cleantech

Commented by André Will-Laudien on January 16th, 2026 | 07:10 CET

AI, defense, and the energy crisis - Things are looking up! E.ON, CHAR Technologies, DroneShield, BayWa

Things are continuing where they left off in 2025. The colorful US President Trump is now threatening Greenland and Iran at the same time, raw materials remain in demand, and the Western industrial world is worried about its supply chains. At the same time, the increasing use of artificial intelligence is keeping energy efficiency and supply issues at the forefront of public and corporate attention. Sophisticated business models allow investors to identify promising strategies that are resilient in a fragile and uncertain world. Below, we highlight a few notable examples.

ReadCommented by Nico Popp on January 16th, 2026 | 07:00 CET

Trash to gas: How A.H.T. Syngas, EQTEC, and 2G Energy are making companies self-sufficient

German industry is undergoing one of its toughest trials. The "trilemma" described by analysts - volatile energy prices, rising CO2 taxes, and the physical uncertainty of the power grids - has driven production costs to a level that poses a massive threat to competitiveness. While politicians debate hydrogen pipelines that will take years to complete, innovators are already creating a new reality: decentralized energy supply from waste materials. Three players are emerging in this booming sector, working together to solve the puzzle of energy self-sufficiency. While CHP market leader 2G Energy provides the hardware for a green future with its engines and British supplier EQTEC validates gasification technology worldwide, Germany's A.H.T. Syngas Technology closes the crucial gap for small and medium-sized enterprises. With compact plants, A.H.T. transforms industrial waste into the clean gas that keeps the engines running – regardless of Putin's war or price jumps on the Leipzig energy exchange EEX.

ReadCommented by André Will-Laudien on January 15th, 2026 | 07:30 CET

Acquisition Breakthrough: D-Wave, First Hydrogen, and Plug Power in focus

In an increasingly fast-paced world, investors are seeking timely information on stocks that have been highly volatile in recent weeks. Often, the key opportunities lie in turnaround situations, driven partly by operational news and partly by technical chart patterns. Today's selection of stocks reflects exactly this picture. D-Wave is impressing with a complementary acquisition deal, First Hydrogen with a successful capital raise, while Plug Power is unfortunately facing negative analyst commentary. What is happening on the price board?

ReadCommented by Nico Popp on January 15th, 2026 | 07:25 CET

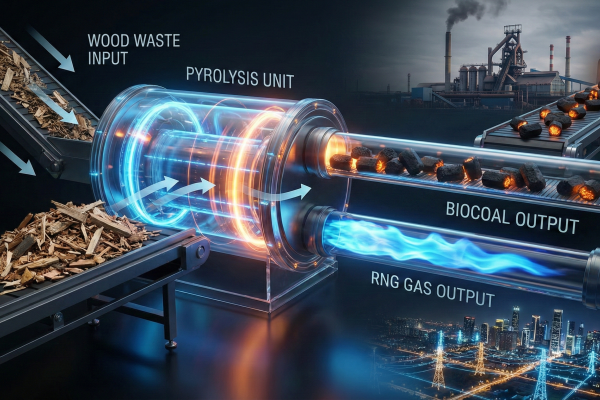

Double returns: How CHAR Technologies is closing the gap between ArcelorMittal's coal hunger and Montauk's gas profits

We are witnessing a historic turning point for global heavy industry. We are currently seeing not only a technological evolution, but also a fundamental revaluation of industrial assets, driven by two parallel megatrends: the decarbonization of primary steel production and the monetary revaluation of waste streams for energy security. While regulatory constraints are forcing steel giants such as ArcelorMittal to reinvent their blast furnaces, and specialists such as Montauk Renewables are demonstrating the enormous valuations possible in the renewable natural gas (RNG) market, CHAR Technologies is positioning itself at the intersection of these two worlds. With its proprietary high-temperature pyrolysis technology, the Canadian company provides the answer to both questions at once: it produces biochar for the steel industry and RNG for the energy grid – from a single waste source.

ReadCommented by Carsten Mainitz on January 13th, 2026 | 07:20 CET

Enormous growth ahead due to hunger for electricity: CHAR Technologies, Siemens Energy, and Nel – Who is in the lead?

