Mining

Commented by Carsten Mainitz on September 17th, 2025 | 07:20 CEST

Globex Mining, Deutz, Novo Nordisk – Prices are rising!

On the stock market, there is often a difference between price and value. Companies with strong assets and holdings, or those with business models that benefit from long-term trends, tend to deliver attractive returns for investors in the long run. All the better if such companies can be acquired at a favorable price - one that lies below the fair value of their shares.

ReadCommented by André Will-Laudien on September 17th, 2025 | 07:15 CEST

Gold explodes to USD 3,700 – What is next? Time to bet on Barrick Mining, Newmont, Dryden Gold and BASF

The gold price is currently being driven primarily by expectations of falling US interest rates, a weaker US dollar, high geopolitical uncertainty, and strong purchases by central banks. The latter added around 1,045 tons of gold to their reserves in 2024, one of the highest levels in recent years. Major US investment banks have consistently raised their price targets: Goldman Sachs expects around USD 3,700 per ounce by the end of 2025, JPMorgan sees an average of about USD 3,675 in Q4, and UBS even forecasts up to USD 3,800. In very optimistic scenarios, prices of over USD 4,000 are already being discussed in industry. How are gold giants Barrick and Newmont performing in this environment? In the short term, they have been significantly outperformed by Dryden Gold, which has recently doubled in value. Investors should now drastically increase their exposure to precious metals, as they have been overinvested in AI, high tech, and defense for months. Here are a few ideas.

ReadCommented by Armin Schulz on September 17th, 2025 | 07:10 CEST

Rheinmetall, Almonty Industries, RENK: The next wave of the defense stock mega boom is rolling in

Geopolitical tensions and a paradigm shift toward increased national security are fueling a sustained boom in the defense industry. Rising budgets worldwide are ensuring full order books and unprecedented growth prospects for specialized companies. This development is making defense stocks one of the most dynamic, albeit controversial, investment themes. Three listed companies that are perfectly positioned to capitalize on this environment are Rheinmetall, Almonty Industries, and the RENK Group.

ReadCommented by Nico Popp on September 16th, 2025 | 07:15 CEST

Defense industry expands – New growth drivers: Hensoldt, Almonty and Rheinmetall

An industry once largely overlooked by the public is now dominating the headlines. On Monday, it was announced that Rheinmetall will acquire the Marine Division of the Bremen-based Lürssen Group. This includes the Blohm + Voss shipyards, the Norderwerft shipyard in Hamburg, the Peene shipyard, and the Neue Jadewerft shipyard in Wilhelmshaven. This move underscores how the defense industry is venturing into new domains. Meanwhile, tensions between Russia and NATO continue to escalate. The drones that flew over Poland last week are considered by experts to be a serious provocation. In this context, we take a closer look at three high-flyers in the defense industry and highlight where investors may find the greatest opportunities.

ReadCommented by Fabian Lorenz on September 16th, 2025 | 07:10 CEST

OPPORTUNITY for 100% returns and a short squeeze! D-Wave Quantum, Zalando and Rio Tinto partner Aspermont

While traditional AI stocks like Nvidia, Palantir and Oracle are becoming increasingly overheated, investors are now turning their attention to second- and third-tier companies. These are companies that are poised to benefit from the adoption of AI technologies. One example is the hot stock Aspermont. The Australian company holds a massive trove of data on the global resources industry. The latest bombshell: a partnership with mining giant Rio Tinto, which is paying for access to and processing of Aspermont's valuable data. The stock has not yet reacted. At Zalando, analysts see upside potential of up to 100%. The e-commerce group could also benefit from AI advancements. And then, of course, there is quantum computing, seen as a potential challenger to AI. Could investor favorite D-Wave be on the verge of a short squeeze?

ReadCommented by Fabian Lorenz on September 15th, 2025 | 07:20 CEST

Gold mining stocks in takeover fever! Barrick Mining and Newmont are selling! B2Gold neighbor Desert Gold in the crosshairs?

