October 7th, 2024 | 07:00 CEST

The DAX is on a high, with potential for 100% gains in turnaround stocks like TUI, Lufthansa, 123fahrschule, BYD, and VW!

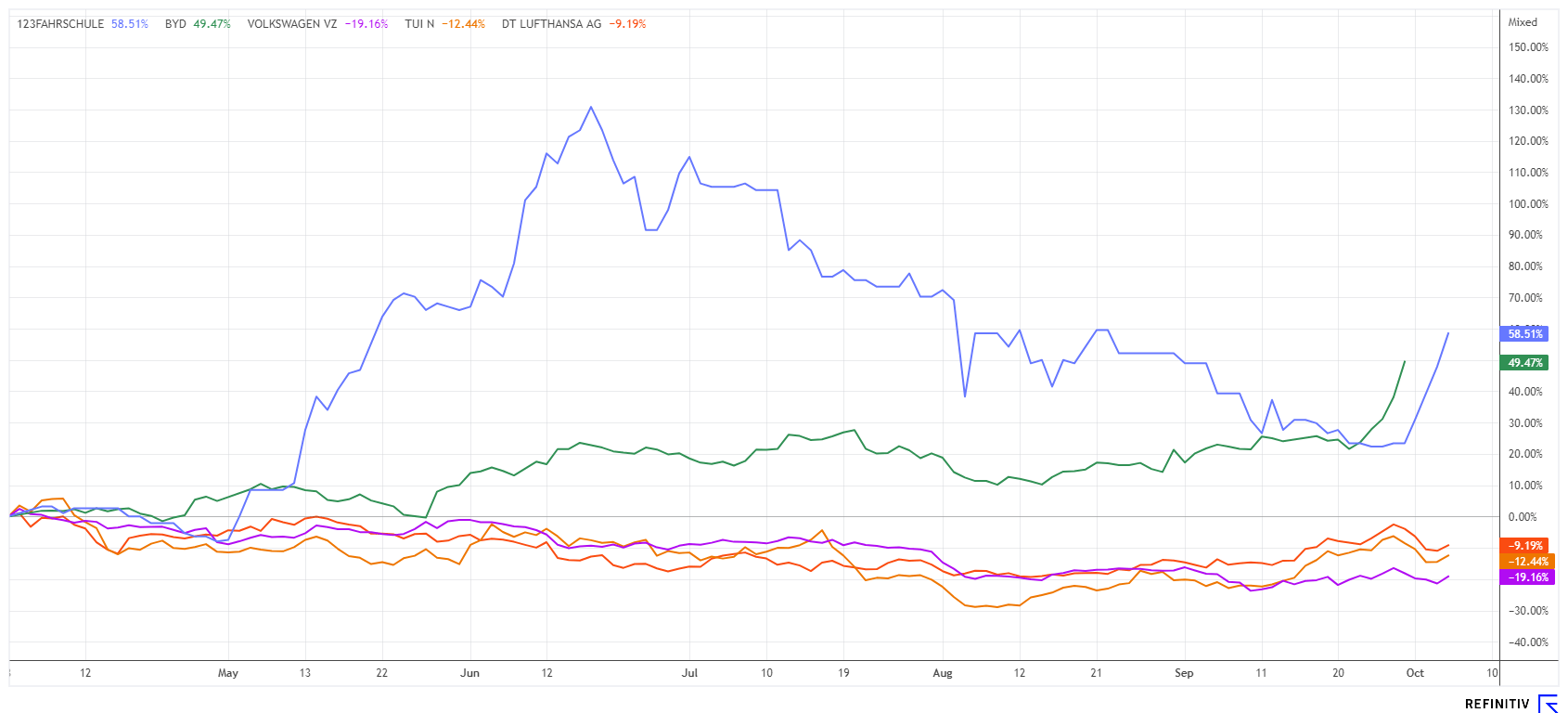

Despite geopolitical uncertainties, slow economic growth, and still high inflation, the market outlook is improving. It is important to remember that stock markets look 6 to 9 months ahead. Expectations are growing that inflation will significantly decrease, and interest rates will likely drop. The central banks are increasingly under pressure due to the sluggish economy. After months of a tech rally, the focus is now turning to lagging stocks. In the automotive sector, we are looking at VW and BYD, and the tourism sector is also picking up again. The digitalization expert in the German driving school sector, 123fahrschule SE, also appears highly promising. Each of these stocks has the potential to deliver more than 100% gains over the next 24 months. Here is our analysis.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125 , 123FAHRSCHULE SE | DE000A2P4HL9 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – Way ahead of Volkswagen and soon to be part of the EU

There is no good news coming from the German automotive industry. While VW wants to close three plants and put up to 30,000 jobs at risk, Mercedes and BMW are simultaneously seeing their margins collapse. The reason: high-margin sales of premium vehicles in Asia are falling by double-digit percentages. This is mainly due to the aggressive expansion policy of Chinese electric vehicle manufacturers, who are now flooding the European markets with subsidized offers. Consequently, the EU Commission had agreed on import duties between 17 and 34% on Friday, against Germany's vote. This is not likely to change the current market conditions much because German electric models are not competitive either technically or in terms of price.

