Bitcoin

Commented by Stefan Feulner on March 5th, 2025 | 08:00 CET

C3.ai, Credissential, Strategy – Strong momentum

Donald Trump has many plans and visions associated with his slogan "Make America Great Again". One of these is that the "capital for artificial intelligence and cryptocurrencies" should be located in the United States. With the Stargate Project, which has a volume of over USD 500 billion, a program for investing in AI has been approved. Over the weekend, the Republican followed up by introducing a strategic cryptocurrency reserve, which caused the introduced currency pairs to take off.

ReadCommented by Armin Schulz on February 10th, 2025 | 07:10 CET

Palantir, Desert Gold, MicroStrategy – Profits with data, gold, and Bitcoin

In times of looming trade war and high volatility, as recently triggered by DeepSeek, one should invest in booming business models. Otherwise, in these turbulent times, it is wise to move at least part of your portfolio into "safe havens." Traditionally, this has been gold, but for the younger generation, who are more willing to take risks, it is cryptocurrencies. To outperform the market in the long term requires patience and foresight. Today, we look at three companies in the fields of data processing, gold, and cryptocurrencies and examine where the risks and opportunities lie.

ReadCommented by Fabian Lorenz on January 28th, 2025 | 07:30 CET

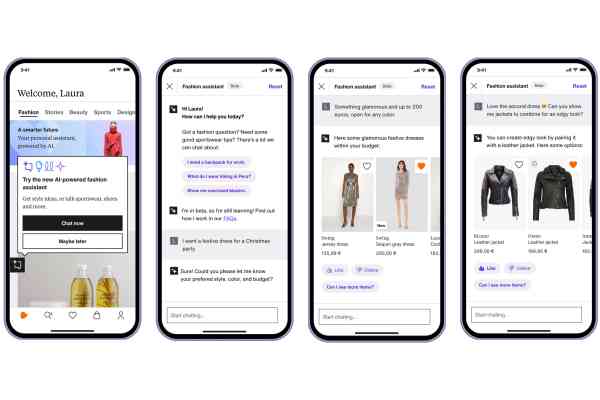

4,000% stock Carvana: TeamViewer, Bitcoin Group, Zalando, and Credissential offer opportunities

Away from the big tech stocks, multipliers are waiting. One example from the US is Carvana, which has risen 4,000% in two years. Credissential aims to challenge the online used car dealer. The startup wants to provide brick-and-mortar used car dealers with a response against Carvana using artificial intelligence. Scaling is planned for 2025. If successful, the stock is much too cheap. In the DAX, Zalando offers significant upside potential. The online retailer is back on the growth path and plans to compete with Shein and Temu through the acquisition of About You, with analysts recommending a "Buy". By contrast, TeamViewer's stock lacks momentum. Analyst opinions are divided. And is the Bitcoin Group stock finally waking up?

ReadCommented by André Will-Laudien on January 24th, 2025 | 06:50 CET

Artificial intelligence and crypto mania – the 500% duo! Bitcoin, MicroStrategy, Credissential, Palantir and D-Wave

Since the tech bubble of 2000, no other year of investment has seen such huge gains for just a few sectors as 2024. And it looks like 2025 will be no different! Bitcoin, high-tech, artificial intelligence and armaments were and are the blockbuster topics for making quick money. MicroStrategy, D-Wave, Palantir, and Nvidia are the current protagonists of this incredible spectacle. Now these stocks have priced in a golden future, in some cases with P/E ratios of over 100. What comes next? Even experts are at a loss - nobody expects a correction here as all the shorts of recent weeks have turned into painful experiences. The keywords are "momentum & liquidity" – is fundamental analysis useless?

ReadCommented by Fabian Lorenz on January 21st, 2025 | 08:20 CET

Stock market driven by Donald Trump: Renk, Bitcoin, Barrick Gold, First Nordic Metals

Since yesterday, Donald Trump is again US president. And the Trump Trades such as Bitcoin, gold and defense continue to rise. The US president's own meme coin caused a stir over the weekend. At the same time, gold is setting its sights on an all-time high. The stocks in the sector should also benefit from this. Barrick Gold was one of the disappointments in 2024. Will the gold giant now start a new buying wave in the industry? New impetus could come in February. First Nordic Metals might be interesting for one of the large gold producers. The Company has exciting projects in Scandinavia and is implementing an extensive drilling program in 2025. The stock is cheap. At the turn of the year, investors likely also found Renk's stock too cheap. After a disappointing performance in 2024, the share price picked up in the new year. Analysts see further upside potential.

