renewableenergies

Commented by André Will-Laudien on January 13th, 2025 | 07:10 CET

Greentech stocks make a flying start in 2025 – Tax package on the way? Nel ASA, dynaCERT, Plug Power, and Nordex in focus

The stock market kicked off the year with significant volatility. However, while the DAX 40 index is setting new records daily, the NASDAQ is consolidating at a very high level. Some profit-taking is weighing on the recently favoured "Magnificent 7" stocks, while long-neglected stocks in the greentech sector are starting to make a comeback. Canadian hydrogen specialist dynaCERT has now cleared all regulatory hurdles and strengthened its emissions trading team with the appointment of a new board member. In Germany alone, the environmental certificate market represents an annual volume of EUR 18.5 billion. We analyze which greentech stocks are now in a position to unlock their potential.

ReadCommented by Stefan Feulner on January 13th, 2025 | 07:00 CET

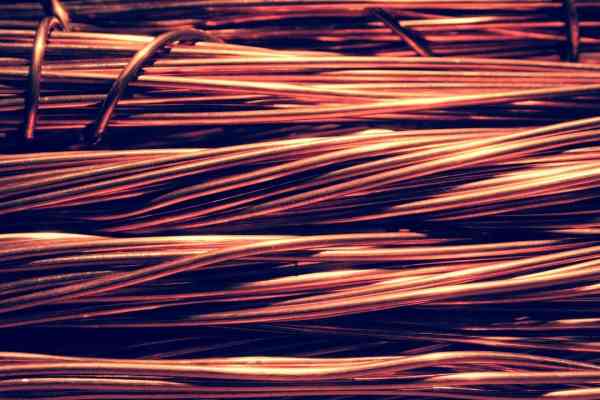

Nordex, XXIX Metal, D-Wave Quantum – Demand is driving prices

The decarbonization of the energy industry and the accelerated expansion of data centres for calculating artificial intelligence are creating a steadily increasing demand for energy sources that are as clean and efficient as possible. In addition to the ramp-up of solar energy, wind power plays a major role. The energy transition is leading to an enormous increase in the demand for copper. Forecasts assume that the demand for copper could increase by around 50–70% by 2030. By contrast, the past decade has seen a failure to meet rising demand by developing new projects. As a result, the few copper producers are likely to benefit from rising prices in the long term.

ReadCommented by Fabian Lorenz on January 9th, 2025 | 07:00 CET

Plug Power share price explodes! Golden times ahead for Siemens Energy and F3 Uranium?

The saying "those declared dead live longer" applies to the stock market - and seemingly to Plug Power. The hydrogen stock rose by almost 50% in the first few days of trading, although it has recently struggled to maintain this level. Is this the breakthrough, or is it going down again? Siemens Energy and F3 Uranium could be on the verge of golden times. Both are benefiting from the boom in data centres. In the past few days alone, billion-dollar investments have been announced in the US. To supply energy to the data centres for artificial intelligence, grids and nuclear power plants are needed. However, analyst sentiment is weighing on the price of Siemens Energy. In contrast, F3 Uranium appears ripe for a breakout from the sideways movement, with the potential for its stock to double.

ReadCommented by Armin Schulz on January 6th, 2025 | 07:15 CET

Volkswagen undervalued! What about European Lithium and BYD?

Looking at the market for electric vehicles in Germany, the outlook seems bleak. However, taking a broader view, the global picture tells a different story. Battery production is also steadily rising, driving a growing demand for lithium. Currently, the lithium supply is still sufficient, but experts predict that by 2030 demand will exceed supply. The reason for this is not only the automotive industry but also the demand for energy storage for renewable energies. We take a look at three companies and their current situation.

ReadCommented by André Will-Laudien on January 2nd, 2025 | 07:20 CET

Uranium and defense – Rally expected in 2025! Renk, F3 Uranium, Hensoldt, Rheinmetall and thyssenkrupp in focus

After nearly 19% gains in 2024, many investors wonder whether such dream returns are repeatable in 2025. We believe so, although the growth will be selective. Stocks are no longer rising across the board; instead, they are rising due to their strength in the sectors or because of an extraordinary competitive position. Underperformers will still be abundant, and investors should, therefore, position their portfolios to weather the storm. There is a significant risk of a lower valuation in certain NASDAQ-listed stocks, which have already reached P/E ratios of over 40. One indicator of such exaggerations is the so-called Shiller P/E ratio. At 24.8, the MSCI World is currently well above its long-term average, mainly due to stocks in the technology and communications sectors, which are trading relatively well above their historical valuation median. The time has, therefore, come for a sector rotation – here are a few ideas.

