November 28th, 2025 | 07:20 CET

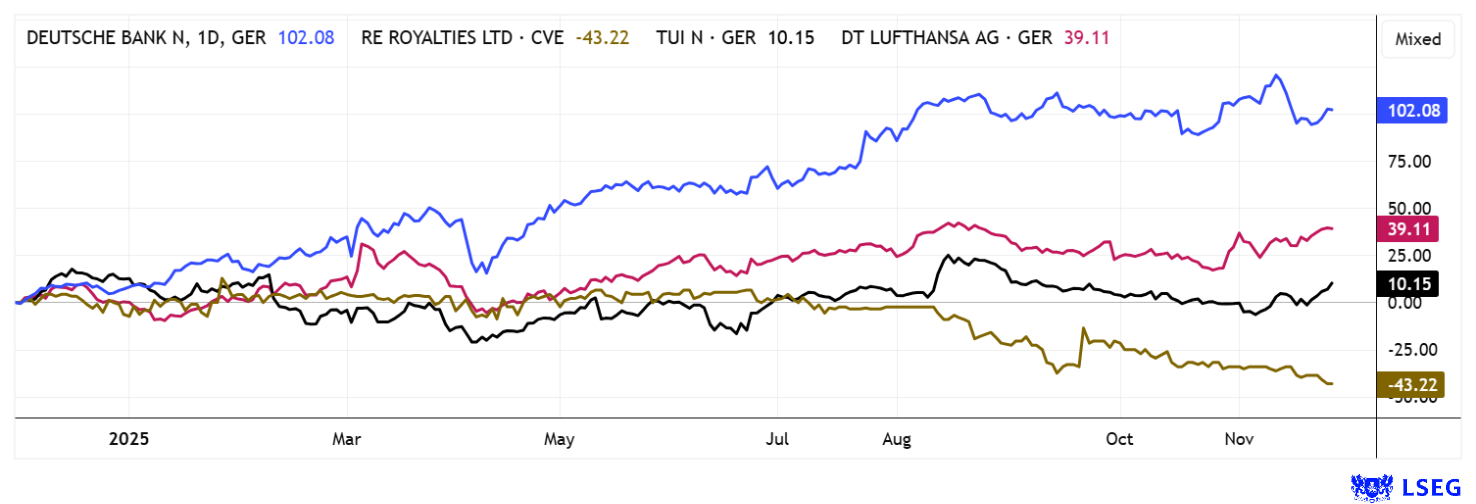

2, 20, or 200% return in 2026? Interest rates are falling, a golden opportunity for Deutsche Bank, RE Royalties, Lufthansa, and TUI

At the beginning of the week, the mood on the stock markets was still significantly subdued. Many investors saw little chance of an interest rate cut in the US in the near future, but hope springs eternal. On Monday, the DAX briefly slipped below the 23,000-point mark, but this did not trigger any new selling pressure in the short term. On the contrary, a strong counter-movement set in over the following days. The index has now gained more than 700 points and regained its 200-day line. The technical picture is now back on track. Yesterday was Thanksgiving in the US. In addition to giving thanks for a good life, US investors are up a full 16% on their stock investments based on the S&P 500. Overall, 2025 will be a positive year for investors. And because of the US debt problems, the Federal Reserve will certainly put a few more treats under the tree. So the current bubble appears to remain secure!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , RE ROYALTIES LTD | CA75527Q1081 , LUFTHANSA AG VNA O.N. | DE0008232125 , TUI AG NA O.N. | DE000TUAG505

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Between returns and responsibility – Deutsche Bank strengthens its profile

Who would have thought it! After years of restructuring, Deutsche Bank is now in a much more stable position. Following the complete integration of Postbank and restructuring costs of over EUR 1 billion, the bank is now operationally stronger and more profitable than ever. Pre-tax profit reached an outstanding EUR 2.4 billion in Q3, around 8% more than in the previous year. The institution now has EUR 675 billion under management on its way to becoming an asset bank, and this figure alone generates asset management fees of more than EUR 2.5 billion per year. Shareholders are benefiting. Not only has the share price tripled since 2022, but the dividend is also looking good, with an expected EUR 1.00 for 2025.

