Technology

Commented by Armin Schulz on April 2nd, 2024 | 06:45 CEST

MorphoSys, Defence Therapeutics, Novo Nordisk - Biotech deals: Corporations on a shopping spree!

In 2023, the volume of business in the pharmaceutical industry, with mergers and acquisitions, reached USD 152 billion despite high interest rates. Experts predict that this momentum could continue as large pharmaceutical companies are facing a wave of patent expiries for their key products that will roll in between 2025 and 2030. Companies are therefore on the lookout for new active ingredients, often by acquiring or licensing developments from smaller biotech companies to compensate for potential revenue shortfalls. There have also been major takeovers in recent months. We take a look at takeover targets and buyers.

ReadCommented by Fabian Lorenz on March 28th, 2024 | 08:55 CET

Shares on a high: Up to 300% with Canopy Growth, Super Micro Computer, Aspermont

Is the German cannabis market on the verge of a tenfold increase? The head of Canopy Growth thinks so. The Company wants to profit from the boom. Canopy shares have already benefited and more than doubled. What are the Company's plans here in Germany? Super Micro Computer shares have already multiplied, but analysts remain bullish. Growth is expected to remain high. Aspermont offers a hot turnaround story. The B2B media company for the raw materials industry has freed itself from legacy burdens and now aims to grow more strongly again. Analysts see a high free cash flow and 300% share price potential!

ReadCommented by André Will-Laudien on March 26th, 2024 | 07:30 CET

The race begins! Beating DAX records with BYD, Altech Advanced Materials, Hensoldt and Rheinmetall

The DAX 40 index is setting new records almost daily, following the bullish lead from the US. Artificial intelligence (AI), armaments, crypto and high-tech are the top themes on the stock markets. Nobody wants to know anything more about hydrogen, and e-mobility has also seen better days. It can be profitable to examine the sought-after stocks with a fundamental magnifying glass. Often, hints about where the journey is heading can be found there. We focus on some of these stocks.

ReadCommented by Juliane Zielonka on March 15th, 2024 | 06:00 CET

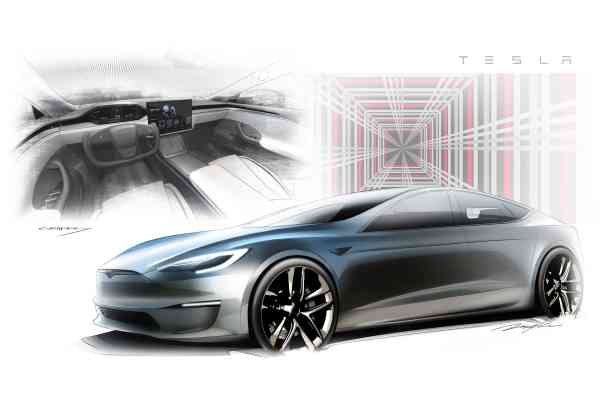

Altech Advanced Materials, Tesla, E.ON - Accelerators of the Future in Europe

Germany's automotive industry is in a state of upheaval. With an annual turnover of EUR 411 billion, solutions are urgently needed to drive electrification forward. E.ON, as one of the largest utilities, is investing billions in European infrastructure for this purpose. The Company is also increasing its dividend. Heidelberg-based Altech Advanced Materials is launching stationary battery storage systems on the market at the beginning of April. It has also published the results of the current feasibility study for its second pillar: a special coating for silicon battery anodes that ensures greater power and longevity. These are exactly the sticking points that customers have been complaining about so far. Tesla also relies on silicon batteries in its models. This week, Elon Musk visited the German plant in Grünheide, and has some good news in store...

ReadCommented by Fabian Lorenz on March 7th, 2024 | 06:45 CET

Buy recommendations for TUI and Saturn Oil + Gas share - Aixtron share price targets tumble

TUI was among the daily winners yesterday. The tourism group's share price rose by more than 5%. The reason was positive analyst commentary. The price target was raised, providing significant upside potential from the current level. Experts also recommend buying Saturn Oil & Gas. After a successful capital increase, the target price for the oil producer's shares was raised. Analysts see over 100% upside potential and scope for high dividends. At Aixtron, analysts' price targets are tumbling. There is even a sell recommendation. However, not all analysts are pessimistic; some see an opportunity in the price slide of the past few days.

ReadCommented by Juliane Zielonka on March 7th, 2024 | 06:30 CET

Sustainable investments in focus: Occidental Petroleum, Carbon Done Right, Plug Power - Which stock offers the greatest advantage for a net zero economy?

True sustainability is a delicate balancing act for investors seeking high returns. Companies worldwide still need fossil fuels to keep their businesses running and growing. The US oil and gas producer Occidental Petroleum is no exception. The Company, in which Warren Buffett also invests, is doing a lot to reduce its carbon footprint. On the other hand, Carbon Done Right is sustainable through and through. Its business model involves the reforestation and greening of forests and rainforests to trade real CO2 certificates for companies such as Amazon and Microsoft. Thanks to innovative AI, Carbon Done Right is finally bringing the desired transparency to the carbon market by monitoring tree growth via satellite. Meanwhile, Plug Power relies on in-house hardware and expects a restructuring of tech companies to favour its CO2-friendly solutions. Who truly has the edge when it comes to sustainable measures and returns?

ReadCommented by Stefan Feulner on March 4th, 2024 | 07:30 CET

C3.ai, Altech Advanced Materials, BYD - Ready for the rebound

The major stock market barometers, the DAX and Dow Jones, continue to surge and rush to new highs almost daily. Currently, one of the hottest sectors is the semiconductor industry, which is reporting record figures due to the emergence of artificial intelligence. In contrast, another future topic, electromobility, is currently in correction mode. Market leaders such as Tesla and BYD have seen their stock market value fall dramatically. Currently, it appears that these stocks have found a bottom from which the next upward movement could begin.

ReadCommented by Armin Schulz on February 28th, 2024 | 07:15 CET

Varta Thriller! Altech Advanced Materials, BYD work on the electrification of the future

While production at Varta is at a standstill following a cyber attack, the wave of electrification is rolling inexorably through our society, changing how we generate, store and utilize energy. Innovations are needed here, especially in energy storage from renewable sources and the further development of batteries for use in electric vehicles. Advances in electric vehicles and the increasing use of electrical energy are paving the way towards the future. Intensive research is currently being carried out on technologies that will increase both the effectiveness and capacity of battery systems. Altech Advanced Materials and BYD stand out here.

ReadCommented by Stefan Feulner on February 26th, 2024 | 07:15 CET

Infineon, Saturn Oil + Gas, Block - Things are heating up here

Last week, all eyes were on chip giant Nvidia, which once again surprised Wall Street with a positive performance and a net profit increase of almost 770%. In Germany, Allianz also made headlines with a record profit and a significant dividend increase. In contrast, a report that could significantly impact the future of green technologies, with positive signals for the oil and gas industry, went somewhat unnoticed.

ReadCommented by Fabian Lorenz on February 20th, 2024 | 08:00 CET

Sell Varta shares? Nel and Altech Advanced Materials with new opportunities

The bad news for Varta seems to be unending. First, a cyber attack paralyzed the Company. Now, analysts are lowering their thumbs and recommending selling the share. Estimates for the years 2024 and 2025 have been lowered. As a result, Altech Advanced is increasingly becoming the German battery hopeful. Even though Altech's share price has declined significantly in recent months, the Company is on track operationally. The current year will be exciting. Things also remain exciting for hydrogen shares. While Nel and Plug Power & Co. still need to prove the future viability of their business models, they are receiving billions in support.

Read