March 28th, 2023 | 14:40 CEST

Switch now: Volkswagen, Meta Materials, Varta - Get out of banking and invest in climate change!

The banks are sputtering again. The somewhat more mature investors can well remember the horror year 2008 when the spectacular collapse of the small investment bank Bear Stearns occurred in the first half of the year. In May 2008, JPMorgan Chase had to take over the ailing institution in a night and fog operation. But that was just a preliminary flurry of activity. Lehman Brothers finally delivered the huge bankruptcy on September 15, 2008. That was the financial crisis's historical beginning, which only ended 7 years later. Now they are back, the troubled banks and the emergency takeover of Credit Suisse by UBS. What is next? That is the big question! After Corona and the Ukraine war, a recession combined with a banking crisis could be heading our way.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , Meta Materials Inc. | US59134N1046 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen - Battery plant in Spain creates 30,000 jobs in the medium term

Yet no end to internal combustion engines! The EU wanted to ban the use of fossil fuels from 2035, but things turned out differently. After weeks of wrangling over the future of cars with internal combustion engines, the German government has reached a compromise with the EU Commission. According to the agreement, new cars can still be registered after 2035 if they are fueled with climate-neutral fuel or so-called e-fuels. The auto industry applauded the agreement, but climate activists called it a lazy compromise.

However, the green politicians' intentions will stand or fall with the tax subsidies made available, because it will not be possible to sell e-mobiles on their own. The investment decision was not easy for VW, but the Company has already decided in favor of e-mobility. The official go-ahead has now been given in Valencia for the EUR 10 billion investment in the second battery cell factory of the subsidiary PowerCo. The production facility will be trimmed to 60 GWh production in perspective and could create up to 30,000 indirect jobs at suppliers and partners in Spain. This is a big deal for VW, a huge deal for Spain and a slap in the face for Germany as a business location. Evidently, the framework factors are better elsewhere than in Germany.

The VW share has recently come under intense pressure due to contradictory statements on the margin situation in the Group and has lost a whole 16% since the beginning of March to just EUR 121.50. Analytically, the stock would now be quite favorably valued with a 2023 P/E ratio of 4.3 and a dividend yield of 6.2%. However, if the big bet on e-mobility passes the consumer by, the Wolfsburg-based group will dig itself a billion-dollar grave in the medium term. Keep an eye on VW's sales of internal combustion versus e-mobiles, as the battle for future new car buyers is shaping up to be an exciting ride on the razor's edge.

Meta Materials - Development cooperation with an OEM battery manufacturer

The Canadian company Meta® Materials (META) is all about high-tech applications in the field of surface coatings on glass, building structures and other design elements. The new applications serve the purpose of increasing the handling as well as the ecological efficiency of machines and construction elements and improving the CO2 footprint. For example, the Company is developing sensibly installed antennas and camouflage caps for armaments. On the other hand, the product metaAIR® protects the crew of an aircraft from glare and irritation caused by laser glare strikes hitting the cockpit.

A joint development agreement for NPORE® battery separator materials has been signed with a global top 10 battery OEM. NPORE® is a free-standing, flexible separator made from a ceramic nanomaterial that offers unique dimensional stability with less than 1% thermal shrinkage at temperatures up to 220°C to prevent thermal runaway of the battery. Conventional plastic separators shrink significantly at high temperatures, which can lead to thermal failure. META is able to customize the separator's properties by changing its thickness, porosity and pore size.

"We are pleased that our battery team, led by Dr Steve Carlson, who has pioneered battery safety technologies for two decades, is working with one of the world's leading battery manufacturers to jointly develop and adapt NPORE® as a separator solution," said George Palikaras, CEO of Meta Materials. "Meta management sees strong interest in this novel solution for safer, more efficient and more sustainable batteries. META markets NCORE™ in collaboration with DuPont Teijin Films and Mitsubishi Electric Europe. According to Yano Research, META's reference market is growing from an estimated USD 16.7 billion in 2022 to USD 31.7 billion in 2026, a CAGR of 17%. One would like to take a leaf out of their book.

