January 24th, 2025 | 06:50 CET

Artificial intelligence and crypto mania – the 500% duo! Bitcoin, MicroStrategy, Credissential, Palantir and D-Wave

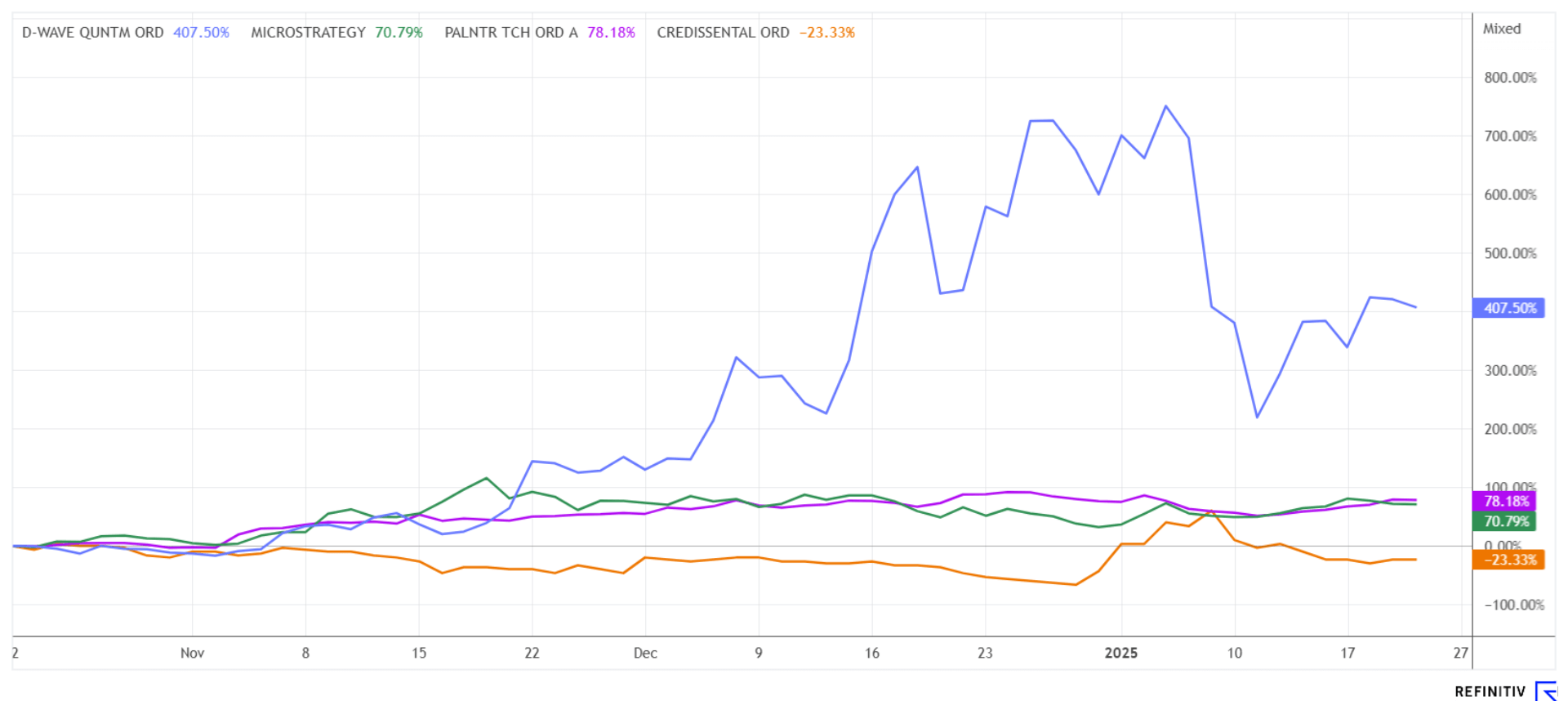

Since the tech bubble of 2000, no other year of investment has seen such huge gains for just a few sectors as 2024. And it looks like 2025 will be no different! Bitcoin, high-tech, artificial intelligence and armaments were and are the blockbuster topics for making quick money. MicroStrategy, D-Wave, Palantir, and Nvidia are the current protagonists of this incredible spectacle. Now these stocks have priced in a golden future, in some cases with P/E ratios of over 100. What comes next? Even experts are at a loss - nobody expects a correction here as all the shorts of recent weeks have turned into painful experiences. The keywords are "momentum & liquidity" – is fundamental analysis useless?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MICROSTRATEG.A NEW DL-001 | US5949724083 , CREDISSENTIAL INC | CA22535J1066 , PALANTIR TECHNOLOGIES INC | US69608A1088 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MicroStrategy – The wild ride on Bitcoin

A brief look at the Bitcoin prodigy MicroStrategy is in order. With the rise of the crypto currency BTC to over USD 100,000, MicroStrategy was able to gain almost 700% in the past year. CEO Michael Saylor is pursuing an aggressive crypto strategy: since October 2020, the Company has issued USD 16 billion in shares and convertible bonds to invest in Bitcoin. In the middle of this week, the Company announced that it had sold a total of 3,012,072 of its own shares between January 13 and January 20, 2025. The total net proceeds of approximately USD 1.1 billion were used to purchase approximately 11,000 additional Bitcoins at an average price of USD 101,191.

