Hydrogen

Commented by Carsten Mainitz on January 26th, 2026 | 07:35 CET

2026 – The comeback of hydrogen stocks: Now it is substance that counts, not hype! The hidden potential of dynaCERT, Ballard Power, and VW

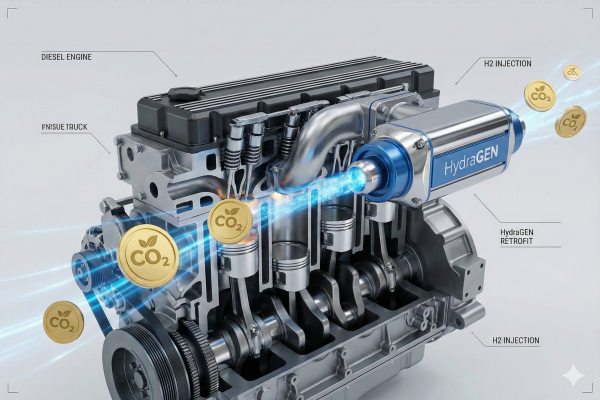

For years, hydrogen stocks were considered the promise of the future. The hype was followed by a hangover. Valuations have fallen sharply, and after a phase of exaggerated expectations, the focus is now shifting to robust business models and industrial scaling. dynaCERT stands out with its innovative bridge technology that meets high environmental standards. Its ready-to-use solutions for reducing emissions are convincing more and more customers from industry. As an established player, Ballard Power is driving the further development of fuel cells in heavy-duty transport. Volkswagen is taking a different approach. A few days ago, the automaker published key data for the past fiscal year, which came as a positive surprise.

ReadCommented by Armin Schulz on January 23rd, 2026 | 07:10 CET

The new hydrogen turbo: How Plug Power, First Hydrogen, and Nel ASA are benefiting from the AI boom

The course has been set for the hydrogen revolution. Following a consolidation in 2025, clear regulations, groundbreaking production technologies such as SMRs, and entirely new sources of demand, from AI data centers to heavy-duty transport, will drive the market into a new, potentially profitable growth phase. This momentum is now positioning pioneers in the value chain for exceptional opportunities. We analyze the promising strategies of Plug Power, First Hydrogen, and Nel ASA.

ReadCommented by Nico Popp on January 22nd, 2026 | 07:20 CET

Gas boom Down Under: Omega Oil + Gas and Elixir Energy becoming increasingly expensive – balance sheet treasure at Pure One Corporation

There is a strange discrepancy in the global energy markets that is nowhere more tangible than on Australia's east coast. While politicians and ESG funds have been rehearsing the demise of fossil fuels for years, reality is now hitting the economy with full force. Sentiment in trading rooms from Sydney to Perth has shifted markedly. A gold-rush mood has returned – this time for natural gas. In its "Gas Statement of Opportunities 2025," market operator AEMO warns in an almost alarmist tone of an impending supply gap. Gas explorers such as Omega Oil & Gas and Elixir Energy have already risen sharply. But away from the obvious investments, hydrogen company Pure One presents a classic arbitrage opportunity that is still largely ignored by the broader market. The Company is preparing to spin off its gas division, and a detailed comparison with its peers suggests that investors can currently acquire this asset at virtually no cost – a gift for anyone who knows how to read balance sheets.

ReadCommented by André Will-Laudien on January 20th, 2026 | 07:35 CET

Will new Trump tariffs slow down the stock market boom? Keep an eye on Plug Power, dynaCERT, and Nordex

The stock market currently has to cope with all kinds of weather conditions. First, there is a very dry and cold winter, which is causing problems for Ukraine in particular due to the war. To make matters worse, the energetic US President Donald Trump is suddenly laying claim to Greenland. Most likely, he is only interested in securing the entire NATO, hence the pressure over the new tariffs. The EU will also have to make a huge security contribution for Greenland. It feels as if the war machine is running at 300% capacity. How the states intend to finance all this is more than questionable, because taxes will no longer cover the costs if they do not want to stifle their economies. In this environment, capital market interest rates should actually be skyrocketing, but Trump is vehemently demanding interest rate cuts. We are looking for attractive opportunities in a challenging environment.