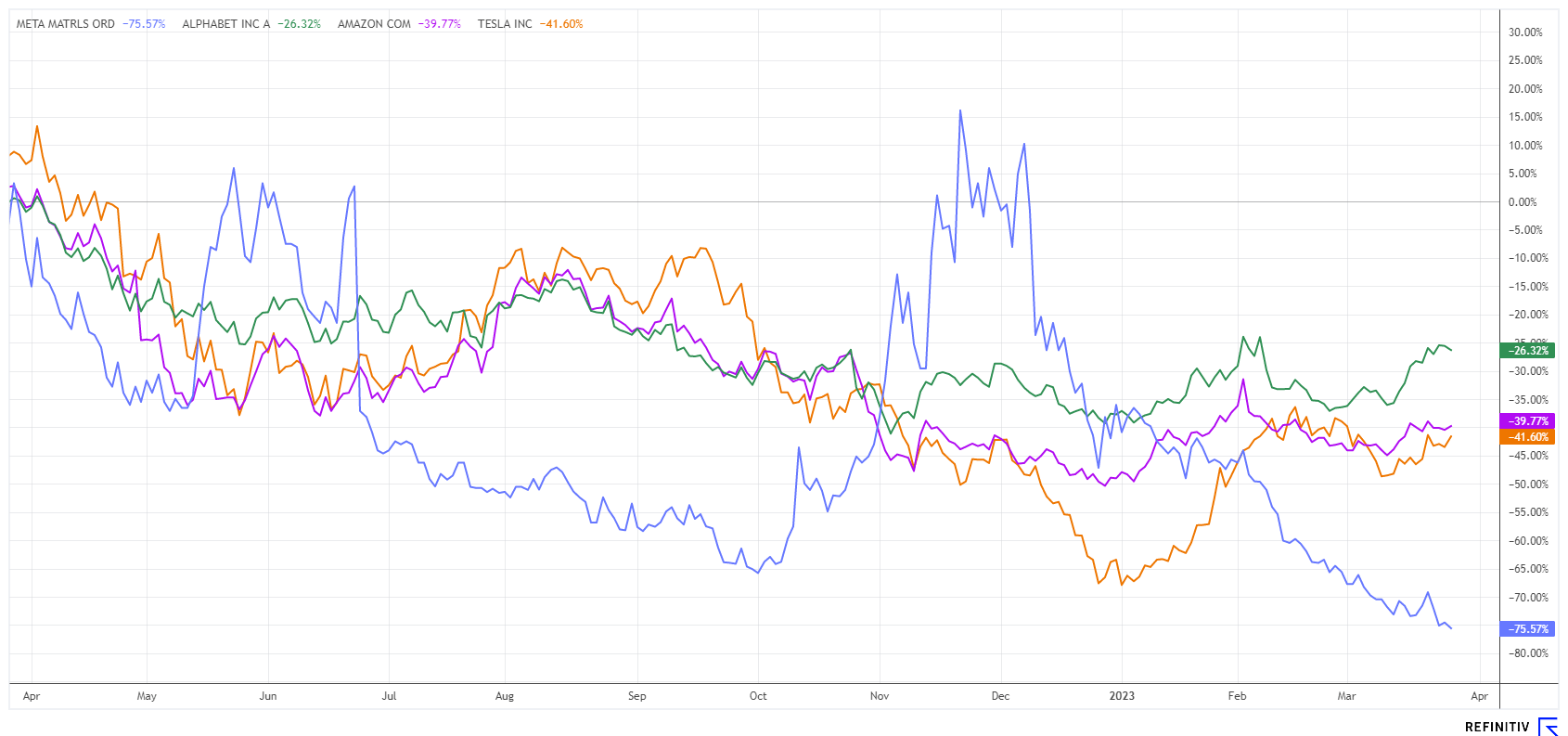

The 2022 annual figures still reflect very high development costs. So while revenues were up 150% to USD 10.2 million, the net loss increased in parallel to USD 79.1 million or USD 0.24 per share. Cash on hand was still USD 11.80 million as of December 31, 2022, and to raise additional funds, META is currently conducting an at-the-market (ATM) financing of up to USD 100 million. This is likely to weigh on the current share price of USD 0.50 for the time being. In the hydrogen sector, the spin-off of the subsidiary Next Bridge Hydrocarbons, Inc. should take place soon. The technology company remains highly interesting. Due to many market uncertainties, NASDAQ investors currently prefer to cover themselves with the popular FAANG shares.

Varta AG - Capital increase and restructuring sealed

Varta AG has seen its share price plummet by over 80% in 2022. After 3 consecutive profit warnings, the guidance had to be completely revised, and a new board was appointed. At the end of March, the share price fell to a new low for the year of around EUR 21.60 after the Group had issued more than 2.2 million new shares at EUR 22.85. The gross proceeds of this issue landed the Company in the black. This issue raised around EUR 51 million; the major shareholder Montana Tech was the sole subscriber to the new shares, with subscription rights excluded.

Shortly before the announcement of the figures for the year 2022, Varta reached an agreement with the banks on a comprehensive restructuring. The restructuring concept was drawn up based on an IDW-S6 expert opinion prepared by KPMG. The short-term financing requirements identified therein correspond to the proceeds from the capital increase. This sum is intended to secure the further development of the Company. Also important is the successful agreement with the banks, which extends the current financing until December 31, 2026, and amendments to the credit terms. The restructuring contribution of the majority shareholder Montana Tech Components agreed with the banks has already been made through the guarantee and subscription of the capital increase that has taken place.

The key points of the restructuring program include an adjustment of production and structural costs and targeted investments in growth areas such as energy storage and e-mobility. The measures also include cost savings in the personnel area, the amount of which was not explained in detail. Analysts reacted positively verbally but are waiting for the figures for the full year 2022 on March 30 with their new ratings. Investors should now pay close attention; this could be a turnaround entry in April.

The political decisions on climate change are now becoming more gripping. For industrial products, the CO2 footprint thus becomes essential, and manufacturing and recycling processes must become more sustainable. VW and Varta are gradually taking up the battery issues, and Meta Materials is also strengthening itself through cooperation in this sector.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.