November 28th, 2024 | 07:00 CET

Thunder Gold Corp., Amazon, Rheinmetall - Record values for gold, AI and armaments

The technology landscape and the commodities sector are currently showing their most dynamic side. Thunder Gold Corporation is delivering exceptional exploration results in Ontario, Canada. The reported gold grades of 9.12 g/t Au over 12.66 m are not only the strongest in the project's history, but they also indicate a potentially large gold deposit. The project's strategic location, with direct access to important infrastructure, further enhances the potential of this area. Amazon is making a technological breakthrough in the highly competitive AI chip market. With its new Trainium 2 processor, the tech giant is taking a direct shot at market leader Nvidia. The promised fourfold increase in computing power at a significantly lower cost could fundamentally change the balance of power in this billion-dollar market. Rheinmetall is also continuing its growth course. Deutsche Bank is significantly raising its estimate and the target price to EUR 700. The Düsseldorf-based company, which wants to double its sales to EUR 20 billion by 2027, is benefiting from a new major order from Canada worth EUR 215 million.

time to read: 4 minutes

|

Author:

Juliane Zielonka

ISIN:

THUNDER GOLD CORP | CA88605F1009 , AMAZON.COM INC. DL-_01 | US0231351067 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Thunder Gold reports top results in gold exploration in Ontario

Thunder Gold Corporation reports promising gold discoveries at its Tower Mountain project in Ontario, Canada. Sampling at the P-Target revealed an exceptionally intense gold grade of 9.12 g/t over a length of 12.66 m being detected.

The 100%-owned project, located just 50 km west of the port city of Thunder Bay, covers an area of 2,500 ha. Recent investigations show a strong continuity of gold occurrences. For example, the sample site TMCH24-01 returned an average of 4.93 g/t Au over 24.87 m - the longest continuous mineralized interval in the project's history.

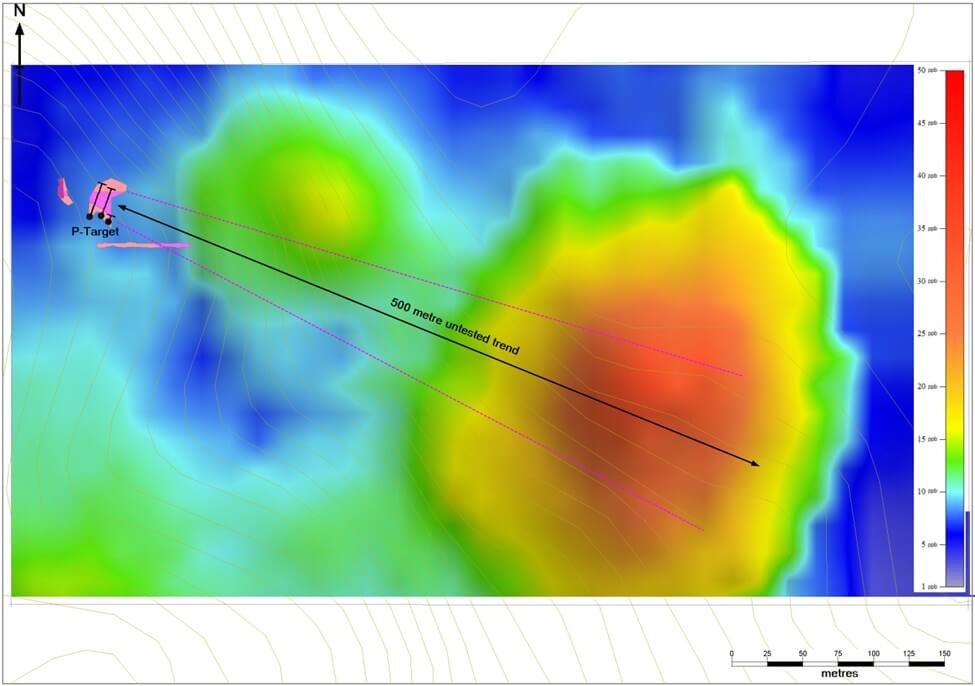

Of particular note is that over 82% of the channel samples taken have a gold grade higher than 0.3 g/t Au. This frequency rate is three times higher than in the previous 40,000 drill core samples. Mapping and soil sampling suggest that the mineralization may extend a further 500 m to the southeast.

The Company is now planning an eight-hole, near-surface diamond drilling program to further explore this promising trend. Drilling is expected to continue until mid-December 2024. The Tower Mountain Project is strategically located just off the Trans-Canada-Highway and encompasses the largest exposed intrusive complex in the eastern Shebandowan greenstone belt.

Amazon attacks Nvidia - New AI chip four times faster

Amazon is using a technological innovation to challenge the USD 100 billion AI chip market. The new Trainium 2 processor is said to offer four times the computing power and three times the memory of its predecessor. Amazon's stock reacted to this announcement with a 3.18% price increase.

In a development center in Austin, Texas, a team of engineers led by Rami Sinno are working on the future-oriented chip. The performance targets are to be achieved through a simplified design that reduces the number of chips per unit from eight to two, as well as improved heat management and the replacement of cables with printed circuit boards.

The strategy is already showing initial success: Amazon was able to win the AI company Anthropic as an important partner and recently doubled its investment to USD 8 billion. In return, Anthropic will train its largest AI models on the Trainium chips. David Brown, Vice President of Computing and Networking at AWS, promises cost savings of up to 50% compared to Nvidia chips.

With this initiative, Amazon is challenging the previous market leader Nvidia. Success will depend to a large extent on the further development of software tools and seamless integration into existing AI frameworks.

Deutsche Bank sees Rheinmetall on the fast track - Target price significantly increased

Rheinmetall continues on its successful path: Deutsche Bank has revised its cautious assessment of the armaments group and upgraded the share from "Hold" to "Buy". The target price has been significantly increased from EUR 550 to EUR 700 – a reaction to the dynamic business development of the Düsseldorf-based company.

The Group's growth prospects had previously been underestimated. While analysts had previously forecast revenue of between EUR 16 billion and EUR 17 billion by 2027, Rheinmetall is now aiming to double this figure to around EUR 20 billion. This optimistic assessment is shared by the majority of experts, with 16 of 19 analysts recommending the share as a "Buy".

The positive trend is also reflected in a new major order: the Canadian armed forces are ordering 85 HX heavy recovery vehicles. The contract, which has a volume of EUR 215 million, extends over five years and, in addition to the vehicles, also includes recovery equipment. An additional service contract worth EUR 20 million underscores the long-term nature of the partnership.

The stock market has welcomed the development: since the beginning of the year, the share price has more than doubled. With a current price of EUR 621.80 and a daily gain of 0.45%, the stock continues its upward trend. The strong performance reflects investors' growing confidence in the Company's strategy.

Thunder Gold reports exceptionally strong gold grades of 9.12 g/t over 12.66 m at Tower Mountain Project. This indicates excellent exploration potential in a prime location: Its strategic location on the Trans-Canada Highway, with access to a port, airport and power supply, offers optimal development opportunities. Tech giant Amazon is attacking market leader Nvidia with its new Trainium 2 AI chip, promising four times the performance at a significantly lower cost. The strategic partnership with Anthropic and an investment of USD 8 billion indicate the seriousness of this bid to unseat Nvidia from its throne. Deutsche Bank has rediscovered the growth potential of the arms manufacturer Rheinmetall and predicts that its revenue will double to EUR 20 billion by 2027. The new major order from Canada, worth EUR 215 million, confirms this positive trend.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.