January 2nd, 2025 | 07:20 CET

Uranium and defense – Rally expected in 2025! Renk, F3 Uranium, Hensoldt, Rheinmetall and thyssenkrupp in focus

After nearly 19% gains in 2024, many investors wonder whether such dream returns are repeatable in 2025. We believe so, although the growth will be selective. Stocks are no longer rising across the board; instead, they are rising due to their strength in the sectors or because of an extraordinary competitive position. Underperformers will still be abundant, and investors should, therefore, position their portfolios to weather the storm. There is a significant risk of a lower valuation in certain NASDAQ-listed stocks, which have already reached P/E ratios of over 40. One indicator of such exaggerations is the so-called Shiller P/E ratio. At 24.8, the MSCI World is currently well above its long-term average, mainly due to stocks in the technology and communications sectors, which are trading relatively well above their historical valuation median. The time has, therefore, come for a sector rotation – here are a few ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RENK AG O.N. | DE000RENK730 , F3 URANIUM CORP | CA30336Y1079 , HENSOLDT AG INH O.N. | DE000HAG0005 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp AG – Was that the turnaround?

The shares of thyssenkrupp AG were one of the hottest turnaround candidates of the past year. From a low of EUR 2.77 in September, they rose to EUR 3.92 by the end of the year. Those who regularly follow our comments bought shares below EUR 3 and are now sitting on profits of around 30%. The restructuring of the entire steel sector and the latest decisions by the federal government to consolidate and keep the naval shipyards in northern Germany alive are currently fuelling speculation. For a long time, the market had feared that the important naval and submarine expertise could be sold abroad.

Shortly before Christmas, positive statements from the government were made public. Defense Minister Boris Pistorius sees a growing threat in Northern Europe, which is forcing NATO countries to make further investments. "We need the submarines because the maritime threat situation urgently requires them," said Defense Minister Boris Pistorius (SPD) during a recent visit to Norway. ThyssenKrupp's Marine Systems (TKMS) division is a promising high-tech area with a recent turnover of around EUR 2.1 billion and an adjusted EBIT of EUR 125 million. Increased submarine construction would certainly support the Company in its challenging restructuring process. Meanwhile, the Steel Europe (TKSE) division plans to cut 5,000 jobs and close a processing site in Kreuztal in the Siegerland region. This is an adjustment of capacities to match the current market demand. While thyssenkrupp is certainly not out of the woods yet, a market capitalization of EUR 2.4 billion represents roughly the fair value of the Marine division. Raise it to EUR 4!

F3 Uranium – Starting the new year with full coffers

Uranium is playing an increasingly important role in global military rearmament, particularly through its use in nuclear weapons and in nuclear energy supply. The "NetZero" efforts within the global energy transition are focusing on new nuclear technologies such as small modular reactors (SMRs), which can be used both to provide a solid foundation for local energy supply and to provide military units such as submarines and aircraft carriers with a reliable source of propulsion. The global undersupply of uranium has been scientifically demonstrated for the years from 2027 onwards. Not enough uranium projects are currently being launched to meet the growing demand for over 100 new reactors in the next five years. Uranium is considered a strategic resource, and countries with large uranium deposits, such as Kazakhstan, Australia, Canada and Russia, therefore play a key role in its supply. Under the US President-elect Donald Trump, international power blocs will realign, which is more likely to negatively impact supply security. The spot price of around USD 73 does not yet reflect this uncertainty, as it was already above USD 100 in the middle of last year.

The Canadian company F3 Uranium (FUU) was formed from a spin-off of Fission Uranium and has several promising properties in the uranium-rich Athabasca Basin. The current exploration work is focused on the JR zone, where many drill results have already indicated an industrially viable level of mineralization of more than 1.0% U3O8 by weight. Some sites even showed 30%. Exploration of the properties will now continue into 2025. For this purpose, a further CAD 8 million in equity was raised shortly before Christmas. The FUU stock is currently trading between CAD 0.22 and CAD 0.25, with medium-term price targets of CAD 0.60 and CAD 0.75 from research firms Red Cloud and SCP. A new commodity supercycle could start in 2025 after a subdued 2024, with uranium companies expected to lead the market. Collect!

Hensoldt, Rheinmetall and Renk Group – Is the armaments hype set to continue?

Uranium is essential for the defense industry. Due to its high density of about 1.7 times that of lead, it is used for armor-piercing ammunition because it is extremely destructive on impact due to kinetic energy. It is also used in armor plating, which is particularly resistant to penetration. It is also used as radiation shielding in armaments facilities to protect sensitive electronics and personnel from radiation. In submarines and aircraft carriers, uranium-235 is used as fuel in nuclear reactors that allow for an almost unlimited range.

