November 18th, 2024 | 07:10 CET

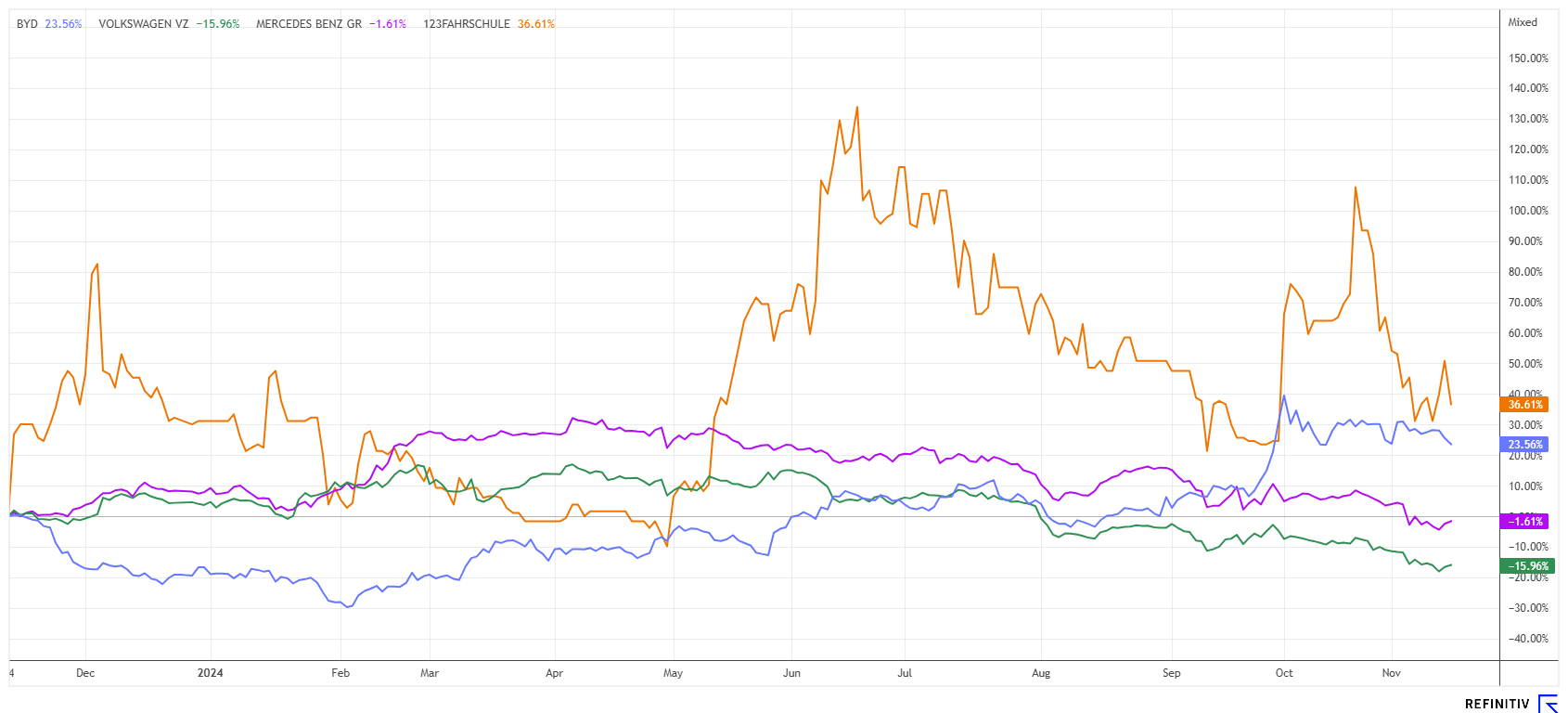

Uncertainty, volatility and BTC at USD 100,000? The stock checklist with BYD, VW, 123fahrschule and Mercedes

Donald Trump is moving back into the White House. Investors took the election result as an opportunity to stage a celebration on the US stock market. The major indices recorded a full 10% increase, and the US dollar strengthened significantly. Trump stands for fossil fuels, nuclear power and armaments. He dismisses climate change and the Paris Agreement and will not invest any further funds in the energy transition. This is a warning sign for the European economy because local governments are pursuing a "net zero" target for 2045, and their efforts are globally losing ground. High costs are squeezing the margins of local corporations, whereas US companies and Asian firms are doing brilliantly. For investors, there are many opportunities and timing is more important than ever. We have done the math.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , 123FAHRSCHULE SE | DE000A2P4HL9 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – Here to stay

The Chinese technology company "Build Your Dreams (BYD)" is making a name for itself. The first ATTO 3 was delivered by the Reisacher company in Bavaria in February 2023. A visit to a sales outlet in Munich shows four brand new models, one of which is already sold out. Supposedly, one vehicle is currently being sold per day, so that would be almost 250 units in one year. The dealership operates 7 locations. As you can see from this simple calculation, BYD will soon be no rarity on Germany's roads.

