July 1st, 2025 | 09:25 CEST

Why Almonty Industries could become the BioNTech of critical metals

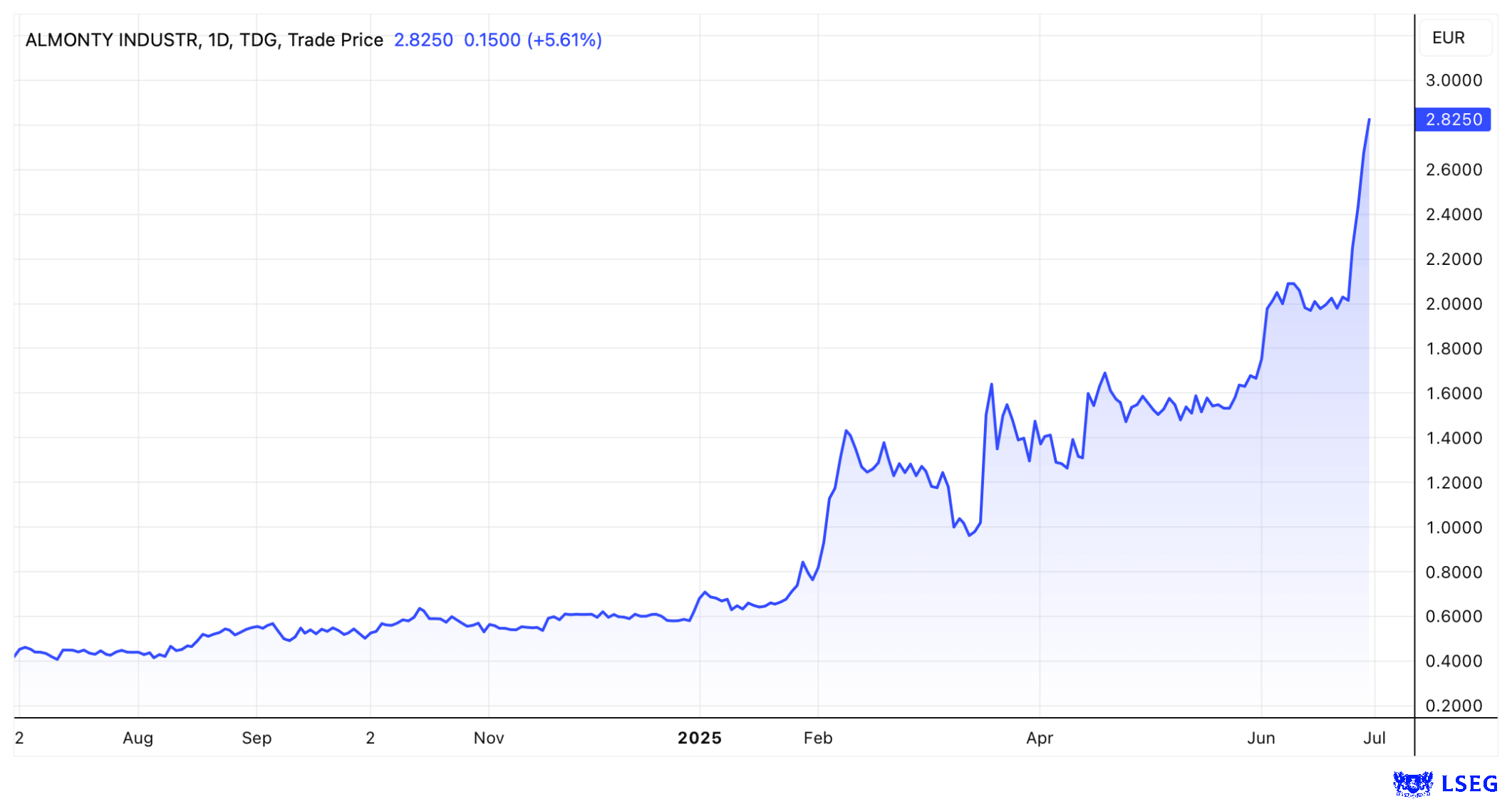

Between 2019 and 2021, investors in BioNTech witnessed a prime example of how a strategically relevant product – in this case, the COVID-19 vaccine – became a real stock market rocket thanks to government pressure, political support, and high public expectations. During this period, the share price rose from less than EUR 12.00 to over EUR 397.00. Those who invested early and were patient were able to achieve returns of over 3,200%. The decisive driver was not only technological innovation but also the government's determination to have the population vaccinated multiple times, which secured massive revenues for BioNTech. Today, a strikingly similar scenario is emerging with Almonty Industries (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) – only this time it is not about vaccines, but about the strategic raw material tungsten, which is indispensable for defense, aerospace, electronics, and mechanical engineering.

time to read: 2 minutes

|

Author:

Mario Hose

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , MP MATERIALS CORP | US5533681012

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

Tungsten: Few alternatives, but growing demand

Currently, 90% of the world's tungsten supply comes from China. Sanctions, geopolitical tensions, and growing security concerns are driving tungsten prices upward almost weekly. At the same time, remaining stocks from conflict-free regions are shrinking. Experts expect that Western buyers could panic once these stocks are depleted. This is because tungsten is a key factor in the defense capabilities of nations. Without tungsten, there would be no tanks, no aircraft, and no precision weapons.

Political pressure to become independent of Chinese supply chains is growing rapidly – and this is precisely where the parallel with BioNTech lies: back then, the state had to provide vaccines; today, it has to make provisions for critical raw materials such as tungsten.

Almonty Industries: From survivalist to monopolist

Almonty Industries has survived the decades-long price war that drove many Western tungsten producers into bankruptcy. The Company secured its survival through minimum-price offtake agreements for its Panasqueira mine in Portugal. Almonty is now applying this expertise to the development of the Sangdong mine in South Korea, one of the largest tungsten projects outside China. The local infrastructure has been completed, and production is expected to begin shortly in 2025.

By multiplying its current production volumes, Almonty will be able to meet the demand of many Western industries. With the Sangdong mine, the Company could effectively become the Western monopolist for tungsten. The potential for a significant share price increase is correspondingly high – comparable to the massive upswing at BioNTech when it became clear that the vaccine would receive government backing, regardless of its actual efficacy.

Valuation: MP Materials as a comparison

By way of comparison, US-based MP Materials, which specializes in rare earths, is valued at USD 5.37 billion. Almonty, on the other hand, is currently valued at only around USD 0.9 billion – even though it is in the process of establishing itself as the only significant Western tungsten producer. Should the anticipated NASDAQ listing materialize, the share price could undergo a revaluation to better reflect the strategic importance of the Company.

Conclusion: Never sell too early!

Tungsten is no less systemically important than vaccines in the pandemic – for Western countries, it is essential for national security. Almonty Industries (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) offers investors a rare opportunity to participate in this strategic trend. Anyone who made the mistake of selling BioNTech too early knows that patience can pay off when it comes to politically relevant issues – and Almonty could become the BioNTech of critical metals.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.