renewableenergies

Commented by Fabian Lorenz on March 3rd, 2025 | 07:00 CET

50% upside potential or end of the rally? Nordex, Barrick Gold, and Golden Cariboo Resources

Analysts see 50% upside potential at Nordex. The wind turbine manufacturer is entering the new year with a strong base. The outlook for 2025 is convincing, and there could even be a surprise in terms of EBITDA. Perhaps there will even be a dividend soon? However, there are risks in the important US business. Gold is among the winners of the Trump era. As the scandal in the White House on Friday showed, the geopolitical situation remains unstable. Although the gold price has not managed to break through the USD 3,000 mark, the upward trend remains intact. The stock of Golden Cariboo Resources is still cheap. The security of the largely undiscovered gold pearl has just overcome a resistance, and promising drilling results have been obtained. Experts advise buying. And what is Barrick Gold doing? The struggling industry giant recently made positive headlines, but the stock is weakening.

ReadCommented by Juliane Zielonka on February 27th, 2025 | 07:20 CET

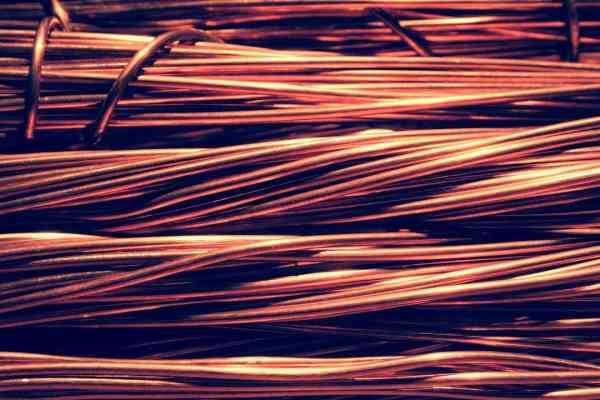

Copper as the key: Siemens Energy, Benton Resources, and Hensoldt are shaping the energy transition and security

Copper is a key factor in shaping the energy transition and security. The green transformation, in particular, is increasing demand. Siemens Energy is driving sustainable electrification and uses recycled material for circuit breakers in its energy transition products - a small step with a big impact. The Company is strengthening its market position in the circular economy and securing a billion-dollar order volume. The Canadian mineral exploration company Benton Resources is profiting from the raw materials boom and expanding its copper deposits in the Great Burnt project in Canada. Experts predict an imminent copper shortage due to the energy transition. Benton Resources can now position itself as a future supplier for this industry. Hensoldt, a specialist in sensor technologies in defense and aerospace, is deepening its drone expertise by cooperating with QinetiQ, thus ensuring geopolitical stability. Read on to find out how these companies combine sustainability, raw materials, and defense.

ReadCommented by André Will-Laudien on February 25th, 2025 | 07:15 CET

CDU wins, and the stock market celebrates! Caution with Nel ASA, First Nordic Metals, Xiaomi, and Agnico Eagle

In addition to the stock indices constantly reaching new highs, gold has also reached new record levels above USD 2,950. After the tech indices climbed to new highs during February, there is now a slight correction. No one is talking about a trend reversal yet, as buybacks are still too present. Top performers like Palantir and Nvidia may have to take a hit in the short term, while low-valued securities and defense stocks are currently in demand again. Rheinmetall remains the top share in the DAX 40 index, with a plus of over 800% since February 2022. This year, the value is once again excelling with an increase of more than 50%. We highlight some opportunities.

ReadCommented by Juliane Zielonka on February 21st, 2025 | 07:00 CET

RWE, First Nordic Metals, and Siemens Energy: Europe's new energy independence is gathering pace

Germany is still feeling the effects of the sabotage of the Russian gas pipelines years later. Expensive energy costs are driving industry to the brink of ruin. Solutions are needed to bring the European country back to the forefront economically. Energy company RWE is setting a good example by launching large-scale battery storage systems in two cities that can provide energy for critical infrastructure within seconds. This project demonstrates how Germany is future-proofing its energy supply. First Nordic Metals is working to make Europe independent of raw materials and is conducting exploration projects with a focus on gold in Scandinavia. This precious metal offers a solid hedge, especially in times of crisis. Adam Cegielski, recently appointed president, strengthens the team with his 25 years of industry experience. Siemens Energy is banking on growth on the French coast: the Company is investing EUR 200 million to build offshore wind turbine rotor blades. This will not only create 200 new jobs but also send a strong signal for Europe's path toward energy independence.

