June 24th, 2025 | 07:25 CEST

Revolution in the pharmaceutical industry – NetraMark beats ChatGPT by a mile

It was a real bombshell when NetraMark announced yesterday, shortly before the US stock market opened, that a preprint published on the arXiv portal shows that the Company's proprietary AI, NetraAI, is not only technologically ahead but also measurably outperforms leading models like ChatGPT and DeepSeek. In the analysis of clinical study data, NetraAI delivers the only statistically valid and medically actionable results. This positions the Canadian company as a potential game changer in a billion-dollar market where traditional machine-learning methods often fall short.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

NETRAMARK HOLDINGS INC | CA64119M1059

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Precision instead of a black box

NetraMark develops AI systems specifically designed for the pharmaceutical industry. At its core is the NetraAI platform, whose algorithmic basis differs from classic machine learning approaches and generic language models. Instead of relying on large, unstructured data sets, NetraAI also processes smaller, highly complex clinical data sets with maximum explainability.

The secret lies in a meta-evolutionary framework that combines principles of dynamic systems theory, information geometry, and evolutionary computation. Using only 2 to 4 explainable variables, NetraAI discovers so-called "personas," - clinically relevant patient subgroups. These groups are statistically significant and directly applicable for clinical study design and regulatory drug approval processes. The AI agent "Dr. Netra" contributes additional expertise from medical literature without compromising interpretability.

This technology enables NetraMark to gain valid insights even with small data sets and classify patient subtypes that respond particularly well or poorly to certain drugs. This is an enormous advantage for study planning, precision medicine, and regulatory approvals.

NetraAI clearly outperforms ChatGPT and DeepSeek

In a recent comparative study, NetraMark tested its platform against ChatGPT, DeepSeek, and traditional machine learning methods. The study was based on three renowned and highly complex clinical datasets: CATIE (schizophrenia), CAN-BIND (depression), and COMPASS (pancreatic cancer). The results were groundbreaking, as only NetraAI was able to generate clinically meaningful and statistically valid insights.

In the CATIE dataset, NetraAI accurately identified patient groups with high response rates to medication. Model accuracy increased from 55–66% (ML standard) to over 85%. ChatGPT and DeepSeek, on the other hand, only provided generic statements with no clinical value. Neither a valid cluster nor practical interpretations could be found.

With CAN-BIND, NetraAI achieved an almost perfect result with AUC values of 0.99. The subgroups identified showed significant differences in response to treatment for depression. ChatGPT and DeepSeek were again unable to recognize meaningful patterns despite the reduced complexity of the data. Traditional ML remained stuck at 66% accuracy.

In the COMPASS dataset for pancreatic cancer, NetraAI achieved over 90% model accuracy even with highly heterogeneous cancer data, identified survival-relevant patient groups, and offered a new approach to treatment decisions. DeepSeek and ChatGPT delivered results at random levels that are unsuitable for oncology and precision medicine. Conventional algorithms failed in terms of consistency and interpretability.

In a class of its own

What makes NetraAI so special is its unique combination of explainability, robustness, and precision. While other models always predict something, NetraAI clearly distinguishes between highly predictable patient subgroups and those with higher uncertainty. This capability helps reduce misdiagnoses, placebo effects, and clinical trial failures.

Particularly noteworthy is its ability to work with a small number of highly relevant variables. This enables precise study submission criteria, faster recruitment of suitable test subjects, and strategically optimized study designs. In a market where up to 90% of clinical trials fail, NetraAI could make a decisive difference.

