February 17th, 2025 | 07:35 CET

Shooting star Rheinmetall continues to rise - Greentech stocks like Nel, dynaCERT, and Plug Power are in the starting gate!

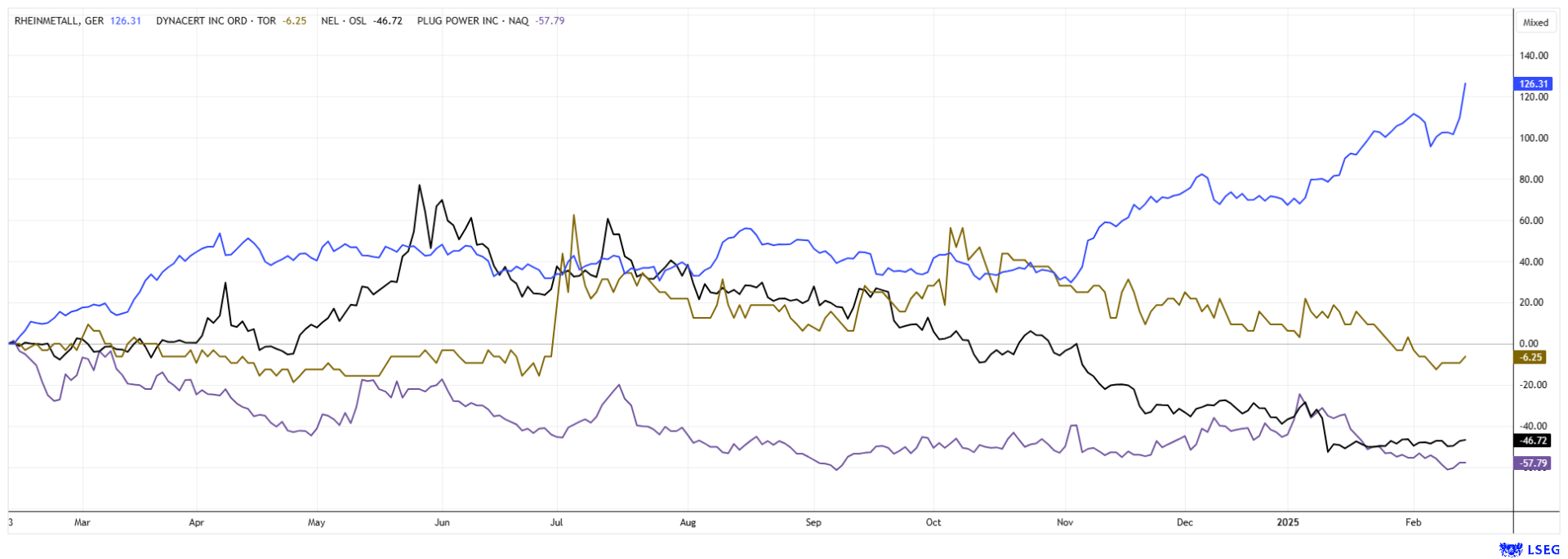

With the start of the security conference, they were back – the defense stocks. Rheinmetall thus exceeded the EUR 800 mark for the first time. The DAX 40 index is also doing brilliantly, currently at 22,600, well ahead of the NASDAQ. Now, rumors of peace talks are circulating, but the stock market is still not quite believing it. The losers of recent months were, not least, due to the re-election of Donald Trump, the greentech stocks. They were simply ignored in the face of the "climate change deniers" from the White House. But the charts no longer reached new lows. This is reason enough for us to refocus on these stocks. dynaCERT made its first leaps with the VERRA certification, but there is still much more potential. Selection remains key!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , NEL ASA NK-_20 | NO0010081235 , DYNACERT INC. | CA26780A1084 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – The next milestone has been reached

Rheinmetall is experiencing a phenomenal rally! It could become the DAX stock of the year that has just begun. At the end of December, the stock was still trading at EUR 600 after a pronounced two-year rally, but that already meant a sixfold increase compared to 2022. Since the military conflicts in Ukraine and Gaza have not ended, the stock has continued to rise rapidly almost daily. The price has not yet paused, and on Friday, a new all-time high of EUR 831 was marked. The latest fantasy is generated from a fabulous flood of orders for military equipment, particularly ammunition, from across the entire NATO alliance. The Munich Security Conference is also further fueling armaments speculation; it seems we are still a long way from peace.

