NIO INC.A S.ADR DL-_00025

Commented by Nico Popp on July 19th, 2021 | 09:49 CEST

NIO, EuroSports Global, Porsche: You have never thought of e-mobility like this before

Tomorrow's mobility is electric. The promises of electromobility are great. Clean vehicles, gliding along the roads with almost no noise and possibly even driving autonomously. But there is also another side to electromobility. Companies such as Porsche and EuroSports Global want to electrify driving pleasure. Tesla's chic Roadster shows that there is a market for this.

ReadCommented by Stefan Feulner on July 16th, 2021 | 14:45 CEST

Plug Power, Kodiak Copper, NIO - The shortage as an opportunity

Commodity markets are always subject to the forces of supply and demand. The energy transition and the achievement of climate targets pose new challenges for society. With the expansion of electromobility and renewable energies such as wind and hydropower, demand for some mineral raw materials will increase sharply. This is offset by an extremely tight supply and trade conflict with the leading producer China. There is a threat of further rising prices and, to be seen with the current chip shortage, even production losses.

ReadCommented by Stefan Feulner on July 12th, 2021 | 13:36 CEST

NIO, Kainantu Resources, BASF - Bright prospects

The first half of the 2021 stock market year is over, and the stock market indices continue to march from high to high. While some market participants were hoping for a stronger correction after the Corona rally, they have been disappointed so far. The FED has now laid the foundation for further rising prices. It sees the rising inflation, which is currently at 5% in the USA, as temporary. In favor of growth, interest rates will remain at historic lows for the time being. In addition, the bond-buying program of the monetary guardians continues unabated - a feast for the stock markets.

ReadCommented by Stefan Feulner on July 6th, 2021 | 10:55 CEST

NIO, Troilus Gold, Vestas - Shares with a tailwind

US President Joe Biden has been in office for around six months. In contrast to his predecessor Donald Trump, he places climate protection at the center of his policies. The renewed accession of the US to the Paris Climate Agreement was the first official act, and the updated Nationally Determined Contribution to climate protection stipulates that the USA will halve its emissions by 2030 compared with 2005. It aims to turn this around with massive trillion-dollar programs. Companies that rely on renewable energies will benefit from this in the long term.

ReadCommented by André Will-Laudien on June 22nd, 2021 | 12:07 CEST

Varta, BYD, NIO, Tesla, Almonty Industries - Battery becomes next billion-dollar topic!

The extent to which reality sometimes diverges from stock market trends is especially noticeable in hotly traded stocks. Early last week, it was the postponement of CureVac's vaccine launch that caused the stock price to lose 50% briefly. Then on Friday, there was the virtual AGM of Varta AG. The mood was very good in the run-up and the share reached a 5-month high of EUR 142. But then there was a correction of over 10% and the price found itself yesterday at EUR 127. The reason: premium manufacturers like Porsche are now going into battery research themselves. This opens up a competitor for Varta among the intended customers - they certainly had not bet on this, but the battery issue is a billion-dollar thing!

ReadCommented by André Will-Laudien on June 15th, 2021 | 14:17 CEST

NIO, Volkswagen, Toyota, Silkroad Nickel - Now it really starts!

Armin Laschet (CDU), the CDU/CSU candidate for chancellor, does not want to give the internal combustion engine an expiration date, even though he himself drives an electric car. He also warns against focusing solely on the electric vehicle regarding climate protection in the transport sector. "I do not believe that this will be the form of mobility for the next 30 years, even though I drive an electric car myself," the CDU federal chairman told Handelsblatt. "There are ecological implications, for example, in battery production and the extraction of raw materials. We will still see many technological leaps." So in terms of e-mobility, the last word has not yet been spoken. Nevertheless, the industry is gearing up for a politically motivated wave of purchases. For this, it needs raw materials.

ReadCommented by Stefan Feulner on June 14th, 2021 | 08:02 CEST

Aixtron, Silver Viper, NIO - Bright prospects

The ongoing green technology revolution, driven by the exponential growth of alternatively powered vehicles and continued investment in solar energy, will further accelerate global industrial demand for silver over the next decade. Battery production for electric car use alone will require approximately 20,554 tons of silver by 2030 - bright prospects for silver companies. Yet, development is just at the beginning of a new cycle.

ReadCommented by André Will-Laudien on June 9th, 2021 | 10:55 CEST

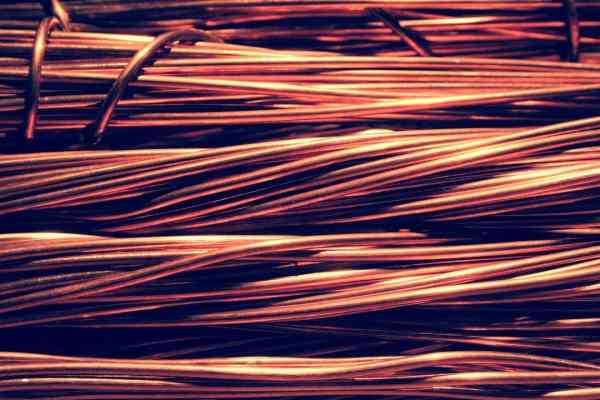

NIO, JinkoSolar, Siemens Energy, Nevada Copper - This is the copper sensation!

The copper shortage continues as demand is continuously increasing. The current slightly weakening copper price should not hide the general state of the market. Resources are scarce, procurement markets are depleted, and demand remains at a high level. Current trends in the economy are further exacerbating this situation. Modern electric vehicles use about three to four times as much copper as a conventional internal combustion vehicle. It should not be forgotten that the construction of the charging infrastructure also requires significant amounts of copper. New mines are not currently in sight, but there is news from Nevada.

ReadCommented by Stefan Feulner on June 8th, 2021 | 07:47 CEST

NIO, Almonty Industries, Daimler - The power struggle escalates

The US government bans American investments for 59 companies from China. They are accused of cooperating with the Chinese state apparatus and military. The response from Beijing is not likely to take long. The Middle Kingdom is pulling the strings concerning the globally planned energy revolution. Whether solar plants, wind turbines or electric cars. The switch from fossil fuels to a sustainable energy supply based on renewable energy requires many metals. At the moment, more than 80% of the production of rare metals takes place in China. The currently prevailing chip shortage could be just a precursor.

ReadCommented by Nico Popp on May 27th, 2021 | 07:25 CEST

Nevada Copper, Salzgitter, NIO: The Greens and the Copper Price

Since the end of March 2020, the copper price has doubled. The trend is intact and investors are using every minor interim correction to get in. After the pandemic, countries worldwide want to get their economies back on track and fit for the future. Investments in infrastructure have been overdue for years anyway and are the very first measure for many countries. Sustainable solutions, such as charging infrastructure for electromobility, are also on the agenda. The copper price should continue to benefit. Demand from Germany, in particular, is likely to increase - a look at the polls in the election year suggests that it should soon rain billions for electric cars and their charging infrastructure. Some stocks are already benefiting.

Read