ReadCommented by Armin Schulz on February 20th, 2025 | 07:00 CET

BYD, Benton Resources, Nordex – Copper Boom: The hidden treasure of the greentech industry

In a world balancing between climate targets and geopolitical tensions, three companies are working on the future of the energy and mobility transition and depend on critical raw materials like copper. While the 2025 German federal election is reigniting the debate on renewable energies – with demands for clear framework conditions for wind power and critical voices from the political arena – other players are pushing ahead with disruptive technologies. BYD showcases the future with AI-driven assistance systems. Benton Resources is unlocking key resources for green technologies like copper, nickel, zinc, and gold, and Nordex receives record orders despite uncertain markets. These companies have more in common than their focus on sustainability: they represent a new era of innovation in which strategic decisions made today determine tomorrow's competitiveness.

ReadCommented by Armin Schulz on February 19th, 2025 | 07:35 CET

thyssenkrupp, Golden Cariboo Resources, Intel – Which comeback strategy will pay off?

In a world where raw materials are becoming scarcer, markets more volatile, and technologies more disruptive, companies face a threefold challenge: they must transform, innovate, and, at the same time, preserve their roots. This balance between tradition and the future currently shapes three publicly traded companies that could not be more different – yet all three have long histories to look back on. thyssenkrupp, a former industrial giant, is in the midst of a transformation. Golden Cariboo Resources, with its "Quesnelle Gold Quartz Mine," can trace its history back to 1865 and has recently presented exciting drilling results. Meanwhile, Intel, a semiconductor giant, is grappling with the aftermath of a technological sprint that has catapulted the industry into a new era.

ReadCommented by Fabian Lorenz on February 19th, 2025 | 07:25 CET

FOMO Rally in energy and defense! Hensoldt, Siemens Energy, First Hydrogen

Shares in the energy and defense sectors continue to be among the most rapidly rising stocks. First Hydrogen has catch-up potential. The hydrogen specialist is currently expanding its business model and plans to use nuclear power, a potential the market has yet to recognize. Siemens Energy is also profiting from the world's hunger for energy. The latest figures are convincing; the free cash flow is exploding, and even the problem child Gamesa is picking itself up. However, analysts believe the stock might face some headwinds. The Hensoldt share is also unstoppable, riding the FOMO rally in Rheinmetall & Co. The share price surge accelerated again at the start of the week. NATO countries are preparing for years of massive investments. Can this momentum continue?

ReadCommented by André Will-Laudien on February 17th, 2025 | 07:35 CET

Shooting star Rheinmetall continues to rise - Greentech stocks like Nel, dynaCERT, and Plug Power are in the starting gate!

With the start of the security conference, they were back – the defense stocks. Rheinmetall thus exceeded the EUR 800 mark for the first time. The DAX 40 index is also doing brilliantly, currently at 22,600, well ahead of the NASDAQ. Now, rumors of peace talks are circulating, but the stock market is still not quite believing it. The losers of recent months were, not least, due to the re-election of Donald Trump, the greentech stocks. They were simply ignored in the face of the "climate change deniers" from the White House. But the charts no longer reached new lows. This is reason enough for us to refocus on these stocks. dynaCERT made its first leaps with the VERRA certification, but there is still much more potential. Selection remains key!

ReadCommented by Fabian Lorenz on February 14th, 2025 | 07:00 CET

SHARE PRICES are falling at Plug Power, Nel, and Hensoldt! BUY RECOMMENDATION for BMW partner European Lithium!

Buy opportunity or bankruptcy? Shares in Plug Power, Nel, and Hensoldt are under pressure these days. The former hydrogen favorites are facing one piece of bad news after another. After mass layoffs at Nel, the next catastrophe comes from Plug Power. Investors are also getting nervous about Rheinmetall, Renk, and Hensoldt. Is a correction looming? Analysts believe the correction at Hensoldt should be seen as a buying opportunity. At BMW partner European Lithium, analysts even see potential for a multiple increase in value. The stock, which focuses on lithium and rare earths, has gained traction, and the current consolidation offers an exciting entry opportunity. Even peace in Ukraine could benefit these companies.

ReadCommented by Armin Schulz on February 13th, 2025 | 07:00 CET

Plug Power, First Hydrogen, BP – Here are the opportunities of the new US energy policy

The global energy transition is at a crossroads. Electric vehicles will likely prevail in the long term, but not everywhere and not through mandates. The US aims to provide affordable energy and wants to promote oil and gas production while focusing on nuclear power in the form of small modular reactors. With these mini-nuclear power plants, hydrogen could be produced cheaply, taking the technology a decisive step forward. This could solve some of the issues electric vehicles face, which would be a boon for the transportation industry, which is subject to green regulations. We are, therefore, looking at the largest US hydrogen player today and taking a closer look at First Hydrogen, which specializes in hydrogen-powered light commercial vehicles. Finally, we will analyze BP, a major oil producer.

Read