Investments

Commented by André Will-Laudien on February 12th, 2026 | 08:00 CET

Critical raw materials are becoming scarce! Silver makes a new attempt to reach USD 100 - Silver North, Nordex, and Siemens Energy in focus

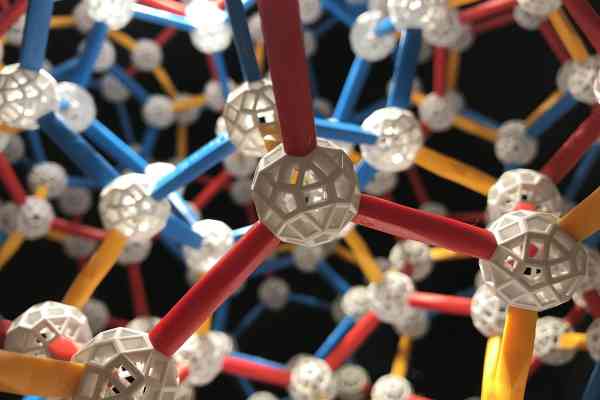

January brought the situation surrounding critical metals to a head. Copper, tungsten, and palladium reached new highs, and precious metals were also in high demand. Experts suspect significant distortions in derivatives, which led to astonishing increases in the value of silver and gold. Although silver is systematically classified as a precious metal, it has blossomed into a sought-after industrial metal over the past 10 years. Its extremely good electrical properties, thermal conductivity, and corrosion resistance make it irreplaceable in high-tech and defense applications. Silver has long been used in the field of alternative energies, with demand exceeding supply by a factor of 1.5. And then there are the speculators, who also want a piece of the pie. This means that all eyes are clearly focused on the sky. What portfolio changes make sense?

ReadCommented by Fabian Lorenz on February 12th, 2026 | 07:50 CET

Is the dispute between Barrick Mining and Newmont escalating? Gold gem DRC Gold finally gains momentum!

In recent weeks, the safe haven gold has not been for the faint-hearted. But after the correction, the price of the precious metal has worked its way back above the USD 5,000 mark surprisingly quickly. More than just a war of nerves appears to be unfolding between Barrick Mining and Newmont. Barrick plans to list its North American assets on the stock market. This does not sit well with industry leader Newmont. Could it even lead to a hostile takeover? DRC Gold is also fundamentally a takeover candidate. However, the company is currently focused on expanding its own activities. The stock has finally gained momentum, and many factors point to further upside potential for the gold explorer.

ReadCommented by Carsten Mainitz on February 9th, 2026 | 07:20 CET

New analyst comments: Almonty Industries at all-time high, volatility at Rheinmetall and RENK – What is next?

The latest analyst ratings assess the growth prospects of Almonty Industries and several defense companies. The tungsten producer's stock stands out as particularly positive. The high price level of this critical raw material, combined with rising production volumes, is acting as an enormous profit lever with net margins of around 60% from 2028 onwards. The bottom line is that the experts' verdict on defense stocks is positive. The big picture underpinning this outlook is the tense geopolitical situation and massive increases in defense budgets.

ReadCommented by Nico Popp on February 4th, 2026 | 07:30 CET

History repeats itself: Why Antimony Resources now offers the Lynas Rare Earths opportunity of 2010 and could benefit like Cameco

There are moments when geopolitical ruptures disrupt entire industries. Anyone who remembers 2010 knows what we are talking about: at that time, China effectively shut down exports of rare earths amid a dispute over the Senkaku Islands. Western industry was in shock, prices exploded, and a small, hitherto little-noticed Australian explorer named Lynas Rare Earths became the Western world's only hope overnight. Today, 15 years later, we are experiencing déjà vu: this time, however, the focus is not on neodymium, but on antimony – the forgotten metal without which the defense industry would grind to a halt. Once again, China dominates the market, once again export restrictions are being used as a political weapon, and once again the West is desperately searching for a safe alternative. This is where Antimony Resources comes into play. The company is now at exactly the same point where Lynas was before its legendary rise: it controls an antimony project in a secure jurisdiction that can break dependence on the East.

ReadCommented by Nico Popp on February 4th, 2026 | 07:05 CET

Solution to a billion-dollar problem: MustGrow Biologics validates business model – Revolutionary news also for Bayer and Corteva Agriscience

Canola is to Canada what oil is to Saudi Arabia: an economic driver of enormous proportions. With an estimated production value of around CAD 14 billion in 2025, the yellow-flowering crop is the "green gold" of the prairie. Yet this billion-dollar market is in danger: clubroot, an aggressive soil-borne disease, threatens crops and is already causing annual losses exceeding CAD 500 million. Previous solutions have reached their biological limits, but now the Canadian AgriTech company MustGrow Biologics is reporting a decisive success. As the company announced on Tuesday, its proprietary TerraMG™ technology has not only suppressed the disease in large-scale field trials, but also significantly increased yields. For agricultural giants like Bayer and Corteva, this could be the decisive lever to protect their high-performance seed varieties over the long term.

