Investments

Commented by André Will-Laudien on December 8th, 2025 | 07:05 CET

The high flyers of 2026: who will lead the next rally? Almonty, Rheinmetall, BYD, and Mercedes-Benz in focus

As the year draws to a close, investors are already thinking about the next investment year. This is understandable, as hardly any other period in history has brought as much return as the past year. AI, defense, and high-tech stocks led the way, with some even reaching 1,000% in individual cases. However, the price trends also show that stocks that have performed well will eventually enter a consolidation phase. In the case of Almonty, the share price rose tenfold, and even after the correction, it was still up almost 700% at the beginning of December. In addition to fundamental data, timing also plays a decisive role in success. We are thinking about the coming year. Will the old favorites also be the new winners?

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

True sustainability in the portfolio: JinkoSolar, Nordex, and the smart niche player RE Royalties

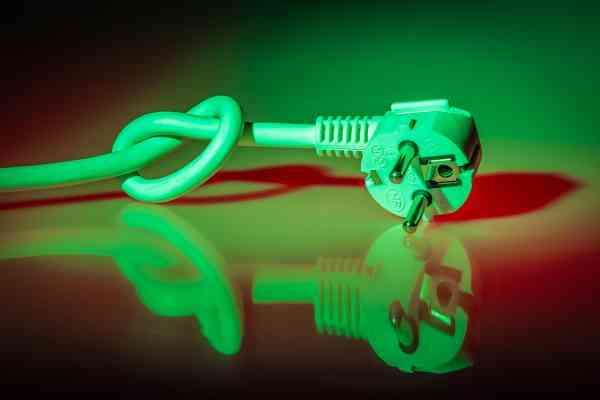

"Green" is no longer a mark of quality on the stock market, but rather a minimum requirement. However, those who mindlessly invest in anything with a solar panel or wind turbine in its logo will often have learned a costly lesson by 2025. The sector is becoming more differentiated: on the one hand, the industrial heavyweights are struggling with price wars and supply chains. On the other hand, specialized financiers are emerging who are closing precisely these gaps and often operating more profitably than the manufacturers themselves. Anyone seeking real returns must now make a clear selection: between mass-market players, turnaround candidates, and intelligent niche specialists.

ReadCommented by Nico Popp on December 5th, 2025 | 07:00 CET

Siemens Energy, Deutsche Bank, Almonty: Why 2025 belonged to the tankers – and 2026 will be the year of the speedboats

There are years on the stock market that are remembered for decades. 2025 was one such year. It was the year the old economy made its comeback. Who would have thought 12 months ago that a former DAX turnaround candidate would outperform tech stocks? Or that a major German bank would suddenly be viewed as a highly attractive core investment? The scoreboard does not lie: the big tankers delivered. However, stock market history rarely repeats itself exactly. While many blue chips are now trading at high valuations and no longer offer much upside potential, experienced investors are already positioning themselves for the next cycle. A presentation at the International Investment Forum (IIF) on Wednesday provided a decisive clue as to where the momentum may shift in 2026.

ReadCommented by Nico Popp on December 4th, 2025 | 07:05 CET

Hype fades, substance remains: Why Bank of America, Commerzbank, and Nakiki are now winners

"The tide lifts all boats, but it is only at low tide that you can see who is swimming without swimming trunks." This stock market bon mot from Warren Buffett perfectly describes the current state of the crypto market. While Bitcoin is stabilizing after its volatile phase and reaching a new stage of maturity, speculative bubbles are bursting at the edges - the best example: American Bitcoin from the Trump universe. Investors increasingly understand that quality is what matters when it comes to blockchain. We present financial stocks with substance that also exude crypto fantasy.

ReadCommented by André Will-Laudien on December 4th, 2025 | 07:00 CET

Gold & silver with a record year – 100% in 2026 too? Barrick, Kobo Resources, First Majestic, and Endeavour Silver

Gold and silver remain the surprise of 2025. Despite many prophecies of doom, both precious metals have so far managed to hold on to their record highs of USD 4,350 and USD 58.50, respectively. After a brief correction at the end of last week, the highly volatile silver price quickly rose back to the USD 58.00 mark. Experts warn of an approaching pain threshold for short sellers and futures speculators. They had hoped to be able to close their uncovered positions at a favorable price before the approaching settlement date on November 28. Far from it, because on Friday, metals took off again. According to traders, it is currently almost impossible to procure sufficient quantities of physical silver to cover the many derivative transactions. This is leading to unusual behavior on the market. So where should investors pay close attention now?