As a sponsor of the 2024 European Football Championship, the Chinese technology group and carmaker BYD came to the attention of the world's public and reached an audience of millions. Started 30 years ago as a battery manufacturer, BYD has become a major player in research and development. The Company, which has only been active in Europe since 2022, is launching vehicles at an impressive pace. With over 100,000 engineers and 11 research institutes, BYD claims to have the largest development team in the world; in addition, over 900,000 employees work for the Company. BYD already accounts for 23% of the global market for electric vehicles. In other words, almost one in four newly registered electric vehicles worldwide comes from this company. The Chinese are currently on the verge of producing their ten millionth electric vehicle.

"It took 13 years to go from zero to one million vehicles, but we managed the leap from seven to nine million in just six months," explained Stella Li, Executive Vice President of BYD recently. While competitors tend to rely on direct sales or subscriptions, BYD uses the classic car dealership. The Company already works with around 50 dealers in Germany, and this number is expected to rise to around 125 by the end of 2025. With the start of production in Hungary from the end of 2025, EU import tariffs would then also be a thing of the past. The share price is up around 8% over 12 months, while market capitalization grew by an incredible 600% between 2019 and 2024. With a P/E ratio of 18.5 in 2024, the share is fairly valued but no longer cheap.

123fahrschule – Digitizing the driver's license process

At the beginning of any individual mobility journey is, first and foremost, a driving licence. 123fahrschule was founded in 2016 and specializes in digitizing and modernizing the driving school industry. The Company combines innovative technologies such as online registration, app-based appointment management and driving simulators with traditional driving school services. It has since become one of Germany's largest driving school chains and is focusing on further growth through new openings and acquisitions. **With approaches such as a learning app, a driving simulator, block-based theory training and targeted exam preparation, 123's offering stands out from the market. The aim is to make it possible to obtain a class B driving license for between EUR 2,000 and 2,500.

The German driving school market is highly fragmented and generates annual sales of around EUR 3 billion, with 123fahrschule expected to generate a good EUR 24 million in annual sales. This means that there is still plenty of scope for market consolidation in Germany. CEO Polenske is optimistic about the Company's growth: "In my view, simulators will play a much more important role in driving license training in the coming years. With the digital and virtual driving instructor in the simulator software, the student can be trained in a much more stress-free and flexible way, saving money and providing an effective solution to the shortage of driving instructors. With the acquisition of Foerst GmbH in May 2024 and further investments in the simulator software planned for 2025, we are creating a unique product on the market," says the innovative founder.

Mr. Polenkse also votes with his feet on the stock exchange because the CEO repeatedly appears in the insider filings with purchases, most recently on Friday. After a successful capital increase at EUR 2.30, EUR 1.12 million came into the Company's coffers. A total of 5,558 million shares have now been issued, with a market capitalization of around EUR 13.9 million, corresponding to less than 50% of the planned revenues for the current year. In Q3, there was a jump to EUR 5.7 million. mwb research confirms its "Buy" recommendation with a price target of EUR 6.20. The analysts see 123 as well positioned to benefit from the upcoming regulatory changes by 2026. The Company is making progress in implementing its recently presented Strategy 2027 and the digital transformation in the German driving school market. From a chart perspective, The small setback from EUR 3.70 to EUR 2.50 offers a good entry zone.

VW and Mercedes – Is there still hope?

We have recently reported several times about the operational plight and the major restructuring at VW. Three plants and more than 30,000 jobs are at risk. But is there still hope after a 24% price drop? For John Goetz, chief strategist at US asset manager Pzena, low prices for former market leaders represent a significant opportunity. He manages USD 72 billion in investable assets. In a recent interview with Handelsblatt, he said: "We love bad news; we actively seek it and see it as an opportunity. We already hold a small position in VW but are considering buying more shares." The idea is not to be dismissed. At around EUR 84, VW has now lost around 70% of its peak value from 2021, but with a P/E ratio of 3.2 in 2025 and an expected dividend yield of at least 5%, the stock is starting to look like a bargain. Analysts on the Refinitiv Eikon platform expect a 12-month average price target of EUR 116, which is still 38% above Friday's closing price.**

Mercedes-Benz in Stuttgart has also seen better days. At a price of EUR 53, the stock is only 30% away from its peak, but operating performance is suffering greatly from falling margins. However, the carmaker currently sees no need to adjust its production capacities due to stagnating sales figures. The plant in Hambach has already been sold, production in Brazil and Russia has also been discontinued, while the Hungarian plant in Kecskemét has been expanded. In addition to Germany and Hungary, the Company's production sites also extend to countries such as China, the US, Mexico and South Africa. Mercedes sees itself as well positioned for the coming years. The shift to e-mobility, the focus on sustainability and increasing digitalization are shaping the challenges in production. The current price, with a 2024 P/E ratio of 5.5, is more attractive than it has been in years. On top of that, there is a healthy distribution of almost 8%, although this could still be adjusted downwards.

The automotive sector was one of the most exciting areas on the stock market in 2024. While BYD and Tesla dominate the global leaderboard, European manufacturers are falling behind. Regulations are hindering technological progress in Europe while far-off China smiles at our struggles. While we diligently sanction carbon emissions, the local market is being overrun by products from the Far East. Those who, unlike Brussels, do not want to stand in their own way can at least take action as investors. The service provider 123fahrschule is also interesting, as it is driving the industry forward with increasing digitalization.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.