ReadCommented by André Will-Laudien on February 3rd, 2026 | 07:25 CET

SILVER CRASH - From USD 122 to USD 72! Time to sharpen your knives with TKMS, CSG, Silver Viper, and thyssenkrupp

The explosive rise in the price of silver, which rose almost in a straight line from around USD 35 to USD 122 by the end of last week, is now taking its speculative toll. The precious metal has soared by more than 300% within 14 months, accompanied by widespread rumors of huge short positions and extreme problems for the futures exchanges in terms of material supply. The fact remains that silver has been used for several years across various high-tech industries, from wind power and e-mobility to state-of-the-art defense technology. Manufacturers are also said to have been spotted on the market making large cover purchases due to impending physical shortages. Industry sources report a possible deficit of over 1 billion ounces in the March settlement – equivalent to around 125% of total annual production. In addition to the exciting silver explorer Silver Viper, we also analyze thyssenkrupp, its subsidiary TKMS, and the newcomer to the stock market, CSG. It is worth reading on.

ReadCommented by Nico Popp on February 3rd, 2026 | 07:20 CET

The gold correction is irrelevant here: Why Desert Gold is the missing piece of the puzzle for B2Gold and Allied Gold

The gold market is in a phase that analysts now refer to as a supercycle. With prices breaking historical records, smart capital is turning its attention to the world's most productive regions – even after the recent correction in precious metals. West Africa, and specifically the Senegal-Mali Shear Zone (SMSZ), is considered the geological heartland. This is where some of the largest and richest mines on the planet are located. But the business follows an inexorable logic: even the largest mines are emptying, and the processing plants need to be kept busy. This is true in the south of the zone for Canadian giant B2Gold with its world-class Fekola mine and in the north for Allied Gold, which is revitalizing the historic Sadiola asset. Desert Gold is considered a potential supporter of both companies. The company controls the largest non-producing land parcel in the entire region, located precisely between the two giants. This makes Desert Gold extremely interesting for investors.

ReadCommented by Fabian Lorenz on February 3rd, 2026 | 07:15 CET

US government pours billions into USA Rare Earth - Could Antimony Resources be next?

Almonty Industries, MP Materials, and other commodity stocks have already demonstrated the new reality: in today's geopolitical environment, commodities are becoming critical, and stock prices can multiply dramatically. Antimony Resources offers investors an opportunity to participate at a comparatively early stage. History shows that when mining companies transition from explorer to producer, valuations can move into the billions. Despite a strong rally, Antimony Resources is still valued at "only" around EUR 50 million. Due to pressure from the US government and a mining-friendly jurisdiction, Antimony Resources could advance toward production significantly faster than is typical in the sector. A direct involvement by the US government would not be surprising. After investments in MP Materials, Vulcan Elements, and Trilogy Metals, the Trump administration recently pumped billions into USA Rare Earth. Could Antimony Resources be next?

ReadCommented by Armin Schulz on February 2nd, 2026 | 07:10 CET

Taking advantage of the crash: How Newmont, Silver Viper Minerals, and First Majestic Silver are poised for the silver boom

The sharp sell-off in precious metals on January 30 caught many investors off guard. Silver fell by as much as 34%, while gold declined by a more moderate 12%. This abrupt correction has unsettled markets, yet it may also be obscuring a significant opportunity. A structural supply deficit in silver is meeting with exploding demand from industry and technology. This imbalance forms the basis for a potentially powerful next phase in the silver cycle. Three companies appear particularly well-positioned to benefit from this dynamic: Newmont, Silver Viper Minerals, and First Majestic Silver. We take a closer look at their strategies.

ReadCommented by Carsten Mainitz on January 28th, 2026 | 07:30 CET

Silver Viper Minerals – The perfect combination of a silver boom, exploration potential, and takeover speculation

All eyes are on silver. Recently, the price per troy ounce almost reached the USD 120 mark. Even though short-term speculation is on the rise, one thing is certain: the silver market is experiencing a sustained and structural supply deficit. All in all, these are favorable conditions for existing and prospective producers. Mexico is the global leader in silver production and is dynamically developing new deposits. Investors can benefit from this situation with Silver Viper Minerals shares. Under the leadership of an experienced management team with a strong track record, the Company is developing large, high-quality silver properties in the Central American country. Further progress is also fueling takeover speculation.

Read