Technology

Commented by André Will-Laudien on October 29th, 2025 | 07:45 CET

Caution! Moment of truth for TeamViewer, TKMS, thyssenkrupp, Beyond Meat, and Kobo Resources

The stock market has been very volatile in October. Many market participants had expected a "crash" after the initial downward swings. The definition of such an abrupt downward movement is a minimum decline of at least 25% within just a few trading days. This already happened back in April, when Donald Trump projected his feverish dreams of tariff policy onto the board. Little remains of these announcements, which is why stocks quickly rebounded. Yesterday, Tuesday, the NASDAQ 100 reached a new all-time high of over 26,000 points on massive trading volumes. Fund managers and desperate private investors are pushing more and more money into stocks that have long since ceased to be cheap. What to do now? Good advice remains hard to come by!

ReadCommented by Armin Schulz on October 29th, 2025 | 07:20 CET

Get in now: How DroneShield, NEO Battery Materials, and Hensoldt are benefiting from exploding defense budgets

The drone revolution is fundamentally changing warfare and driving defense spending to unprecedented heights. This technological turning point is opening up unique investment opportunities. Analysts are already talking about a supercycle in this area. Those who invest now in the key technologies of tomorrow can benefit from this structural megatrend. Three specialized companies that embody this opportunity are in the spotlight: DroneShield, NEO Battery Materials, and Hensoldt.

ReadCommented by Carsten Mainitz on October 28th, 2025 | 07:25 CET

Do not miss out! Almonty Industries – Price correction as an opportunity, Gerresheimer and the Damocles Sword of BaFin, TKMS underestimated!

As is well known, there is, of course, no universal rule for stock market success. Successful investors have their own strategies, which often sound very simple at their core. Commodities legend Jim Rogers summed it up with a straightforward formula: investors should simply be aware of supply and demand. Currently, this means that stocks like Almonty Industries rank among the favorites due to the prevailing market conditions. The same applies to defense stocks. But opportunities also exist in stock picking – here, it is worth taking a closer look at the beaten-down Gerresheimer.

ReadCommented by Nico Popp on October 28th, 2025 | 07:05 CET

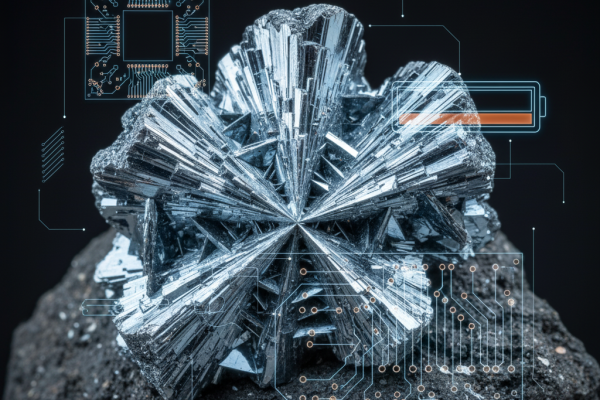

Antimony remains scarce and in demand: EnerSys, Aurubis, Antimony Resources

Antimony is a semi-metal with a silvery sheen, primarily used in lead-acid batteries, flame retardants, electronics, and military technology. In recent months, China has severely restricted its antimony exports. According to estimates, China produced around 60% of the world's antimony in 2024, followed by Tajikistan. China's dominance is heightening supply fears: as Reuters reported in June this year, US battery manufacturers are already referring to a "national emergency." This is reason enough to take a closer look at the supply chain in the West and examine the role of Antimony Resources, which recently attracted attention in the stock market.

ReadCommented by André Will-Laudien on October 27th, 2025 | 07:00 CET

Super returns, clear conscience! Nel ASA and JinkoSolar turn around, nucera surprises, and RE Royalties celebrates!