ReadCommented by Juliane Zielonka on January 2nd, 2025 | 07:00 CET

Saturn Oil + Gas, Nel ASA, RWE - How three energy giants are redefining the future of global energy supply

Only a few days remain until January 20, 2025. The day the new US president will be sworn in and can push ahead with another energy turnaround. In North America, energy companies like Saturn Oil & Gas are expanding, and their products are driving the economy. With its blueprint strategy, Saturn ensures continuous value creation and is investing around CAD 320 million in further oil drilling projects for 2025. The clear financial strategy also provides more flexibility for the coming year. In Europe, the shift toward renewable energies continues. Nel ASA boasts full order books thanks to demand from Asia, but analysts remain cautious given the lack of hydrogen supply infrastructure in Europe. However, the new EU supply chain law could reshape the market conditions in favour of Nel ASA, as initial threats from Qatar indicate. As a global player, RWE continues to do business where it is most lucrative. The Company has achieved a milestone in the US, and in Italy, RWE is bringing a fresh breeze to the energy sector. Where investors should act now.

ReadCommented by Armin Schulz on December 30th, 2024 | 07:10 CET

Myriad Uranium - Uranium prices are exploding! What is the outlook for Nel ASA and RWE?

Uranium is increasingly coming into focus. Recently, the largest uranium producers, Kazatomprom and Cameco, revised their production forecasts downward, and this at a time when the world needs more energy. Data centres for quantum computing, crypto mining, artificial intelligence, and electromobility are driving the world's hunger for electricity. At the same time, some large tech companies are researching modular nuclear reactors, which could further boost the demand for uranium. While the uranium sector is performing well, 2024 has been a tough year for hydrogen and renewable energies. We look at one company from each sector and examine the prospects for 2025.

ReadCommented by Fabian Lorenz on December 27th, 2024 | 07:40 CET

MicroStrategy buys Bitcoin! Nel ASA halved! F3 Uranium ultra-high grade!

The Bitcoin super-bull has struck again just before Christmas. MicroStrategy purchased an additional 5,262 Bitcoins, with an average price exceeding USD 100,000. However, the potential for a setback is increasing. The story is different for F3 Uranium, where new drilling results are described as "'ultra-high grade"'! This seems to prove analysts right. They see the fair value of the uranium explorer's shares as almost 200% higher than its current level. In contrast, experts have halved their price target for Nel ASA shares. For them, the former hydrogen high-flyer is no longer a buy, as the industry faces serious problems.

ReadCommented by Fabian Lorenz on December 27th, 2024 | 07:30 CET

Renk electric tanks with Rheinmetall? Buy Nordex shares? XXIX Metal profits!

Is electric mobility coming to the battlefield soon? This is likely to be only a matter of time. For example, Renk is already working on hybrid models that are expected to offer clear advantages in the field and could also be used to electrify Rheinmetall tanks in the future. In addition, the new transmissions pave the way for autonomous driving tanks. Electric vehicles are driving the demand for copper just as much as artificial intelligence and renewable energies. XXIX Metal is benefiting from this. The Company emerged from a merger this year and has become a leading player. The copper content of the projects, which already exists, is convincing. And what is Nordex doing? The wind turbine manufacturer has reported a new order. The stock has remained relatively stable throughout 2024. Analysts see upside potential, but there are also risks.

ReadCommented by Fabian Lorenz on December 23rd, 2024 | 08:25 CET

SHARE PRICE RALLY 2025 or cash in? Siemens Energy, thyssenkrupp nucera, Myriad Uranium

Will the Siemens Energy share continue its price rally in 2025? This year, the Siemens Energy share was the top performer in the DAX. The problems in the wind sector were outshone by the boom in the gas and grid business. Now, the major shareholder wants to cash in! What do analysts say? The chances are good that the rally will continue for Myriad Uranium. The newsflow is positive, analysts see a lot of potential, and a capital increase was easily placed. Analysts are divided on the upside potential for thyssenkrupp nucera. Is a 100% rally possible for the German hydrogen hopeful?

Read