Global electricity demand is exploding. What was once considered a stable, moderately growing market has been transformed by two powerful megatrends. AI applications, cloud infrastructures, and energy-intensive data centers are causing electricity demand to rise sharply. At the same time, decarbonization is putting increasing pressure on the economy and society. Many countries have committed to climate neutrality by 2050. This raises a key question for investors: Who can satisfy the growing demand for electricity in a reliable, affordable, and climate-neutral way?

ReadCommented by Armin Schulz on January 7th, 2026 | 07:30 CET

AI's energy hunger and decarbonization: How Siemens Energy, CHAR Technologies, and Plug Power are positioning themselves to profit

The global energy transition is caught in a paradoxical race: While electricity demand is exploding due to AI and electrification, decarbonization must succeed. This collision is creating a billion-dollar market for companies that solve fundamental bottlenecks, from grid stability to green industrial energy to the hydrogen economy. Three pioneers exemplify this systemic change. Their strategies could not be more different, as current developments at Siemens Energy, CHAR Technologies, and Plug Power show.

ReadCommented by André Will-Laudien on January 5th, 2026 | 07:30 CET

Double-digit start to 2026 for Plug Power, Nel ASA, CHAR Technologies, and thyssenkrupp nucera

Things are continuing as they ended in 2025: high volatility, challenging circumstances, and political upheaval. Now the guns are speaking again, because there is no peace in Ukraine after all, putting defense stocks back at the top of the shopping list. However, after years of decline, investors are now venturing back into the alternative energy sector. Since the hydrogen boom in 2021, the industry's protagonists have lost up to 90% of their share price value. So why not venture back into an area where money has not flowed for a long time? Biomass specialist CHAR Technologies is a newcomer on the scene. The rally started here in 2025 and is likely to continue. thyssenkrupp nucera is also worth a look. After being spun off from the Duisburg-based group, the lights appear to be green!

ReadCommented by Fabian Lorenz on December 30th, 2025 | 07:00 CET

HYDROGEN STOCK with 10x POTENTIAL! Nel ASA, thyssenkrupp, and dynaCERT are starting the new year in different ways

Hydrogen stocks have had a challenging year. However, analysts see the potential for 10x growth in the new year, specifically, for the cleantech company dynaCERT. Operational tailwinds are coming from market entry in Mexico and sales successes in Europe. Successes in Asia are expected to follow in 2026. The decisive factor for 2026 will be whether dynaCERT makes progress in terms of order volume, capacity utilization, and recurring revenues. With its retrofit solution, dynaCERT is setting itself apart from large plant manufacturers such as thyssenkrupp nucera and Nel ASA. Analysts praise the former for its efficient structures and full coffers. The other is aggressive despite its share price being at an all-time low.

ReadCommented by Fabian Lorenz on December 29th, 2025 | 07:10 CET

Three potential takeover candidates for 2026: Puma, RENK, and CHAR Technologies

Which companies could become acquisition targets in 2026, and where might shareholders benefit from strategic interest? Three names stand out. From the booming energy sector, CHAR Technologies is attracting attention. The Canadian company has only recently been listed on the Frankfurt Stock Exchange, but has already completed its development phase and is targeting strong revenue growth. CHAR benefits from strong partners such as ArcelorMittal, which could easily manage an acquisition. RENK is also a candidate: anchor shareholder KNDS could make good strategic use of an acquisition in the context of its IPO story, and the former RENK CFO is already on board. Things are also likely to remain interesting at Puma. According to analysts, a takeover premium of around 30% could be on the cards.

ReadCommented by Armin Schulz on December 23rd, 2025 | 07:05 CET

The strategic positioning of Plug Power, dynaCERT, and Nel ASA in the USD 110 billion market

2025 marks the long-awaited turning point for the hydrogen economy: with global investments of over USD 110 billion, annual volumes recently exploding by 70%, and groundbreaking infrastructure projects such as Germany's 400 km core network, the vision is becoming a commercial reality. Technological milestones, such as Bosch's production-ready fuel cell truck system, and ambitious EU targets underscore the enormous potential for decarbonization. In this dynamic environment, it is innovative companies that are translating these macroeconomic dynamics into concrete growth opportunities. Against this backdrop, it is worth taking a closer look at the pioneers Plug Power, dynaCERT, and Nel ASA.

Read