February 3rd, 2026 | 07:25 CET

SILVER CRASH - From USD 122 to USD 72! Time to sharpen your knives with TKMS, CSG, Silver Viper, and thyssenkrupp

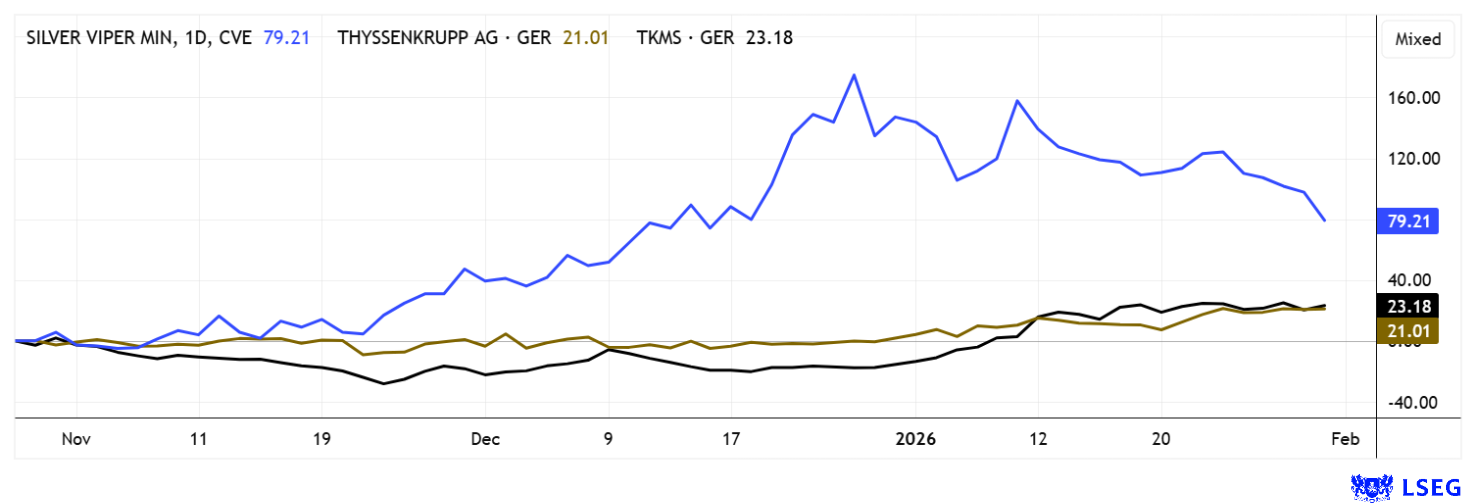

The explosive rise in the price of silver, which rose almost in a straight line from around USD 35 to USD 122 by the end of last week, is now taking its speculative toll. The precious metal has soared by more than 300% within 14 months, accompanied by widespread rumors of huge short positions and extreme problems for the futures exchanges in terms of material supply. The fact remains that silver has been used for several years across various high-tech industries, from wind power and e-mobility to state-of-the-art defense technology. Manufacturers are also said to have been spotted on the market making large cover purchases due to impending physical shortages. Industry sources report a possible deficit of over 1 billion ounces in the March settlement – equivalent to around 125% of total annual production. In addition to the exciting silver explorer Silver Viper, we also analyze thyssenkrupp, its subsidiary TKMS, and the newcomer to the stock market, CSG. It is worth reading on.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TKMS AG & CO KGAA | DE000TKMS001 , CSG NV | NL0015073TS8 , SILVER VIPER MINER. CORP. | CA8283344098 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver Viper positions itself for the next phase of growth

What movements on the silver market? Up to USD 122, down to USD 75 USD. The share price of explorer Silver Viper Minerals remains largely unaffected by this, as the stock has outperformed the underlying silver price by more than 400% over the past 12 months. The focus is on gold and silver projects in Mexico, in particular the La Virginia and Coneto properties, both of which are located in established precious metal regions. A recently successful capital increase of approximately CAD 17 million has significantly strengthened the financial base and, at the same time, confirmed the interest of institutional investors. The available funds will enable the continuation of surface work at La Virginia and the preparation of extensive drilling programs with the aim of substantially expanding the existing resource estimate.

