NIO INC.A S.ADR DL-_00025

Commented by Stefan Feulner on April 29th, 2021 | 08:47 CEST

NIO, Deutsche Rohstoff, BP - Demand is exploding!

The massive inventory overhang, which still existed on the oil market last year and led to the crash due to the Corona pandemic, will be used up by the second quarter of 2021. With vaccination programs well underway and the economies of China and the United States recovering quickly, further demand is rising rapidly. Currently, it looks more like a fundamental supply deficit of black gold, with rising prices in the coming months. Experts already foresee a supercycle with oil prices just below USD 200 per barrel.

ReadCommented by André Will-Laudien on April 27th, 2021 | 12:00 CEST

BYD, NIO, Nikola, Nevada Copper - The Tesla hunters step on the gas!

The appointment of the candidates for chancellor in Germany has led to a significant increase in the Green Party. While at the same time, the current government parties have been punished. For consumers, this means continued tax incentives of the highest magnitude for so-called "environmentally friendly technologies," which, in addition to solar panels and wind power, include above all battery-powered mobility and hybrid vehicles. The German Federal Office of Economics and Export Control (BAFA) is subsidizing the purchase of electric cars throughout Germany until the end of 2025 - this year, the bonus is particularly high. This environmental bonus supports not only the purchase but also the leasing of electric cars. One half of the subsidy comes from the manufacturer, the second half from BAFA. The stock market likes to hear this, and the manufacturers' shares are selling like hotcakes. It seems that this bull market can start again with every political statement.

ReadCommented by Stefan Feulner on April 19th, 2021 | 08:35 CEST

NIO, NewPeak Metals, Barrick Gold - The calm before the storm!

The stock indices are still in a celebratory mood. Both the DAX and the Dow Jones benchmark index again reached historic highs last week. In addition to all the euphoria, there was the successful debut of the crypto exchange Coinbase, which also helped Bitcoin, Etherum & Co to achieve new all-time highs. Meanwhile, the first signs of life came from the precious metals for the first time in months. Gold was able to stop its losing trend since the beginning of the year and should become interesting again due to the fundamental data. One can profit from the favorable entry opportunities!

ReadCommented by Nico Popp on April 12th, 2021 | 07:50 CEST

NIO, Varta, Nevada Copper: Where the best opportunities lurk in the value chain

The theory around value creation is simple: the more a raw material is refined or processed, the greater the margin a company can ultimately achieve. While a kilo of Kobe beef fillet costs around EUR 400, a savvy chef will conjure up ten dishes from it and take in four-figure sums. There are many reasons to invest at the end of the value chain, but the risk also increases. If the chef cannot cook, he will not make sustainable sales even with the best ingredients. The situation is similar in the value chain around electromobility.

ReadCommented by Stefan Feulner on April 8th, 2021 | 09:32 CEST

Volkswagen, Rock Tech Lithium, NIO - It is getting dramatic for Germany!

Metal processing industries and steel manufacturers in Germany are increasingly reporting delivery problems and rising costs resulting from significantly increasing raw material prices. Due to the strong growth in demand resulting from the energy transition, it is becoming increasingly difficult to secure the supply of raw materials in the long term. The dependence on China, which currently has a virtual monopoly on many metals, has been evident for a long time. As early as 2008, the then German President Horst Köhler called for a raw materials strategy for the Federal Republic. Little has happened since then, but the bottleneck is steadily approaching. According to the motto of a former SPD politician: "Germany is doing away with itself."

ReadCommented by Nico Popp on April 1st, 2021 | 05:50 CEST

NIO, Defense Metals, Rheinmetall: These shares have catch-up potential

While Germany is facing a new lockdown rather than finally taking flight, the DAX has risen to over 15,000 points. What this shows: The market is already anticipating the post-pandemic upswing. Around the globe, societies are divided into two; those suffering from the pandemic and those that are pandemic winners. The latter sit on high reserves and are just waiting to finally spend their money again, which suggests a clear upswing. With stocks in a doze, this can lead to great opportunities.

ReadCommented by Stefan Feulner on March 31st, 2021 | 09:57 CEST

BYD, Silkroad Nickel, NIO - Elon Musk: "mine more nickel!"

As electromobility emerges, global demand for certain metals will increase sharply in the coming years. The metals lithium, cobalt and nickel, are crucial for the production of lithium-ion batteries. Nickel, not lithium, takes the rank as the key metal, especially since an increased nickel content dramatically increases the efficiency of the batteries. The Tesla founder already addressed mining companies years ago with an urgent appeal.

ReadCommented by Nico Popp on March 18th, 2021 | 06:05 CET

SunMirror, Barrick Gold, NIO, Volkswagen: Megatrend sustainable battery metals

There is no doubt that the mobility of the future will be electric - at least if you believe Volkswagen. A few days ago, the global corporation presented a strategy for its battery production as part of its Battery Day. But batteries need raw materials and these raw materials have become increasingly scarce in recent years. There was already a boom around lithium in 2016. Prices have calmed down again, but many a small supplier went off the market. This is now taking revenge. When Volkswagen wants to double the number of electric cars it sells, raw materials are in short supply. How can investors use the situation for themselves? Read on.

ReadCommented by Stefan Feulner on March 17th, 2021 | 08:40 CET

BP, Saturn Oil + Gas, NIO - Energy transition: Will it all be different?

Politicians and industry are pumping billions into alternative energies, the replacement of combustion engines by electric cars has already been decided, and power supply will be decentralized in the future. Thus, the end of the petroleum age seems near. Even one of the industry leaders, BP, sees the supposed decline of fossil fuels in the energy transition course and is looking for alternative business fields. However, the oil price, which experts had ruled out last year, has already reached pre-crisis levels after just one year. There is currently talk of an imminent "oil supercycle" with price targets of just under USD 200 per barrel. The producers will profit greatly from this.

ReadCommented by André Will-Laudien on March 15th, 2021 | 08:51 CET

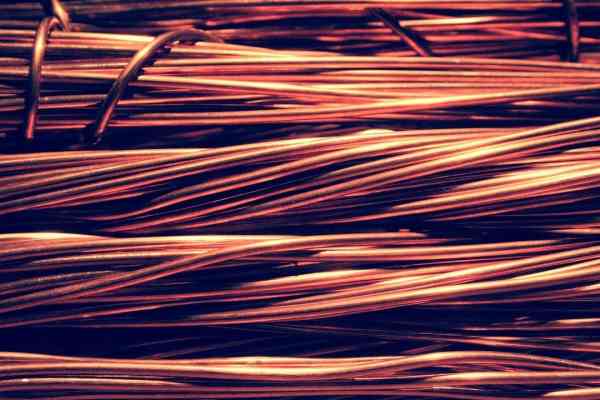

TESLA, NIO, Kodiak Copper: E-mobility drives the copper price!

The copper shortage continues as demand continues to rise steadily. The battery of an electric car uses about three to four times as much copper as a conventional combustion vehicle. It should also not be forgotten that the charging infrastructure's construction also requires considerable amounts of copper. And growth in renewable energies is also driving demand. Last year, the largest copper mine in the world was again the Escondida mine in Chile's Atacama Desert. With a production of 1.2 million tons, it alone accounts for about 5% of global output. However, Chile will not be able to meet the world's copper demand on its own.

Read