Defense

Commented by André Will-Laudien on October 15th, 2025 | 07:05 CEST

Supply chains on the NASDAQ! Critical metals sold out? What is next for Almonty - Caution advised with Rheinmetall, Deutz, and RENK

Snip-Snap! In and out of the markets! At the moment, all stock market wisdom applies, because there is nothing more unpredictable for investors than the current US president. And who would have thought that the critical metal supply chains would suddenly become a major driving force behind the NASDAQ rally? Just as Xi Jinping threw rare metals into the ring as a bargaining chip, Donald Trump blew a fuse. Punitive tariffs of up to 100% were suddenly on the table, and the markets went into a tailspin. Yet just one trading day later, everything is put into perspective, and the markets have to find their new valuation point – no easy task. Yesterday, nervousness returned, as reflected in a sharp rise in the volatility index. What should investors be keeping a close eye on now?

ReadCommented by Armin Schulz on October 14th, 2025 | 07:25 CEST

China closes the door – NEO Battery Materials opens a window to profits in the drone market

From November 2025, China will tighten export controls. The export of high-performance batteries and related materials will become significantly more difficult. This political decision is turning the global supply chain for electric mobility and high-tech upside down. While established players outside China struggle, a small Canadian company is catapulting itself into a unique position. NEO Battery Materials has positioned itself in the right place at precisely the right time. For investors, this creates a rare opportunity to profit from a geopolitical turning point.

ReadCommented by Carsten Mainitz on October 14th, 2025 | 07:15 CEST

Momentum plays with a new wave: Almonty Industries and Rheinmetall – what is Gerresheimer doing?

The trade dispute between the US and China appears to be entering the next round. Late last week, US President Trump announced his intention to impose additional punitive tariffs of 100% on Chinese goods. The measures are expected to take effect by November at the latest. This follows China's decision to tighten export controls on certain technologies and raw materials. China holds many critical raw materials and is gradually restricting their export. While consumers face major challenges in view of the shortage of demand and rising prices, producers of these raw materials are among the stock market favorites.

ReadCommented by Armin Schulz on October 14th, 2025 | 07:00 CEST

Why RENK Group needs Antimony Resources just as much as the largest US defense contractor, RTX

The global defense industry is facing a fundamental supply crisis. Antimony, a largely overlooked metal that is indispensable for high-performance electronics, armor-piercing alloys, and flame-resistant propulsion systems, is becoming a key strategic factor. Prices are skyrocketing, and massive supply bottlenecks are emerging. This shortage is hitting defense giants and suppliers hard, forcing them to radically rethink their procurement strategy. Today, we take a closer look at the current situation of the RENK Group, the explorer Antimony Resources, and the largest US defense contractor RTX.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:30 CEST

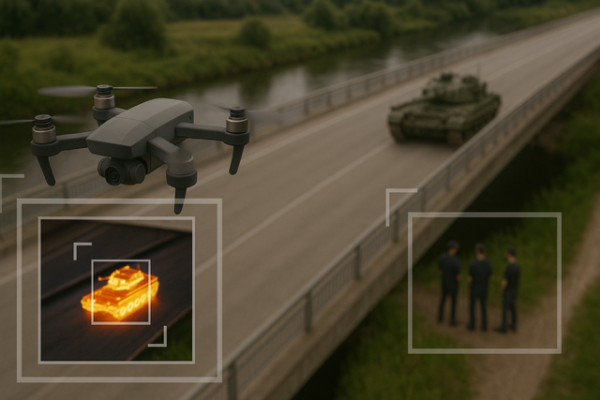

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

ReadCommented by Nico Popp on October 13th, 2025 | 07:25 CEST

Drone stocks: Opportunities with Volatus Aerospace, DroneShield, and Rheinmetall

When drones appeared over several European airports in September and brought flight operations to a standstill, it came as a shock. The incidents revealed that Germany and many other Western countries are largely powerless against drones, as there are no defense mechanisms in place. Instead, representatives of the German Armed Forces and police are arguing over who is responsible for countering such threats – in Germany, there are even regulations governing who may defend against enemy threats and where. Meanwhile, the war in Ukraine continues – and with it, the drone war is evolving. It has long been clear that drones are essential as a deterrent and have become a core element of every modern army. We explain why Volatus Aerospace is well-positioned to benefit from the ongoing drone hype.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:05 CEST

Winners in the tariff war: Almonty Industries, MP Materials, Bayer

Stock market turmoil on Friday: Donald Trump once again threatens to wield the tariff club. This came in response to China's announcement to tighten export controls on rare earths. Yet, there are also winners in the raw materials battle between the two superpowers. In recent months, the US government has invested in companies such as MP Materials, focusing so far on rare earths and lithium. Will tungsten be next? This critical metal has not been mined in the US for a long time, and Almonty would be the logical partner to change that. Notably, while US stocks lost ground, in some cases heavily, on Friday, Almonty shares recovered significantly from their intraday lows.

ReadCommented by Nico Popp on October 10th, 2025 | 07:05 CEST

War increasingly likely? This supplier is improving drones: AeroVironment, NEO Battery Materials and Kratos Defense

"Is war against Putin inevitable?" This was the headline in BILD yesterday in response to statements by military historian Sönke Neitzel on the ARD talk show Maischberger. According to Neitzel, Putin has already paved the way for war with his recent escalations. The historian asks: "If Putin is determined – many in NATO say so, and I would agree – will he wait until we can say that even the German Armed Forces now have enough drones? No, probably not." Neitzel believes that, due to the current poor equipment of many NATO countries, a military conflict between NATO and Russia could occur within the next three years. Investments in drones are therefore urgently needed. We present a battery supplier that offers tailor-made technology for drones, capable of drastically reducing the dependence of Western militaries on batteries from China.

ReadCommented by Armin Schulz on October 10th, 2025 | 07:00 CEST

Drone boom vs. pilot strike: What you need to know about DroneShield, Volatus Aerospace, and Lufthansa

As the global drone market expands at double-digit growth rates, unprecedented opportunities are emerging above and beyond the clouds. Innovative technologies are driving not only military but also civilian applications into previously untapped economic areas. This high-flying growth stands in sharp contrast to the challenges facing traditional aviation, which is being hit by operational difficulties. Three companies - DroneShield, Volatus Aerospace, and Lufthansa - embody these contrasting realities, highlighting both the lucrative paths of the future and the risks inherent in the sector.

ReadCommented by Fabian Lorenz on October 9th, 2025 | 07:20 CEST

GOLD RUSH to USD 5,000? DEFENSE STOCKS set for a billion-dollar contract! Barrick Mining, Hensoldt and Kobo Resources!

While the US government shutdown drags on, the rush for tangible assets persists. The pace at which gold and silver prices are climbing is almost alarming. On the stock market, AI and defense remain key drivers. With surprising ease, the price of gold has broken through the USD 4,000 mark - could USD 5,000 be next? Barrick Mining is also continuing its rally, while those looking for undiscovered gems amid this hype should take a closer look at Kobo Resources. The junior explorer could soon become a potential takeover target. In the defense sector, the capital market is waiting for major orders. One such order could now come from the German government. Hensoldt stands among the likely beneficiaries.

Read