Takeover fever is sweeping through the gold sector. The typical cycle of the industry appears to be repeating itself once again: with the rising price of gold, which remains solidly above USD 3,600, the appetite for takeovers is also growing. Gold producers are earning more, and banks and private equity firms are opening their coffers for mergers and acquisitions. For large and small mining companies alike, the current market phase offers an opportunity to expand their portfolios, optimize projects, or reposition themselves through strategic sales and purchases. Barrick and Newmont are currently raising billions through asset sales, boosting their war chests. In contrast, Desert Gold - a neighbor of B2Gold - could soon see a partner come on board or even become an acquisition target. Analysts see significant upside potential for the share.

ReadCommented by Stefan Feulner on September 15th, 2025 | 07:10 CEST

Equinox Gold, AJN Resources, K92 Mining – Gold boom with clear signals

The price of gold is currently only moving in one direction: Steeply upwards! After jumping above the previous record high of USD 3,500 per ounce, the USD 4,000 mark is now within reach. Central banks are buying massively, and investors are seeking security amid geopolitical crises, thereby driving up prices. Gold mining stocks are now benefiting enormously from this development. We present three stocks that are particularly in focus and are being carried by the current momentum.

ReadCommented by André Will-Laudien on September 15th, 2025 | 07:00 CEST

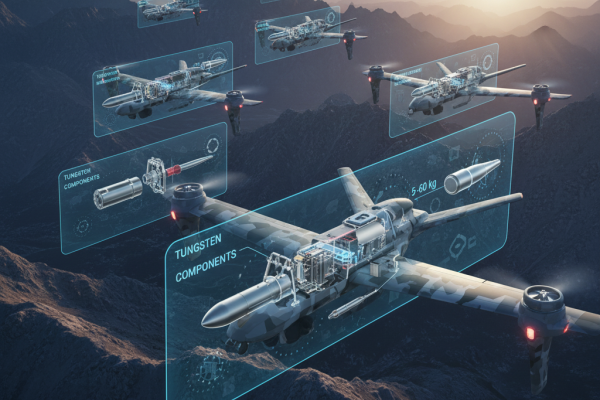

Security is key – Acquisitions continue to drive growth! 100% bull market possible with Almonty, Steyr, Mutares and Deutz

The stock markets are looking for direction! While the Russia-Ukraine conflict enters the next round with the drone incident in Poland, prices for strategic metals continue to rise. Western industries are under pressure from NATO rearmament and are looking for secure jurisdictions to be able to process highly sensitive orders. Supplies of critical raw materials from China have fallen by 90% since March 2025, with only long-term contracts still being fulfilled. But what about the current boom in orders? The price of the critical metal tungsten has doubled within 12 months. The primary beneficiary is Almonty Industries, as it already has active mines in Europe and is about to launch a mega-project in South Korea. Highly exciting, but also a challenge for investors. What happens next?

ReadCommented by Armin Schulz on September 12th, 2025 | 07:00 CEST

NATO attack!? How to IMMEDIATELY arm your portfolio with RENK Group, Antimony Resources and Deutz

The presence of Russian drones on Polish territory - a NATO member - marks a dangerous escalation in the security situation. With a swift ceasefire in Ukraine increasingly seeming a distant prospect, investors should refocus their attention on defense stocks. This new escalation is directly fueling demand for modern defense technology and opening up tangible opportunities for investors in specialized suppliers. Three companies that stand to benefit directly from this trend are RENK Group, Antimony Resources and Deutz.

ReadCommented by Fabian Lorenz on September 11th, 2025 | 07:20 CEST

Almonty set for TAKEOVER? RENK after 260% rally! D-Wave Quantum faces exciting weeks ahead!

Almonty is making headlines with takeover plans in the US – tungsten production on American soil could help solve one of the country's strategic problems. It is difficult to understand why the share price did not react more strongly to the Bloomberg interview. Analysts already see 50% upside potential for Almonty shares and a 2027 P/E ratio of 5. RENK has also impressed with a 260% rally and strong half-year figures. With a new, state-of-the-art transmission for light tracked vehicles, the MDAX company is positioning itself for autonomous military technology. The coming weeks are likely to be exciting for D-Wave. The quantum high-flyer is participating in numerous international conferences. These provide a stage for technological advances and new customer contacts and could catapult the stock out of its sideways movement.

Read