Analytically, it is worth taking a look at Rheinmetall's shares because, with the new price level, the valuation parameters also have more future to price in. Experts on the LSEG platform expect sales to rise by almost 27% in 2025, which should continue over the next few years. After deducting a moderate increase in costs, earnings per share are expected to rise from EUR 12.32 in 2024 to EUR 21.33 in 2025 and EUR 53.29 in the distant 2027. Therefore, the current P/E ratio of 39 will gradually fall to around 16. Compared to US technology stocks, this is obviously a no-brainer! Thus, the rally should continue, and the EUR 1,000 mark will only be a technical stop for a moment of reflection. Adjust your stops accordingly; the EUR 670 mark currently makes sense from a chart perspective.

dynaCERT – A lot is happening behind the scenes

Those who, despite many wars and Trump, are thinking about the energy transition should, far from green dreams, look at concepts that work and are feasible for industry. Canada has abundant fossil fuels and a huge arsenal of various critical metals. It is no surprise that innovative companies are setting up there and offering investors solid investment opportunities. One standout is the Canadian technology company dynaCERT, which, after years of development, provides hydrogen-based add-on devices for diesel engines across all applications. With its in-house product series under the name HydraGEN™, combustion processes can be optimized to such an extent that, depending on the type of use, fuel savings of between 5 and 15% can be achieved. After a long lead time, the important certification by the internationally recognized VERRA organization was finally granted at the beginning of October. The HydraGEN™ technology is now an approved process and part of the VERRA organization's range of applications, meaning that users of the technology can generate CO2 certificates when using it. This makes it easier for logistics companies, large fleet operators, and mining companies to comply with existing ESG principles. Public transportation must also follow the "NetZero" requirements set by governments with carbon reductions.

dynaCERT has recently restructured its team. In addition to CEO Jim Payne, German national Bernd Krüper now leads the Company's operational matters. He is supported by long-time associate Doug Seneshen, who has already held important positions at MTU and Detroit Diesel. In January, the Company also appointed Seth Baruch to the advisory board, and at the same time, it engaged the consultant Carbonomics LLC to implement VERRA carbon credit projects.

Last week, the Canadians completed a private placement of CAD 5 million at CAD 0.15. This means that the coffers are well stocked to push ahead at full speed in terms of product sales. The stock is now classified as an ESG-relevant investment, with institutional investors coming into focus. There has been little news in recent weeks, but behind the scenes, work is obviously underway on a major product offensive. Investors can now take advantage of the recent price drop of around CAD 0.15 before the next big deals hit the ticker.

dynaCERT will be represented by President Bernd Krüper at the next International Investment Forum on February 25. free registration with this link.

Nel ASA and Plug Power – The lowest prices are behind us

After analyzing the international hydrogen sector multiple times, we take another look at it. Investors had already believed in a turnaround by the fall of 2024, but with the high-tech and defense rally, these same stocks were thrust back into the spotlight, with Nel ASA and Plug Power once again under pressure. However, the next few weeks will be exciting. Nel ASA will present its 2024 annual figures on February 26, followed by Plug Power the day after. Q4 losses per share of NOK 0.0469 for Nel ASA and USD 0.2305 for Plug Power are expected. If there are no further revisions in the order book, chances are good that some new orders have been secured in the first quarter, and the outlook will be revised upwards. On the other hand, poor numbers and outlooks could lead to another sell-off.

Chart-wise, a good support level can be seen in the case of Nel ASA at around NOK 2.20 or EUR 0.19. For Plug Power, this barrier is around USD 1.50. Quite surprisingly, the price lost around 50% again in January alone after Trump canceled the green programs of his predecessor Biden and withdrew from the Paris climate protection agreement. This means the US will likely experience a step backwards in the energy transition debate. However, it is not yet set in stone whether the country will actually go back to the oil and gas age completely. Plug Power was still able to secure a loan guarantee of USD 1.66 billion from the Biden administration for the construction of several hydrogen plants. These commitments were approved only two days before the Republican Trump took office. It should soon become clear whether the commitment will be honored.

Nel ASA and Plug Power are now valued at price-to-sales ratios of around 3 to 4. Of course, it will take years before a profit is finally made, so further capital measures are to be expected. Keep the stocks on your watch list so that you can react immediately to good news and rising momentum. There is currently no need for action.

The stock market currently loves high-tech, artificial intelligence, and armaments. The fact that this orientation can change again ad hoc could be seen in the prices after Trump's peace statements. Rheinmetall lost 10% within 2 hours. With the start of the security conference, the mood turned again. Caution: ESG investments like dynaCERT, Nel ASA, or Plug Power will eventually take off, and when they do, the stock prices will likely rise very quickly.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.