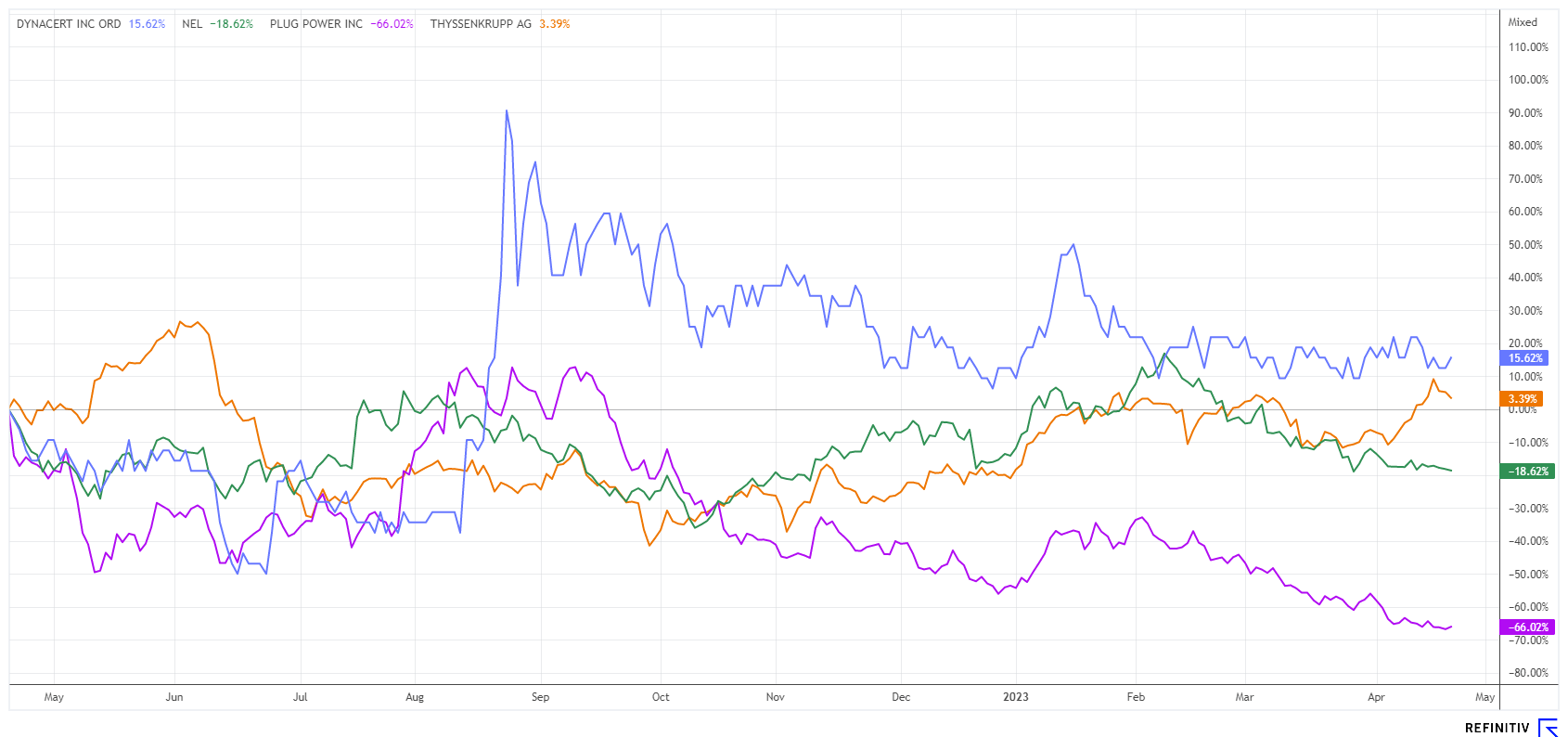

Many investors are wondering when this share will finally hit bottom. The US hydrogen benchmark company lost 62% in 12 months, and the sell-off continues unabated. We have already pointed out the dramatic overvaluation in many comments, and the hype from 2021 now seems to be completely reversing.

The figures for the financial year can only be described as a disappointment. However, CEO Andy Marsh was not consistent enough with his sales warnings, according to many investors who feel completely cheated and have already filed a class action suit. The reason: the planned revenues, which according to the 2022 guidance were to be around USD 915 million, were then reported at around USD 701 million in 2023. Even worse was the bottom line result: with a deficit of around USD 460 million, they burned USD 0.82 per share.

