NIO INC.A S.ADR DL-_00025

Commented by Stefan Feulner on June 22nd, 2022 | 11:22 CEST

New opportunities in the supercycle - Glencore, Defense Metals, NIO

Concerns about a further sharp rise in inflation sent the stock markets into a tailspin in recent weeks. The main reason for the enormous inflation was exploding energy and commodity prices. In addition to crude oil and natural gas, metals important for industry, such as copper and rare earth metals, are currently correcting. This should again offer an opportunity to participate in the supercycles in the long term.

ReadCommented by Stefan Feulner on June 14th, 2022 | 13:35 CEST

The stock markets are on fire! What is next for Nio, First Hydrogen and Nel ASA?

It has been brewing for weeks. The mixture of sharply rising inflation rates, market participants' concerns about further interest rate hikes, and uncertainties surrounding the Ukraine war broke the camel's back and sent global stock markets plummeting through the ranks. The losses cut across all sectors. Along with equities and precious metals, cryptocurrencies are losing disproportionately. Due to the emerging economic concerns, the oil price is also losing ground. The partly exaggerated corrections are already calling bargain hunters on the scene again.

ReadCommented by Stefan Feulner on May 27th, 2022 | 10:30 CEST

Nel ASA, Erin Ventures, NIO - Using setbacks as long-term opportunities

Since Russia invaded Ukraine, stock markets have corrected sharply, and volatilities have increased significantly. The S&P 500 Volatility Index VIX, for example, rose from under 20 to a high of over 35 points. Individual stocks are also still subject to high fluctuations, with market leaders in promising future-oriented sectors such as hydrogen fuel cell technology, photovoltaics and wind energy losing more than 50%. In such market phases, an anticyclical entry can represent a particularly worthwhile investment. A historic opportunity could also present itself in a critical commodity.

ReadCommented by Stefan Feulner on May 3rd, 2022 | 13:01 CEST

BASF, Meta Materials, NIO - New opportunities through the correction

Whether the old stock market rule "Sell in May and go away" still applies this year is at least doubtful. The DAX and S&P 500 benchmark indices have lost more than 10% since the beginning of the year. The Nasdaq technology segment was hit harder, losing more than 20%. Concerns about further interest rate hikes, the threat of stagflation and uncertainties regarding the Ukraine conflict are causing investors to go on a buyers' strike in some cases. Nevertheless, there are good long-term, anticyclical entry opportunities at current levels.

ReadCommented by André Will-Laudien on April 19th, 2022 | 13:24 CEST

Turn of the times: Varta, Altech Advanced Materials, BYD, NIO - Batteries over oil and gas!

The Ukraine crisis reveals a dangerous dependency. Central Europe is on Russia's energy drip. It is not easy to threaten Russia with sanctions when the oil and gas giant is also the leading supplier. For the primary supply of our population, any change in German-Russian relations is dramatic as long as we do not manage to build up alternatives. Of course, this cannot be done in just a few months but involves an investment cycle of the next 5 to 10 years. It will therefore be critical for the coming winter. The automotive industry has long recognized what threatens heating and district heating today. Move away from fossil fuels - towards batteries! Only who can build them?

ReadCommented by Stefan Feulner on April 13th, 2022 | 17:59 CEST

Commerzbank, Kodiak Copper, NIO - Unstoppable trend

Remember last year when both Federal Reserve chief Jerome Powell and ECB frontwoman Christine Lagarde called rising inflation "temporary"? According to the Federal Statistical Office, consumer prices for March have come in fresh across the news tickers, showing a 7.30% increase, the highest level since reunification. On the one hand, of course, the Ukraine conflict impacts rising energy and commodity prices, but even after the end of the warlike activities, many goods in demand because of the energy transition are likely to at least maintain the high price level.

ReadCommented by Stefan Feulner on April 11th, 2022 | 19:03 CEST

K+S, Edgemont Gold, NIO - Shares as protection against demonetization

Inflation rates have been rising steadily since the end of 2020. What was initially declared by central bankers as a temporary event is becoming a permanent problem for society and the economy. The loose monetary policy, the shortage of raw materials, and the blown-up supply chains were responsible for the fact that the inflation rate in the USA was 7.9% in March, the highest since 1982. As a result of the sanctions imposed on Russia, the supply of raw materials and oil and gas is becoming even tighter, causing prices to shoot up once again. Investors can protect themselves by investing in producers of scarce commodities. In addition, for diversification, gold should not be missing in any portfolio as protection against currency devaluation.

ReadCommented by Stefan Feulner on April 4th, 2022 | 11:15 CEST

NIO, Power Nickel, BYD - Extreme demand despite rising prices

Due to climate change, something historical is taking place in the transport sector: the transformation of fossil-fueled cars to so-called electric vehicles powered by batteries. The growth figures of electric car manufacturers such as Tesla, BYD and NIO are impressive. The trend is only just beginning and is expected to pick up speed significantly in the next 2-3 years. Due to the high demand for battery-powered cars, the raw materials required, such as lithium, cobalt and nickel, are increasing in parallel. Due to the lack of supply, the winners are precisely those producers and exploration companies that are currently, or in the near future, able to supply the scarce commodities.

ReadCommented by André Will-Laudien on March 14th, 2022 | 13:23 CET

The battery sensation: Varta, BYD, NIO, Power Nickel: Shares down, oil price above USD 150?

Since the invasion of Russian troops in Ukraine, the changes in the world are now clearly noticeable. Above all, it is tragic that thousands of people have died, and millions are once again forced to flee their homes. There is despair and compassion all over the globe because most nations have been blessed with peace for decades. The standard of living has also increased significantly in 95% of regions. Now, time seems to be running backward again: raw materials, food and everyday necessities are becoming dramatically more expensive, leading to substantial inflationary spurts sector by sector and pushing the level of prosperity back again. But it also shows: We humans must become more independent of fossil energy and advance alternative technologies. We show you shares that are in line with this trend.

ReadCommented by André Will-Laudien on February 24th, 2022 | 09:41 CET

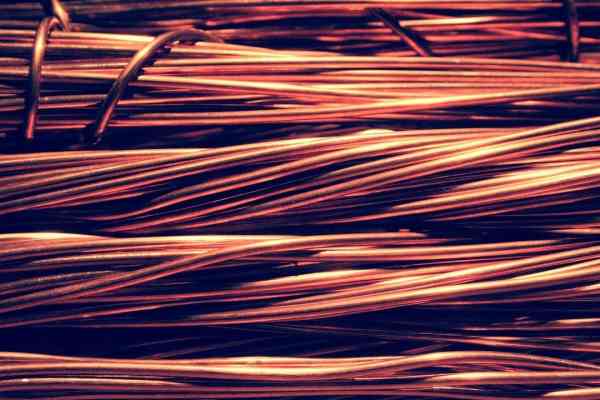

BYD, Nio, Nordex, Phoenix Copper: Nothing works without copper!

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it, the research and development of drives, batteries and power-saving components. However, in addition to electricity storage, vehicle cabling and the fitting of high-tech components are also coming to the fore. Today, an electric vehicle requires 3 to 4 times as much copper as it did 20 years ago. Still, the earth's deposits are exhaustible, and copper, in particular, is pretty much stretched to the limit. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. A current conflict, such as Ukraine, provides additional fuel and further rising prices! Where are the opportunities?

Read