ReadCommented by Carsten Mainitz on December 2nd, 2025 | 07:20 CET

Watch out! Take advantage of the price correction in Almonty Industries, Rheinmetall, and RENK!

According to a study by consulting firm EY-Parthenon and DekaBank, direct defense investments by European NATO countries are expected to rise to EUR 2.2 trillion by 2035. Based on this enormous surge in demand, companies and analysts are forecasting strong growth with rising margins. The medium- and long-term outlook is therefore positive. A possible price consolidation presents a good opportunity to pick up a few shares at a low price. Another exciting investment area is critical metals, which are indispensable for the defense industry, among others. Tungsten producer Almonty Industries stands out positively in this regard.

ReadCommented by André Will-Laudien on November 28th, 2025 | 07:20 CET

2, 20, or 200% return in 2026? Interest rates are falling, a golden opportunity for Deutsche Bank, RE Royalties, Lufthansa, and TUI

At the beginning of the week, the mood on the stock markets was still significantly subdued. Many investors saw little chance of an interest rate cut in the US in the near future, but hope springs eternal. On Monday, the DAX briefly slipped below the 23,000-point mark, but this did not trigger any new selling pressure in the short term. On the contrary, a strong counter-movement set in over the following days. The index has now gained more than 700 points and regained its 200-day line. The technical picture is now back on track. Yesterday was Thanksgiving in the US. In addition to giving thanks for a good life, US investors are up a full 16% on their stock investments based on the S&P 500. Overall, 2025 will be a positive year for investors. And because of the US debt problems, the Federal Reserve will certainly put a few more treats under the tree. So the current bubble appears to remain secure!

ReadCommented by Fabian Lorenz on November 28th, 2025 | 07:10 CET

A 100% price gain not enough? Barrick Mining, First Majestic Silver, and gold gem Kobo Resources!

Barrick Mining's share price has risen by over 100% in the current year. The consolidation of the gold price in recent weeks has had virtually no impact on the Company, and analysts see further upside potential. The Company is closing a billion-dollar deal, and the major problem within the group appears to have been resolved. Now, precious metal prices are rising again. This should also herald a return to prosperity for exploration companies. Kobo Resources is emerging as a hot takeover candidate. The gold explorer has reported high-grade results. A neighbor will be watching developments closely. And what is First Majestic Silver doing? The Company has divested itself of a stake.

ReadCommented by André Will-Laudien on November 27th, 2025 | 07:20 CET

Black Week sales, Bitcoin flop, DAX steady – another interest rate cut? Almonty, Rheinmetall, thyssenkrupp, and TKMS

And up it goes again! It is the season of rising prices. After the widely expected autumn correction turned out to be very mild, many investors believe: That is it! True to the motto "Buy every dip!", they are piling back into the order books. Too few shares are available, so should investors continue buying at high prices? Caution is advised with some stocks. The euphoria surrounding the IPO of thyssenkrupp's marine subsidiary TKMS has completely evaporated, and investors in Düsseldorf-based defense group Rheinmetall are taking profits on a larger scale for the first time. After all, if the war in Ukraine ends, the rearmament cycle could slow down. We will guide you through the Advent bargain hunt!

ReadCommented by Armin Schulz on November 27th, 2025 | 07:10 CET

USD 2.4 trillion is being invested in the energy transition – How to benefit with Siemens Energy, RE Royalties, and Nordex

The global energy market is undergoing a fundamental transformation. With record investments of USD 2.4 trillion being made, it is no longer just about building plants. The real key to success lies in system integration - the intelligent networking of generation, storage, and stable grids. This development creates unique opportunities for companies that are central to shaping the new energy landscape. Three players stand out in particular: Siemens Energy, RE Royalties, and Nordex.

Read