PLUG POWER INC. DL-_01

Commented by Fabian Lorenz on January 3rd, 2024 | 07:20 CET

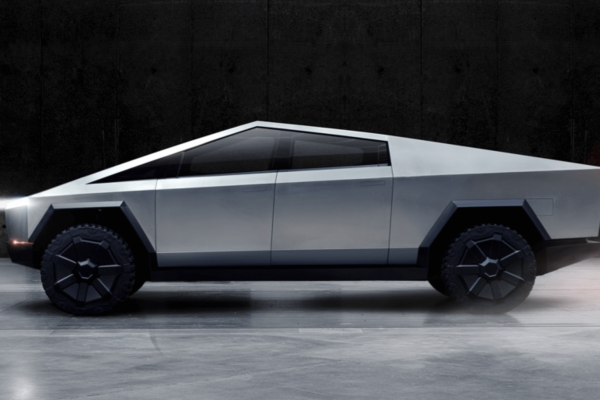

100% share price increase in a few days! Plug Power, BYD and Defense Metals shares

Within just a few days, the Defense Metals share price more than doubled shortly before Christmas. Even if the price level of the developer of a rare earths project in Canada could not be fully maintained, the share is entering 2024 with new momentum. Important data is due soon. If these are also positive, the current valuation of around CAD 50 million could be a real bargain. Plug Power is not a bargain despite the massive drop in the share price. The hydrogen specialist needs to grow and accelerate its path to break even. The e-commerce giant Amazon should help with this. BYD can only dream of doing big business in the US so far. The market is closed to Chinese e-car manufacturers. Is it justified?

ReadCommented by Armin Schulz on January 2nd, 2024 | 08:00 CET

BYD, a pioneer in electromobility: Can First Hydrogen and Plug Power follow suit with hydrogen?

The future of mobility is increasingly environmentally conscious and innovative: now that electric cars have firmly established themselves on the market, hydrogen propulsion is emerging as a promising candidate for a green transportation revolution. Driven by the increased use of renewable energies, we are seeing growing potential for the production of green hydrogen. It is in the spotlight of current energy strategies and could come into its own, particularly in areas of mobility where electric batteries are reaching their limits. We look at the top dog of electromobility and two companies that focus on hydrogen.

ReadCommented by Juliane Zielonka on December 29th, 2023 | 07:40 CET

Manuka Resources, Plug Power, Amazon: Precious Metals, Energy, E-Commerce - Which global future trends investors are betting on now

Renewable energy and digital transformation bring companies like Manuka Resources, Plug Power, and Amazon Web Services into focus. While Manuka Resources serves the rising demand for precious metals in the energy transition through mining activities for gold and silver, Plug Power, a pioneer in hydrogen technologies, faces challenges and seeks ways to overcome them. This time, the US government appears to be more of an opponent than an ally for Plug. In North America, Amazon Web Services, as a leader in cloud technology, is advancing Canadian infrastructure with an investment of over USD 17.9 billion. Meanwhile, the AI startup Anthropic, supported by giants like Google and Amazon, is betting on the future of artificial intelligence with ambitious revenue goals by 2024, from which AWS could also benefit. For more detailed insights into these connections, read here.

ReadCommented by André Will-Laudien on December 29th, 2023 | 07:15 CET

The big turnaround 2024: Hydrogen with Nel, Plug Power, ThyssenKrupp Nucera and dynaCERT

While the DAX 40 and NASDAQ indices are climbing to new all-time highs, hydrogen stocks are sinking further and further into the ground. But there is hope! With the exception of the OPEC states, around 200 countries have spoken out in favor of phasing out fossil fuels at the COP28 Climate Conference in Dubai. This should give the signatory governments a good opportunity to restart their state subsidy programs in favour of alternative energies in the coming year. Now is the time to re-examine the battered sector. Nel ASA and Plug Power have recently reported declining order volumes, while dynaCERT and Nucera are performing well operationally. We are looking at a sector that has the potential to gain several hundred percent in 2024.

