Electromobility

Commented by Armin Schulz on January 18th, 2024 | 08:15 CET

Nel ASA, Klimat X Developments, BYD - Green business: The Success Factor of Climate Neutrality

In today's business world, climate neutrality is no longer just a catchphrase - it has become a crucial factor for long-term success and sustainability. More and more companies are recognizing that reducing their carbon footprint is both an ethical and economic necessity. But how does one achieve this coveted climate neutrality? Carbon credits are proving to be a key tool here. In addition, innovative technologies such as hydrogen energy and electromobility are increasingly becoming the focus of companies that view the transition to green energy as an essential building block for a sustainable corporate strategy. Today, we look at three companies that are working towards climate neutrality.

ReadCommented by André Will-Laudien on January 16th, 2024 | 07:15 CET

E-mobility boom 2024, when will the German vehicle market take off? BYD, Edison Lithium, VW, BMW

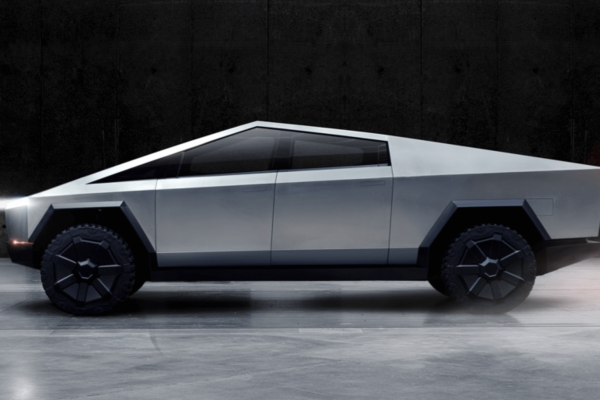

The last word in e-mobility has not yet been spoken. While BYD is leading the sales list worldwide, Tesla is struggling with important supplier parts and has had to halt production temporarily. German manufacturers have used the last two years to catch up on technical backlogs and are preparing to score points in the "electric world", too. Last year, buyers were offered a state environmental bonus on top, but this was cancelled before Christmas. Now, the market has to prove that it can survive with fewer subsidies. Where are the opportunities for investors?

ReadCommented by Stefan Feulner on January 15th, 2024 | 06:30 CET

Hertz, Saturn Oil + Gas, Occidental Petroleum - Clear signs of a trend reversal

Electromobility, often hailed as the future of transportation, is at the forefront of a global transport revolution. A swansong has already been sung for the traditional combustion engine. However, the fossil fuel-powered vehicle is still by far the best-selling vehicle. Issues with battery-powered vehicles are increasing. In addition to the continuing lack of refueling infrastructure, the purchase prices are simply too high without government subsidies. Additionally, higher repair costs are becoming more prevalent.

ReadCommented by Stefan Feulner on January 8th, 2024 | 07:15 CET

Infineon, Globex Mining, Volkswagen AG - Excellent general conditions

The year got off to a bumpy start. The DAX, Dow Jones and Co. started the first trading week of the year with losses. The fact that several traders were still on their well-earned Christmas vacations and volumes were low led to high fluctuations in both directions. Chip stocks, in particular, suffered due to a sales warning from the US. In contrast, gold and commodity stocks benefited due to their stable underlying values. This positive trend could continue after the corrections of the past year.

ReadCommented by André Will-Laudien on January 8th, 2024 | 07:00 CET

Start of the year with GreenTech hype! Will BYD, Klimat X Developments, Plug Power and Freyr Battery deliver now?

The year 2024 will be the next test for GreenTech shares. In the past investment year, despite bullish markets, they were the biggest losers in the portfolio. Plug Power and Freyr Battery incurred the most significant negative returns, ranging from 70 to 80%, but BYD and Klimat X also saw a slight decline. However, with the resolutions passed in Dubai and new government climate protection programs, things could pick up again in the new year. But who can win the coveted government contracts? We analyze the opportunities and risks.

ReadCommented by Juliane Zielonka on January 5th, 2024 | 08:45 CET

Altech Advanced Materials, BYD, and Rheinmetall - Growth drivers: innovation, market power and strong cash flow

Made in Germany stands for durability. Battery storage pioneer Altech Advanced Materials stands out as a German company with innovative material developments that can radically change electromobility and stationary energy storage with a 30% increase in efficiency. Meanwhile, the Chinese car manufacturer BYD has established itself as the leader in the electric vehicle market, surpassing Tesla in terms of sales figures in Q4/23. Rheinmetall is also strongly expanding its electromobility divisions and can look forward to a 3-digit million dollar order in its ubiquitous division. Find out who is setting new standards and shaping the future here.

ReadCommented by André Will-Laudien on January 5th, 2024 | 08:30 CET

Berlin abolishes the eco-bonus, so what now for e-mobility? Plug Power, Prospera Energy, VW and Porsche in focus

Investors who bet on green energy in 2023 took a big hit. Contrary to many forecasts for the future, the wind and hydrogen sector has yet to show any sustained positive development. Government budgets are simply insufficient to promote these still unprofitable forms of energy. Private investors want to see returns on their investments. State-of-the-art combustion technologies will likely remain available for years because they are efficient and work in all weather conditions. Those who experienced their electric vehicle running out of power on December 1, 2023, at minus 10 degrees with 1 meter of fresh snow can attest to the challenges. We look at titles that carry the essence of fossil energy approaches in their soul.

ReadCommented by Armin Schulz on January 4th, 2024 | 07:45 CET

Almonty Industries, Volkswagen, Rheinmetall: Which share will take off in 2024?

The new year has barely begun, and investors are looking for the winning stocks for the coming year. Investors should keep an eye on the critical raw material tungsten, which Almonty Industries produces. There is significant dependence on China and Russia in this sector. The areas of application are diverse and range from electric cars, which Volkswagen builds, to medical products, metal alloys, industrial applications, electronic devices and the defense industry, where Rheinmetall operates. In times of increasing conflicts and escalating trade disputes between the US and China, essential resources such as tungsten are increasingly coming to the fore. We look at which of the three shares could take off in 2024.

ReadCommented by André Will-Laudien on January 4th, 2024 | 07:15 CET

This is where the music plays: Top values wanted for 2024! Mercedes, Globex Mining, BYD, and NIO to the inspection!

It was a challenging year for the otherwise popular automotive stocks. Berlin and Brussels no longer want combustion engines, but consumers do. Then, to top it off, the environmental bonus was also cut at Christmas. The traffic light coalition believes that e-mobility should now sell itself. Far from it, say the experts: combustion engines still account for 97% of road vehicles. Those in office are governing for minorities, as there has long been a lack of scientific facts and a lack of tact. But well, customers are voting with their feet, turning new vehicles into shelf warmers and buying their beloved diesel SUVs through the used car market. This market could even flourish over the next few years and demand scarcity premiums. Where are the opportunities for investors?

ReadCommented by Fabian Lorenz on January 3rd, 2024 | 07:20 CET

100% share price increase in a few days! Plug Power, BYD and Defense Metals shares

Within just a few days, the Defense Metals share price more than doubled shortly before Christmas. Even if the price level of the developer of a rare earths project in Canada could not be fully maintained, the share is entering 2024 with new momentum. Important data is due soon. If these are also positive, the current valuation of around CAD 50 million could be a real bargain. Plug Power is not a bargain despite the massive drop in the share price. The hydrogen specialist needs to grow and accelerate its path to break even. The e-commerce giant Amazon should help with this. BYD can only dream of doing big business in the US so far. The market is closed to Chinese e-car manufacturers. Is it justified?

Read