At the same time, the company is pushing ahead with the complete acquisition of the Coneto project, which is located in one of Mexico's most productive silver zones. The industrial validation by Fresnillo and the participation of Orex, which contribute additional technical and regional expertise, are particularly valuable from a strategic perspective. Macroeconomically, Silver Viper benefits from a structurally strong silver market, which is driven by the growing importance of the metal in electromobility, photovoltaics, and other future technologies, while supply remains limited.

Silver Viper is also setting clear priorities at the governance level. With the appointment of Rakesh Malhotra as CFO, the company gains an internationally experienced financial expert with over 30 years of experience in capital markets, accounting, and corporate governance. The management team is complemented by capital markets specialist Jeff Couch, who was recently appointed to the board and brings extensive investment banking and private equity experience to the table. After peaking at CAD 2.56 in December, the stock is currently consolidating, which opens up attractive entry zones for dynamic investors. The medium-term outlook for the dynamic Canadians is outstanding! The current volatility offers favorable positioning in the CAD 1.60 to CAD 1.70 corridor. Exciting!

IIF moderator Lyndsay Malchuk talks to CEO Steve Cope about the further exploration strategy in Mexico.

thyssenkrupp and TKMS – Impressive rally after the spin-off

That is impressive. It took the struggling thyssenkrupp Group almost three years to get a robust restructuring program off the ground. In the fall of 2025, the subsidiary thyssenkrupp Marine Systems (TKMS) went public. The placement price of EUR 60 was already exceeded on the first day, with prices close to EUR 100, but this euphoria subsided over the following three months to EUR 62. The Duisburg-based parent company retained 51% of the shares in TKMS, while 49% of the shares were distributed to existing thyssenkrupp shareholders. TKMS is currently seen as the clear winner of the global increase in defense spending, supported by an order book worth around EUR 18 billion, which secures its revenue base for years to come. In the first nine months of fiscal year 2025, the company already generated revenues of around EUR 1.59 billion, matching the level for the entire previous year and underscoring its operational momentum. This makes it all the more surprising that this volume has so far only resulted in an operating margin of just under 4%, raising questions about efficiency, project mix, and cost structure.

At the same time, the company is strengthening its international positioning, for example, through deeper cooperation with Canadian shipbuilder Seaspan, with the aim of building long-term capabilities for the maintenance and support of naval vessels, particularly as part of the Canadian submarine program. This agreement is one of a series of industrial partnerships through which TKMS promotes local value creation, employment, and technological sovereignty in key markets. Despite fundamentally positive conditions and prices around EUR 100, a market capitalization of around EUR 6 billion for just under EUR 2 billion in revenue seems very ambitious. Interested parties should first wait for the 2025 annual press conference and the update of the forecast for 2026.

CSG – Strong debut in the defense sector

CSG shares got off to a dynamic start on Euronext. The industrial group, which has a strong focus on defense technology, made its stock market debut with a market valuation of around EUR 30 billion, combined with issue proceeds of just under EUR 4 billion. Driven by very strong demand from institutional investors, the share opened well above the issue price and showed considerable fluctuations in the following sessions, suggesting that the search for a fair price level is not yet complete.

Majority owner Michal Strnad realized billions in proceeds and, according to Bloomberg, became the wealthiest man in Czechia. At the same time, the group itself received an additional EUR 750 million in fresh funds for acquisitions and capacity expansions. CSG is one of the largest suppliers of ammunition and military vehicles in Central and Eastern Europe, which explains the high level of interest from international investors. CSG has now set up a joint venture with the state-owned Hellenic Defense Systems through a subsidiary. The joint venture is to establish the production of large-caliber ammunition in Lavrio and completely renovate existing industrial capacities. CSG will gain operational control of the production site for a period of 25 years through MSM Greece, with EUR 50 million to be invested. The plant already produces 155 mm ammunition, with other calibers to follow in the course of the year. With a gain of only 20% to date, the share price has been somewhat subdued so far. It cannot be ruled out that the accompanying banks still have significant placement stocks. Given the already ambitious valuation at launch, with a 2026 price-to-sales ratio of 5.5, new entrants can confidently wait for a small pullback.

Silver stocks are currently being turned from left to right. Silver Viper has suffered little, quadrupling since mid-2025 and still showing a 300% increase over June 2025. thyssenkrupp made a good turnaround and also presented a good IPO story with its subsidiary TKMS. A fan base has now established itself here. CSG appears to be valued somewhat ambitiously, but that has rarely been a problem for defense stocks so far!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.