ReadCommented by André Will-Laudien on December 21st, 2023 | 07:30 CET

After the COP28 Climate Conference: Hydrogen, solar or oil? Plug Power, Nucera, Saturn Oil + Gas, JinkoSolar in focus

It could have gone better! The COP28 Climate Conference in Dubai is over, the results sobering for many, for others within the realm of expectations. While large parts of the world are calling for a stricter approach to reducing fossil fuels, the countries in the Gulf region want to continue their successful business model of the last 150 years. Oil is not going out of fashion, and its production will continue to be abundant and delivered to buyers through various channels. Hydrogen and solar energy, like wind power, are essential energy sources, but they will not replace existing structures; at best, they will supplement them. Even nuclear energy, which has been widely frowned upon, is now seen as a climate solution by countries such as Poland, France and Finland and is being drastically expanded. Where are the opportunities for investors?

ReadCommented by André Will-Laudien on December 20th, 2023 | 07:00 CET

COP28 a toothless tiger? Nel ASA, Klimat X, Nvidia, and Plug Power in the climate change check!

Another earth-shattering climate conference is behind us. The outcome was as sobering as it was predictable. Around 200 countries were able to agree on measures to reduce fossil fuels, but the Gulf states insisted on their right to continue the business model of oil and gas production that has been successful for decades. This makes it clear that the availability of fossil fuels will continue on a large scale because the BRICS states, such as Russia, China, India and Brazil, will continue to exploit their fossil resources unabated. Incidentally, international conflicts only work with fuels and not with battery-powered drives. So, if you consider the wars in Ukraine and the Middle East with their accompanying environmental destruction, there is no need to invent bans on European diesel vehicles. However, there are a few glimmers of hope for a greener future...

ReadCommented by Fabian Lorenz on December 19th, 2023 | 07:10 CET

Star investor Buffett bets on oil: BYD, Plug Power, Shell, Prospera Energy

While the world was watching the Dubai Climate Conference, Warren Buffett invested in oil. The star investor increased his stake in Occidental Petroleum to 27% via Berkshire Hathaway. There is also the possibility of increasing the stake in the US oil company to 33%. The move came after Occidental shares had lost 20% in just a few weeks. This anti-cyclical move is typical of Buffett and shows that oil stocks like Shell are exciting. A similar turnaround story to Occidental is Prospera Energy. Things are expected to get interesting for the Canadian oil producer next year. This is likely also the case for BYD and Plug Power. Chinese companies want to attack the Japanese market, among other things. Like so many hydrogen companies, Plug Power has to address the question of the profitability of its business model.

ReadCommented by Armin Schulz on December 13th, 2023 | 06:40 CET

Rock Tech Lithium, Klimat X Developments, Plug Power - Which GreenTechs have potential?

GreenTech companies have become increasingly important in recent years as they focus on developing and disseminating technologies that promote environmental protection. One example of this is lithium refinement, which is required for the production of batteries for electric vehicles. Another crucial topic is CO2 certificates, which companies can purchase to offset their emissions. Hydrogen technology is also becoming increasingly important, as it is seen as a clean alternative to fossil fuels. We have selected a candidate from each sector and are examining their potential.

ReadCommented by André Will-Laudien on December 12th, 2023 | 06:40 CET

Climate conference and Venice turns green! Oil remains in demand; goodbye hydrogen? Nel ASA, Prospera Energy and Plug Power in Focus

Too little, too slow, too half-hearted! Climate activists in Italy have drawn attention to themselves with a spectacular campaign. The "Extinction Rebellion" group members painted the famous Grand Canal in Venice fluorescent green. Some activists abseiled from the Rialto Bridge over the central canal of the northern Italian lagoon city on Saturday afternoon and poured dye into the water. Their action was intended to protest against the "ridiculous progress" made at the COP28 World Climate Conference in Dubai. "We are tired, we have had enough of being taken for fools by our governments and knowing that our future is in danger while politicians do nothing," they said in a statement to the press. How do we tackle the energy issues of the future? A look at selected energy stocks paints a clear picture.

ReadCommented by Stefan Feulner on December 11th, 2023 | 07:20 CET

Infineon, First Hydrogen, Plug Power - Opportunities upon opportunities in decarbonization

Once again, 2023 was a stock market year to forget for companies in the renewable energy sector. Share price falls of around 70% for market-leading companies were the rule rather than the exception. However, decarbonization is underway, demand is rising, and the potential is huge. As a result, there are tremendous long-term opportunities for disproportionately high share price gains in selected stocks.

Read