MicroStrategy now holds around 461,000 BTCs with an equivalent value of around USD 48 billion. The crux of the matter, however, is that MSTR shares currently have a market capitalization of USD 88 billion, which means that the premium over the only asset is a good 80%. Added to this is the Company's debt, which runs into the billions. Furthermore, according to the SEC filing, the Virginia-based company plans to drastically expand its Class A common shares from around 330 million to 10.33 billion shares to continue its aggressive Bitcoin investment strategy. Founder Michael Saylor firmly believes in Bitcoin's dominance as an established asset class and has thousands of followers. His business strategy relies on Bitcoin's mega-performance, which can generate extreme profits or go horribly wrong. A hot ride on a razor's edge!

Credissential - Artificial intelligence for car buying

Today we want to introduce a newcomer from the field of software and artificial intelligence in the vehicle trade. This is the Canadian company Credissential Inc (WHIP), a developer of AI-driven financial services software. It is currently focused on developing and commercializing its flagship products: Credissential, Dealerflow, and Antenna. Credissential uses AI to improve financial technologies in order to make old and new financial services marketable. The two flagship products, Credissential and Dealerflow, embody the goal of democratizing finance through innovative, secure, and personalized solutions.

The combination of advanced analytics, proprietary encryption, and human-centered design will significantly change the future of finance. AI is increasingly being used to make processes more efficient, improve customer service, and increase sales. In the example of the automotive trade, it is about customized vehicle offers and algorithm-based platforms to suggest vehicles that meet the needs of interested customers. AI models take into account market data, vehicle condition, supply and demand to determine competitive prices. Chatbots and digital sales consultants provide the necessary customer support in selecting vehicles and answering questions.

Credissential's software solutions help affiliated dealers to efficiently manage and offer their vehicle inventory. The Company handles the formalities for acquiring a vehicle for the customer, including checking creditworthiness with financing institutions. From identity protection to wealth optimization, Credissential is committed to providing individuals and businesses with smart financial tools that make a lasting impact. The development of the Company's proprietary software is progressing rapidly. The Company is currently expanding its dealer contracts and earns revenue from license fees. Operational break-even is expected as early as 2026. Credissential shares are listed under the symbol WHIP in Canada and the securities identification number A40NJZ on all German stock exchanges. Those looking to get in early should act quickly, as the market capitalization is still around EUR 4 million. Exciting!

Palantir and D-Wave Quantum – Riding the Liquidity Wave

The valuations of Palantir and D-Wave Quantum have gotten completely out of hand. Palantir Technologies went public at around USD 10 in 2020, valued at approximately USD 16 billion at the time. Just four years after that event, the value of the data analytics company has increased more than tenfold to over USD 175 billion. At the time of its IPO, the Denver-based company had a turnover of around USD 1 billion, while analysts estimate that by 2024, it will have a turnover of around USD 2.8 billion. Yesterday, after a decent correction of 20% by mid-January, the share price reached its highest level again at around USD 78. The stock is currently trading at a 2025 P/E ratio of over 160. On February 3, investors will find out whether they are right to be long, when the 2024 figures are presented.

The D-Wave Quantum share has also veered into entirely different realms. Investors have put their money on the value because the AI scene is speculating on higher computing power. D-Wave can already offer these systems today, making it one of the first movers. However, there are still no significant revenues. From late October to early January, the price shot up by around 1,000%, from around USD 1.15 to 11.40. After a correction of 50%, the market capitalization is now back at USD 1 billion, having peaked at around USD 2 billion. With estimated revenues of USD 15 million in 2025, the price-to-sales ratio is projected to be 66 (currently even > 100). If the momentum in the stock turns, there is a risk of high losses. 5 "Buy" recommendations with an average price target of USD 6.50 can be found on the Refinitiv Eikon platform. One can only envy investors in the stock for their strong nerves. Tech bubble reloaded!

The cards will be reshuffled in 2025. While AI stocks and high-tech stocks want to match their dream performance of last year, there are interesting AI followers, such as the start-up Credissential. If it succeeds in connecting with many car dealers, the stock could take off.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.