One can clearly find starting points for a deliberate deception here. The courts will have to decide this case, and the stock market has already punished Plug Power once. A supposed technical support at USD 10 has now also been broken. And the really bad news: the price-to-sales ratio is still at 3.5. Therefore, the only hope is that the targeted breakeven in 2025 will still be achieved through the investments of the international "climate rescue lobby". Keep watch!

ThyssenKrupp - Nucera shares are not yet available for purchase!

ThyssenKrupp now seems to be getting serious. The rumour mill is boiling that the subsidiary Nucera could be listed on the stock exchange this year. Nevertheless, the current fraud incident of a company called EB Finanz, which has already been active in the placement of Nucera shares via telemarketers before the stock exchange, is also interesting. Both ThyssenKrupp AG and BaFin point out that purchase offers for these shares are unlawful and originate neither from ThyssenKrupp AG nor its subsidiaries. Recently, there have been increasing reports of attempted fraud in which shares in well-known companies are offered for subscription. However, these shares are not delivered after payment by the buyers, and the sellers can no longer be contacted. Appalling!

Nucera, however, is a gem. The H2 specialist expects sales of up to EUR 1 billion by 2026, making it a respectable size for a stock market listing. ThyssenKrupp's 66% stake is valued at between EUR 1.8 billion and EUR 2.3 billion, putting Nucera's total valuation between EUR 2.9 billion and EUR 3.4 billion. According to Refinitiv Eikon, analysts are correspondingly optimistic about the parent company, valued at a median of EUR 8.45. The Duisburg-based company is currently trading at EUR 6.50, a full 11% lower on the day. CEO Martina Merz has asked the supervisory board to terminate her contract prematurely, and ex-Norma board member Miguel Ángel López Borrego is to succeed her. At first glance, the stock market is unsettled, but this level could be an entry opportunity in the long term.

dynaCERT - Waiting for the Big Bang

dynaCERT surprises almost every week with new technology partnerships. On the sidelines of the Hanover Fair, it became known that, together with its partner Cipher Neutron Inc. it has signed a letter of intent with the Chilean company Molibdenos y Metales S.A. (Molymet). This involves the joint development, production and marketing of modern hydrogen technologies, including AEM electrolysis technology.

The aim is the industrial production of green hydrogen tailored to Molymet's operating facilities. Molymet's rhenium products will be tested and used to increase the efficiency of the H2 electrolyzers. Molymet has developed a wide range of molybdenum and rhenium solutions for the metallurgical, chemical and metal processing industries. The cooperation partners want to be at the forefront of innovations in the storage and generation of environmentally friendly energy by aiming for a competitive price for green hydrogen. So far, there is no manufacturer in the world that has launched an industrial price to replace other energies.

If the partners are successful and the latest effort also coincides with VERRA's certification of CO2 savings, it could mean a big bang for the dynaCERT share. The Canadians have just filled their coffers with a CAD 2 million placement of a convertible at a subscription price of CAD 0.30 per share. On the stock market, investors can access the shares at CAD 0.185.

Nel ASA - Good order situation, but no profits!

Hydrogen stocks were among the shooting stars in 2021 - but now reality is returning. The billions in investments from the private and public sector are still missing. Nel ASA is also feeling the effects of this. Although it was recently able to bag a EUR 34 million contract with the German company HH2E, the share price remains underwater. After disappointing annual figures for 2022, the Norwegians now have the opportunity to show a good first quarter on April 27. The experts' estimates are NOK -0.16 per share.

But the long-term view of the Company seems much more important. Starting from a turnover of NOK 915 million, it is expected to rise to about NOK 1.5 billion in 2023 and even reach NOK 3.8 billion in 2025. Because of the high investments, however, profits remain low. The order books are full, but there will be no operating surplus until 2026. The 2023 P/S ratio has been around a factor of 10 for months, so even at EUR 1.11 and a 26% loss in 12 months, the share is not yet a fundamental investment. Nevertheless, momentum traders with strong nerves can always find an opportunity between EUR 1.05 and EUR 1.30. Below EUR 1.02, one should consistently take leave with a stop because then the value will likely run into a technical sellout.

Thanks to the EU's announced hydrogen bank, the hydrogen sector is getting some air under its wings again. By decree, the gap between fossil fuels and green hydrogen is to be closed with taxpayers' money. With a budget of EUR 800 million, private companies will receive a fixed premium on their green H2 production. Our conclusion: Plug Power and Nel ASA remain in a downward trend, ThyssenKrupp is being shaken up, and dynaCERT convinces with its technical strength.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.