ReadCommented by André Will-Laudien on January 21st, 2025 | 07:00 CET

The stock market boom continues – Power Nickel, BYD, Bitcoin, and MicroStrategy are soaring, and thyssenkrupp is turning a corner!

The stock market started the new year at full speed. Chart analysts see the DAX reaching 21,500 points as early as January! Yesterday, the stock markets in the US were closed for Martin Luther King Day, but Donald Trump was sworn in again as the 47th President. Storm clouds are currently a rarity, and corrections have been limited to just a few hours. Investors have to keep pace with this speed to achieve returns. Stagnation or even setbacks are seen only in Germany's GDP, which has declined for the second consecutive year. However, this is no obstacle for higher stock market valuations. Here is a selection of stocks that continue to cause a stir!

ReadCommented by André Will-Laudien on January 14th, 2025 | 08:00 CET

THE VOLATILITY TRAP: Sell-off in Bitcoin, gold on the rise! Desert Gold, MicroStrategy, Lufthansa, and Nel ASA

After a record year for equities in 2024, the new year is entering a challenging phase. Hopes of interest rate cuts look bleak, with inflation remaining too high. The mega rally in Bitcoin also needs to be deflated soon. This hits BTC collector MicroStrategy quite hard. Nel ASA, which had started the year on a hopeful note, now has to announce a production stoppage! Lufthansa, meanwhile, is working on acquiring the state-owned Italian airline ITA. Volatility is rising dangerously, signaling that a correction is due. These developments are positive for the safe haven of gold. The key now is consistent action!

ReadCommented by André Will-Laudien on December 30th, 2024 | 07:05 CET

Will the corks be popping in 2025, too? 100% with BYD, VW, Power Nickel, MicroStrategy and Bitcoin possible

Since the tech bubble of 2000, there has been no year in which profits were so concentrated in just a few sectors as in 2024. Bitcoin, high-tech, artificial intelligence, and armaments were the blockbusters, while other sectors such as biotech, pharmaceuticals and automotive lagged far behind or even ended the year in the red. Nvidia, Tesla, D-Wave, Super Micro Computer, Rheinmetall and MicroStrategy were the protagonists of an incredible spectacle. Now, these stocks have priced in a golden future, in some cases with P/E ratios of over 100, and no one can seriously predict how things will continue here. Historically, the subsequent crash in the three years following the reference year 2000 resulted in losses of over 90%. The important difference: whereas in the past stocks were listed without any fundamental value, today it is predominantly world market leaders in their particular niche. Investors are betting on the fact that there will be no competition in the long term. Where are the opportunities for investors at the turn of the year?

ReadCommented by Fabian Lorenz on December 27th, 2024 | 07:40 CET

MicroStrategy buys Bitcoin! Nel ASA halved! F3 Uranium ultra-high grade!

The Bitcoin super-bull has struck again just before Christmas. MicroStrategy purchased an additional 5,262 Bitcoins, with an average price exceeding USD 100,000. However, the potential for a setback is increasing. The story is different for F3 Uranium, where new drilling results are described as "'ultra-high grade"'! This seems to prove analysts right. They see the fair value of the uranium explorer's shares as almost 200% higher than its current level. In contrast, experts have halved their price target for Nel ASA shares. For them, the former hydrogen high-flyer is no longer a buy, as the industry faces serious problems.

ReadCommented by Stefan Feulner on December 12th, 2024 | 07:05 CET

MicroStrategy, Thunder Gold, C3.ai – These are the favorites

The 2024 stock market year is coming to an end, and despite all the uncertainties in geopolitics, leading stock indices, Bitcoin, and the precious metal gold are close to their historic highs. While looking at the favorites for the coming year, companies involved in artificial intelligence are expected to continue to perform well. The majority of experts remain bullish on Bitcoin and gold.

Read