BYD offers models such as the BYD Dolphin from around EUR 33,000, while the VW ID.3, a similar compact model, is around EUR 40,000 - around 21% higher. BYD will open its plant in Hungary in 2026 and then produce in the EU for the first time, at which point import tariffs will be obsolete. The difference between the two stocks is also reflected in their performance. While BYD has a market capitalization of EUR 96 billion and a P/E ratio of 14.4 for 2025, VW figures are EUR 48 billion and a P/E ratio of 3.4. The 12-month share price performance shows an increase of 24% for BYD, while VW's preferred shares lost around 12%. Only a crystal ball can tell what will happen in a year's time.

123fahrschule – Capital increase oversubscribed and positive analysts

Anyone who wants to be mobile typically requires a driver's license first. With his listed company 123fahrschule SE, manager Boris Polenske proves this topic can also be a growth story for the stock market. With innovative approaches such as a learning app, a driving simulator, blocked theory training, and targeted exam preparation, 123's offering stands out from the market. Even today, a class B driver's license should still be available for between EUR 2,000 and EUR 2,500. With a comprehensive digitization approach, the Company aims to continue to be one of the low-cost providers in the future. The German driving school market is highly fragmented and generates annual sales of around EUR 3 billion, with 123fahrschule expected to generate a good EUR 24 million in annual sales. This means that there is still plenty of scope for market consolidation in Germany. Possible expansion abroad is not yet on the cards due to the heterogeneity of international training systems.

In the first half of the year, 123fahrschule increased its revenues by 6% to EUR 11.1 million. For the year as a whole, analysts are forecasting revenues of EUR 24.6 million and, due to high investments, a remaining loss of EUR 0.49 per share. In 2025, revenues are expected to grow by around EUR 3 million and the loss is expected to shrink to around EUR 0.25 per share. Last week, 123fahrschule carried out a capital increase. Demand was so high that 487,556 new shares were issued instead of the 430,000 originally planned. The subscription price was EUR 2.30, meaning that the Cologne-based company will generate around EUR 1.12 million. The money will be used to finance further expansion in Cologne, Hamburg, and Berlin, with around 20 new branches in 2025. The driving simulator developed in-house will also be rolled out successively.

The positive news of recent weeks has not gone unnoticed by analysts. mwb research confirmed its "Buy" recommendation with a target price of EUR 6.20 shortly before the experts at NuWays issued a recommendation with a target price of EUR 7.20. The 123fahrschule share price rose from around EUR 2.60 to over EUR 3.00 last week. Given the good prospects for the digitization of the driving school business, this is likely to be just the beginning of a longer upward rally.

CEO Boris Polenske will give some insights into the current business and explain his expansion plans for 2025 at the upcoming International Investment Forum being held next week on October 15 at 2:00 p.m. CET Click here for free registration.

TUI and Lufthansa – Is this the breakout?

The TUI share is currently benefiting from strong demand for vacation travel, with Turkey, the US, and Thailand, particularly on the agenda for the coming fall vacations. Management is pursuing a strategic realignment with an increased focus on vacation experiences. A key element of this strategy is the expansion of international hotel brands such as TUI Blue, RIU, Robinson, and TUI Magic Life. As part of a 50:50 joint venture, TUI operates around 100 hotels and resorts in 19 countries with the RIU hotel chain. The FTI bankruptcy has created a shortfall for TUI, meaning the Hanover-based company can now sell additional capacity. This led to record bookings in the last quarter. However, the old problems remain: high costs and a still-burdening debt. At least the stock has now briefly crossed the EUR 6 mark again and even risen to almost EUR 7. After a turbulent week, the price closed at EUR 6.56 on Friday. The sentiment for the TUI share has now clearly turned. Newly invested investors are raising their stop from EUR 5.75 to EUR 6.25 and letting the profits run.

Total chaos at Munich Airport. This has never happened in the history of airport operations: a 2-kilometer line in front of the security check with waiting times of up to 6 hours. Unbelievable! According to Spiegel, Lufthansa CEO Carsten Spohr considers Munich Airport the worst in Europe, even after Frankfurt, which also has major problems. Significant delays and a lack of staff are common there. This year, Munich was overwhelmed by foreign guests attending Oktoberfest, with numerous construction sites and train cancellations in local transport quadrupling passenger traffic at Terminal 2 at peak times. Due to heavy criticism from the airlines, the issue has already been escalated to Prime Minister Markus Söder. Whether a rapid improvement is possible here or across Germany depends on the willingness of the left-green government in Berlin, which would prefer to abolish private flying altogether. The traffic light also has no conclusive answer to the numerous actions of climate activists that have caused millions in damages. As a result, flying in Germany remains an adventure with numerous imponderables. On the stock market, Lufthansa shares are starting to show some signs of recovery, finally surpassing the EUR 6 mark. However, from a chart perspective, the next resistance level to the upside is already lurking at EUR 6.80. Both values remain very favourable!

Stocks worldwide are benefiting from the recent cycle of interest rate cuts by the ECB and the Fed. This makes growth financing cheaper again, and valuation models show higher company values. This should lead to a seamless transition from the summer rally to an autumn spending spree. Vehicle and tourism stocks are suffering from the limited budgets of private households, but 123fahrschule is providing the right answers with its digitization strategy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.