In parallel, the bank is strengthening its technological foundation, but continues to face cautious customer sentiment toward artificial intelligence. The Postbank Digital Study 2025 shows that 77% of German citizens currently trust AI-based advice less than personal conversations with bank employees. There is particular reluctance when it comes to investment advice. Younger customers are driving this trend, which the bank is specifically exploiting with innovative service offerings. With a market capitalization now of around EUR 57 billion, the institution is once again among the European leaders. 8 out of 20 analysts give it the thumbs up and see moderate upside potential with an average price target of EUR 32.85. Deutsche Bank could indeed take a breather next year in terms of returns - our 2% tip.

RE Royalties – Attractive dividend yields in the green infrastructure sector

In recent years, the market for sustainable financing has developed very dynamically. In 2024 alone, the volume of green bonds placed worldwide reached around half a trillion USD, a new record high. Experts expect this segment to grow to more than USD 5 trillion by 2030, which corresponds to an average annual growth rate of around 12%. Europe, in particular, is considered the most important and at the same time strictly regulated economic area, with the EU taxonomy ensuring clear transparency requirements and harmonized reporting obligations. Sustainable investment forms now account for around 18% of global assets under management. ESG funds recorded net inflows of over USD 150 billion in 2024, with North America accounting for around 40% of the global green finance market and Europe for around 45%; Asian markets are catching up, accounting for around 12%.

One company that stands out in this environment is Canadian energy and project financier RE Royalties Ltd. The Company applies a licensing and participation model that originated in the mining sector to the financing of renewable energy. Instead of building plants itself, RE Royalties provides capital for solar, wind, and hydroelectric projects as well as energy storage systems. In return, the Company receives contractually agreed interest components and long-term revenue shares, generating predictable and recurring income without project developers having to give up shares.

RE Royalties offers investors a regular distribution mechanism: quarterly payments of CAD 0.01 per share are typically made, which, since 2020, have added up to an annual dividend of CAD 0.04. With a share price of around CAD 0.25, this results in a yield of around 16%, which is remarkably high for the renewable energy sector. The Company's cash flow is fed by more than 100 projects with contract terms ranging from 20 to 40 years. The majority of the portfolio is located in North America, supplemented by growing activities in Europe, Asia, and Africa. In total, RE Royalties has supported over 130 projects with a financing volume of more than CAD 80 million to date. The Company sees itself as an active supporter of the global energy transition, combining economic stability with environmental and social impact. RE Royalties could be a 200% candidate for 2026 if its steep growth continues and its business model gains a broad understanding.

CEO Bernard Tan explains what plans he still wants to put into action in an interview with Lyndsay Malchuk.

Lufthansa and TUI – Same course, different concerns

Sustainability is an important issue for the two tourism companies, Lufthansa and TUI. Because airlines are generally considered to have little regard for the environment, many environmental activists have targeted the aviation industry for their protests in 2025. The first ruling was handed down in recent days: The Hamburg Regional Court ordered 10 climate activists to pay a total of EUR 400,000 in damages for paralyzing Hamburg Airport in July 2023. It remains unclear who can and will pay this sum. Although the airline's operations were occasionally blocked, its financial performance has gradually improved since the coronavirus crash. Revenue is expected to increase by 6% in 2025, with operating profit (EBIT) even doubling to EUR 1.9 billion. The bottom line is expected to be earnings per share of EUR 1.12, which is expected to rise to EUR 1.48 by 2027. This brings the P/E ratio down to 5.5 – the turnaround seems to have been mastered.

Travel competitor TUI is also expected to see a 5% increase in revenue, but the change in profit is estimated to be even more dynamic. Lufthansa often struggles with strikes and personnel problems and is feeling the impact of high location costs, particularly airport fees, which are weighing on earnings per seat. TUI, on the other hand, is heading into a new booking season, but inflation is putting pressure on household budgets. Hotels, resorts, and cruises are once again delivering good results, but airlines are experiencing problems. The geopolitical uncertainty factor affects both companies equally. Given the same starting level of EUR 8.15, analysts on the LSEG platform see a 12-month average price target of only EUR 7.6 for Lufthansa, compared to EUR 11.20 for TUI. A pure 20% gain is therefore not immediately apparent, but Lufthansa has been trading well below book value for five years now. In the overall analysis, it is probably Germany's location that is causing concern here: high wages, high taxes and fees, little growth!

**Green finance is a welcome topic, but it remains underrepresented on the capital markets. RE Royalties is filling a crucial gap by generating recurring royalty income from renewable energy projects while offering investors predictable distributions - a niche model with significant potential for valuation increases. At the same time, Deutsche Bank is breaking new ground, and both Lufthansa and TUI are also making progress in their restructuring efforts.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.