ReadCommented by André Will-Laudien on January 15th, 2026 | 07:30 CET

Acquisition Breakthrough: D-Wave, First Hydrogen, and Plug Power in focus

In an increasingly fast-paced world, investors are seeking timely information on stocks that have been highly volatile in recent weeks. Often, the key opportunities lie in turnaround situations, driven partly by operational news and partly by technical chart patterns. Today's selection of stocks reflects exactly this picture. D-Wave is impressing with a complementary acquisition deal, First Hydrogen with a successful capital raise, while Plug Power is unfortunately facing negative analyst commentary. What is happening on the price board?

ReadCommented by Nico Popp on January 14th, 2026 | 07:05 CET

Between euphoria and industrial realism: How Linde, Hapag-Lloyd, and dynaCERT are defining the new reality of the hydrogen economy

We are witnessing a decisive turning point in the global hydrogen economy: The phase of speculative euphoria that characterized the beginning of the decade has given way to a phase of industrial realism and technocratic implementation. In investor circles and industry analyses, the term "mean reversion" has become established – a return to reality, away from unrealistic hyper-growth scenarios and toward physically feasible projects. According to the International Energy Agency's (IEA) Global Hydrogen Review 2025, the hydrogen sector continues to grow steadily and reached demand of nearly 100 million tons in 2024, but the structure of this growth is more complex than previously forecast. In this new environment, where regulatory interventions such as FuelEU Maritime and emissions trading (EU ETS) set the pace, three distinct winner profiles are emerging: infrastructure giant Linde, logistics heavyweight Hapag-Lloyd, and technology bridge builder dynaCERT, which occupies a highly compelling niche.

ReadCommented by Armin Schulz on January 7th, 2026 | 07:30 CET

AI's energy hunger and decarbonization: How Siemens Energy, CHAR Technologies, and Plug Power are positioning themselves to profit

The global energy transition is caught in a paradoxical race: While electricity demand is exploding due to AI and electrification, decarbonization must succeed. This collision is creating a billion-dollar market for companies that solve fundamental bottlenecks, from grid stability to green industrial energy to the hydrogen economy. Three pioneers exemplify this systemic change. Their strategies could not be more different, as current developments at Siemens Energy, CHAR Technologies, and Plug Power show.

ReadCommented by Fabian Lorenz on January 6th, 2026 | 07:10 CET

Caution with Plug Power! TKMS with major order! Pasinex Resources completes acquisition!

In 2026, investors are likely to continue to focus on stocks in the defense, raw materials, and hydrogen sectors. Pasinex Resources currently offers an opportunity to buy or add to positions. The zinc high-flyer impressed investors in 2025, and the positive news flow is likely to continue in 2026. A producing mine is being expanded, and a project is set to go into production soon. TKMS started the new year with a major order, giving the stock a new boost. After halving in value, analysts see Plug Power as a buying opportunity. But caution is advised! The hydrogen pioneer faces an important decision on January 15, 2026.

ReadCommented by André Will-Laudien on January 5th, 2026 | 07:30 CET

Double-digit start to 2026 for Plug Power, Nel ASA, CHAR Technologies, and thyssenkrupp nucera

Things are continuing as they ended in 2025: high volatility, challenging circumstances, and political upheaval. Now the guns are speaking again, because there is no peace in Ukraine after all, putting defense stocks back at the top of the shopping list. However, after years of decline, investors are now venturing back into the alternative energy sector. Since the hydrogen boom in 2021, the industry's protagonists have lost up to 90% of their share price value. So why not venture back into an area where money has not flowed for a long time? Biomass specialist CHAR Technologies is a newcomer on the scene. The rally started here in 2025 and is likely to continue. thyssenkrupp nucera is also worth a look. After being spun off from the Duisburg-based group, the lights appear to be green!

ReadCommented by Fabian Lorenz on December 30th, 2025 | 07:00 CET

HYDROGEN STOCK with 10x POTENTIAL! Nel ASA, thyssenkrupp, and dynaCERT are starting the new year in different ways

Hydrogen stocks have had a challenging year. However, analysts see the potential for 10x growth in the new year, specifically, for the cleantech company dynaCERT. Operational tailwinds are coming from market entry in Mexico and sales successes in Europe. Successes in Asia are expected to follow in 2026. The decisive factor for 2026 will be whether dynaCERT makes progress in terms of order volume, capacity utilization, and recurring revenues. With its retrofit solution, dynaCERT is setting itself apart from large plant manufacturers such as thyssenkrupp nucera and Nel ASA. Analysts praise the former for its efficient structures and full coffers. The other is aggressive despite its share price being at an all-time low.

Read