January 6th, 2023 | 09:44 CET

Power Nickel, American Lithium, Cameco - Last chance before new wave?

The climate targets have been set, and the energy turnaround must be achieved. After the escalation of the conflict in Eastern Europe, the future must become green even faster to escape dependence on Russian oil and gas. Decarbonization is to succeed alongside the electrification of transport and the significant expansion of renewable energies. To date, it has yet to be precisely analyzed where the required industrial metals and raw materials are to come from. A shortage and, thus, sharply rising prices are pre-programmed. Producers of critical goods, especially from the West, are the clear beneficiaries.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

Power Nickel Inc. | CA7393011092 , AMERICAN LITHIUM | CA0272592092 , CAMECO CORP. | CA13321L1085

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

American Lithium - The Nasdaq calls

One of the best-known players in the lithium market is American Lithium, based in Vancouver, Canada. In the US, the Company owns the TLC lithium claystone deposit, which is located in close proximity to the Tesla gigafactory in Nevada. Following the acquisition of Plateau Energy Metals, American Lithium is moving forward with the development of the large Falchani hard rock lithium deposit and one of Latin America's most prolific uranium deposits, Macusani, both located in southeastern Peru.

In addition to the expected long-term increase in lithium prices, the uranium asset promises to be particularly exciting. That is because this is to be spun off into an independent company, as according to management, the current share price does not fully reflect the value of the Macusani project. By structuring a spin-off into an independent company specializing in uranium, the Company and its shareholders will benefit from unlocking the importance of this project. In addition, another benefit is that the focus should be on advancing the two lithium projects, TLC in Nevada and Falchani in Peru.

American Lithium's market capitalization is currently USD 468.08 million. With the approval to list its common stock on the Nasdaq Capital Market, the Company should receive even more attention from capital market participants. The January 10 Nasdaq listing does not include a capital increase. American Lithium currently has approximately USD 25 million in cash and is fully funded for its activities and work programs this year.

Power Nickel - Fantasy from many sides

It is difficult to estimate how long the correction in the commodity markets will last due to concerns about an impending recession. However, it is a fact that the demand for nickel will increase significantly in the next few years due to electrification. Global production currently stands at 2.7 million tons of nickel per year. However, due to the required degree of purity, only 1 million tons or 42% of global production, is currently available for batteries. According to estimates by the Nickel Institute, the nickel content in modern batteries will also increase significantly in the next few years. One reason is that less cobalt will be used. Experts estimate that nickel demand will rise to 3.4 million tons in 2025.

As with other raw materials, the Western world needs to catch up with sufficient resources, as the largest nickel production, by far, takes place in Indonesia. Even more troubling is that the largest producers are under Chinese influence.

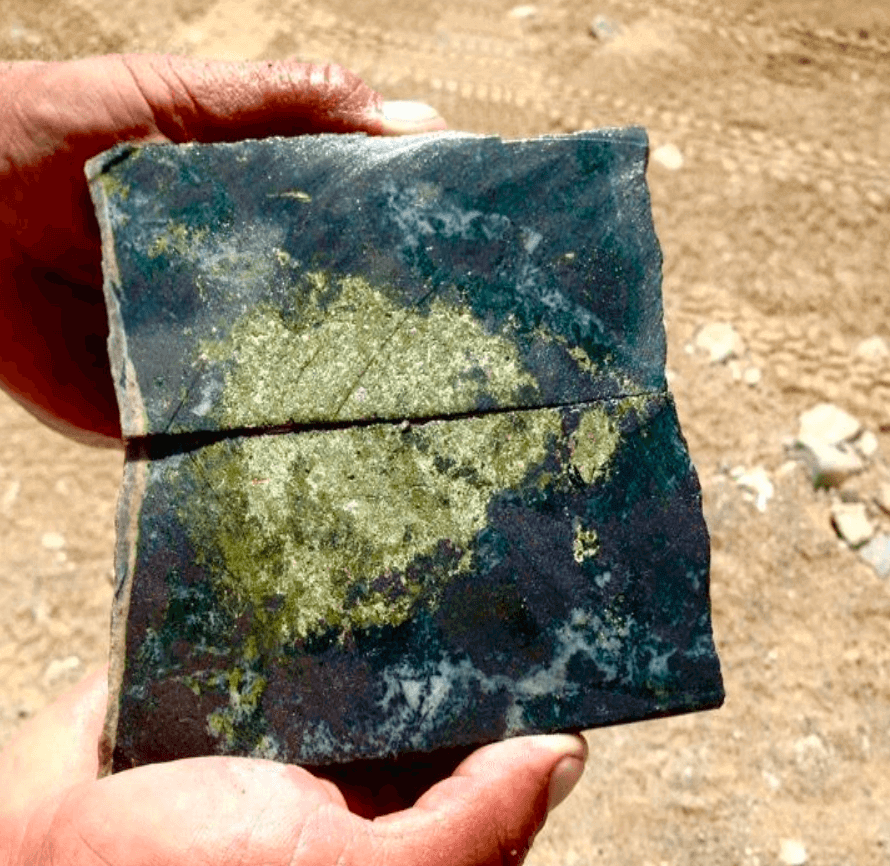

Due to geopolitical upheavals and disrupted supply chains, companies from Western climes are increasingly coming to the fore to further reduce dependence on China. The NISK project aims to realize Power Nickel CEO Terry Lynch's vision of developing one of the world's most sustainable sources of battery metals. NISK covers a significant land position with 20km of strike length and is located near James Bay in Quebec. To date, high-grade mineralization of nickel has been proven, as well as the mineralization of copper, cobalt, palladium and platinum. When comparing the existing, proven grades of the individual metals with the peer group, Power Nickel, with a share price of CAD 0.21 and a market capitalization of CAD 24.63 million, is significantly undervalued compared to comparable players, according to management.

Further fantasy arises for Power Nickel from the spin-off of non-core assets into a separate company. Consolidation Gold and Copper's portfolio is expected to include the 100% interest in the Golden Ivan project in British Columbia's Golden Triangle, several concession rights in Chile, and the Copaquire Royalty.

Cameco - Good sign for recovery

The uranium market is still in the consolidation phase, but more and more countries, with the exception of Germany, are focusing on building new nuclear power plants. That is because measured in terms of CO2 emissions, nuclear energy is one of the cleanest energy sources and would significantly contribute to decarbonization and the achievement of climate targets. Accordingly, the world's major uranium deposits are attracting increasing global interest. Thus, it should only be a matter of time before a new upward wave in the base price is likely to start.

With a stock market value of USD 9.4 billion, the Canadian company Cameco, based in Saskatoon, Saskatchewan, is one of the largest uranium producers. A good sign of an impending market recovery is the fact that Cameco has restarted production at the McArthur River mine, which has been suspended for about four years since January 2018 due to continued weakness in the global uranium market.

It is expected that McArthur River/Key Lake will produce up to 2 million pounds of uranium concentrate in 2022. Beginning in 2024, Cameco plans to produce 15 million pounds of U3O8 annually at these operations, 40% below annual licensed capacity, as part of the Company's strategy to align its production decisions with the procurement needs of its customers.

Due to industry demand in light of the energy transition, rising prices for critical metals are likely in store for the long term. American Lithium, as well as Power Nickel, have great spin-off fantasy. Cameco is ramping up production, which sends a strong signal for a rising uranium price.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.