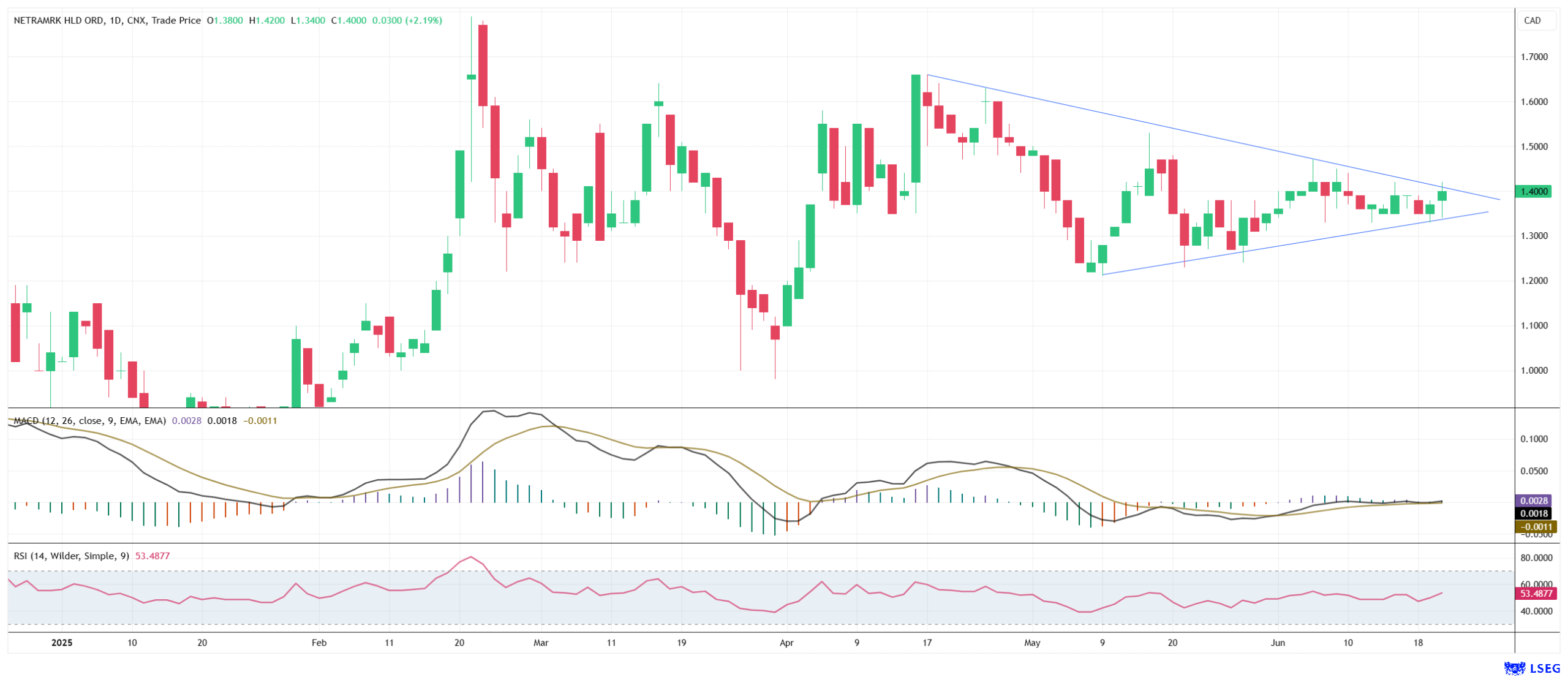

Chart before outbreak

With the pre-market announcement of a major milestone, the NetraMark share price was able to break out of the downward trend established since mid-April. Both the MACD trend-following indicator and the RSI issued buy signals. The next target is the horizontal resistance level at CAD 1.66.

The publication of the comparative study on arXiv marks a turning point in the history of NetraMark. The trend is moving away from generic, "all-powerful" AI systems toward highly specialized, medically validated multi-agent AI platforms. NetraMark could position itself as a first mover with a deep technological advantage in a market where reliability outweighs scale. Pharmaceutical companies stand to benefit in multiple ways, which could make NetraMark a hot takeover candidate in the future. In addition to cost reductions through fewer failures, big pharma also benefits from time savings and regulatory advantages thanks to robust, explainable models with transparent study designs. The capital market is likely to reward this sooner or later, especially since the findings are both regulatory-relevant and economically scalable. With a market capitalization of CAD 114.19 million, NetraMark still holds enormous upside potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.