January 6th, 2023 | 10:48 CET

Nvidia, Meta Materials, Grenke AG - Great chances for a comeback

The stock market year 2022 has left its mark on many companies. Especially for technology stocks, losses beyond 50% were the rule rather than the exception. Fears of rising inflation and the central banks' change of strategy to a strict monetary policy caused investors to throw capital-intensive stocks overboard. The situation on the interest rate front is now easing, which could mean that the massive exaggerations in several stocks are likely to correct again soon.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , Meta Materials Inc. | US59134N1046 , GRENKE AG NA O.N. | DE000A161N30

Table of contents:

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

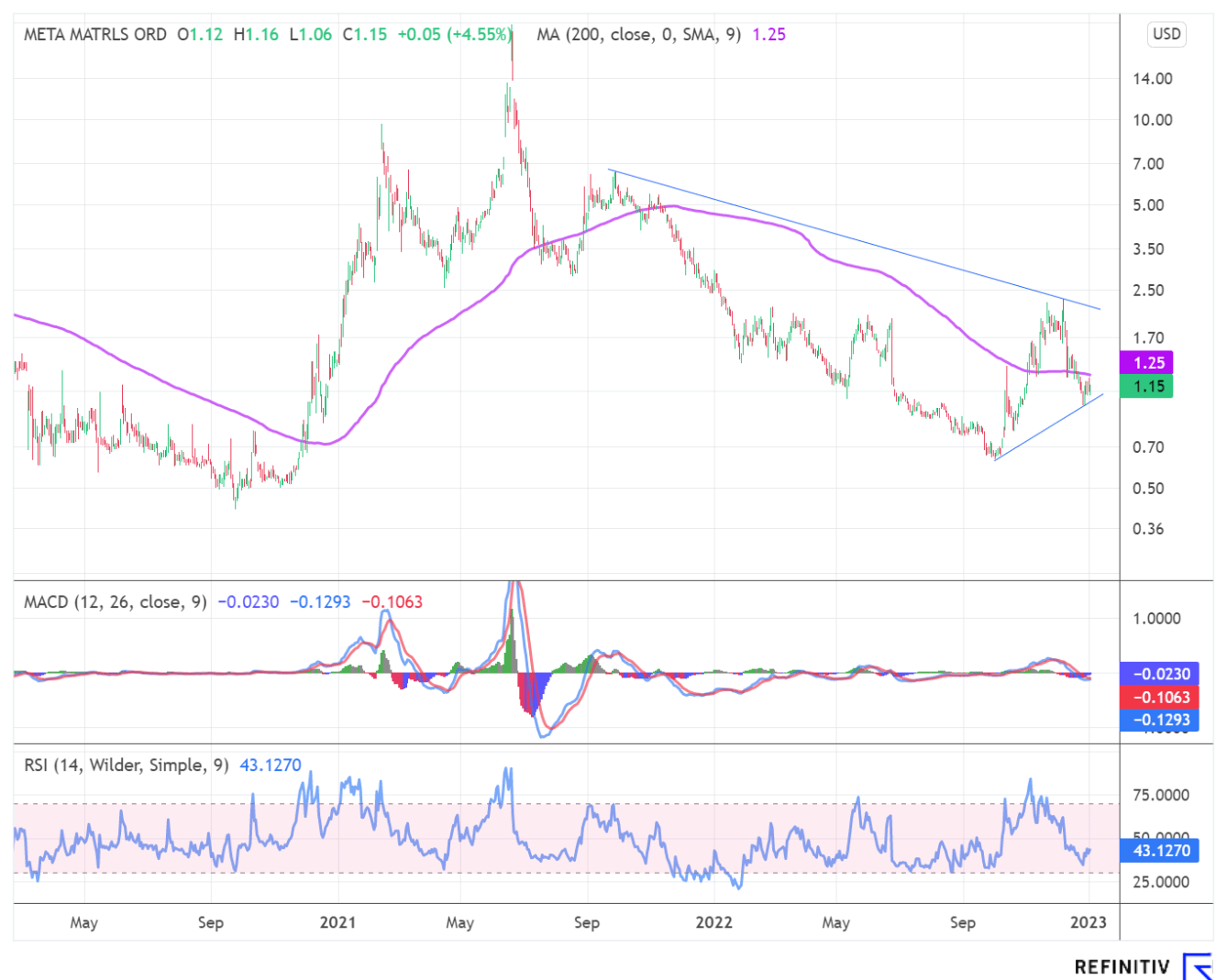

Meta Materials - Bottoming out of the innovator

A promising rebound opportunity is available in the developer of sustainable, highly functional materials, Meta Materials. After losses of more than 90% since the all-time high in June 2021, the stock has been running sideways under high volatility over the past year. By crossing the 200-day line at USD 1.26, the share could now complete its bottoming formation and generate a buy signal that could lead the Nasdaq stock in the short term, at least in the direction of the downtrend at USD 2.09 formed since September 2021. Should this also be successfully surpassed, prices close to the EUR 3 mark would beckon, which would mean a potential of over 150% compared to the current price.