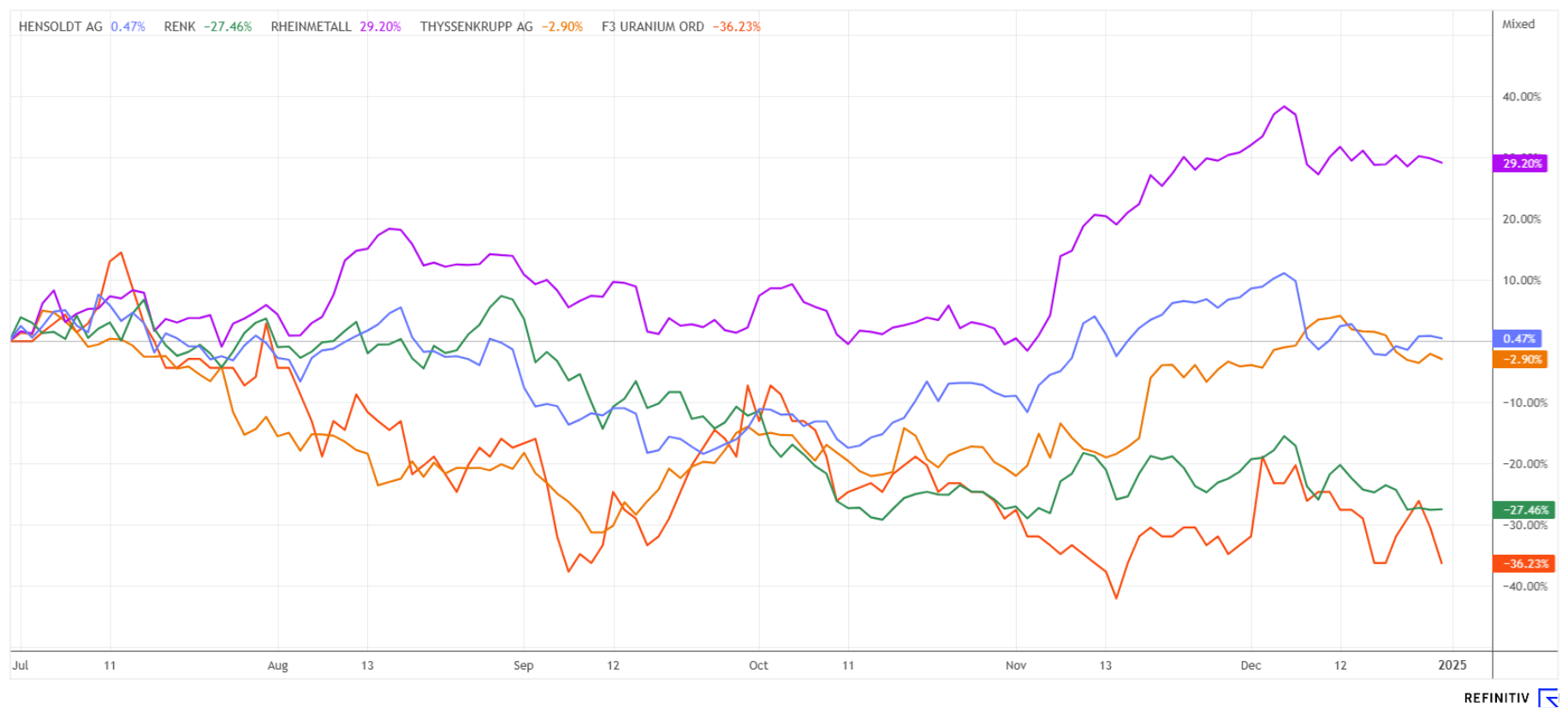

Investors can look back on a generally positive share price performance in the defense sector for 2024. The blockbuster in Germany was the Rheinmetall share, followed by MTU, Hensoldt and Airbus. The gear and transmission specialist Renk also got off to a promising start, quickly doubling in price only to halve again. At the turn of the year, a new CEO will get the Company back on track for returns after weak figures and a cautious outlook. Analysts on the Refinitiv Eikon platform have cut their 12-month consensus from EUR 38 to around EUR 30.50, but 11 of 13 experts are still on the market with a "Buy" recommendation. If Dr Alexander Sagel can quickly complete his streamlining, Renk shares could be among the winners again in 2025.

The Munich-based defense group Hensoldt is somewhat better positioned in the market. In 2024, it took on the arms specialist ESG by incurring debt to the value of EUR 675 million. The Italian major shareholder, Leonardo, did not participate in the deal. Hensoldt does not expect the takeover to make a measurable contribution to earnings until 2026. But the consolidation of the industry continues. As reported by Handelsblatt, defense contractors Rheinmetall and Hensoldt are interested in Thyssenkrupp's naval division. Rheinmetall and the Lürssen shipyard group from Bremen are among the bidders, with Hensoldt among the interested parties. The Munich-based company is expected to grow by 15% over the next few years, while EBIT is expected to double from EUR 295 million to over EUR 600 million. With a market capitalization of almost EUR 4 billion, there is still room for growth. Analysts see some upside potential for Hensoldt. The experts at Deutsche Bank Research recently raised their target price from EUR 37 to EUR 41, which is in line with the consensus of 11 research houses on the Refinitiv Eikon platform. 2025 still seems to have many surprises in store for the sector. Stay tuned.

The investment year 2025 is likely to hold many surprises. With Trump's demand that all NATO countries actually double their defense spending, investors' eyes remain fixed on the defense sector. Uranium as a raw material remains an important aspect of this journey, and with it all, promising uranium projects such as those of the very well-positioned F3 Uranium.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.