From the climate conference to real implementation! The European Union and other nations have committed themselves to ambitious sustainability programs through so-called "green deals." To support these efforts, the financial instrument known as the "green bond" has become firmly established in the market. Banks, in particular, that are keen to enhance their ESG credentials, are increasingly active in this segment. As a result, the green bond market has grown rapidly, driven by global climate targets, such as those agreed upon in the Paris Agreement. ESG investments are benefiting from political incentives like the US Inflation Reduction Act and are being dynamically sought after by insurers. Between 2015 and 2023, issuances grew by an average of 40% annually, with growth slowing somewhat since 2023. For the full year 2025, total issuance volume is expected to reach between EUR 570 and 630 billion. What, when, and where funding is provided is defined by regulatory authorities. But private organizations such as RE Royalties are also active, because green returns are not only rewarding, they also help society achieve its ambitious climate transition goals. Here are a few investment ideas.

ReadCommented by Nico Popp on October 23rd, 2025 | 07:20 CEST

Next DRONE BOOST ahead: NEO Battery Materials, Kratos Defense, AeroVironment

Drones have become indispensable in modern warfare. That much is now clear. NATO and EU countries are therefore pooling considerable resources for unmanned systems: this year, NATO allies decided to increase defense spending to a total of 5% of economic output. Germany alone announced that it would invest EUR 10 billion in drones of all kinds in the coming years. These massive investments underscore that there is no way around drones. To ensure the supply of high-performance drones, battery technology is increasingly coming into focus. China dominates this field and has recently restricted military exports. The up-and-coming Canadian company NEO Battery Materials is closing the gap.

ReadCommented by André Will-Laudien on October 23rd, 2025 | 07:15 CEST

Defense and metals in correction! Enter now with a 100% chance at Almonty, thyssenkrupp, TKMS, Hensoldt, and Mutares

That happened fast. After a temporary surge in defense and metal stocks, investors are taking profits. This is understandable, as some stocks, such as Almonty Industries, had risen by over 1,000% in just 10 months. Now it is time to let the market settle and, with renewed confidence, return to the most sought-after sectors of 2025. Of course, it is recommended to diversify across many regions and sectors, such as AI, high-tech, or precious metals, to keep portfolio volatility low. Here are a few examples that have gained relevance in recent days.

ReadCommented by Armin Schulz on October 23rd, 2025 | 07:05 CEST

Volatus Aerospace: From technology pioneer to key partner for defense and industry

The drone industry is undergoing radical change. What was considered niche technology not so long ago has rapidly developed into an indispensable component for security and infrastructure. Volatus Aerospace is now setting the course amid this transformation. The Company is serious about making the transition from innovative technology supplier to established system partner alongside its customers. The Canadian company is capitalizing on current market developments with remarkable precision and systematically expanding its position. For investors, this presents the image of a company that is setting the right course at precisely the right time.

ReadCommented by Armin Schulz on October 22nd, 2025 | 07:05 CEST

Bitcoin soars: How Strategy, Nakiki, and BlackRock are benefiting from the new MiCA regulation on tokenization

Bitcoin is reaching new record highs. The hashrate is exploding, and analysts are predicting prices of USD 250,000. At the same time, the EU is establishing clear rules for tokenization through MiCA. This unique combination of technological strength and regulatory clarity is unleashing unprecedented institutional interest. Three companies are strategically positioned to capitalize on this boom: Strategy, Nakiki, and BlackRock. Here, we take a closer look at how these companies have positioned themselves.

ReadCommented by Nico Popp on October 22nd, 2025 | 07:00 CEST

Important piece of the puzzle in the fight against cancer: Vidac Pharma, Roche, Merck & Co.

The pharmaceutical market is enormous - and continues to grow. Market research institute Evaluate forecasts an increase to around USD 1.7 trillion by 2030, representing an annual growth rate of 7.7%. Oncology promises the highest sales, at around USD 300 billion. However, there is no single approach. Instead, new modalities and technologies such as antibody-drug conjugates (ADCs), cell and gene therapies, and radiopharmaceuticals are transforming the industry and gaining significant traction. One thing is clear: progress in the biotech sector is increasingly achieved through the combination of active ingredients and technologies. What role does the biotech company Vidac Pharma play in this?

Read