The Company is currently at CES 2023 in Las Vegas and is presenting its award-winning Nanoweb technology to the general public, for which Meta Materials received the CES 2023 Innovation Award. The transparent conductive film is a versatile platform technology that offers the best combination of transparency and conductivity and is versatile in transparent doors for microwave ovens and a range of other applications such as heaters, antennas and 5G reflective films.

The Canadians want to redefine the future of coating materials and are researching novel materials that can redirect light, sound, heat or radio waves using special nanotechnology. The technology has multiple applications and can be used worldwide in various industries such as 5G communications, health and wellness, aerospace, automotive and renewable energy. Meta Materials has a clear competitive edge with 410 active patent documents, including 251 issued patents and 159 pending patent applications.

One of the greatest opportunities for the future lies in the field of batteries for electric vehicles. Here, the Company is developing two new battery materials to improve the performance, safety and sustainability of Li-ion batteries used in electric vehicles and other applications. The NPORE nanocomposite ceramic separators have a heat shrinkage of less than 1% to prevent battery fires. Metal-coated polymer current collectors manufactured with patented PLASMAfusion technology reduce weight by 80% compared to solid copper foils, increase vehicle range, act as a fuse to prevent thermal runaway, and improve sustainability by reducing copper content. At the same time, the solutions are compatible with all Li-ion battery formats and battery chemistries.

Grenke AG - Acquisitions and strong figures

Many investors may still remember September 2020. At that time, short-seller Fraser Perring bet on falling prices at the leasing specialist and accused the Company of fraud, money laundering and accounting fraud, and BaFin investigated. After more than 2 years and the processing of the attack, Grenke AG seems to have returned to normality. The focus is now entirely on the operating business or the expansion of international business activities through acquiring factoring franchise companies.

The global financing partner for small and medium-sized enterprises was able to announce the conclusion of purchase agreements for the acquisition of majority stakes of 58% each in companies in Great Britain, Ireland, Poland and Hungary. The Baden-Baden-based company intends to acquire the remaining 42%, which will be held by local management in each case, by February 2023. In addition to the 4 acquired companies, Grenke intends to adopt a further 10 franchise companies in the near future.

In 2022, the Company achieved a new business volume of EUR 2.3 billion, a YOY increase of 38.7%. In addition, the fourth quarter was the fifth overall with double-digit growth. At EUR 647.0 million, the new leasing business was up 24.1% on the prior-year quarter. The contribution margin as a measure of operating profit could not be maintained due to rising interest rates and decreased by 1.5% to 16.1%. Following the figures, the analyst firm Warburg Research left its rating for Grenke at "buy" with a price target of EUR 36. That equates to a price potential of 67% at the current price of EUR 21.54.

Nvidia - New fantasy autonomous driving

One of the largest developers of graphics processors and chipsets for personal computers, servers and game consoles is tinkering with the future. In the context of the Consumer Electronic Show 2023, the most important technology fair, which takes place from 3 to 8 January in Las Vegas, Nvidia is also presenting its innovations.

The Company from Santa Clara, California, is in the front row when it comes to the car of the future. A strategic partnership to develop automated and autonomous vehicle platforms has been announced with Foxconn, the Taiwan-based manufacturer of various Apple devices. Under the agreement, Foxconn will be a tier-one manufacturer producing electronic control units based on Nvidia DRIVE Orin for the global automotive market. Electric vehicles manufactured by Foxconn will be equipped with DRIVE Orin ECUs and DRIVE Hyperion sensors for highly automated driving. The partnership with Foxconn is expected to allow the US to further expand its efforts to meet growing industry demand as more transportation industry leaders choose DRIVE Orin for smart vehicles.

Nvidia's stock has stabilized after a disastrous 2022 stock market year and an annual loss of almost 55%, forming a bottom in the USD 140 area. A strong buy signal would result with the break of the downward trend formed since November 2021 at currently USD 157.05, and the way to the interim high from December of last year at USD 187.90 would be clear in the short term. Meta Materials also shows signs of bottoming out. After the strong sell-offs in the past stock market year, shares such as Nvidia and Meta Materials are about to complete their bottoming phase. At Grenke, the signs continue to point to inorganic growth in the future.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.